This blog will cover the latest RV and travel data news. We’ve had a bunch of year-end news drop, including some disturbing news from the RV industry. After the pandemic rush, it now seems that the industry has rediscovered the concept of quality! I have a lot to say about this.

Production Numbers

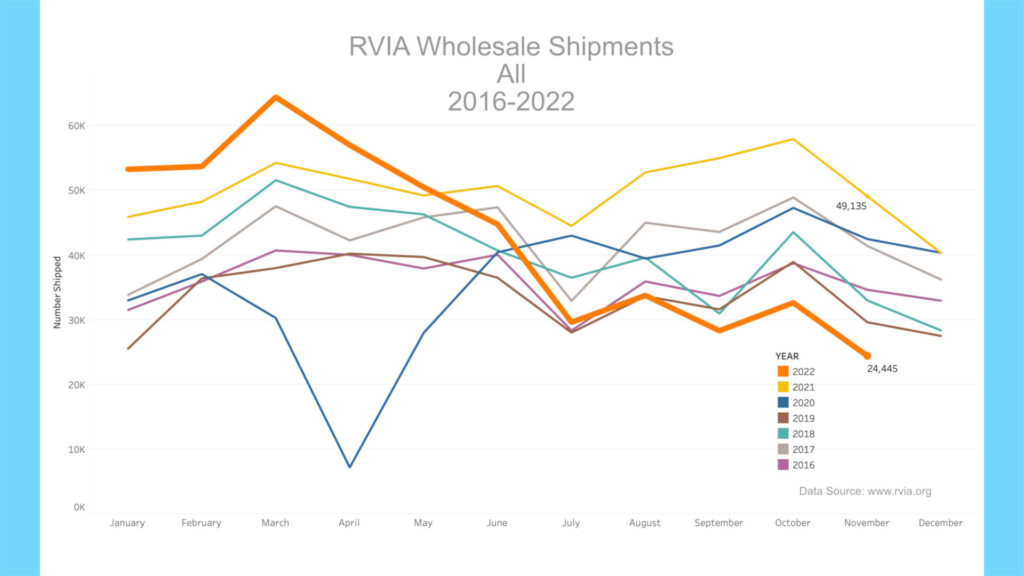

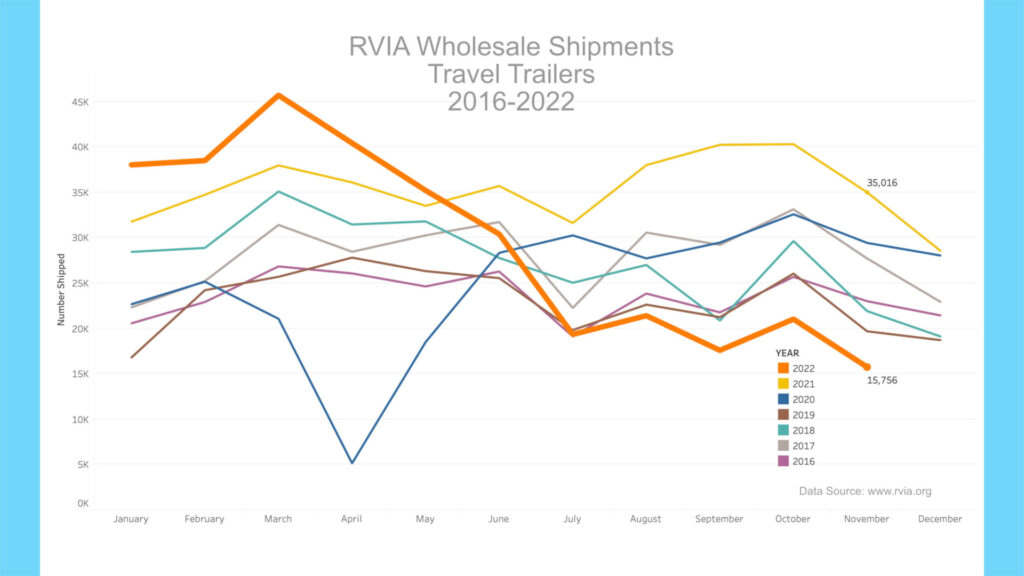

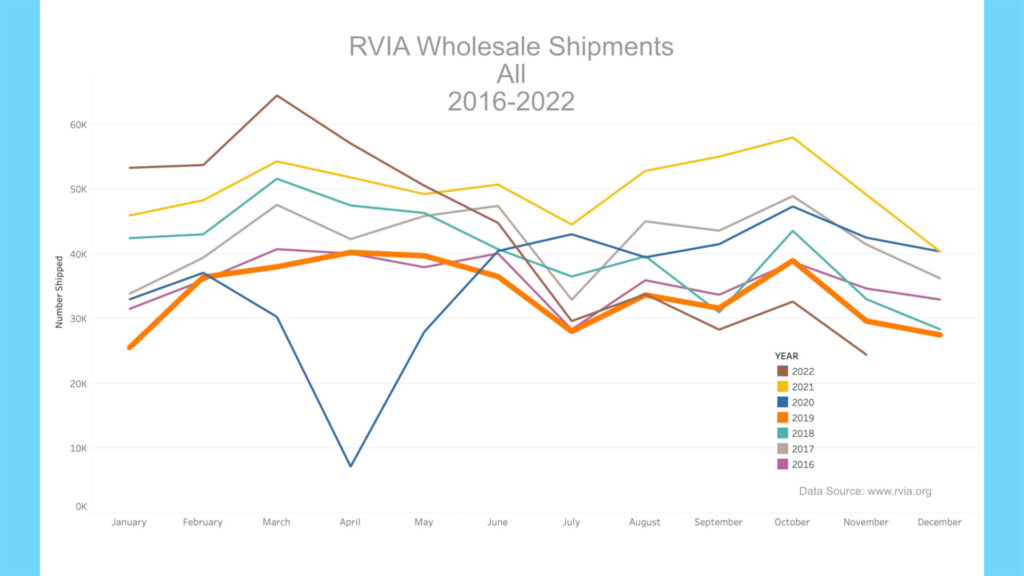

The RVIA posted the latest RV shipment data for November 2022. Can production numbers get even worse than in October? The answer is yes, as the numbers are falling short of the prior six years for the same month. Only 24,445 total RVs were shipped in November, compared to the record 49,135 in November 2021, down 50% year-over-year. Travel trailers witnessed the most significant decline, with only 15,756 shipped in November vs. 35,016 a year ago, a 55 percent decline. It was by far the worst November for towable trailer shipments in over six years. Industry insiders are trying to wrap up the steep decline calling it a “normalization,” but there isn’t any easy way to spin the sharp downward spiral in production other than a demand crash.

Meanwhile, RVs for sale on RVTrader.com continue to remain stubbornly high. There were 155,550 new units for sale as of December 28th. This is up slightly from November’s 155,138 units a month ago, which continues to be very high for this time of year. While new units for sale are staying high, used units are down from last month, at 49,462. This is the first time since March 9th that used for-sale units have fallen below 50,000. This time last year, the number of used RVs for sale was roughly 48,000.

