In this blog we’ll cover the latest RV and travel data news. June 2024 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell or hold an RV. Later in the news, we’ll talk about the latest RV valuations, potential new regulations coming to RVs, and what it means for you.

RVIA Numbers

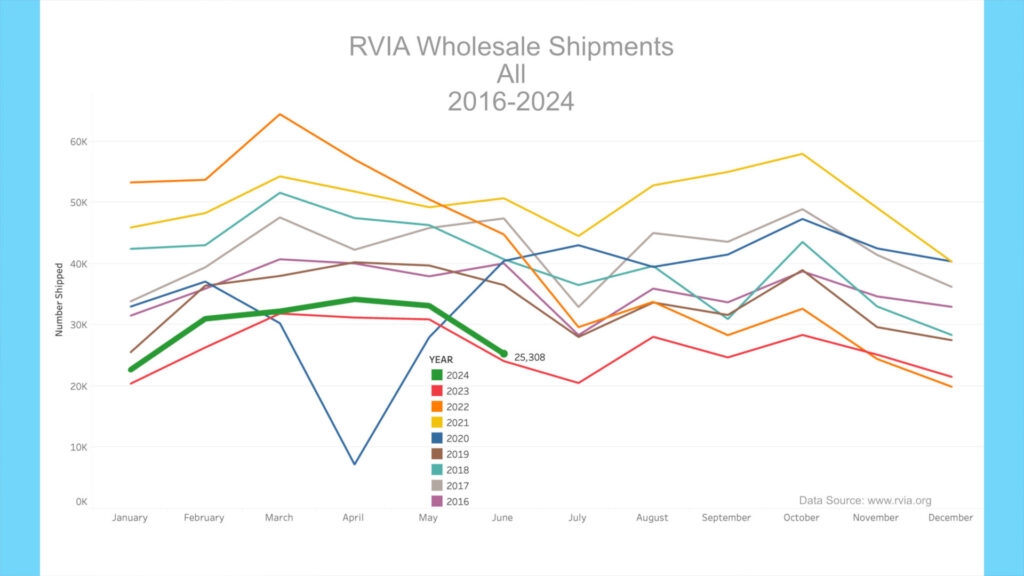

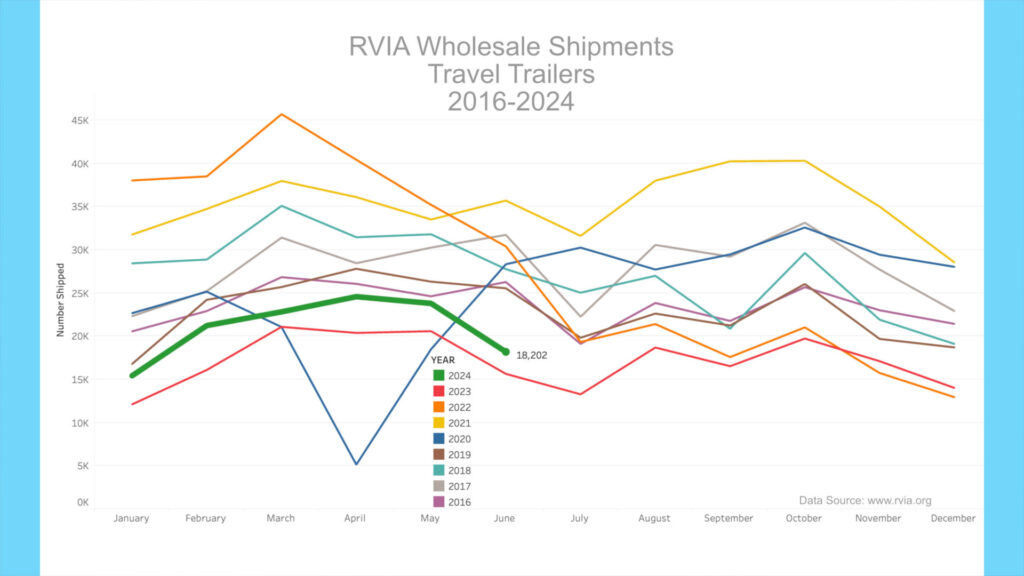

On July 24th, 2024, the RVIA posted the latest RV wholesale shipment data for June 2024. Production increased slightly compared to the prior year, with 25,308 total RVs shipped in June, up 5.0% from 24,095 in June 2023. However, June 2024 was the second lowest production for any June since before 2016. Travel trailer production increased year-over-year, with 18,202 shipped in June 2024 vs. 15,657 a year ago (a 16.2% increase). For context, June 2022, just two years prior, saw the production of 30,409 travel trailers – 12,207 more than in June 2024.

