In this blog, we’ll cover the latest RV and travel data news. February 2024 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell or hold an RV. Later in the news, we’ll cover how some of the big players in the industry are doing.

RVIA Numbers

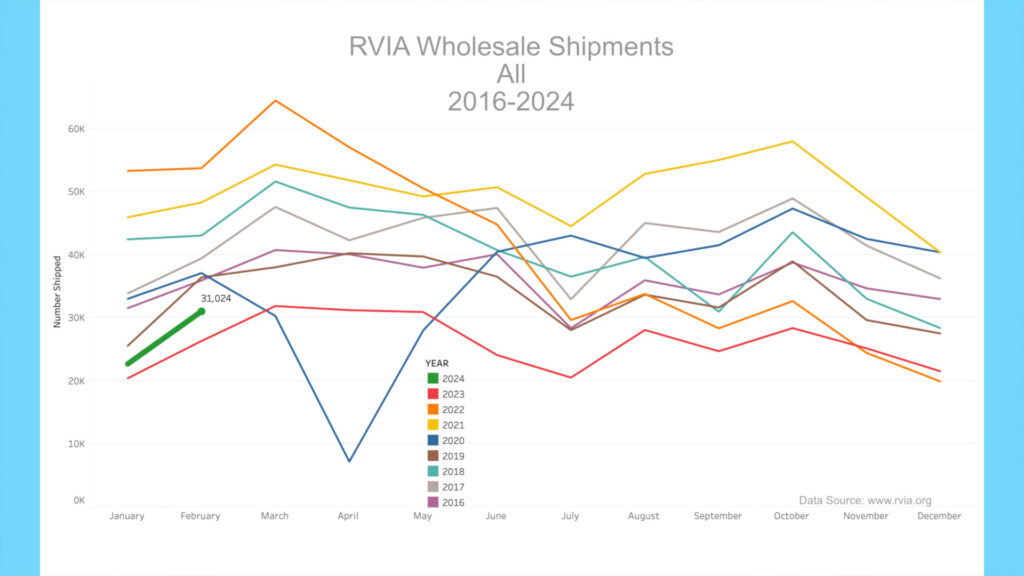

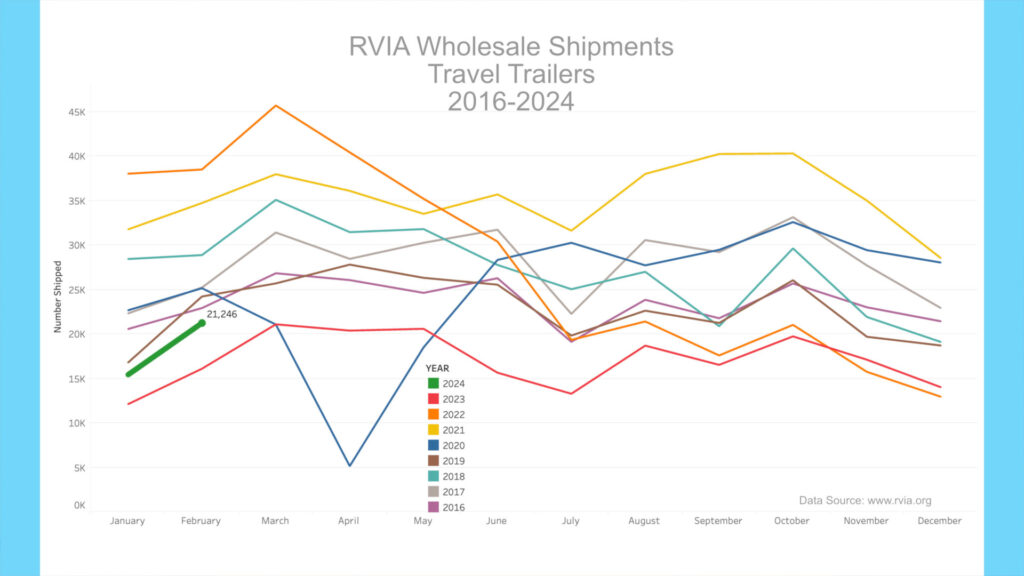

On March 25th, 2024, the RVIA posted the latest RV wholesale shipment data for February 2024. Production increased compared to the prior year, with 31,024 total RVs shipped in February, up from 24,903 in February 2023. However, February 2024 had the second lowest production February since before 2016. Travel trailer production increased year-over-year, with 21,246 shipped in February 2024 vs. 16,109 a year ago.

