This blog will cover the latest RV and travel data news. 2023 started on a low note for the RV industry, as production continues to slow going into the spring selling season. As a major RV supplier and a major dealer see losses at the end of 2022, what does this mean for 2023?

The Numbers

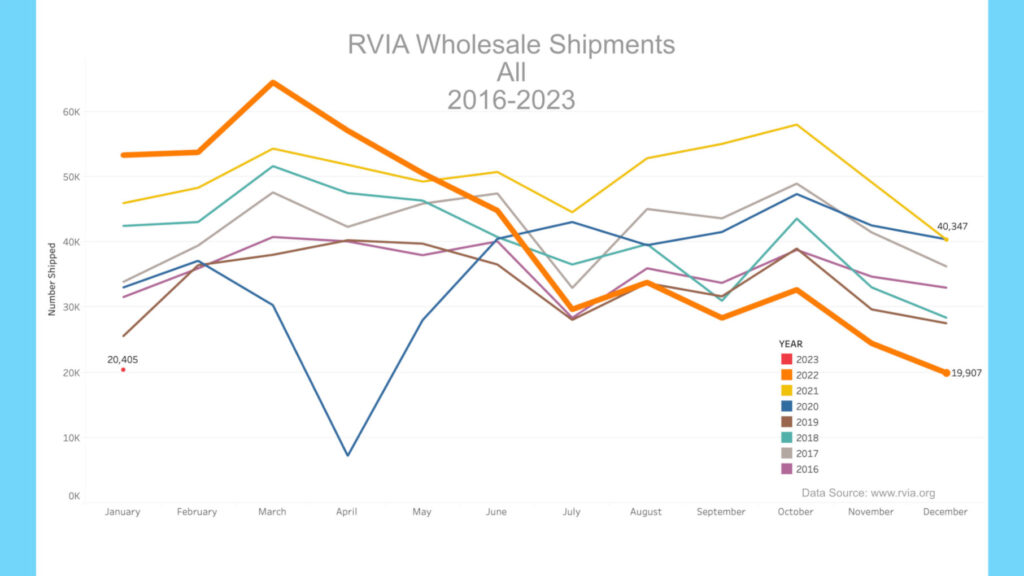

On Monday, February 27th, 2023, the RVIA posted the latest RV wholesale shipment data for January 2023. Production numbers stayed steady with December’s. Only 20,405 total RVs were shipped in January, compared to the record 53,290 in January 2022, down about 62% year-over-year. Travel trailers witnessed the most significant decline, with only 12,122 shipped in January vs. 38,038 a year ago, about a 68 percent decline. It was by far the worst January for towable trailer shipments in over six years.

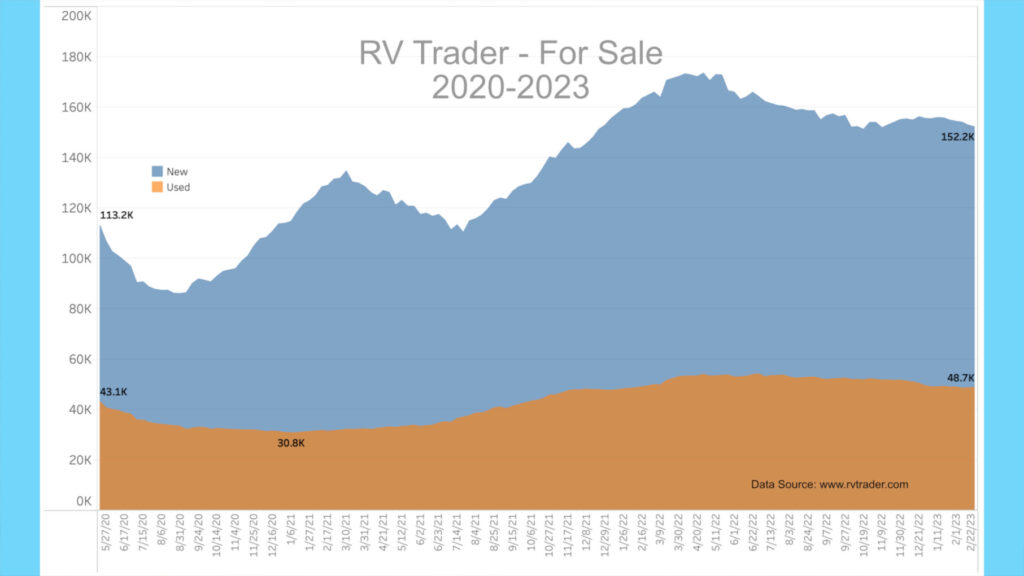

Meanwhile, RVs for sale on RVTrader.com continue to remain high. There were 152,243 new units for sale as of February 22nd. This is down from January’s 154,900 units a month ago, which is about a 1.7% decline in new units for sale. Used units for sale declined slightly from last month to 48,736. This is now the third month in a row with used for-sale units below 50,000 after nine months in a row above 50,000. This time last year, the number of used RVs for sale was 49,415. So, we are seeing a very slow decline in the number of new and used units for sale.