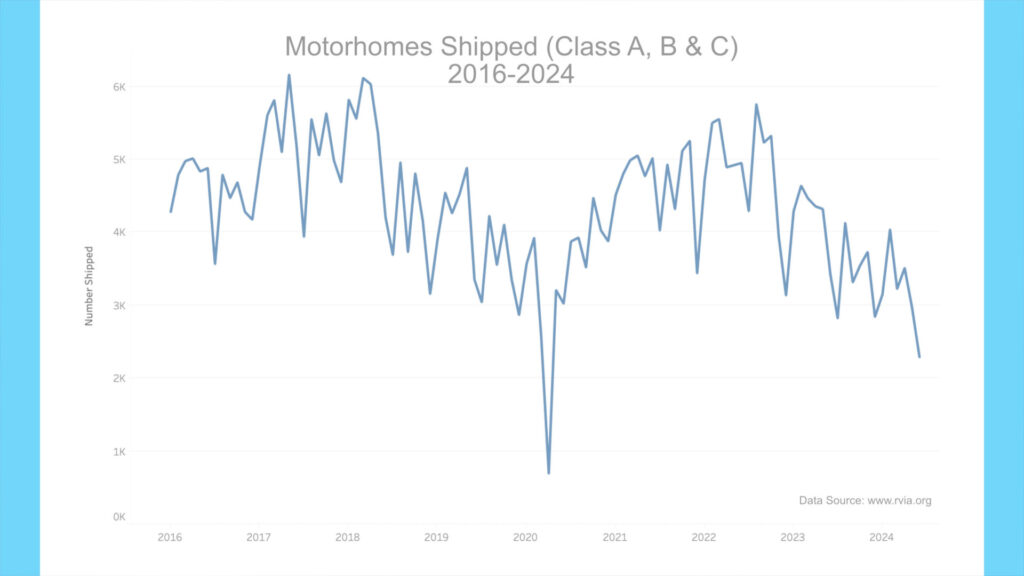

Motorhome production, which includes Class A, B & C motorhomes, witnessed its lowest June since before 2016, with only 2,288 units shipped, down 685 from last month and down about 1,137 or 33% from June 2023. As discussed in detail in last month’s newscast, motorhome sales are in a free fall, with high-end buyers noticeably absent from the market.

RV Trader Numbers

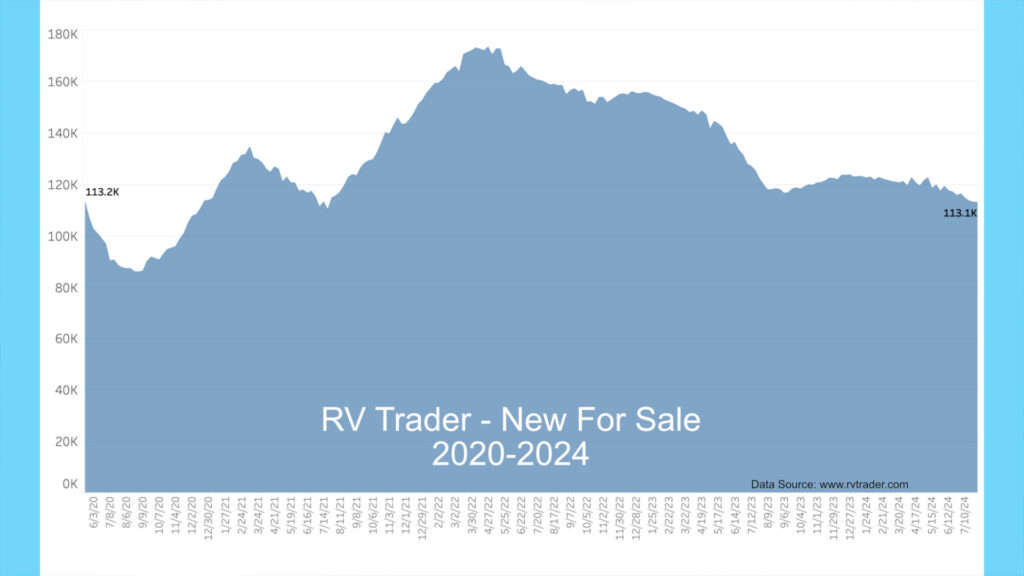

Meanwhile, RVs for sale on RVTrader.com have dropped significantly since last month, with 113,110 new RVs for sale as of July 31st. This is down by 2,710 units from the end of June 2024 and down 9,259 or 7.6% compared to a year ago.