For context, February 2022, just two years prior, saw the production of 38,508 travel trailers – 17,262 more than in February 2024. Motorhome production, which includes Class A, B & C motorhomes, witnessed its second-lowest February in recent memory at only 4,040 units shipped. This is just above the next lowest year, 2020.

RV Trader Numbers

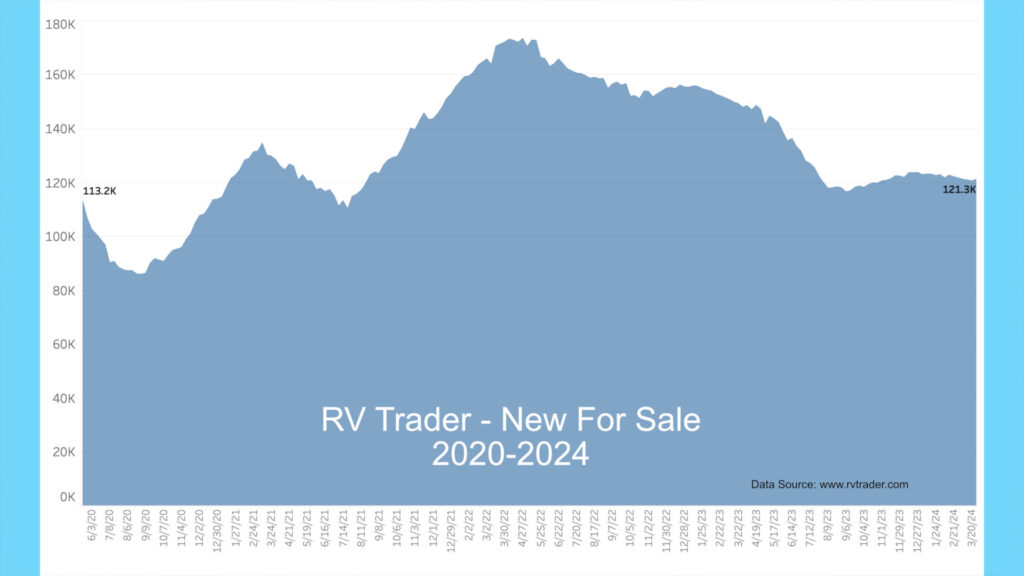

Meanwhile, RVs for sale on RVTrader.com are holding steady, with 121,270 new RVs for sale as of March 27th. This is down only about 500 units from late February 2024 and down 26,752 new units versus late March 2023’s 148,022 new units.