RV Quality Concerns

The Bureau of Labor Statistics has yet to publish manufacturing employment data for January 2023. Elkhart county unemployment data is tied to the input. When they do publish this data, we plan to put the news to our Twitter feed. If you want to stay on top of RV news, our Twitter feed is usually the first place we publish breaking news.

High-End Market

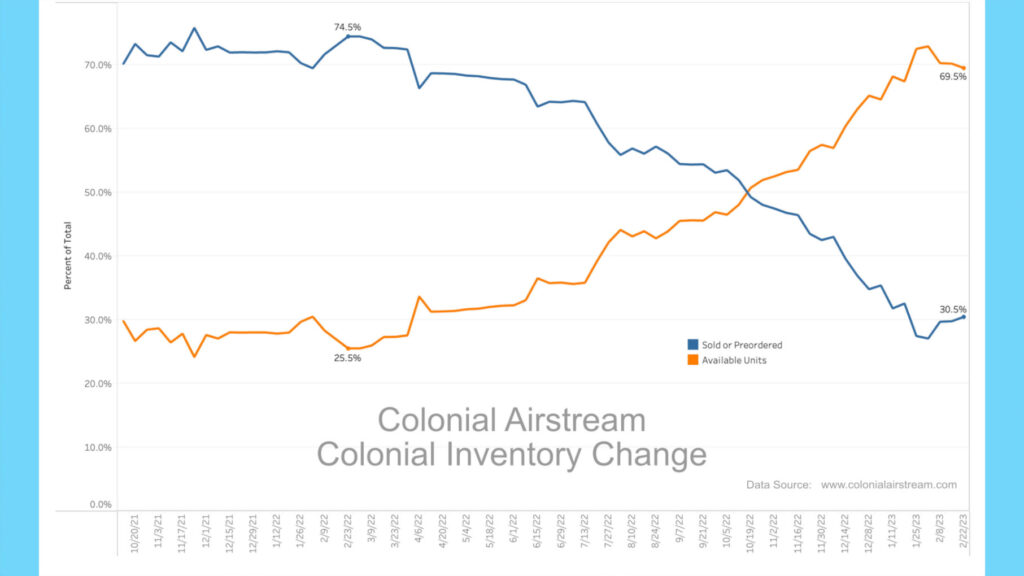

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, continue to remain high.

About a year ago, 74.5% of Colonial’s inventory was preordered, meaning only 25.5% of their Airstream inventory was either on the lot for sale or being delivered and available. A year later and the entire mix has inverted. Now, about 69.5% of inventory is available for sale, with only 30.5% spoken for. Also, total inventory has declined from 290 units to just 233 units, year-over-year. This points to a move to a buyer’s market, even on higher-priced Airstreams.

