This blog will cover the latest RV and travel data news. August 2023 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell or hold an RV. We’ll examine how the industry has decided to build cheaper. There is a massive shift going on.

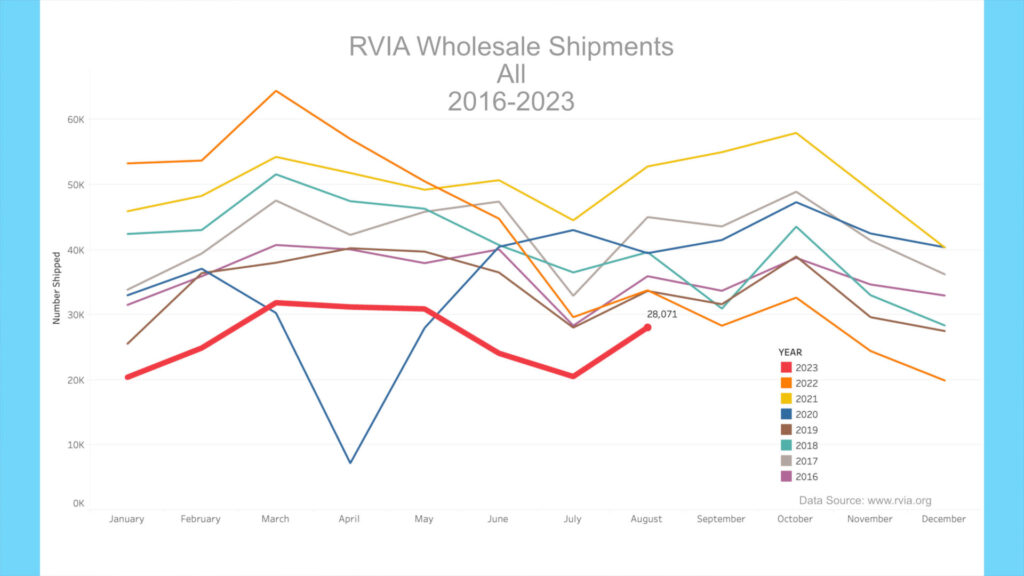

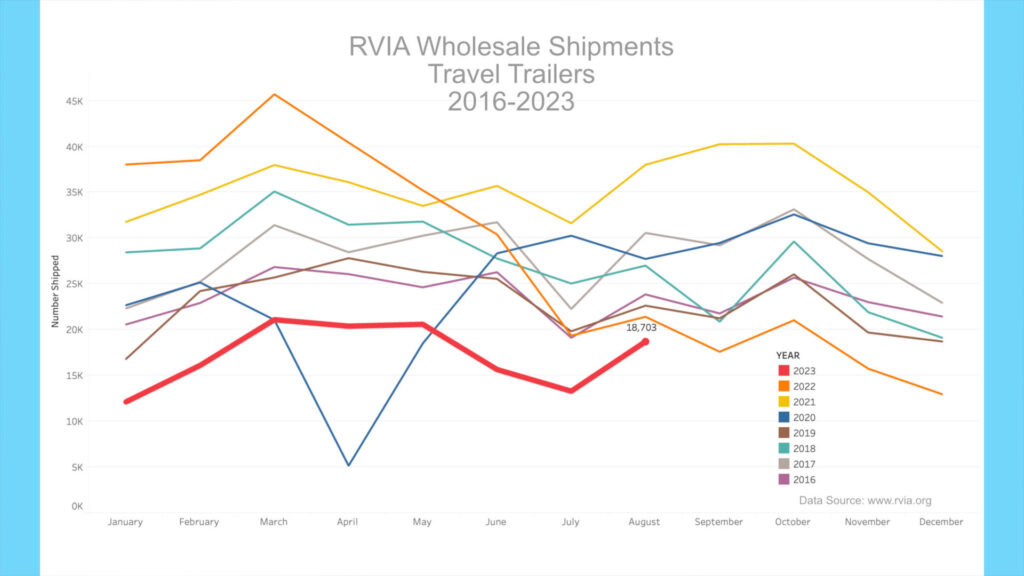

RVIA Numbers

On September 25th, 2023, the RVIA posted the latest RV wholesale shipment data for August 2023. Production continued a downward trend compared to the prior year, as expected. Only 28,071 total RVs were shipped in August, down from 33,783 in August 2022. August 2023 was the lowest year in recent memory. Travel trailers also declined year-over-year, with only 18,703 shipped in August vs. 21,417 a year ago. It was by far the worst August for towable trailer shipments in several years, with almost 3,000 fewer travel trailers shipped than in the next lowest August, in 2022. It is essential to understand that August of 2022 had already witnessed the beginning of severe production cuts. For some context, August 2017 saw production of 30,575 travel trailers, and August 2021 saw a whopping 38,011 travel trailers shipped – over 19,000 more than in August 2023.