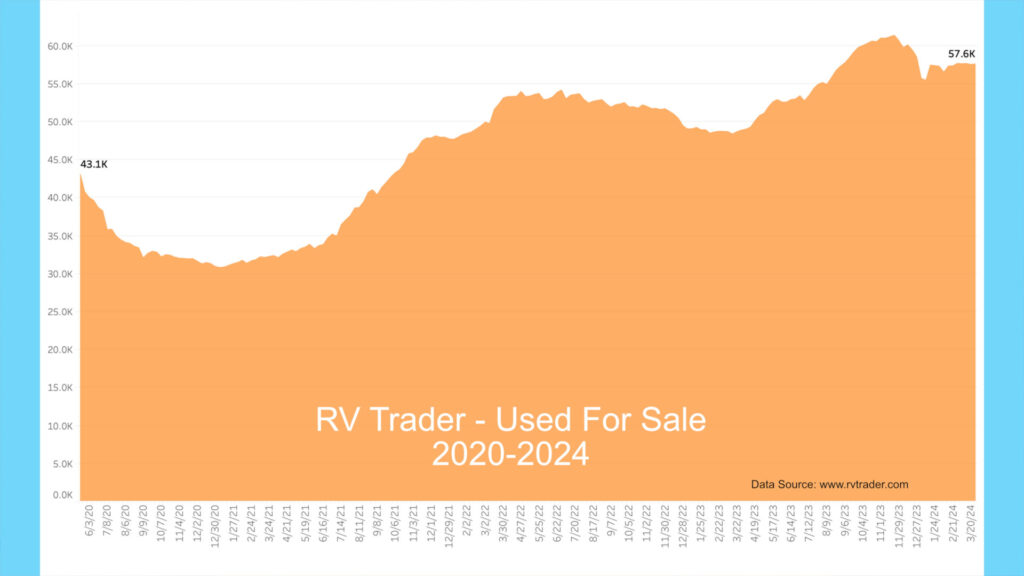

Used units for sale steadied at 57,589 from 57,665 in late February (down by 76). This time last year, the number of used RVs for sale was 48,887, so we still have almost 8.7k more used units for sale now than a year ago. These past 12 months, especially since last camping season, have witnessed a significant increase in people trying to sell used RVs.

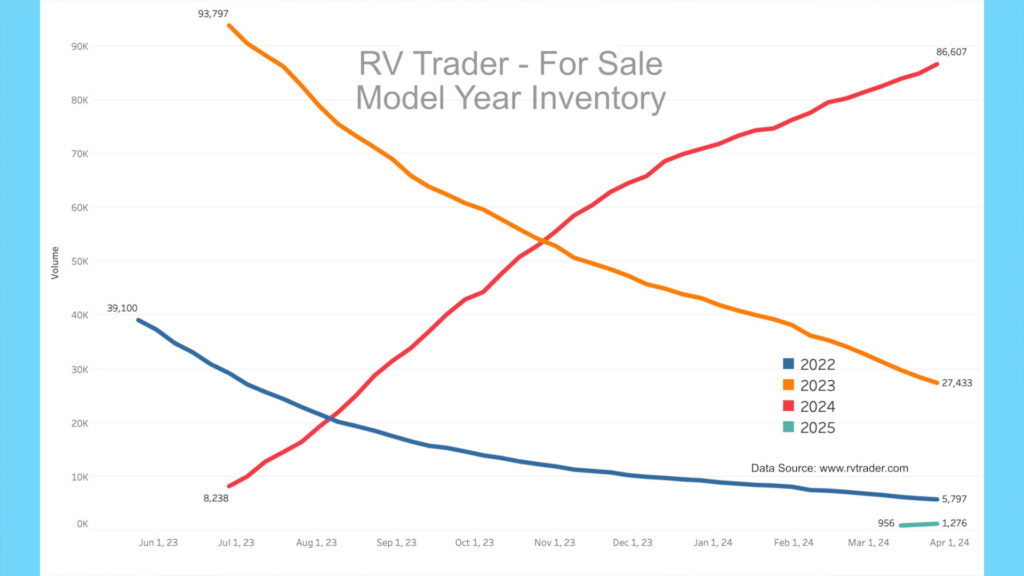

Our model year chart shows new 2022 model volumes since May 2023. As dealers unload these 2022 units, the number of models has decreased from 39,100 to 5,797 units. The orange line shows 2023 models going from 93,797 to 27,433 units since late June 2023. Meanwhile, the red line shows 2024 models on RVTrader.com. In late June 2023, there were 8,238 new 2024s, and now there are 86,607. Also, a few 2025 units are showing up online. There are currently 1,276 2025 units for sale. We’ll start to track these so you can see what age mix is available for sale. So, there are still just over 33k new 2022 and 2023 models on dealer lots. As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory. To receive weekly updates on these data, you can follow my account on X at @JohnMarucci.

