In this blog we will cover the latest RV and travel data news. April 2024 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell or hold an RV. Later, we’ll look to see what the data is saying concerning why the industry is in trouble. There is a lot to cover.

RVIA Numbers

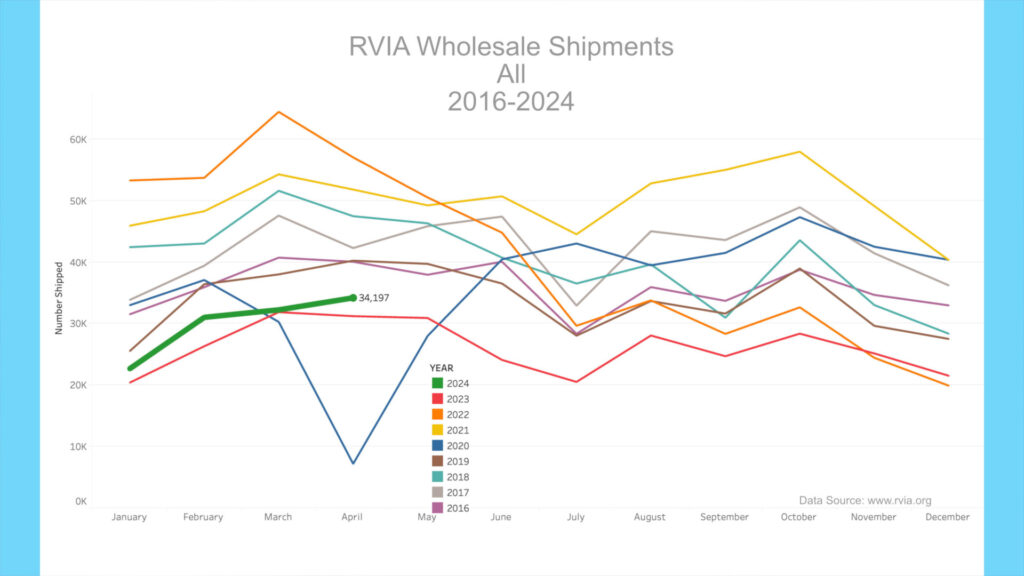

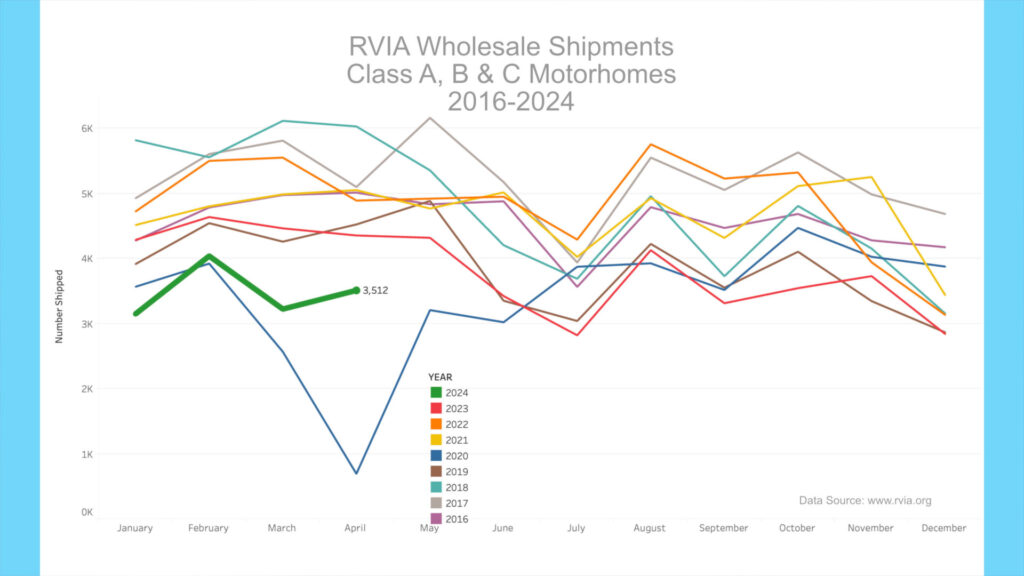

On May 28th, 2024, the RVIA posted the latest RV wholesale shipment data for April 2024. Production increased compared to the prior year, with 34,197 total RVs shipped in April, up 9.5% from 31,216 in April 2023. However, April 2024 had the third lowest production in April, other than 2023 and the pandemic year of 2020, since before 2016. Travel trailer production increased