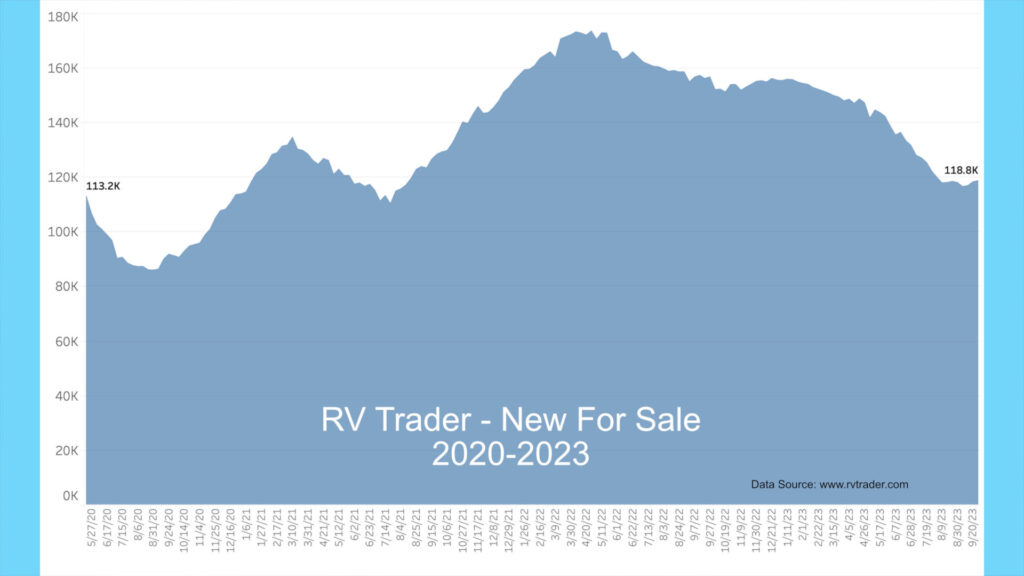

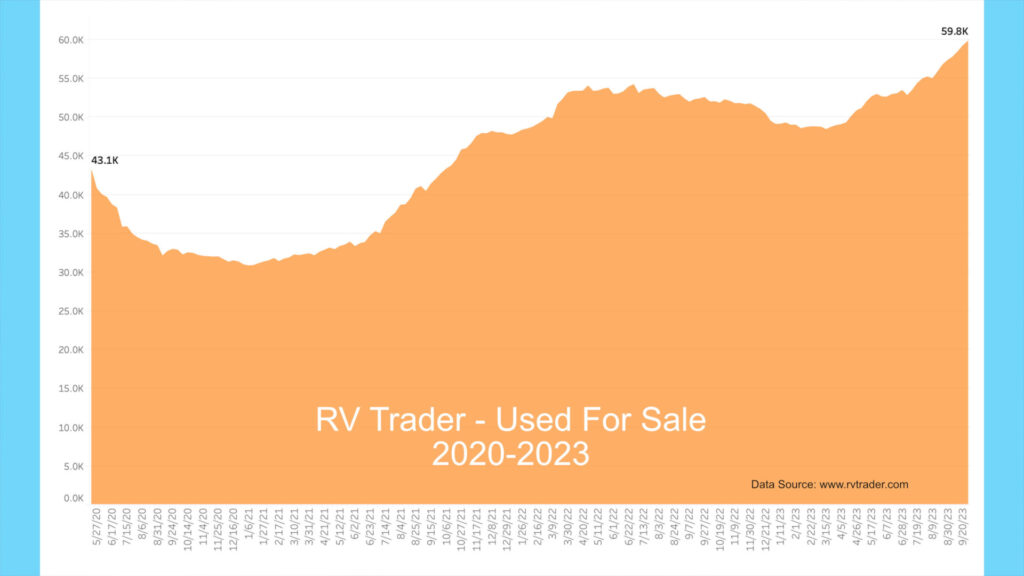

RV Trader Numbers

Meanwhile, RVs for sale on RVTrader.com are increasing, with new 2024 models arriving on dealer lots. There were 118,789 new RVs for sale as of September 27th. This is up 679 units from late August’s 118,110 and down approximately 38,000 new units versus late September 2022.

Used units for sale increased to 59,777, up from 57,308 last month, as more people attempt to unload used RVs. This is now the twenty-fourth week with used for-sale units above 50,000. This time last year, the number of used RVs for sale was 52,513, so we have about 7,300 more used units for sale versus late September 2022.