High-End Market

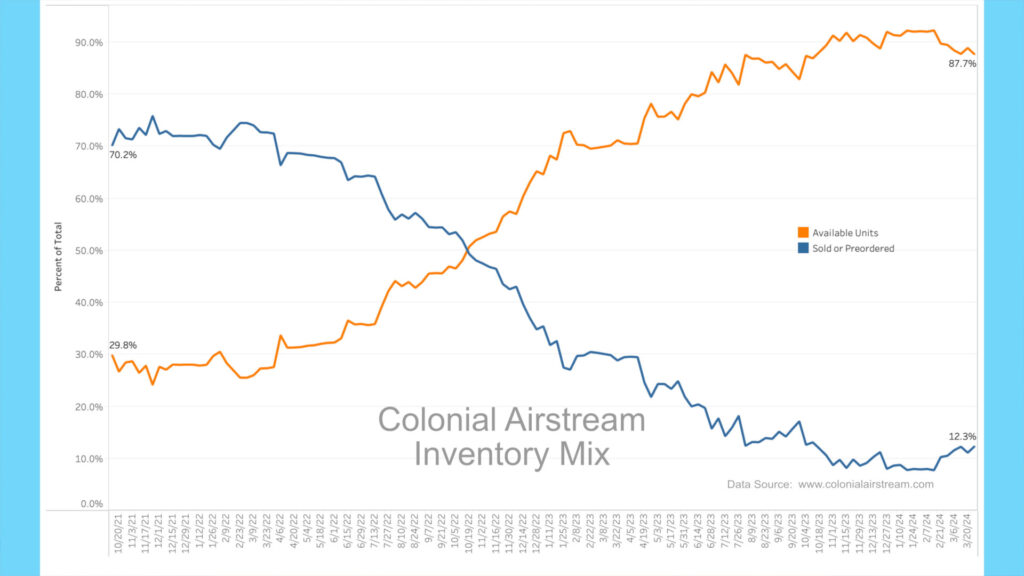

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, one of the nation’s largest Airstream dealers, still show a glut of in-stock units.

About a year ago, 29.5% of Colonial’s inventory was preordered, meaning 70.5% of their Airstream inventory was either on the lot for sale or being delivered and available. As of March 27th, 2024, roughly 88% of inventory is available for sale, with only 12% spoken for. As of March 27th, Colonial has 126 new units on the lot for sale vs. 101 at the end of September 2023.

