In this blog, we’ll cover the latest RV and travel data news. May 2024 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell or hold an RV. Later in the news, we’ll look at the collapse of the high-end RV market and what it means for you. There is a lot to cover.

RVIA Numbers

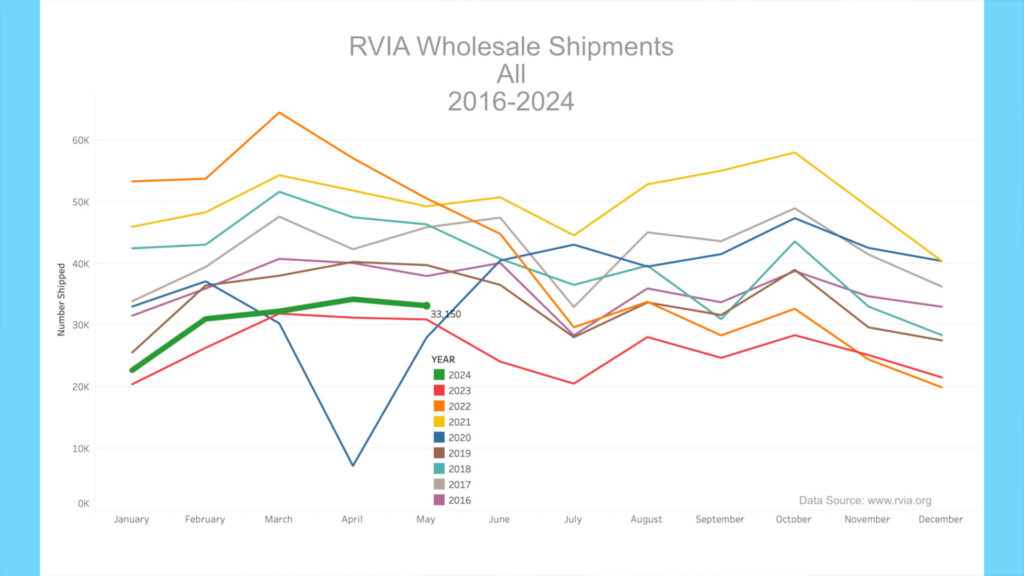

On June 25th, 2024, the RVIA posted the latest RV wholesale shipment data for May 2024. Production increased compared to the prior year, with 33,150 total RVs shipped in May, up 7.2% from 30,919 in May 2023. However, May 2024 had the third lowest production in May, other than 2023 and the pandemic year of 2020, since before 2016. Travel trailer production increased year-over-year, with 23,811 shipped in May 2024 vs. 20,595 a year ago (a 15.6% increase).

For context, May 2022, just two years prior, saw the production of 35,213 travel trailers – 11,402 more than in May 2024. Motorhome production, which includes Class A, B & C motorhomes, witnessed its lowest May since before 2016 at only 2,973 units shipped, down about 550 from last month and down about 1,350 or 31% from May 2023. We’ll discuss this in detail in a moment as we are witnessing a significant demand slowdown for high-end units.