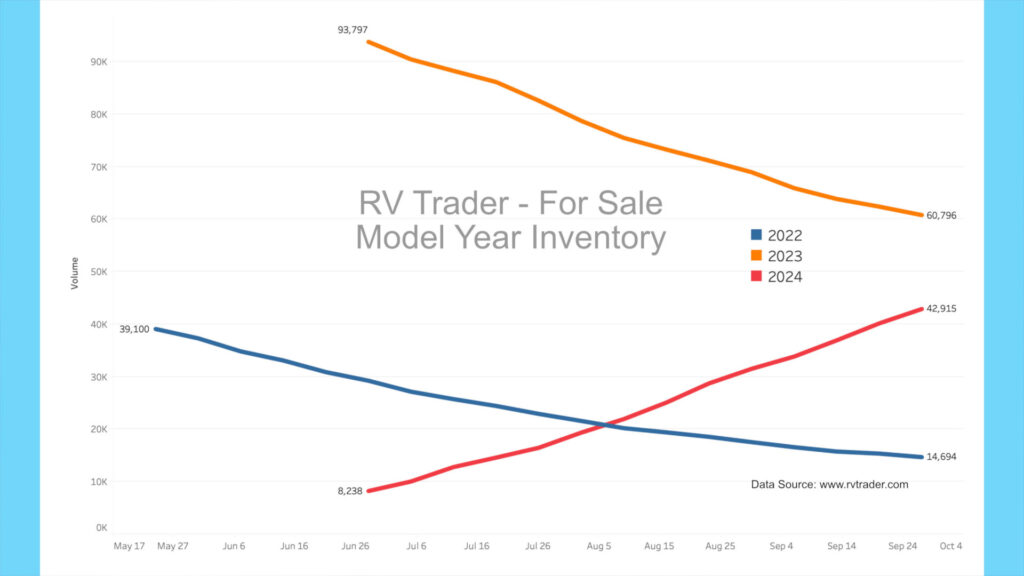

Our new model year chart shows new 2022 model volumes for the past eighteen weeks. As dealers unload these 2022 units, the number of models has decreased from 39,100 to 14,694 units. The orange line shows 2023 models going from 93,797 to 60,796 units over the past thirteen weeks. Meanwhile, the red line shows 2024 models now showing up on RVTrader.com. Thirteen weeks ago, there were 8,238 new 2024s, and now there are 42,915. So, there are still about 75,500 new 2022 and 2023 models on dealer lots. As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory.