BLS RV Manufacturing Labor Stats

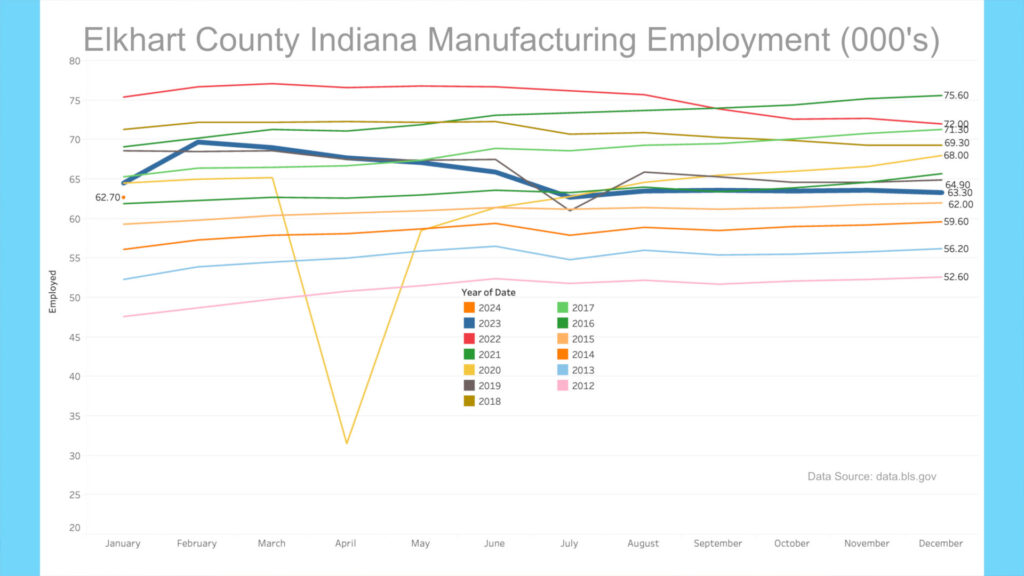

The Bureau of Labor Statistics did a significant downward revision of Elkhart County, Indiana’s manufacturing employment data for the past 21 months. I am not sure the reason for the sizeable downward revision other than the current dataset was likely inaccurate. The short of it is that the employment numbers now match the reality on the ground that we are hearing from industry insiders. The revision shows changes in the data from April 2022 to December 2023 numbers, bringing the employment level down considerably. The January 2024 manufacturing employment level sits at 62,700, slightly above the January 2016 level.

AAA

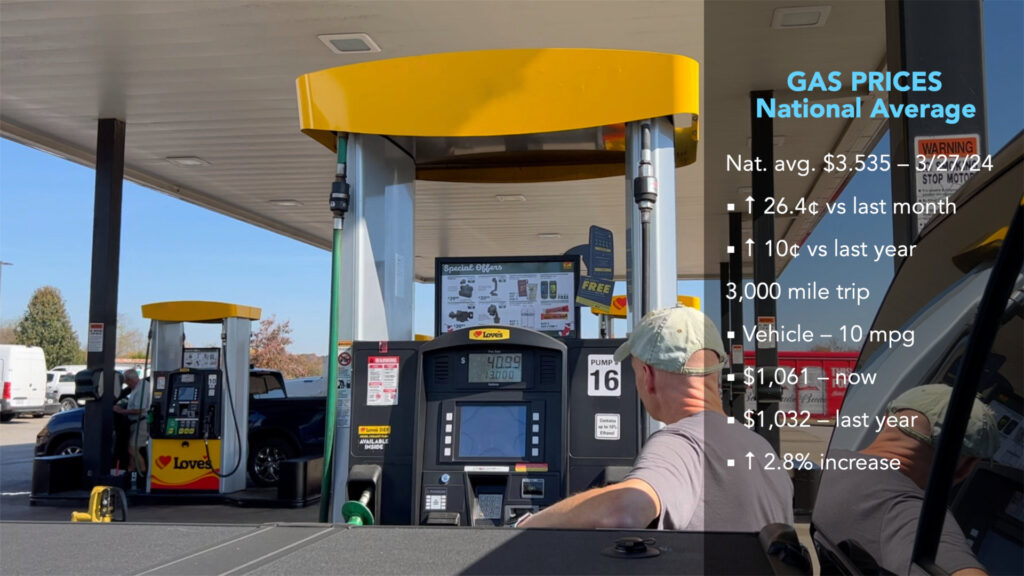

Gas prices have increased in the past month. According to AAA, the current average nationwide price as of March 27th was $3.535 per gallon for regular unleaded, up a hefty $.264 from a month ago and up about $.10 per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $1,061 now vs. $1,032 a year ago, a 2.8% increase YoY. Diesel prices have decreased slightly in the past month and currently sit at $4.051, down $.02 from a month ago and down $.19 from a year ago. A similar 3,000-mile trip getting 15 mpg would cost $810 now vs. $848 a year ago, a 4.4% decrease.

The Big Players Report Downturn

Let’s summarize recent financial reports from the more prominent players in the RV market. We’ll cover a large RV component manufacturer, a couple of more prominent RV manufacturers, and a large RV dealer chain. These large companies are publicly traded, so they must release their performance to the public.