year-over-year, with 24,589 shipped in April 2024 vs. 20,394 a year ago (a 20.2% increase). For context, April 2022, just two years prior, saw the production of 40,435 travel trailers – 15,846 more than in April 2024. Motorhome production, which includes Class A, B & C motorhomes, witnessed its second-lowest April (other than 2020) at only 3,512 units shipped. It seems evident that higher-priced units are seeing the most significant demand slowdown.

RV Trader Numbers

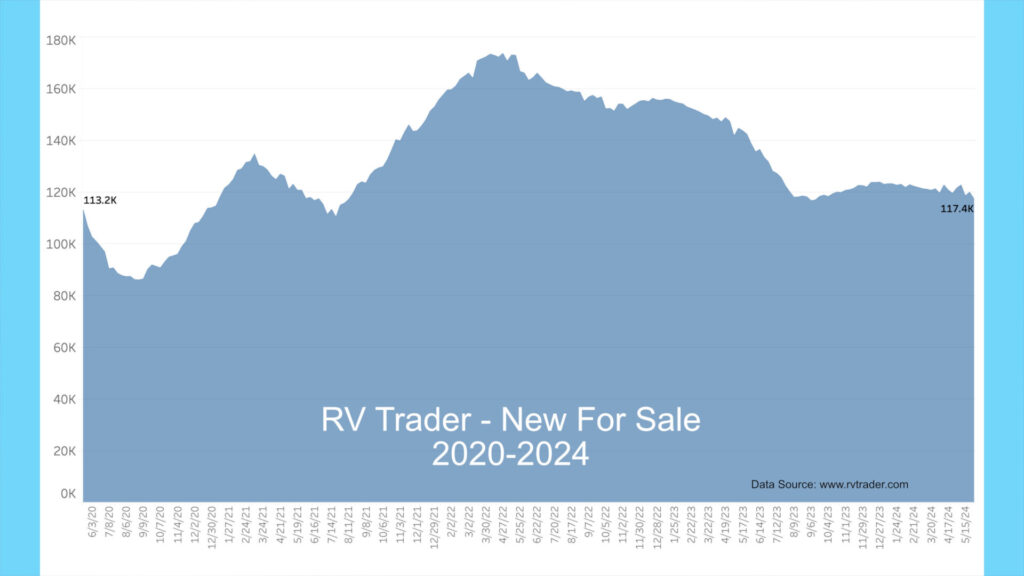

Meanwhile, RVs for sale on RVTrader.com have dropped significantly since last month, with 117,445 new RVs for sale as of May 29th. This is down by 4,016 units from May 1st, 2024, and down a huge 21,223 new units versus late May 2023’s volume.