High-End Market

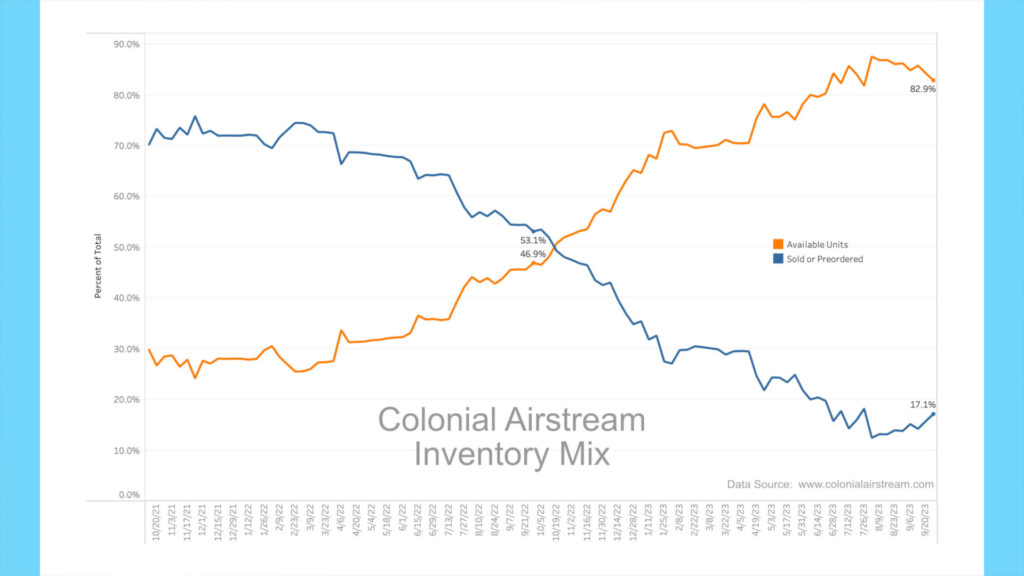

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, one of the nation’s largest Airstream dealers, continue to move towards a buyer’s market with in-stock units remaining high.

About a year ago, roughly 53% of Colonial’s inventory was preordered, meaning only 46% of their Airstream inventory was either on the lot for sale or being delivered and available. As of September 27th, 2023, roughly 83% of inventory is available for sale, with only 17% spoken for. This has meant a continued buildup of on-the-lot inventory. Colonial now has 101 new units on the lot for sale vs. 80 a month ago. This increasing glut should mean a potential buyer can bargain significantly. The problem is that MSRPs have risen considerably in the past few years, so even discounted, these units can be costly.