Dometic

Dometic is the maker of many components in most RVs. They reported lower revenues and profit for 2023, with overall sales down 6.7%. Yet, this covers the entire company’s business on multiple continents. If we focus on their Americas segment, which is mainly RV components, sales were down 26.2% vs. 2022, with earnings before taxes going negative, off approximately $27 million.[1]

Thor

Thor is the largest RV manufacturer in North America, owning brands like Airstream, Jayco, and Keystone. For the six months ending on January 31st, 2024, the company saw sales revenue decline by 22% and earnings before taxes decline by 52%. More telling is the reason for the decline cited by Thor, “Our fiscal second quarter, similar to the prior-year period, presented a challenging operating environment as seasonally lower retail demand and cautious dealer sentiment impacted our results.”[2] Cautious dealer sentiment is code-speak for dealers cutting back on orders.

We get more insight when Thor speaks about towable trailers, where sales were down by 11.9%, with towables selling at an average price 22% below last year’s same period. So, the average selling price for the prior quarter for a towable trailer was down 22%, meaning more sales shifted to lower-priced units. This also points to the reality that fewer people are upgrading, which would generally increase the average price per unit sold.

Motorized RVs performed worse than towable units, with sales down 31% for the six months ending on January 31st, 2024, and earnings before taxes declining almost 66%. Thor mentioned that this was because the mix (cheaper units sold) and average prices were down due to discounting. Translation: Thor had to significantly discount motorized units that were not selling.

Winnebago

Winnebago Industries also reported that sales were down. Besides their name-brand Winnebago models, Winnebago also owns Grand Design and Newmar. For the three months ending on February 24th, 2024, Winnebago reported a sales drop of 17% on towable trailers, with earnings before taxes dropping by 32%. Like Thor, Winnebago attributed the drop to lower unit sales and lower average prices per unit sold. Interestingly, they also explained the earnings drop to “higher warranty” expenses.[3]

Winnebago’s sales revenue for motorized RVs was down 16%, and earnings were down 39% due to lower volumes and, like Thor, higher discounts. Backlog is also a big issue creeping in for the company, as backlog orders (generally orders from dealers) are down 20% on towable RVs and down a whopping 48% on motorized RVs. Once again, it is apparent that dealers have applied the brakes on ordering.

Camping World

Camping World is the largest RV dealer in the U.S. We’ve looked at results from a large RV component player in Dometic and two of the largest RV manufacturers, but how is the country’s largest dealer fairing?

For the quarter ending December 31st, 2023, Camping World saw overall revenue drop by 13.4% compared to last year’s quarter. New unit sales dropped by 6.7%, and used units declined by 18%. Interestingly, the average selling price for new units dropped by 9.6% and by 10.8% for used units. Earnings for the company swung to a loss for the quarter.

Matt Wagner, Chief Operating Officer, mentioned, “Any reduction of new model pricing causes us to reset used vehicle values and slow down the purchases of used RV inventory while market values correct themselves.” None of what Mr. Wagner said is good news. In essence, Camping World is reducing the price of new RVs, directly affecting the pricing of used RVs and your RV indirectly. He also said they are curtailing the purchase of used units “while market values correct themselves.” Translation: don’t try to sell your used RV to Camping World, given they are looking for used prices to bottom out.

Buy, Sell, or Hold

In light of this information, and as mentioned earlier, we track the current RV market to help you know if it is time to buy, sell, or hold. While it is currently a significant buyer’s market, serious ongoing quality concerns and continued elevated prices (even after discounts) lead us to go with an overall hold rating for existing RV owners.

My take is that the used market has too many RVs for sale right now, meaning if you want to sell and upgrade your RV, you will likely be disappointed trying to sell or trade in. Also, as I’ve mentioned numerous times lately, the industry generally hasn’t dealt with quality issues, and it likely won’t happen anytime soon. The best current strategy is to maintain and enjoy using your RV.

That should do it. All the best in your camping adventures!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!

- https://mb.cision.com/Main/10773/3947537/2676229.pdf ↑

- https://ir.thorindustries.com/investor-resources/press-releases/press-release-details/2024/THOR-Industries-Announces-Second-Quarter-Fiscal-2024-Results/default.aspx ↑

- https://rvbusiness.com/winnebago-industries-q2-results-in-line-with-expectations/ ↑