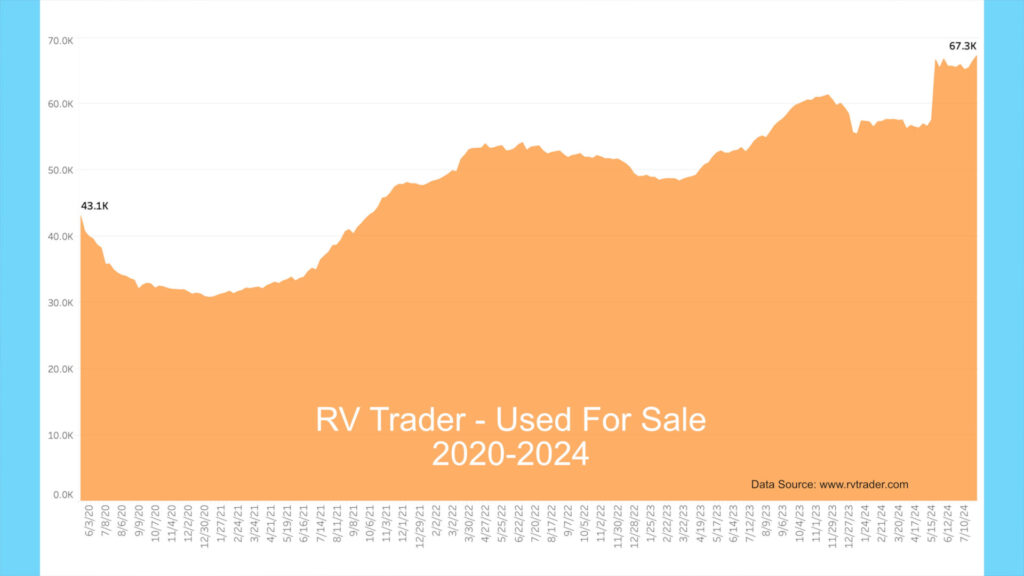

Used units increased to a record 67,289 from 65,523 when last reported at the end of June. This time last year, the number of used RVs for sale was 54.9k, so we have 12.4k or 22.6% more used units for sale now versus a year ago. Used units for sale have stayed historically high for the past six weeks.

For reference, four years ago, in late July 2020, there were only 34.4k used units for sale during the depths of the pandemic. The new norm of greater than 65k used units seems to speak to a shift away, or at least a mass inoculation among pandemic buyers who seem to be unloading units in record numbers.

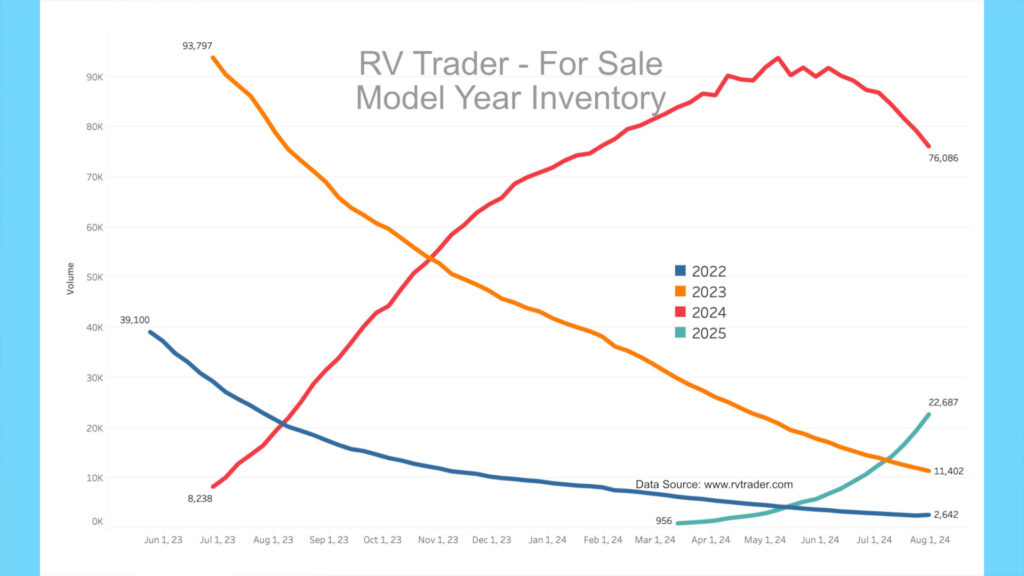

Our model year chart shows new model volumes for 2022 through 2025 since May of last year. As dealers unload the older units, 2022 models have decreased from 39,100 to 2,642 units. The orange line shows 2023 models going from 93,797 to 11,402 units since late June 2023. Meanwhile, the red line shows 2024 models on RVTrader.com. In late June 2023, there were 8,238 new 2024s, and now there are 76,086, seeming to have peaked as 2024 production runs start to wane. Also, 2025 units are ramping up. There are currently 22,687 2025 units for sale, more than doubling since late June. So, there are still about 14.0k new 2022 and 2023 models on dealer lots.