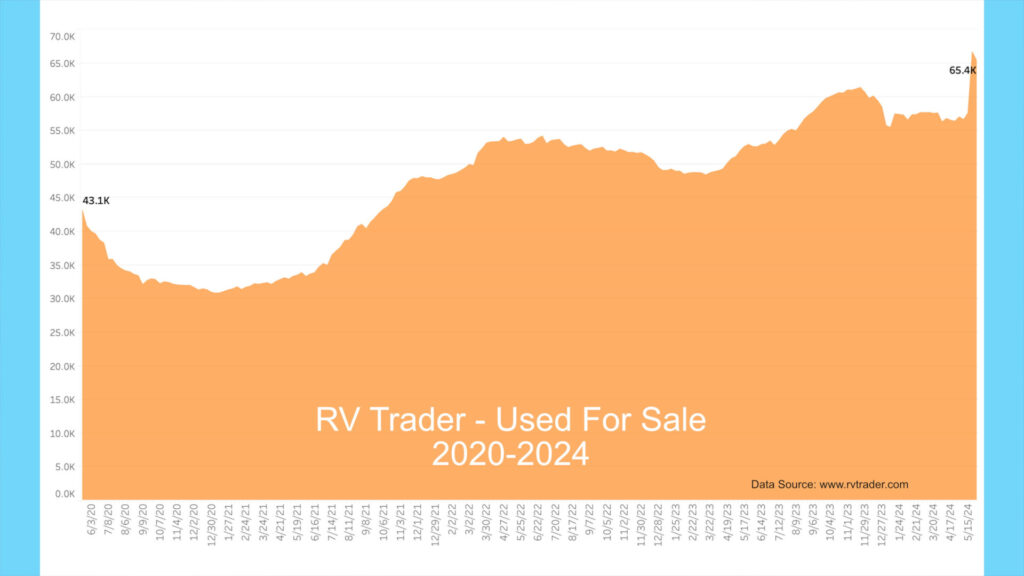

Used units for sale jumped to 65,443 from 57,001 when last reported on May 1st. This is up a whopping 8.400 units. This time last year, the number of used RVs for sale was roughly 52,600, so we have 12.8k or 24% more used units for sale now versus a year ago. In the past two weeks, something odd has happened in the used market as many more used units have shown up for sale. For the 18 weeks prior to May 22nd, the average number of used units for sale was just above 57k. This jumped to over 66k on May 22nd and was over 65k on May 29th.

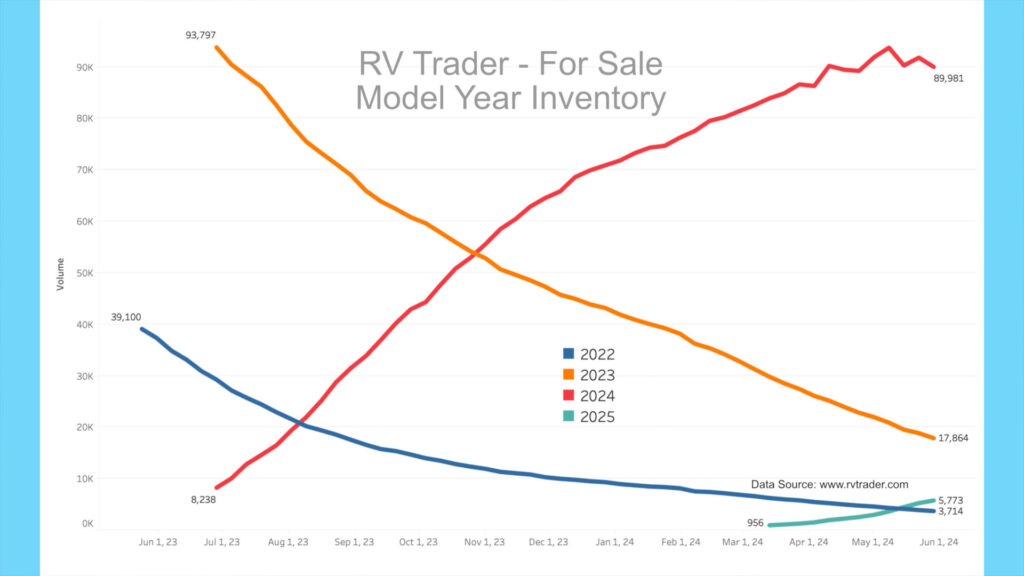

Our model year chart shows new model volumes for 2022 through 2025 since May 2023. As dealers unload the older units, 2022 models have decreased from 39,100 to 3,714 units. The orange line shows 2023 models going from 93,797 to 17,864 units since late June 2023. Meanwhile, the red line shows 2024 models on RVTrader.com. In late June 2023, there were 8,238 new 2024s, and now there are 89,981, seeming to have peaked out as 2024 production runs start to wane. Also, a few 2025 units are showing up online. There are currently 5,773 2025 units for sale. So, there are still about 21.6k new 2022 and 2023 models on dealer lots. As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory. You can follow my account on X at @JohnMarucci to receive weekly updates on this data.