RV Trader Numbers

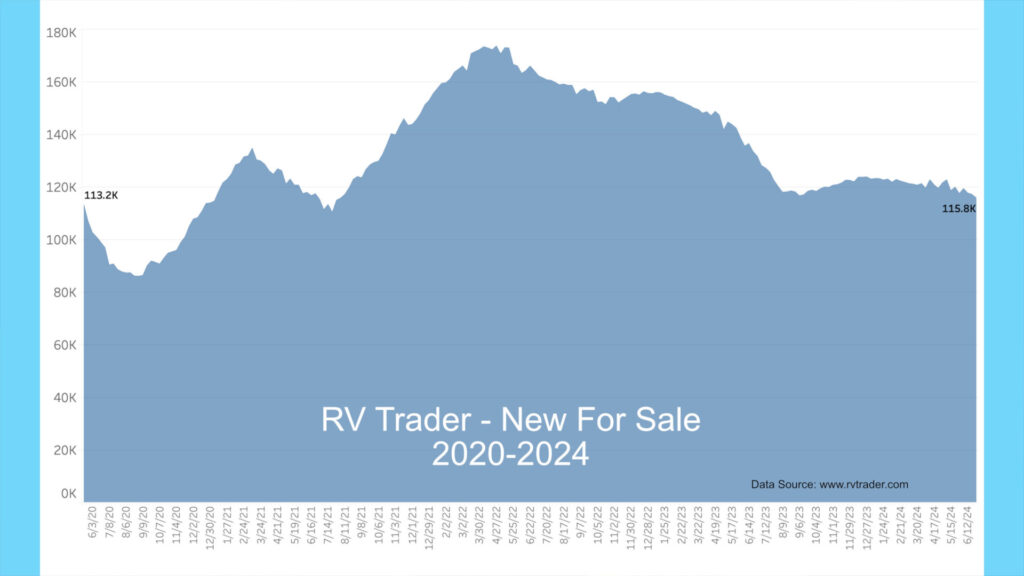

Meanwhile, RVs for sale on RVTrader.com have dropped significantly since last month, with 115,820 new RVs for sale as of June 26th. This is down by 1,625 units from the end of May 2024 and down 15,856 or 12% versus a year ago’s 131,767 new units.

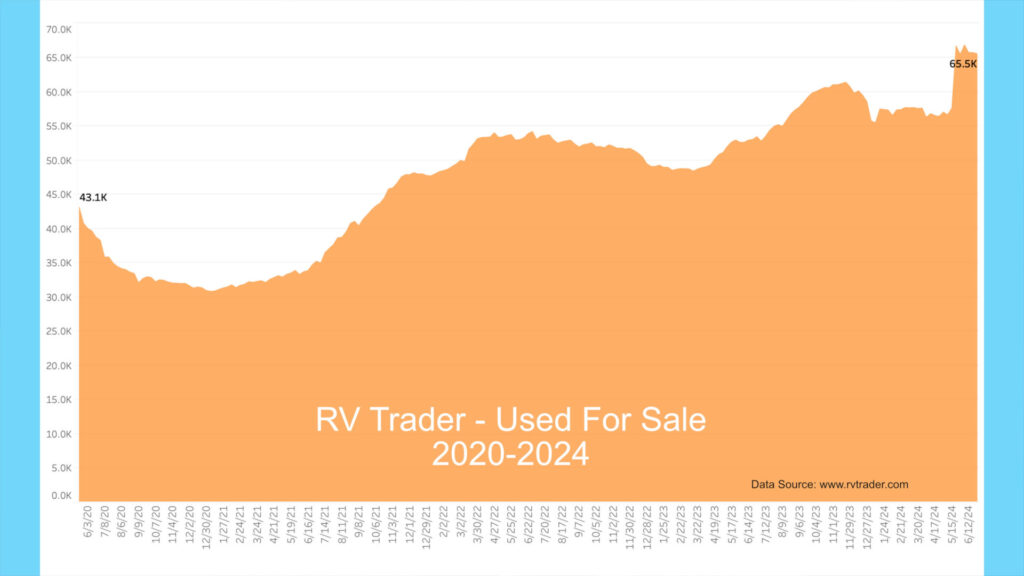

Used units steadied at 65,523 from 65,433 when last reported on May 29th. This time last year, the number of used RVs for sale was 53.4k, so we have 12.1k or 22.6% more used units for sale now versus a year ago. Used units for sale have stayed historically high for the past six weeks.

For reference, four years ago, in late June of 2020, there were only 38.2k used units for sale during the depths of the pandemic. This number went down a year later, in June 2021, to 35.2k, then went way up to 54.2k in late June 2022, and stayed there at 53.4k in late June 2023. The new norm of 65k + used units seems to speak to a shift away, or at least a mass inoculation among pandemic buyers who seem to be unloading units in record numbers.