BLS RV Manufacturing Labor Stats

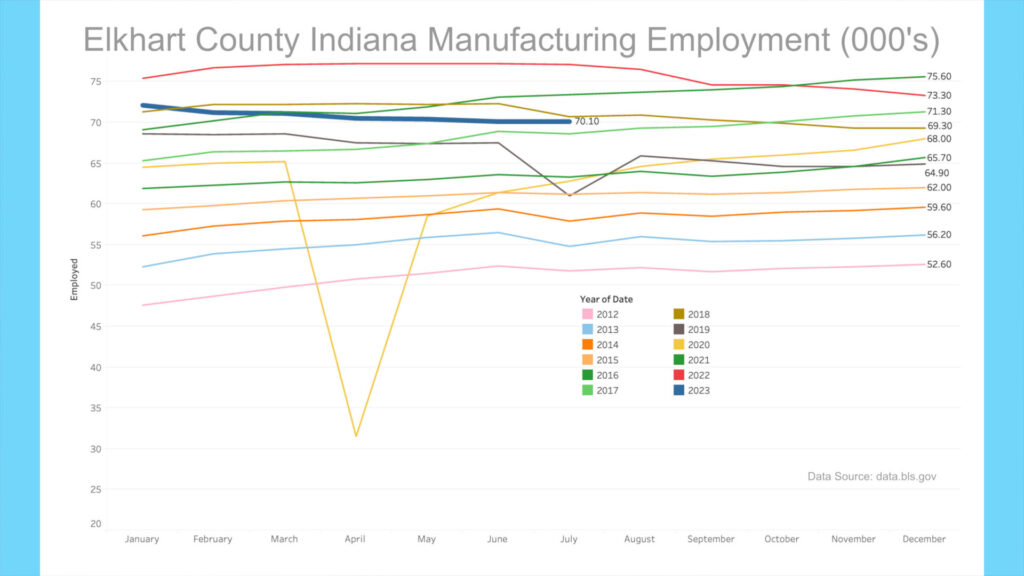

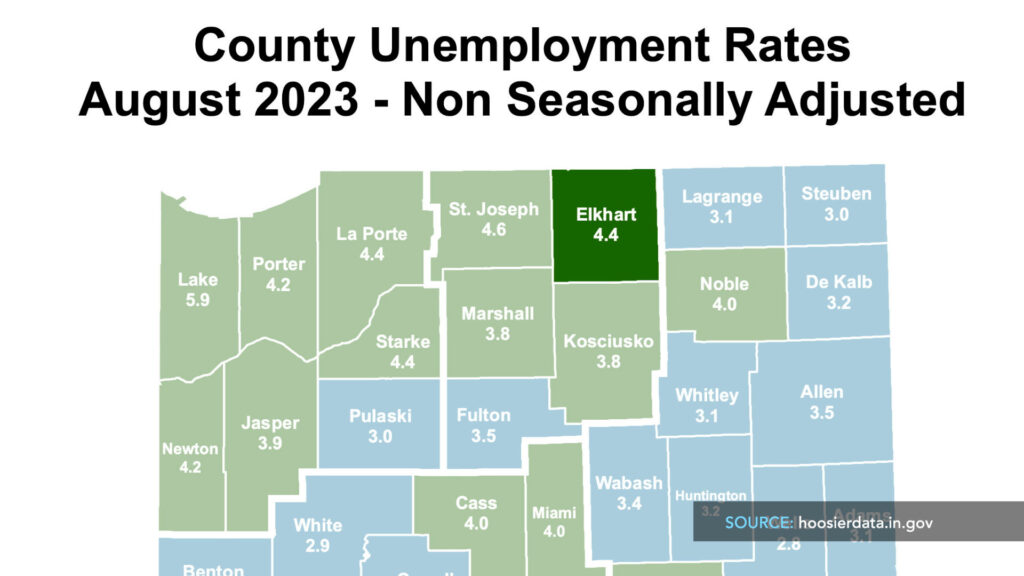

The Bureau of Labor Statistics has revised Elkhart County, Indiana’s latest manufacturing employment data for July 2023. We cover this because a very high percentage of North American RVs are made in this area of the country. The revision shows that at the height of production in the spring and early summer of 2022, there were 77,200 people employed in manufacturing. For July 2023, this number stands at 70,100 people, holding steady from June 2023 and down 7,100 since the peak. The employment number will likely remain stable as manufacturers launch new 2024 models. Accordingly, the unemployment rate for Elkhart, based on August preliminary numbers, settled back to 4.4% in August, down from 5.2% in July.