RV Quality Concerns

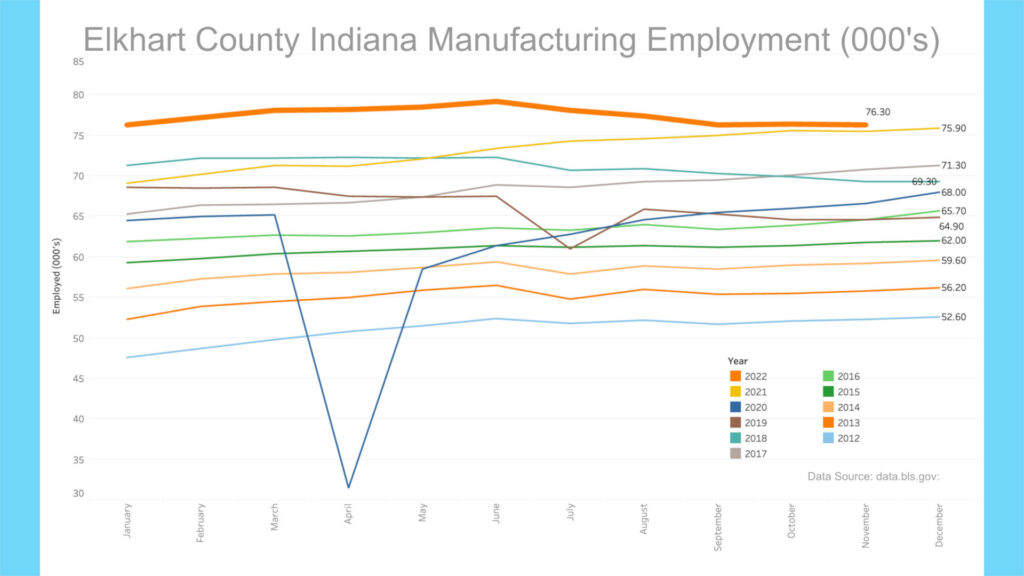

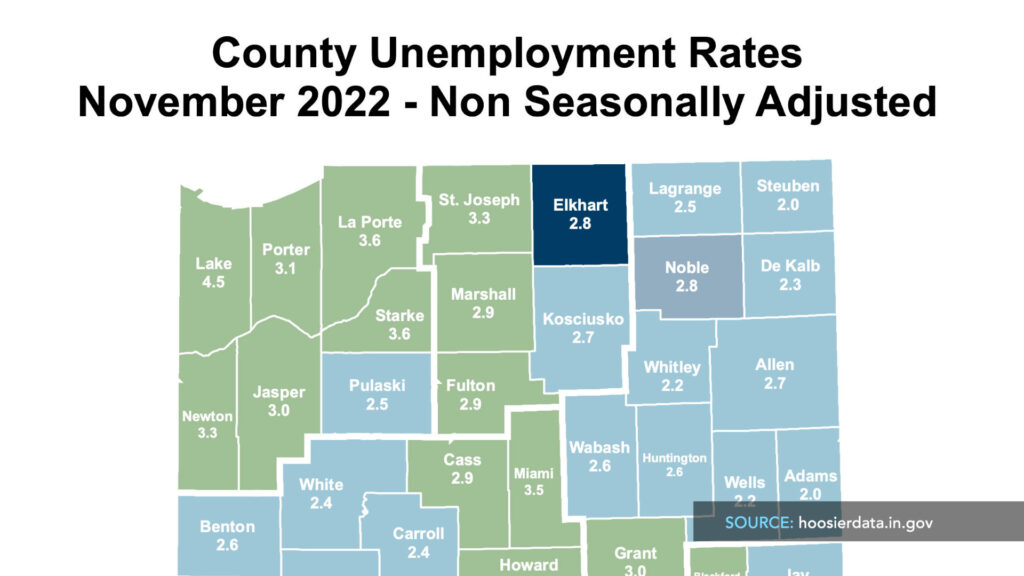

Meanwhile, manufacturing employment levels in Elkhart County, Indiana, have stayed steady even with the pull-back in shipment volumes, which seems counterintuitive. There were 76,300 people employed in manufacturing in November, according to the Bureau of Labor Statistics. This is down from 77,400 in August 2022 and a record 79,200 in June 2022, yet staying reasonably steady for the past three months. This gives Elkhart an unemployment rate of 2.8% for November, up from 2.6% in October.