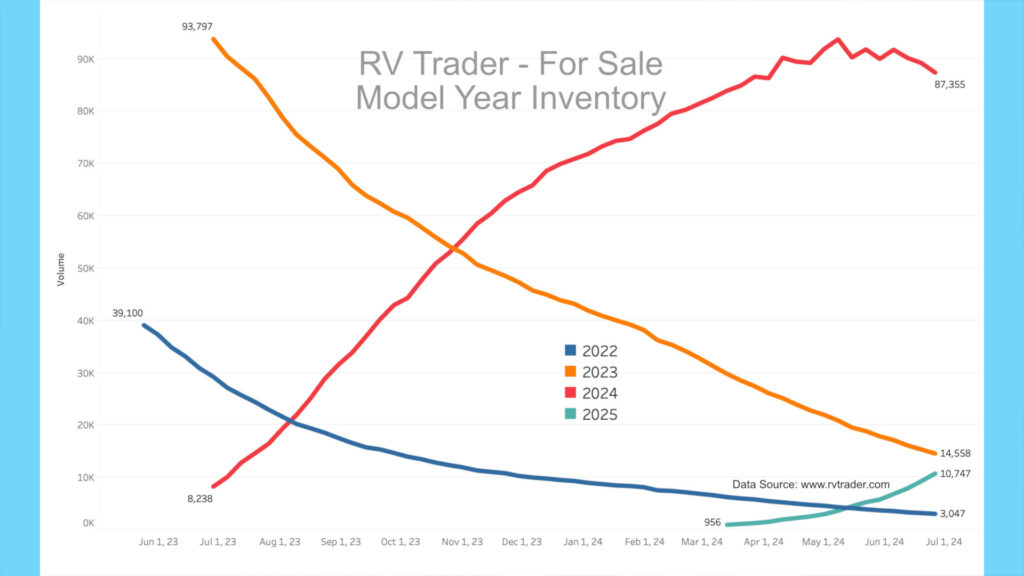

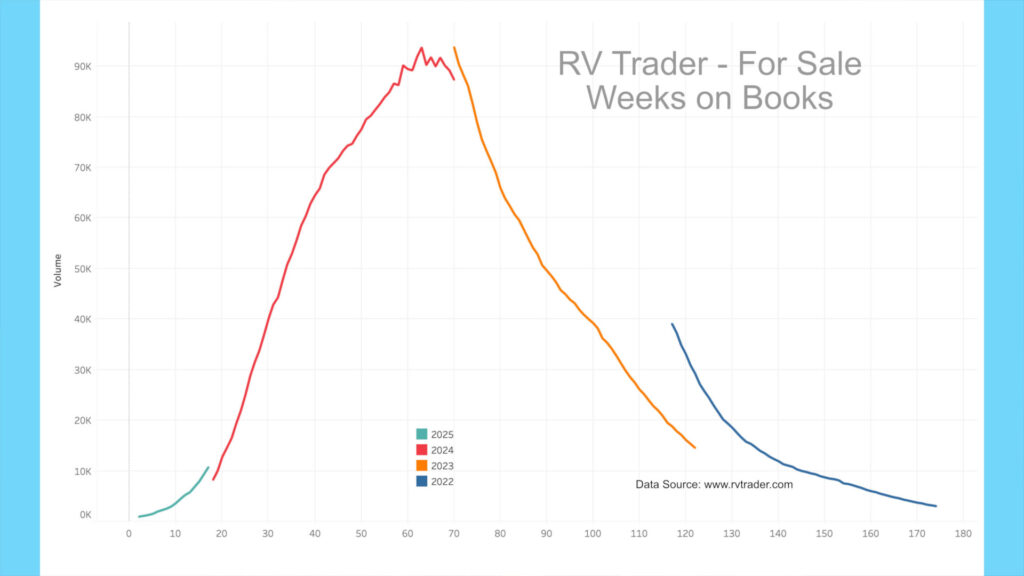

Our model year chart shows new model volumes for 2022 through 2025 since May of last year. As dealers unload the older units, 2022 models have decreased from 39,100 to 3,047 units. The orange line shows 2023 models going from 93,797 to 14,558 units since late June 2023. Meanwhile, the red line shows 2024 models on RVTrader.com. In late June 2023, there were 8,238 new 2024s, and now there are 87,355, seeming to have peaked as 2024 production runs start to wane. Also, 2025 units are showing up online. There are currently 10,747 2025 units for sale, up about 5k since late May. So, there are still about 17.6k new 2022 and 2023 models on dealer lots.

When we look at the model year data by number of weeks on market, surprisingly, we see that 2025’s (teal line) are ramping up quicker than 2024’s (red line) at the same number of weeks on market. Also, the 2024s are falling off much faster than the 2023s (orange line). The 2024 model year looks to be a historically low production run that is coming to a close just now. This new chart is available on johnmarucci.com along with the other charts shown in the newscast. We have pulled this publicly available RV Trader data every Wednesday since May 2020.

As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory. You can follow my account on X at @JohnMarucci to receive weekly updates on this data.