High-End Market

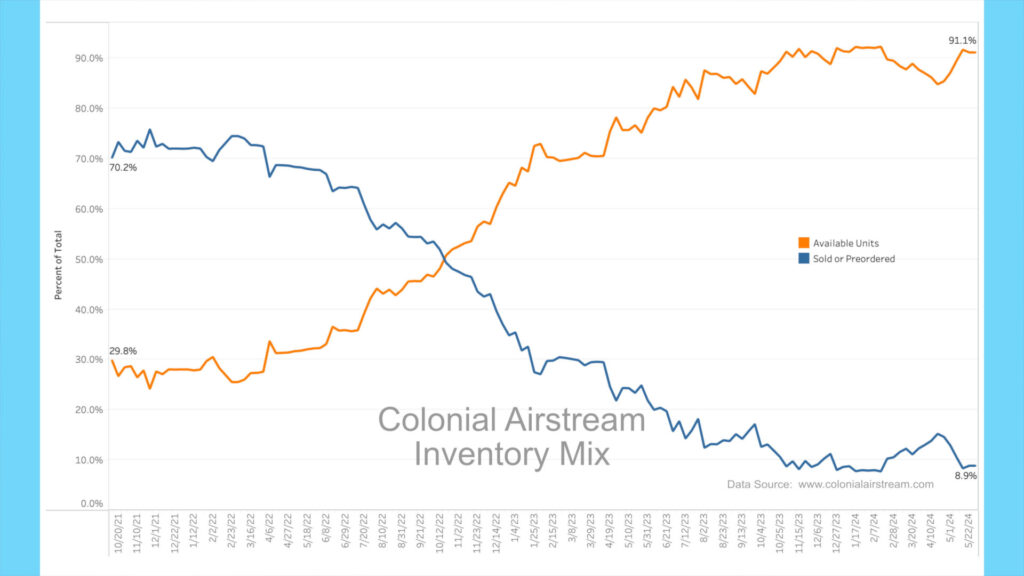

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, one of the nation’s largest Airstream dealers, still show a glut of in-stock units.

About a year ago, 22% of Colonial’s inventory was preordered, meaning 78% of their Airstream inventory was either on the lot for sale or being delivered and available. As of May 29th, 2024, roughly 91% of inventory is available for sale, with only 9% spoken for. As of May 29th, Colonial has 108 new units on the lot for sale vs. 101 at the end of September 2023. Total units in inventory are at a historically low level, indicating a curtailing of ordering, which is a bet that sales will slow. A year ago, in late May 2023, Colonial had 183 units in inventory vs. 158 today and had nearly 300 units in inventory two years ago in late May 2022.