High-End Market

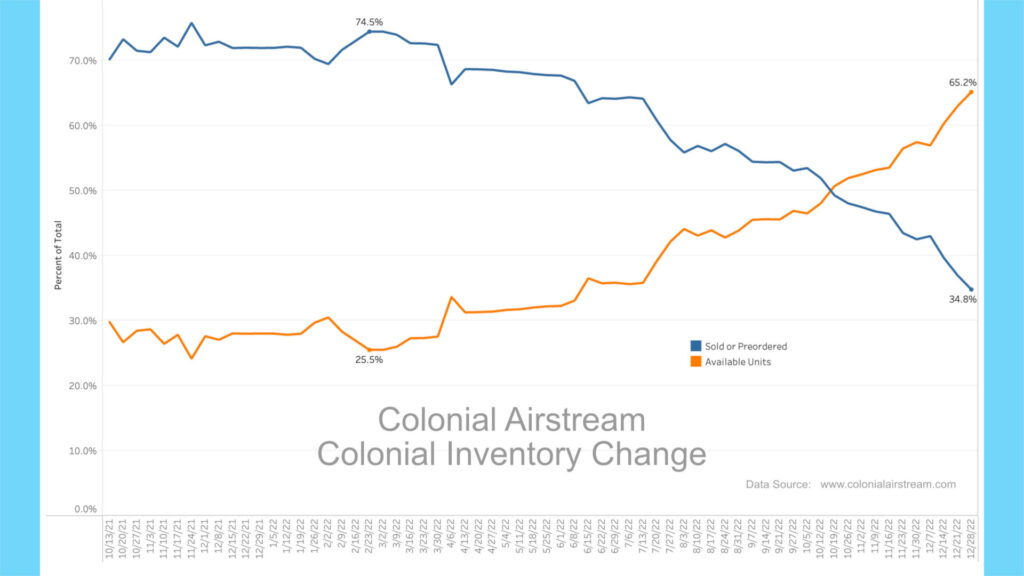

For the high-end market, let’s again take a look at the inventory levels for Colonial Airstream in Millstone Township, New Jersey. They are one of the largest Airstream dealers nationwide.

A year ago, 72% of Colonial’s inventory was preordered, meaning only 28% of their Airstream inventory was either on the lot for sale or being delivered and available. A year later and the entire mix has changed. Now, about 35% of inventory is spoken for, and almost 2/3rds of inventory is fully available for sale. It appears that the high-end market is fully feeling the impacts of a weak stock market and higher interest rates as those with more resources are curtailing larger purchases.

AAA

Some good news on gas prices, according to AAA, prices have continued to fall over the past month, which is a welcomed relief to all those about to or who are now snowbirding with their RVs. The current average nationwide price as of December 28th was $3.133 per gallon for regular unleaded, down about $.41 from a month ago and down $.15 per gallon from a year ago. Just under half of the states have average prices below $3 per gallon. An RV trip of 3,000 miles at 10 mpg would cost $940 now vs. $985 a year ago, about a 4.5% decrease YoY. Diesel sits at $4.675 today, down a whopping $.54 from a month ago yet up about $1.11 from a year ago. A similar 3,000-mile trip getting 15 mpg would cost $935 now vs. $714 a year ago, a 31% increase.

Jayco PDI Update

Last month we reported that Jayco had opened a large facility to do PDI or pre-delivery inspections. They committed to putting 100% of RVs produced through a PDI process going forward. I have been somewhat critical of the industry concerning RV quality lately, so I think it is fair to highlight when a manufacturer is attempting to bring about a solution.

According to RV Business, Ken Walter, President of Jayco, mentioned, “We measure everything by defect per unit and by line. We share those results with the lines so they know where their line is versus the other lines,” he explained, adding that operation directors overseeing production lines have their pay tied based on PDI data. “So, we’re checking the checker with PDI, getting it through system checks, with the ultimate goal being getting better product to the dealers and a better customer experience.”

Walters also was quick to point out that Jayco’s PDI process is more than a cursory walk-around. Instead, each unit undergoes a complete systems check – plumbing, LP, electrical, slide motors, etc. – in addition to inspecting each unit for defects. Targets are set, he said, and then lowered as they are met.