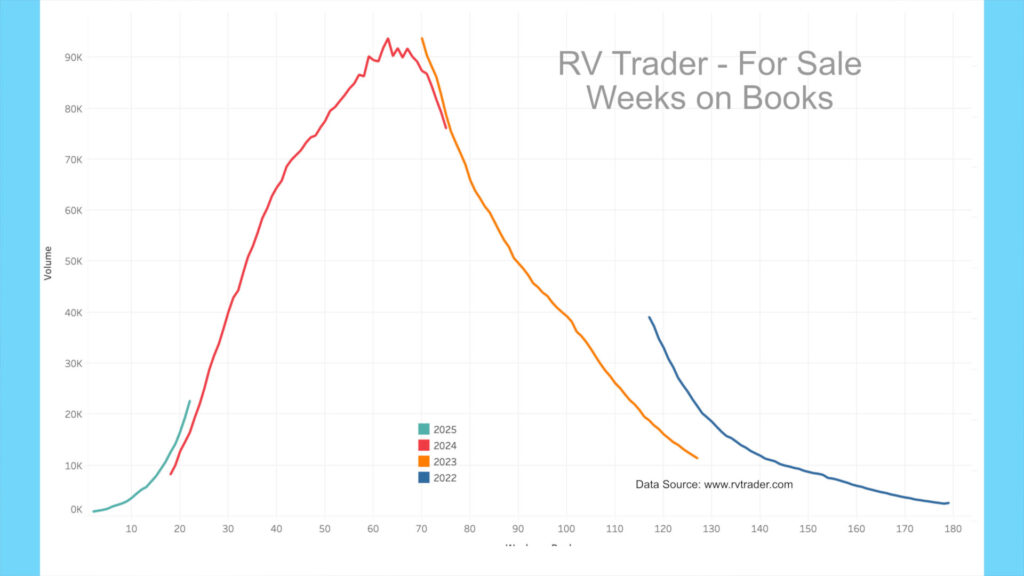

When we look at the model year data by number of weeks on market, surprisingly, we see that 2025’s (teal line) is ramping up quicker than 2024’s (red line) at the same number of weeks on market. Also, the 2024s are falling off faster than the 2023s (orange line). The 2024 model year looks to be a historically low production run that is coming to a close just now. This new chart is available on johnmarucci.com along with the other charts used in the newscast. We have pulled this publicly available RV Trader data every Wednesday since May 2020.

As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory. You can follow my account on X at @JohnMarucci to receive weekly updates on this data.