AAA

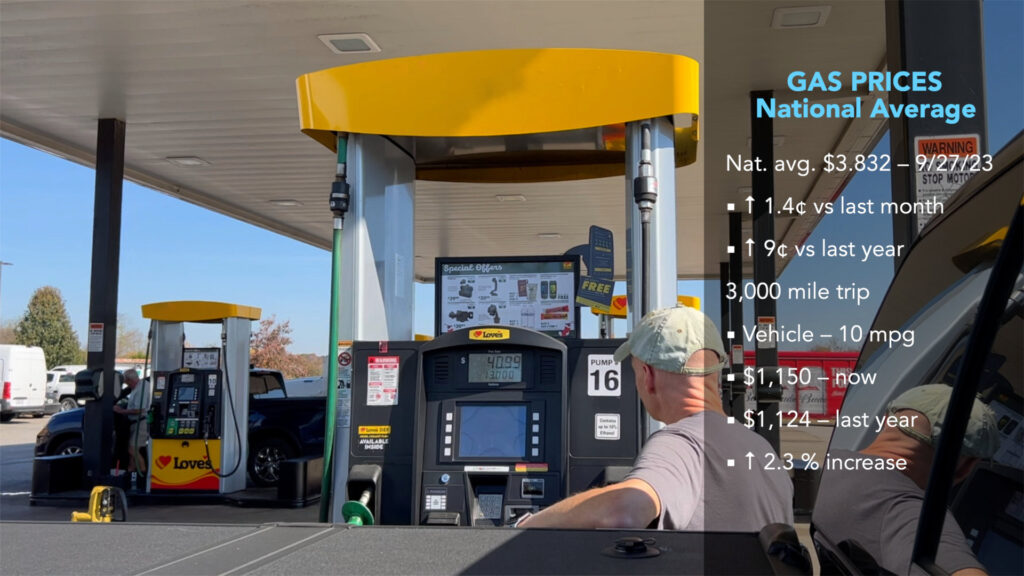

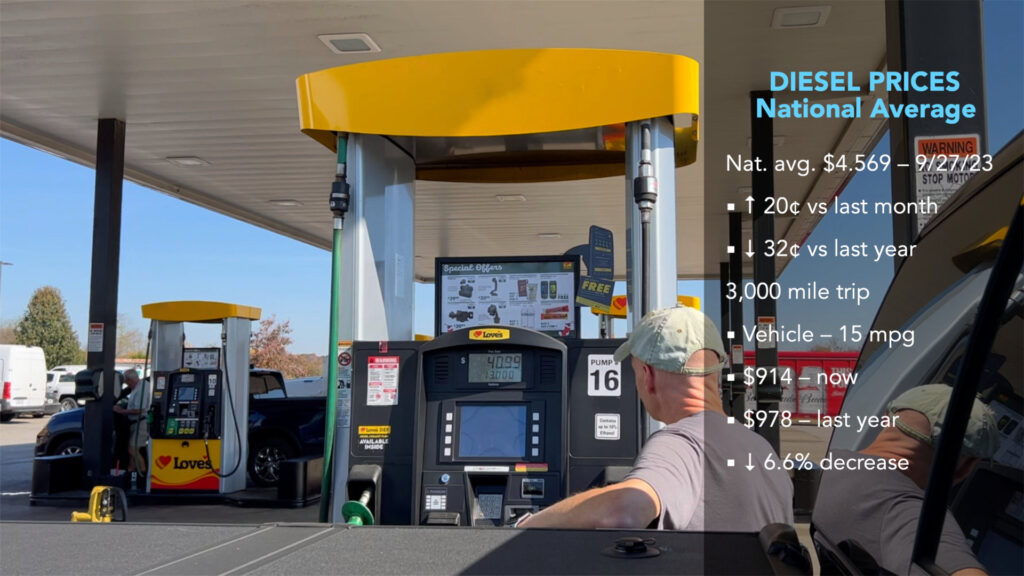

Gas prices have increased slightly in the past month. According to AAA, the current average nationwide price as of September 27th was $3.832 per gallon for regular unleaded, up $.014 from a month ago and up only $.09 per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $1,150 now vs. $1,124 a year ago, a 2.3% increase YoY. Diesel prices have increased in the past month and are staying well above the $4 mark and now sit at $4.569, up $.20 from a month ago and down $.32 from a year ago. A similar 3,000-mile trip getting 15 mpg would cost $914 now vs. $978 a year ago, a 6.6% decrease.

Thor Reports Earnings

On September 25th, Thor Industries, the largest North American RV manufacturer, reported its fourth-quarter and full-year financial results. While its sales in Europe expanded, North American sales and profit fell considerably. According to Bob Martin, President and CEO of THOR Industries, “Fiscal 2023 presented a series of challenges as a result of higher interest rates, rising inflation, increased economic uncertainty, ongoing supply chain constraints, and geopolitical issues.”[1] Net Sales for Towable RVs dropped especially hard, losing 51.5% from $8.66B to $4.20B YoY.

Telling was the drop in gross profit margin, which is the percentage of gross profit to net sales. For the fourth quarter, gross profit dropped to 11.9% from 15.2%. According to the company, “The decrease in gross profit margin for the fourth quarter was primarily driven by higher manufacturing overhead and warranty percentages, partially offset by a decrease in the material cost percentage due to the combined favorable impacts of product mix changes…” I want to draw your attention to the statement that warranty percentages had a negative impact on their profit margin. Translation: There were so many warranty claims on our new RVs that it had a very material impact on our expenses. Public companies can’t hide the reality that quality has been a real issue in the past few years, and this passing item in Thor’s financials exposes the reality of the issue.

If they were to hold the 15.2% gross profit margin, it equates of about $30M more in net income. While the increase in warranty claims is only a part of this $30M increase in expenses, it isn’t disclosed, but is likely a significant portion. This reaffirms what we have been talking about for well over a year, that RV quality issues are a real thing, and any new RV buyer needs to be very careful.