High-End Market

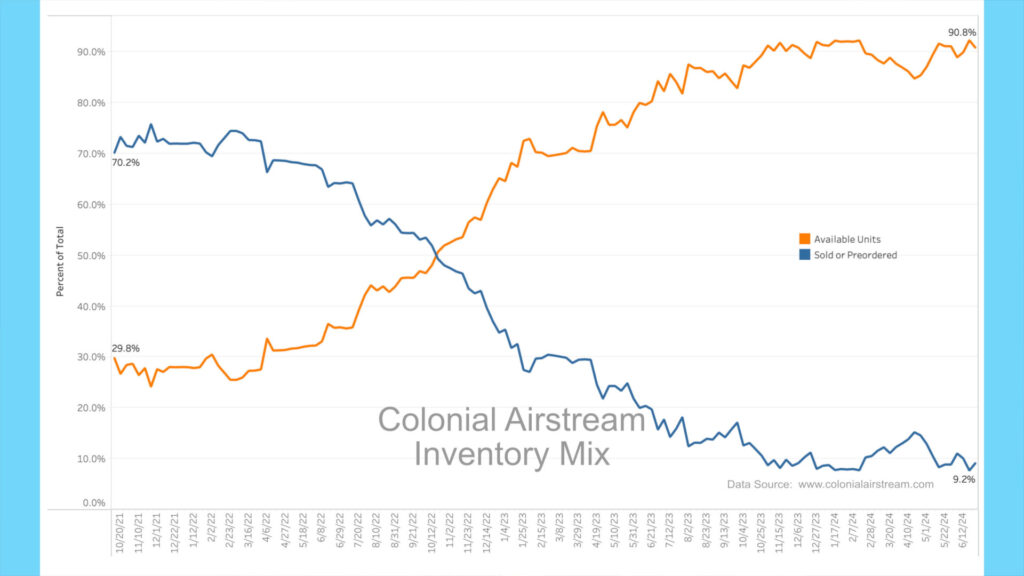

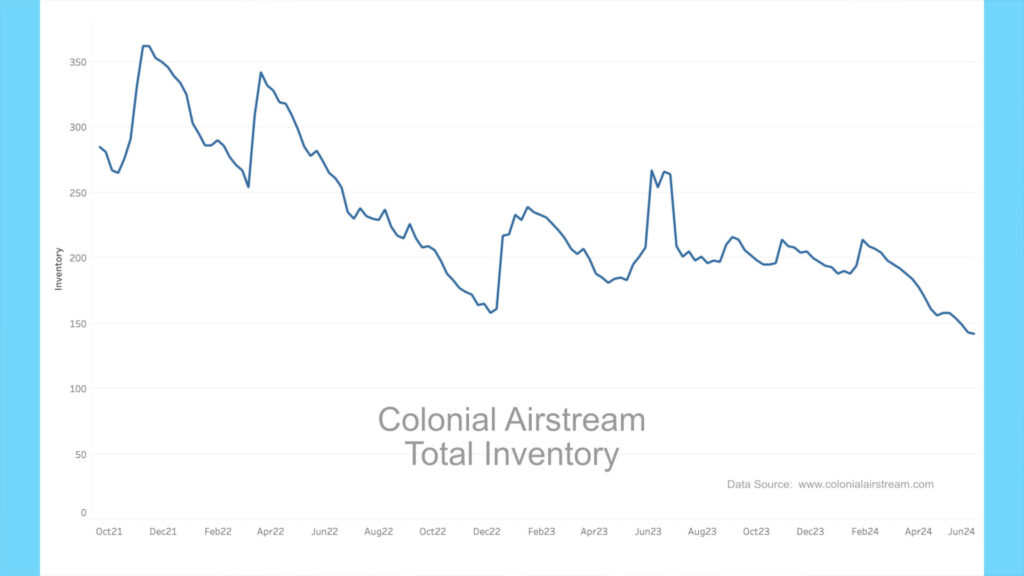

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, one of the nation’s largest Airstream dealers, still show a glut of in-stock units.

About a year ago, 16% of Colonial’s inventory was preordered, meaning 84% of their Airstream inventory was either on the lot for sale or being delivered and available. As of June 26th, 2024, roughly 91% of inventory is available for sale, with only 9% spoken for.

Colonial has 101 new units on the lot for sale, the same number as at the end of September 2023. However, at the end of last September, there were 216 total units in inventory, compared to only 142 currently, down 34%. If we go back an entire year, Colonial had 267 units in inventory vs. 142 now, a whopping 47% decrease. It seems evident that those ordering for Colonial have taken a pause and have curtailed factory orders for these high-end units. This matches what we showed earlier with the massive decline in motorhome production, most of which, like Airstreams, are in the six-figure range.