BLS RV Manufacturing Labor Stats

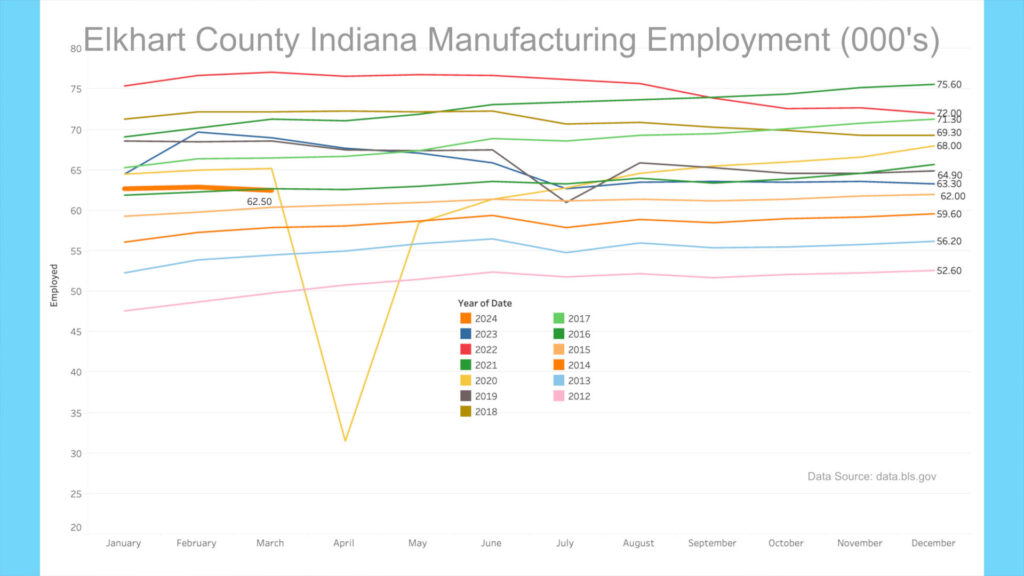

The Bureau of Labor Statistics recently did a significant downward revision of Elkhart County, Indiana’s manufacturing employment data for the past 21 months. I am not sure the reason for the sizeable downward revision other than the current dataset was likely inaccurate. The revision shows changes in the data from April 2022 to December 2023 numbers, bringing the employment level down considerably. The March 2024 manufacturing employment level sits at 62,500, below what was forecasted and slightly below the March 2016 level. The BLS is forecasting manufacturing employment to remain steady for April.