RV Cheapification

On September 1st, 2023, RVBusiness Magazine interviewed two key RV industry insiders from Keystone RV, one of the nation’s largest RV builders. Josh Miller, VP of Sales, and Christy Spencer, Director of Marketing and Communications, were asked about Keystone’s product strategy for the 2024 model year. Keystone RV has been at the front of the curve in accurately anticipating the market, as shown by decades of successful models, like the Cougar, Montana, Bullet, Hideout, and Passport RVs. Their comments shed much light on where the industry is going.[2]

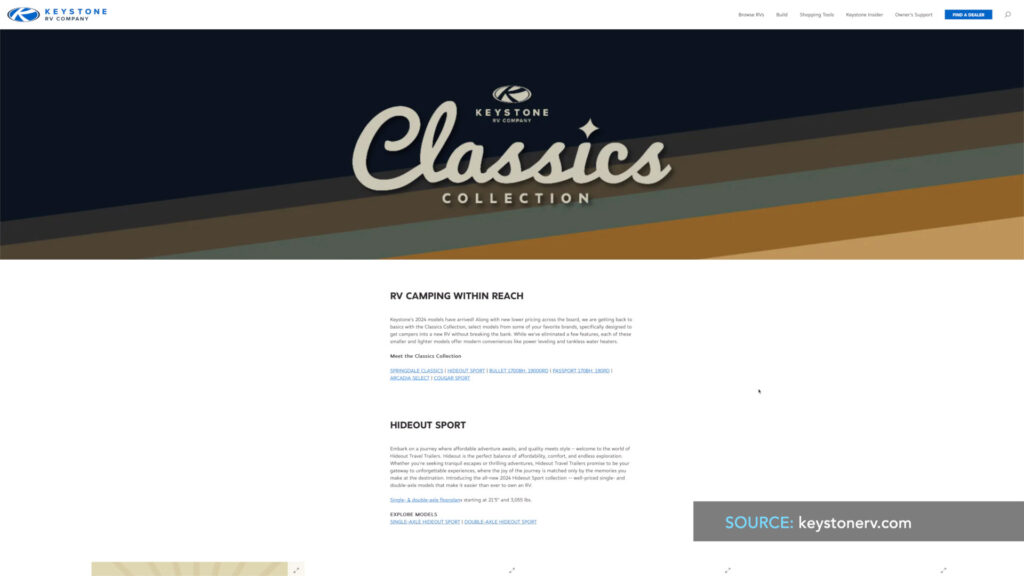

Keystone RV recently launched the Keystone Classics Collection, which are lower-priced, less-contented units. Here is what their website says about the new lower-cost direction:

“Along with new lower pricing across the board, we are getting back to basics with the Classics Collection, select models from some of your favorite brands specifically designed to get campers into a new RV without breaking the bank. While we’ve eliminated a few features, each of these smaller and lighter models offers modern conveniences like power leveling and tankless water heaters.”[3]

Josh Miller, VP of Sales, commented, “We’re going smaller…trailer-wise, we’re really honing in on smaller floorplans. All of the models that we’re going to have that are right around that 3,000-3,500 lb. dry weight, we feel like it is opening up to a whole new segment of tow vehicles for customers, and those seem to be the customers that are entering the market.”

My take is they are not seeing people upgrade nearly as much, so they are having to build for new buyers at lower price points with lower input costs. He reaffirms this thought…

“We partnered with vendors to take a look at the parts and pieces that we’re using so that we can keep the value to the customers high so that their camping experience is an easy one…but also address some price concerns; we looked at engineering, so the way that we engineered the size of those and the way that we’re putting them together, to get cost out and get weight out.”

Christy Spencer, Director of Marketing and Communications, added, “We uncovered an opportunity for buyers — to give buyers a reason to return to the market and give new buyers an opportunity for a swing at some more affordable products.”

My take is that since the end of the pandemic, expensive models have been sitting on dealer lots; our data affirms this. Dealers are likely asking for less expensive models, and this is the response from one of the largest RV manufacturers. People are not repeat buying as in the past, so they are trying to build to attract new customers and repeat customers with a less expensive price point.