High-End Market

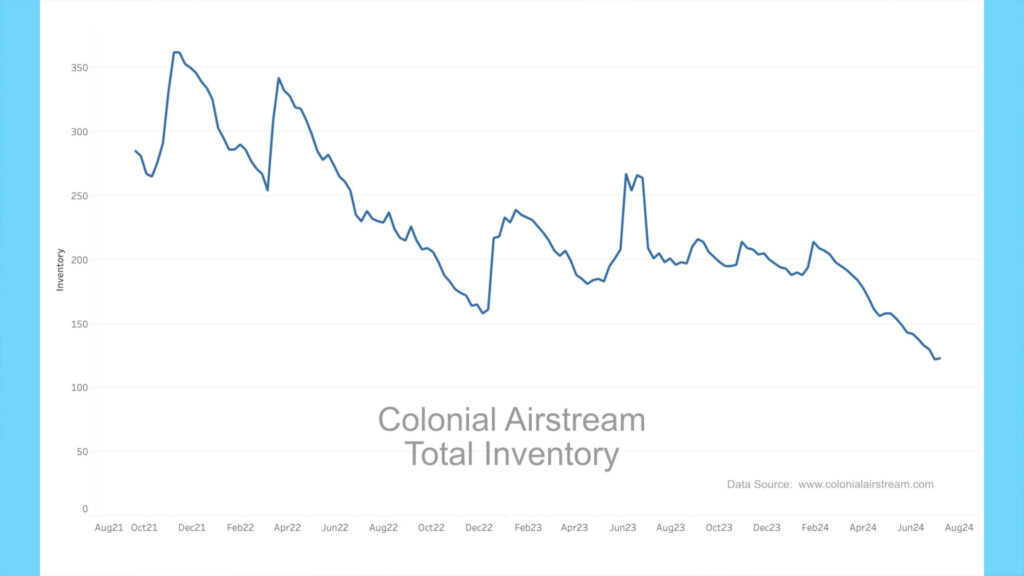

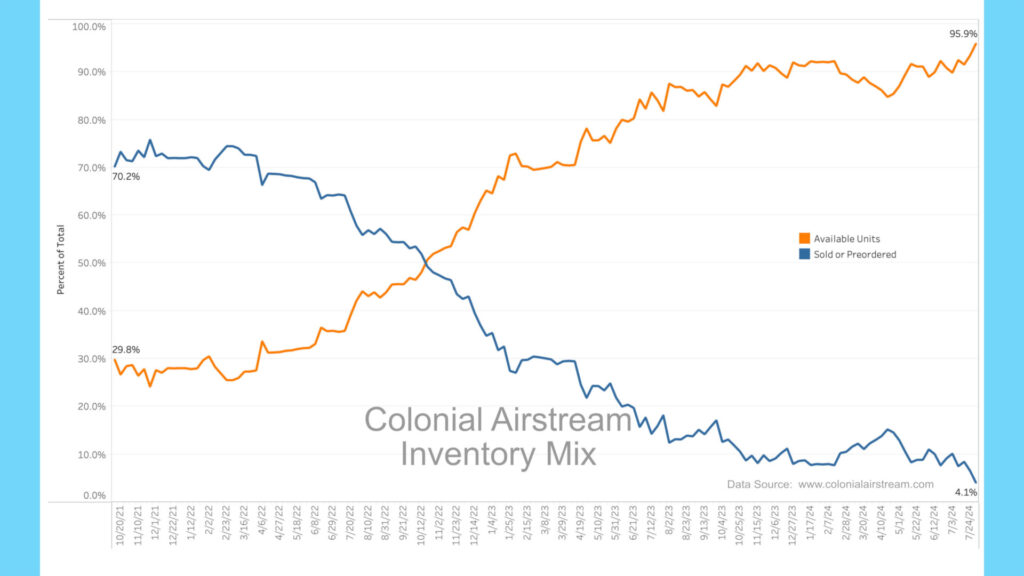

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, one of the nation’s largest Airstream dealers, still show a glut of in-stock units.

Colonial currently has 100 new units on the lot for sale, with only five spoken for. Their order book now sits at only 23 units on order with zero spoken for. This is a historic low since we started tracking Colonial’s inventory in October 2021. A year ago, there were 209 total units in inventory, compared to only 100 currently. This much lower inventory level is a key indicator of perceived future demand by the No. 2 Airstream dealer in the nation.

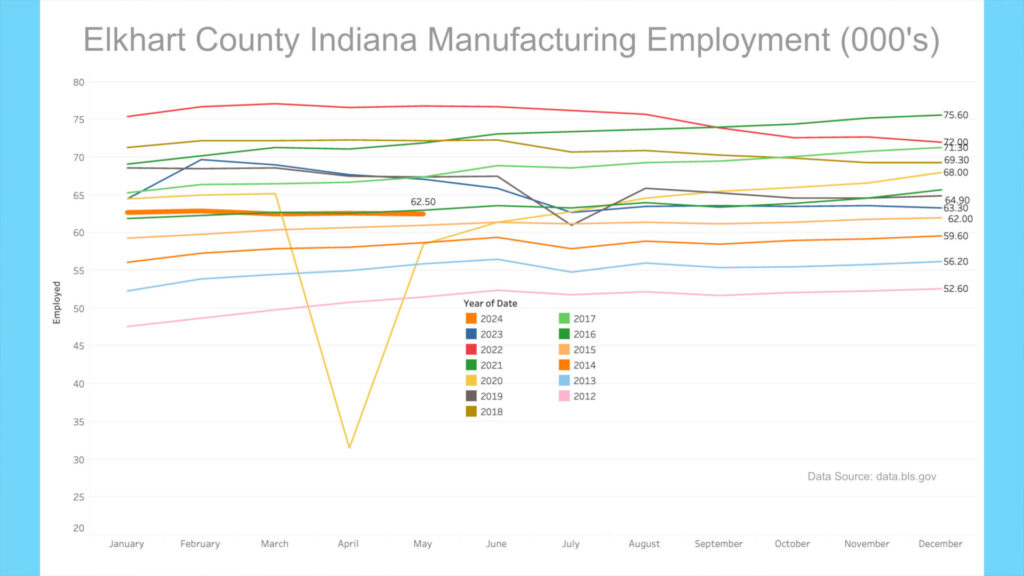

BLS RV Manufacturing Labor Stats

The Bureau of Labor Statistics revised May 2024 manufacturing employment data for Elkhart County, Indiana. The May 2024 manufacturing employment level sits at 62,500, staying steady since the beginning of the year. The May 2024 number is just below May 2016, which was eight years ago. The last eight years of manufacturing employment growth in the Elkhart area have effectively been wiped away and reset to below 2016 levels. This is yet another indicator of how bad things are in RV manufacturing. The BLS is forecasting manufacturing employment to remain steady for June of 2024.