AAA

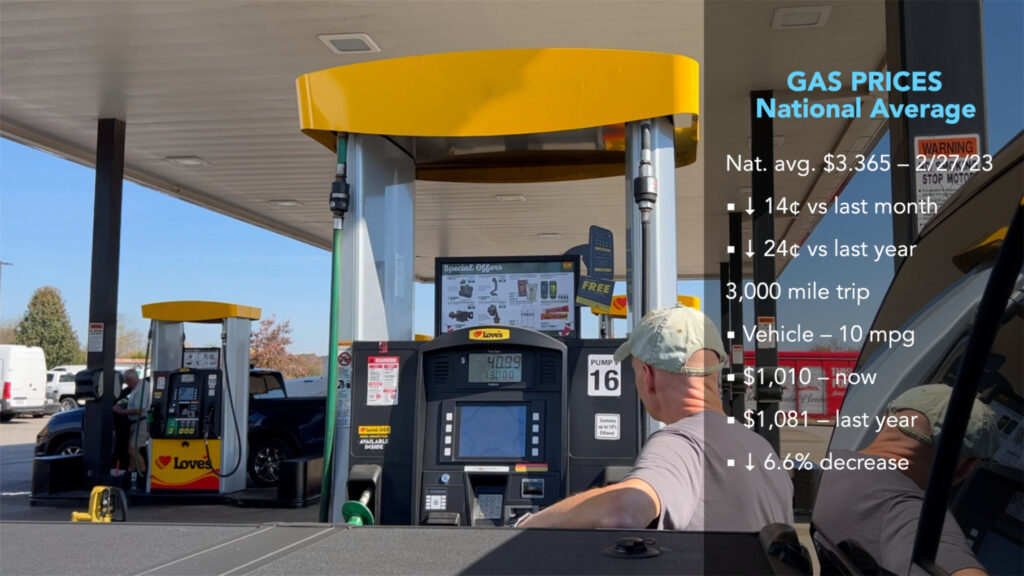

Gas prices have again reversed course and have declined of late. According to AAA, prices have declined slightly over the past month. The current average nationwide price as of February 27th was $3.365 per gallon for regular unleaded, down about $.14 from a month ago and down about $.24 per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $1,010 now vs. $1,081 a year ago, about a 6.6% decrease YoY. Diesel sits at $4.414 today, down $.28 from a month ago and up about $.41 from a year ago. A similar 3,000-mile trip getting 15 mpg would cost $883 now vs. $800 a year ago, a 10% increase.

Spotlight

Are you new to RVing? If so, we have a new-to-RVing group and an excellent set of resources for you. You can find the new-to-RVing video list on johnmarucci.com in the Resources area. Each video has been curated to help with a specific RVing topic. You can also sign up for the new-to-RVing group at the bottom of the page. By doing so, you can receive regular emails to help fast-forward your learning curve and grow your confidence. Just visit johnmarucci.com/resources to learn more.

Downturn & Buyer’s Market

There has been a slew of negative reports recently published that continue to point to ongoing difficulty for the RV Industry and potential buying opportunities for the consumer. First, inflation for January 2023 came in at the fastest uptick since last June.[1] This will likely put the Federal Reserve on the path to raising interest rates, thus making for higher monthly payments on various high-ticket items, including RVs. A high percentage of new RV buyers finance, so this will mean many people will continue to be priced out of the market. If you are fortunate to have the cash to buy an RV, you likely will be in the driver’s seat to bargain.

Second, both Lippert Industries, on the component supply-side of the industry, and Lazydays RV, on the dealer side, reported losses in the 4th quarter, pointing to the obvious fact that the input and sales side of the business are seeing a serious downturn. This is to be expected given the lack of sales and eventual upstream demand crash. The entire supply chain, from inputs to final sales, are feeling the obvious error of over-production from the first half of 2022.

My take is that the first half of 2023 will be tough for the industry and good for the consumer if buyers can find a quality unit. It is amazing how the entire market has flipped in just 12 months from a seller’s to a buyer’s market. What we are seeing right now is a very slow drawdown in inventory, as can be seen from the RVtrader.com data. The run-rate of this draw-down of inventory is very slow, however, meaning there is just way too much inventory on dealer lots, and will be for a long time.

RV Quality

Also, quality is a real and acknowledge issue on units produced in the past year, meaning buyers who are in the market need to beware when purchasing a new unit. The huge ramp-up in production in 2021 and early 2022 pulled in many inexperienced line workers, many of whom learned on the job during heightened production levels. Many of these same people are still pushing out RVs, just at a slower pace. It is a very real thing that many workers have learned the trade in a very high-pressure and fast-paced environment, something that many may have difficulty unlearning.

Pricing

The other main problem with a buyer’s market just now is pricing. You may have tremendous leverage as a buyer right now, but MSRPs have skyrocketed during the pandemic and even significant discounts usually mean a price that is well above pre-pandemic MSRPs. Given the softness in the secondary market, likely many buyers will see a huge depreciation on new RVs in the current environment. As an example, I purchased my 2020 Keystone Bullet 243BHS at a discount in May 2019. The MSRP was in the high $20ks. A similar model now has an MSRP in the mid-$40ks, so even discounted 25% would yield a real price in the low $30ks. Higher than the full MSRP on my 2020 unit. I think this is a big reason why there are so many trailers sitting on dealer lots. Coupled with high interest rates, it is a perfect storm to kill sales.

That’ll do it for now.

All the best in your camping endeavors!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and by their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!

-

https://apnews.com/article/inflation-economy-business-9b044c8ada5aa538d539237be1da9d14 ↑