AAA

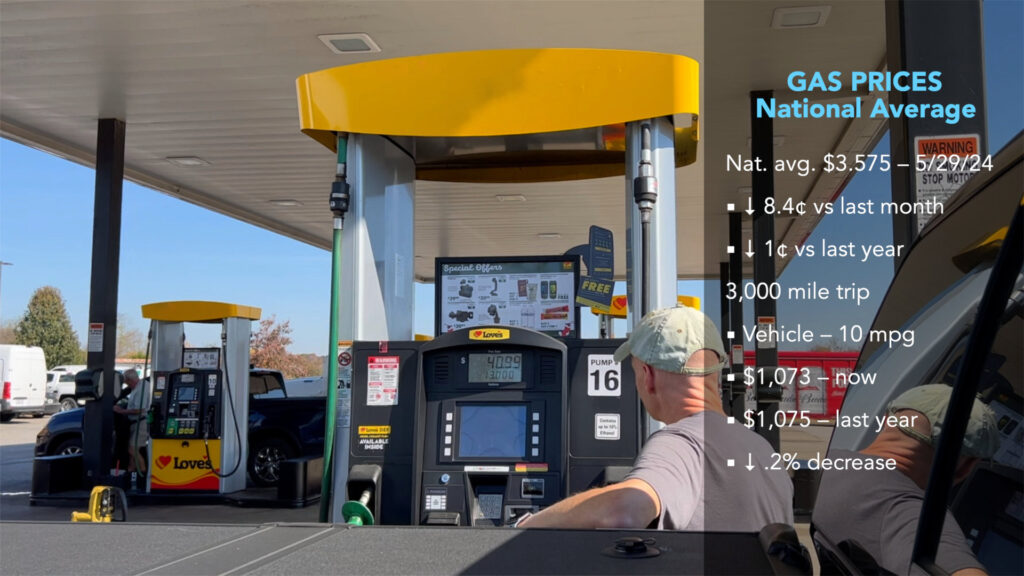

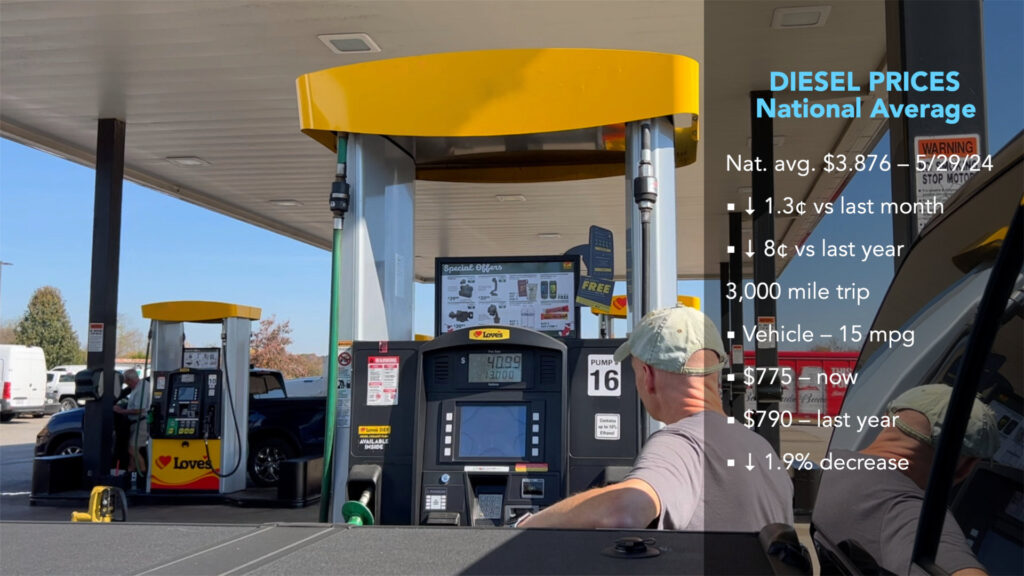

Gas prices have decreased in the past month. According to AAA, the current average nationwide price as of May 29th was $3.575 per gallon for regular unleaded, down $.084 from a month ago and down about $.01 per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $1,073 now vs. $1,075 a year ago, a 0.2% decrease YoY. Diesel prices have decreased in the past month and currently sit at $3.876, down $.013 from a month ago and down $.08 from a year ago. A similar 3,000-mile trip getting 15 mpg would cost $775 now vs. $790 a year ago, a 1.9% decrease.

My Take

A few things seem to be happening when I look at recent trends with most of the data we just reviewed. First, notice that while wholesale shipments are up year over year, almost all of the increase comes from travel trailer volume. We recently reported that several dealerships saw lower average prices, meaning that the average price of trailers sold is down compared to prior years. So, we are seeing some increase in production but for cheaper units. This means any increase in volume is with thinner margin units.

Second, notice the sharp drop in motorhome shipments, which, in general, are much more expensive than travel trailers. I think this spells a significant stop on upgrading from existing owners. If you consider it for a moment, any business would like to sell items with higher profit margins and get existing customers to upgrade to more expensive models. This is precisely what the data says is NOT happening. Higher-priced, higher-margin RVs are not selling, meaning people are not upgrading. This also shows up in Airstream sales, which are slack at best. We’ve tracked Airstream inventory for some time, and inventory is not moving – to the point where orders have been cut – a bet that says the high-end market will be slow going forward.

Third, we’ve seen an odd sharp increase in the posting of used RVs on RVTrader.com. The number jumped from a steady 57k units on average for several months to over 66k units on May 22nd. I can’t immediately place why this happened, but it feels like a dump of used unit inventory by a large dealer onto the RV Trader platform, more than a fundamental change in behavior from current owners.

Also, some recent reports from the industry are touting a younger and more diverse buyer entering the market. While an interesting development, it is immaterial and points to a major problem, given that new RVers generally buy less expensive units to try out the lifestyle. So, new buyers are now purchasing cheaper-made units that fit an entry-level price point. My take is that this likely will inoculate many over the long term.

Finally, some more prominent YouTube influencers have pointed out quality problems and devoted much airtime to allowing owners to voice their issues online to a greater audience. The industry has generally ignored this type of reporting in the past but seems to be reacting with threats and hostility recently. The industry’s reaction seems to be denial that there is a problem with quality or that quality issues are a major factor in the current downturn, especially with upgrading.

The current RV market reminds me of the American car industry in the 1980s ‘malaise era.’ Many were inoculated from purchasing American brands after their experiences during this period. At the same time, the Japanese car companies made inroads into the market. The RV market is ripe for international companies to come in and produce a better product and force real competition. Hopefully, with the recent slowdown, someone in the industry will decide to change the production model and make a better RV, not just a cheaper one.

That should do it. All the best in your camping adventures!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!