AAA

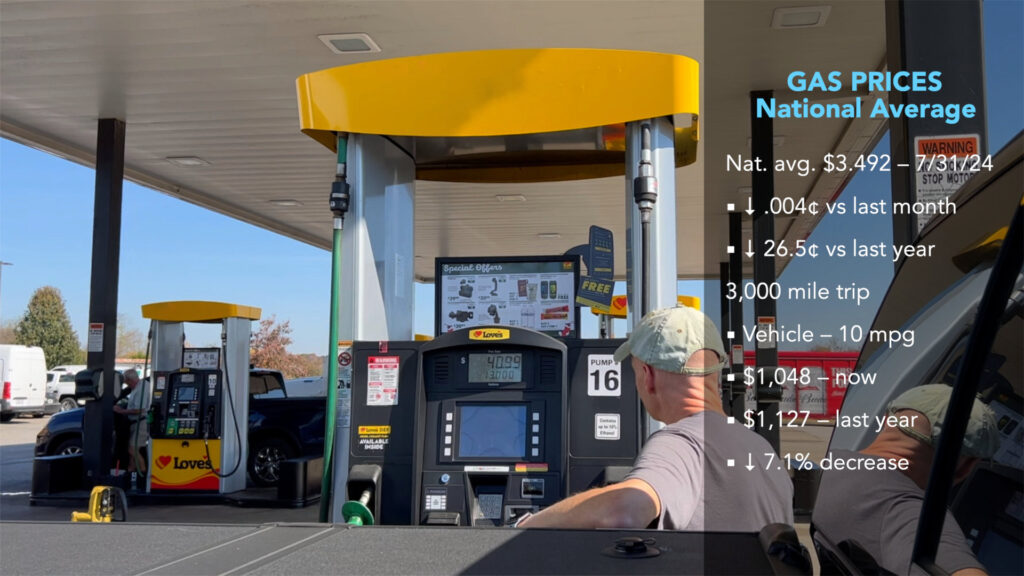

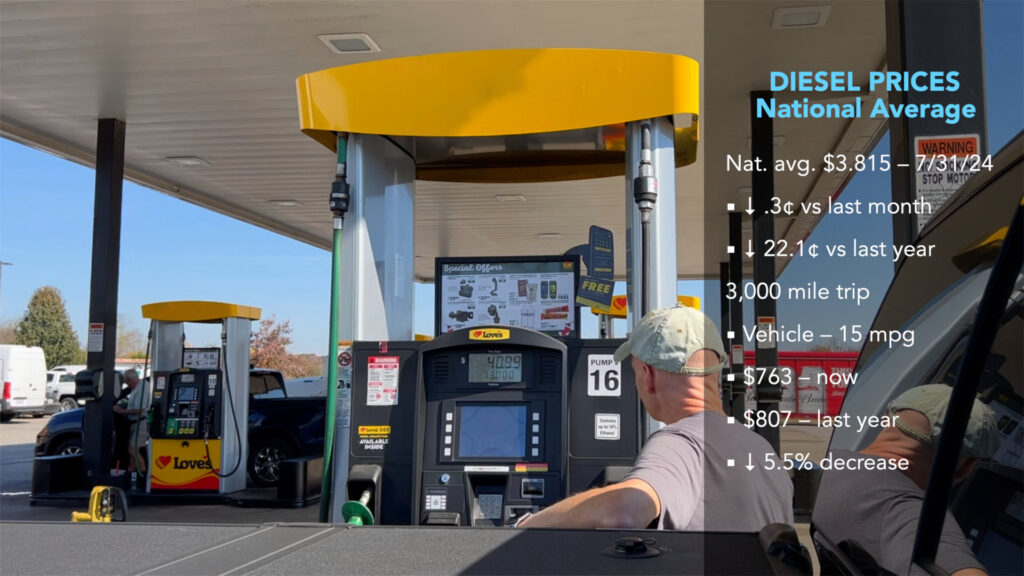

Gas prices have decreased in the past month. According to AAA, the current average nationwide price as of July 31st was $3.492 per gallon for regular unleaded, holding steady from a month ago and down $.265 per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $1,048 now vs. $1,127 a year ago, a 7.1% decrease YoY. Diesel prices have decreased in the past month and currently sit at $3.815, down $.003 from a month ago and down $.221 from a year ago. A similar 3,000-mile trip getting 15 mpg would cost $763 now vs. $807 a year ago, a 5.5% decrease.

My Take

For the past two monthly newscasts, I’ve discussed at length the problem with the high-end market for RVs and how motorhome sales have dried up. This trend only worsened when looking at the latest shipment numbers. While shipments are not sales, they do indicate dealer ordering trends. It is obvious that dealers have taken a pause ordering these more costly units.

Here is a chart for motorhome shipments since January 2016. As you can see, June 2024 was the lowest shipment month other than the pandemic low of April 2020. Since April 2020 was an anomaly, we can safely say that June 2024 was the worst month for motorhome shipments in the last eight years. These more costly units drive considerable revenue, so the loss of sales in this segment only magnifies the financial strain on an already weakening industry.

To reiterate the dilemma, Shyft Group, which produces Spartan Class A RV Chasis for brands like Entegra, Newmar, Foretravel, and Jayco – President and CEO John Dunn said the company’s motorhome business would remain slow the rest of the year. “We did have a very strong first quarter that showed growth,” he said. “I think at the time we pointed to that as maybe a bit of an anomaly. I think the second quarter was soft (and the) second half of the year will be soft.” The Specialty Vehicle segment’s backlog is down 29% compared with the end of 2023, at $59.9 million. Their Chief Financial Officer attributed the decrease to low motorhome demand.[1]