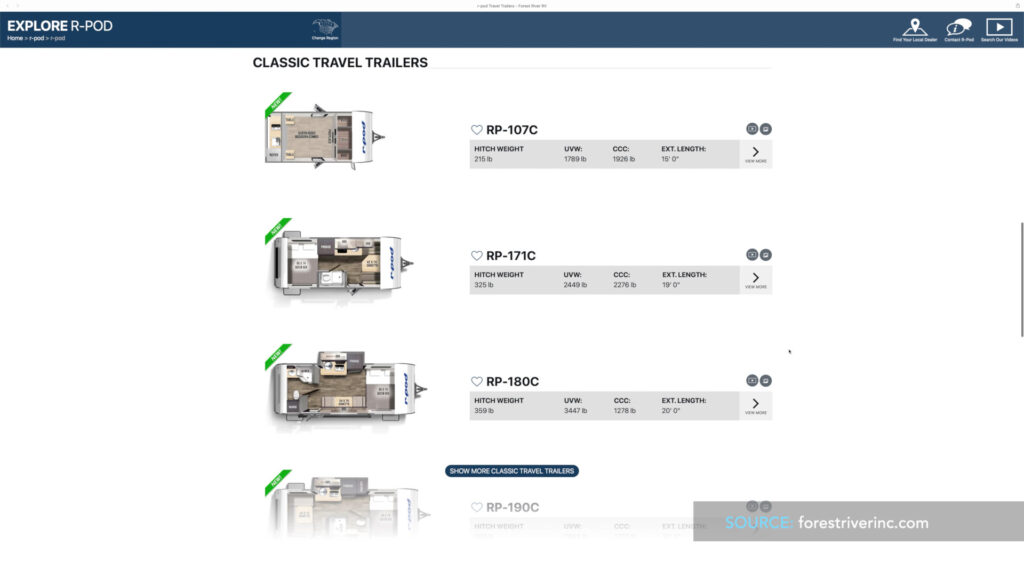

We’re also seeing Forest River R-Pod take a similar direction as they have reintroduced some older models as “R-Pod Classic” travel trailers, bringing back the 171, 180 & 190 models, all without front windows, and introducing a 107 model that is under 1,800 lbs. dry weight.[4]

Ember RV is also taking the same industry direction and just this week introduced their more affordable and lighter E-Series travel trailers. According to RVBusiness Magazine, Ember “introduced the new E-Series, a lightweight, laminated, price-conscious travel trailer. Using plywood, Azdel, dense block foam, and aluminum-framing, E-Series is built on a laminated floor…E-Series also features a fully walkable roof covered with durable Tufflex® PVC backed by a lifetime warranty.”[5]

Another manufacturer confirms the general direction of going smaller and cheaper by saying it is resisting the trend. John Stringer, General Manager of Rockwood/Flagstaff (a Forest River subsidiary), mentioned, “The most important feature is the fact that, instead of doing like what so many other companies are doing, we’re not de-contenting. We’re adding value, keeping pricing similar, but not taking things out of the unit. We’re zigzagging left; they’re zigzagging right.”[6]

From all these data points, it seems apparent that the industry is moving to smaller, more entry-level units as return buyers have taken a break, and inflation has made monthly payments untenable for most prospective buyers.

Moreover, consumers will likely be treated to lower-cost, de-contented new RVs for the next year or two as manufacturers retrench and try to find a price point where sales pick back up. A silent alarm to me is other input costs being reduced that are not mentioned. It takes much labor to hand-build RVs, and lowering costs and retail prices likely means taking labor costs out of production. I was hoping we were out of the woods with pandemic trailers, and the new shift may mean continued poor quality as manufacturers squeeze labor and component costs out of new units.

Recently, I have taken all of this information and decided to upgrade my RV, not by buying new, but by improving what I have. I think many of us are on the same page. Please let me know your thoughts and what you plan to do.

That should do it. All the best in your camping adventures!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!

- https://rvbusiness.com/thor-q4-shows-record-performance-in-european-segment/ ↑

- https://youtu.be/-pzuhIBKohE ↑

- https://www.keystonerv.com/2024-classics-collection ↑

- http://thedesignhornet.com/books/cbpr/#p=81 ↑

- https://rvbusiness.com/ember-recreational-vehicles-introduces-affordable-e-series/ ↑

- http://thedesignhornet.com/books/cbpr/ ↑