“We continually lower the target of defects as we want to continually improve and, the biggest accomplishment, better product. That’s the most important thing. That’s the goal,” Walters said.

“We hear from our dealers that our stuff is showing up cleaner than it was,” he said. “That gives them less time in their bays, which are really valuable… They don’t want PDIs in there. And, again, it is a better customer experience for the end customer from the get go. The customer picks it up, there’s less items to note, and they’re not waiting on pieces and parts.”[1]

RV Quality

I think what Jayco is attempting is commendable. The recent crash in demand for RVs can somewhat be attributed to much higher prices for new RVs and higher interest rates. Yet quality is one area the industry is just now reawakening to. A negative quality perception for RVs predates the pandemic and has been masked by the demand bubble during the pandemic. The point is that the industry was in a downturn before the pandemic when interest rates were low and inflation tame. Why?

We’ve highlighted this before, but it is easy to see by focusing on the production trends of late 2018 and 2019, during a time of economic growth, low inflation, and much lower interest rates. If you hold factors constant, something other than interest rates and inflation was causing the demand slowdown pre-pandemic.

My take is that much of the pre-pandemic slowdown was due to poor quality and bad customer experiences being shared on social media. Going forward, the industry will need to focus on quality or risk continued degradation.

One endemic problem is that the industry is somewhat myopic in its feedback loop. What I mean is that generally, the industry listens to the industry for its main feedback, including dealers, but not really including customers. The RVIA tells manufacturers that they are doing well and better times are ahead. Yet as an RV owner, I have never, once in seven years and four new RVs received a survey on my experience with a new RV.

I would challenge any manufacturer or industry leader to start surveying your customers after 90 days of ownership and find out how much loss of use your average new owner is experiencing. If need be, hire consultants or personnel who know how to compile surveys, manage data, and will speak truth to leadership. I can tell you that all four of my new RVs have been poor in terms of initial quality.

All too often, the managers of RV production aren’t users of their own product; actual builders are disconnected from customers, there seems to be little real-world testing of new models, high-failure-rate components continue to be used, etc. The infamous Dometic 300 toilet is an example of a manufacturer, Keystone, using a defective toilet in many of their models for quite a while after it was known that the toilet was faulty. I am on my third model 300 now, and this last one has held up because I took it apart and fixed the issue.

Getting an RV to where it needs to be after buying it new can be way more work than many owners expect. This is becoming well-known on social media, and I am convinced that much of the current slowdown is related to an accurate perception of poor quality. The pandemic temporarily interrupted this downtrend, but unless the industry wakes up and makes profound changes to enhance quality, the downtrend will likely continue.

This year, I bought a new trailer in April and sold it in August due to substantial quality issues. It caused so much stress personally that I was relieved to sell it at a financial loss after much wrestling to get everything fixed via warranty. The problem is that I’m not an outlier in terms of being burned on a new RV. Most people who buy new RVs have failed expectations in some way due to loss of use, additional repairs, or significant stress.

I hope those in industry leadership would wake up and make real and lasting changes in quality. What Jayco is doing by going to 100% PDI on all new RVs is a good first step, but it also speaks negatively about the production process. The industry needs to start surveying new customers. Be adamant about removing faulty components from your name brand. Fight hard against customer loss of use. Get out in your product. Stress test any new models in extreme conditions. Change the way line workers are incented, so there is a positive reward for quality. Talk regularly to customers and not just dealers.

With that, I think we’ll wrap things up. The good news is gas prices are way down as we go into winter, and it looks like we’ll be back to a buyer’s market in the new year. Speaking of the new year, I hope each of you has the best year yet, and you can go somewhere wonderful in 2023.

All the best in your camping endeavors!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and by their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!

-

https://rvbusiness.com/jaycos-ken-walters-calls-100-pdi-a-fundamental-change/ ↑