RV Valuations

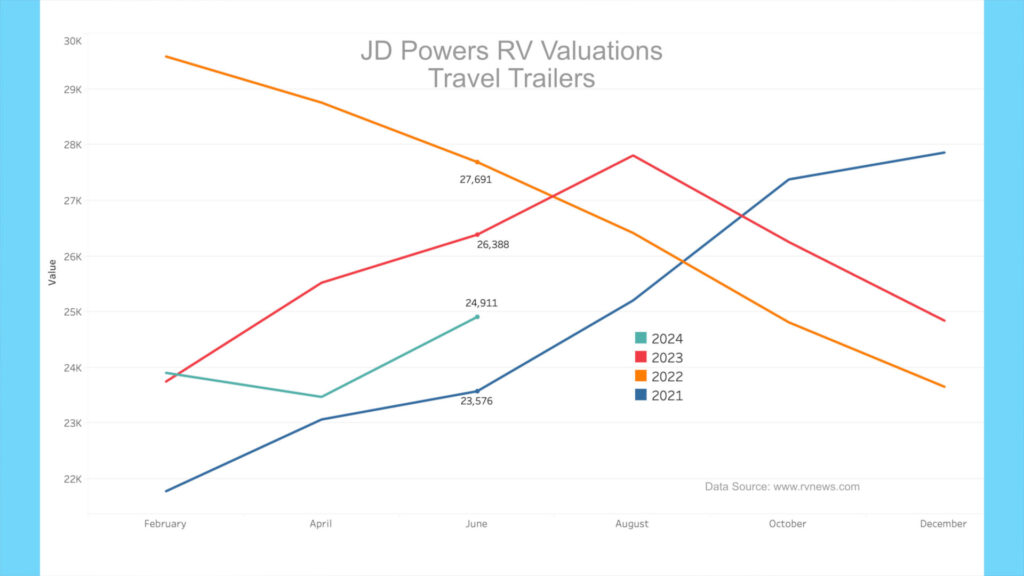

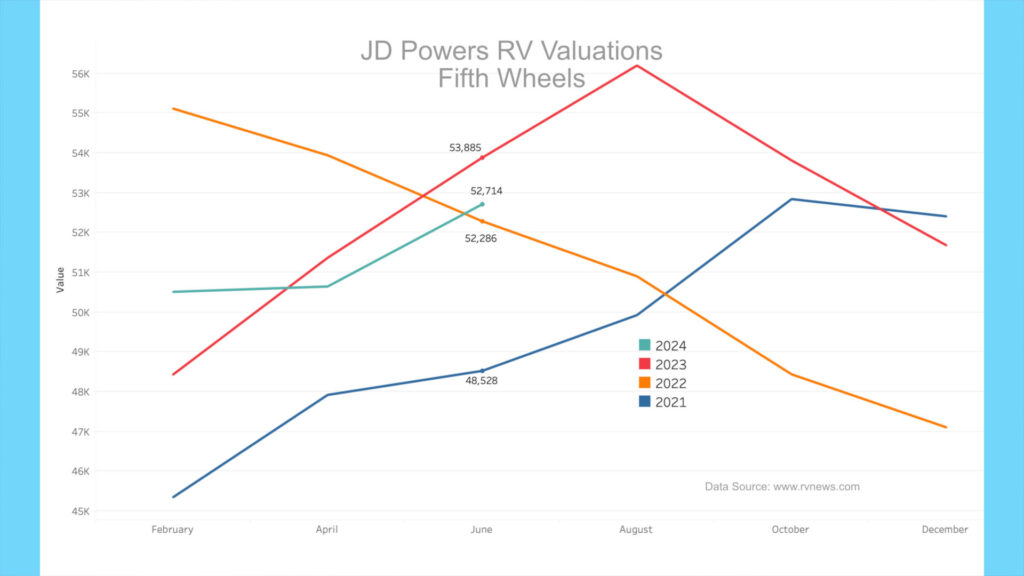

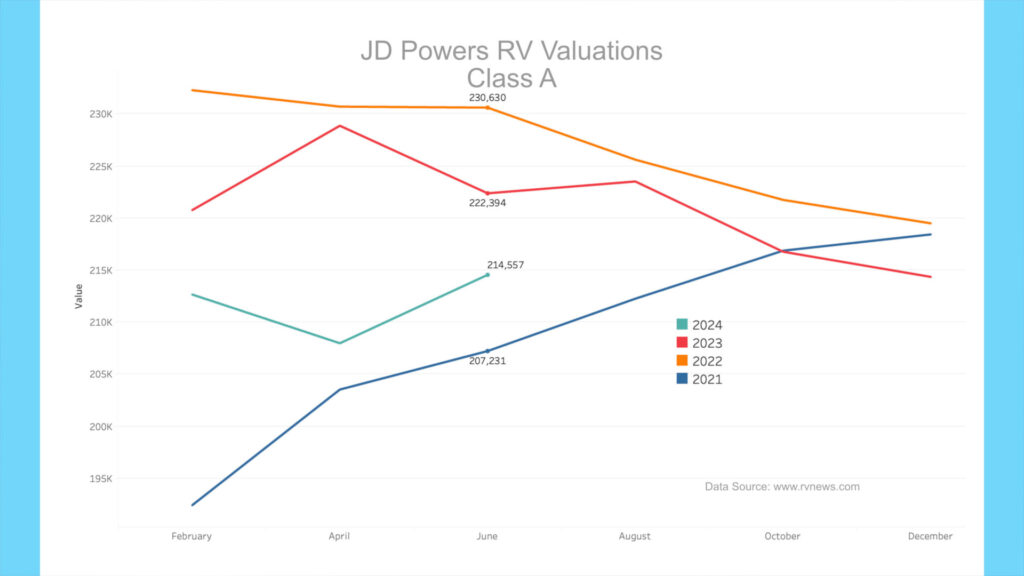

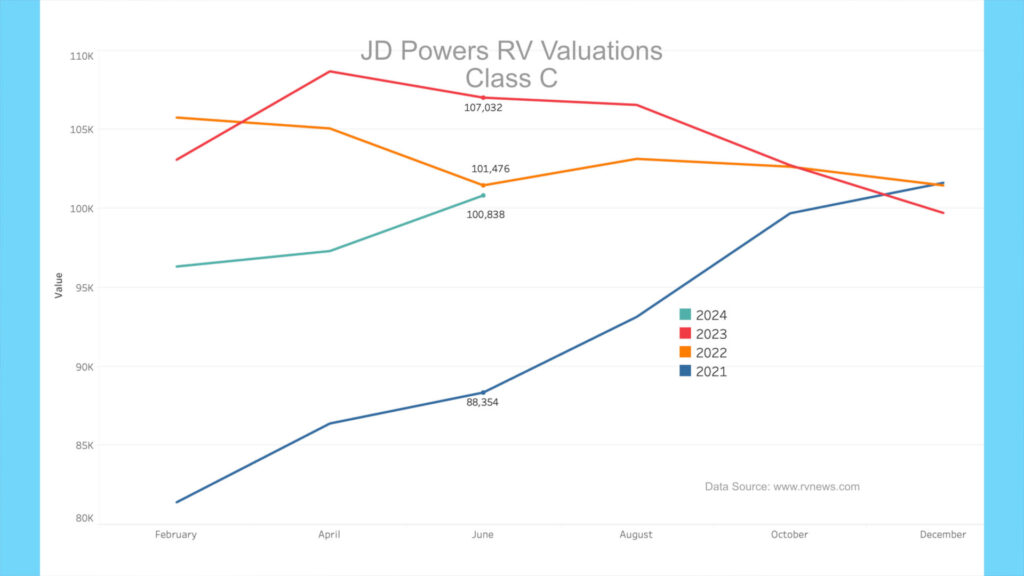

On July 24th, JD Powers released their second-quarter RV valuations. Here is a run down by RV type[2]:

Travel trailer values averaged 6.1% higher in May-June compared with March-April. Travel trailer values were 4.5% lower in the first two quarters of 2024 compared with the same period in 2023.

Fifth wheel values averaged 4.1% higher in May-June compared with March-April. Fifth wheel values were 1.4% higher compared with the same period in 2023.

Class A motorhome values averaged 3.2% higher in May-June compared with March-April. Class A values were 5.5% lower compared with the same period in 2023.

Class C motorhome values averaged 3.6% higher in May-June compared with March-April. Class C values were 7.6% lower compared with the same period in 2023.

PFAS

There is a story that is somewhat buried in the RVNews.com site from July 18th about new EPA rulemaking concerning PFAS substances in RVs (per-and polyfluoroalkyl {poly-floro-alkill}). According to the FDA, PFAS “are chemicals that resist grease, oil, water, and heat. They were first used in the 1940s and are now in hundreds of products including stain- and water-resistant fabrics and carpeting, cleaning products, paints, and fire-fighting foams.”[3]

According to the article, “The chemicals, also known as ‘forever chemicals,’ are found in many RV items, including carpets/rugs, upholstery, fabric treatments, cleaning products and adhesives.” The article continues that “Federal reporting requirements will affect importers and suppliers. Certain states are passing legislation including various reporting requirements, and in some states PFAS bans.” The RVIA is asking its members to take a survey on the subject.

I bring this up because after I read the brief article, I was reminded of the chemical odor emanating from my RV for some time after I purchased it. It took several trips for this chemical smell to dissipate, but it was noticeable. Likely, it was the multitude of adhesives used in construction.

The article and the entire issue highlight how the RV industry has been under its own supervision for some time. The RVIA has a strong lobbying arm to keep regulations out of RV manufacturing, and the new EPA rulemaking is likely something the industry will need to adjust to. Unfortunately, there needs to be this type of rule because industries don’t tend to self-regulate for consumer safety, yet this is nothing new in many industries. I suppose the pressure to produce a return for owners yet again supersedes that of consumer safety.

That should do it. All the best in your camping adventures!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!