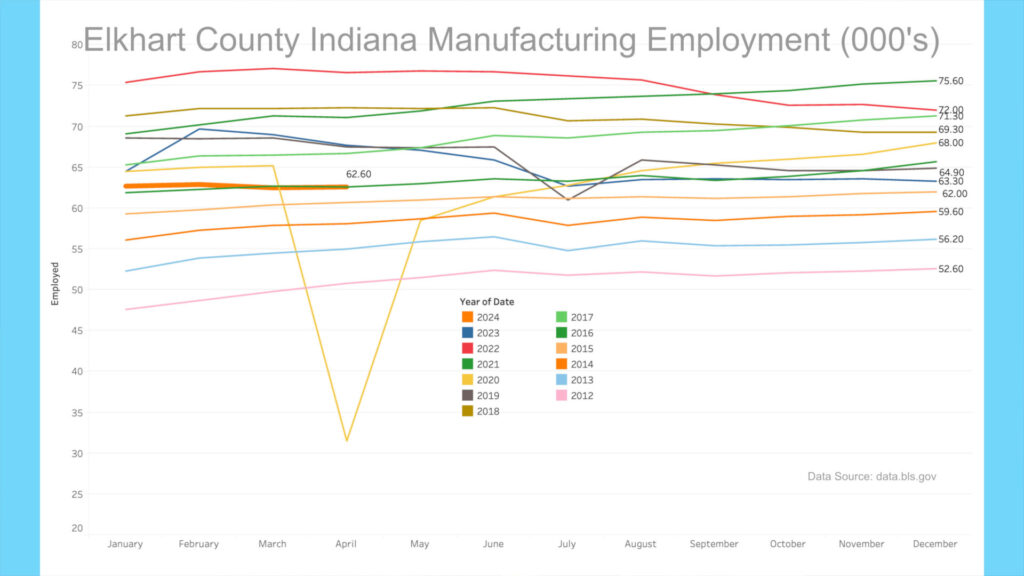

BLS RV Manufacturing Labor Stats

The Bureau of Labor Statistics revised April 2024 manufacturing employment data for Elkhart County, Indiana. The April 2024 manufacturing employment level sits at 62,600, staying fairly steady since the beginning of the year. The April 2024 number is precisely the same as April 2016, which was eight years ago. The last eight years of manufacturing employment growth in the Elkhart area have been wiped away and reset to 2016 levels. This is yet another indicator of how bad things are in RV manufacturing. The BLS is forecasting manufacturing employment to remain steady for May of 2024.

AAA

Gas prices have decreased in the past month. According to AAA, the current average nationwide price as of June 29th was $3.496 per gallon for regular unleaded, down $.079 from a month ago and down about $.053 per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $1,049 now vs. $1,065 a year ago, a 1.5% decrease YoY. Diesel prices have decreased in the past month and currently sit at $3.815, down $.061 from a month ago and down $.056 from a year ago. A similar 3,000-mile trip getting 15 mpg would cost $763 now vs. $774 a year ago, a 1.4% decrease.

My Take

Last month, I discussed at length the problem with the high-end market for RVs, and honestly, the make-it or break-it time for motorhomes this season has come to pass, with things only getting worse. The May number for motorhome shipments of 2,973 is less than any May on record since before 2016, and only March and April of 2020 were lower, at the very darkest time of the pandemic. May 2024 motorhome shipments are even lower than May 2020, still in the depths of the pandemic.

It is hard to overstate how dire the depression in motorhome and high-priced Airstream sales are for manufacturers and dealers. For all the talk of new RVers entering the market, the lion’s share of profit has been from the steady stream of existing RVers upgrading to more expensive units. This upgrade cycle has been like a slow, steady leak in a large boat since this time last year. This is important because one pricy motorhome can bring in as much income to a dealer or manufacturer as several travel trailers. The return on economic inputs is higher, which makes up for some thin margins on lower-priced trailers. With the basic manufacturing and sales mix changing to cheaper units, it is, and will be, much more challenging to reach the high fixed cost thresholds needed to manufacture or sell RVs.

I have a hard time seeing manufacturers and dealers being able to weather the backside of this massive overproduction period for much longer without some sort of consolidation and further rightsizing. We are already seeing some downsizing, albeit with a pause for a short seasonal ramp-up. With the high-end affluent buyer taking a long pause, it may set off some continued downsizing.

What I am not hearing is anyone from the industry asking why this is happening. Has anyone from any more prominent dealership or manufacturer surveyed current RV owners, asking if they plan to upgrade anytime soon and if not, why not? What would it take to see current RV owners move toward upgrading? Is it more than a headwind of interest rates and inflation?

My take is that many people can afford to upgrade but are staying on the sidelines. Many are cash buyers, so interest rates are not the issue. The issue I see is that of a poor value exchange. Prices have risen significantly in the past few years, and the perception of lower quality has seemed to settle over the industry, which is, in my opinion, adequately exposed by social media. Recently, we have seen large manufacturers balk at serious quality issues, creating a PR issue and reinforcing the perception of poor quality. My take is that many potential buyers think a new RV would be more trouble than it’s worth.

That should do it. All the best in your camping adventures!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!