In this blog, we will cover the latest RV and travel data news. October 2024 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell or hold an RV. We’ll also discuss the huge multi-state ban on motorhomes that is planned to go into effect in 2025.

RVIA Numbers

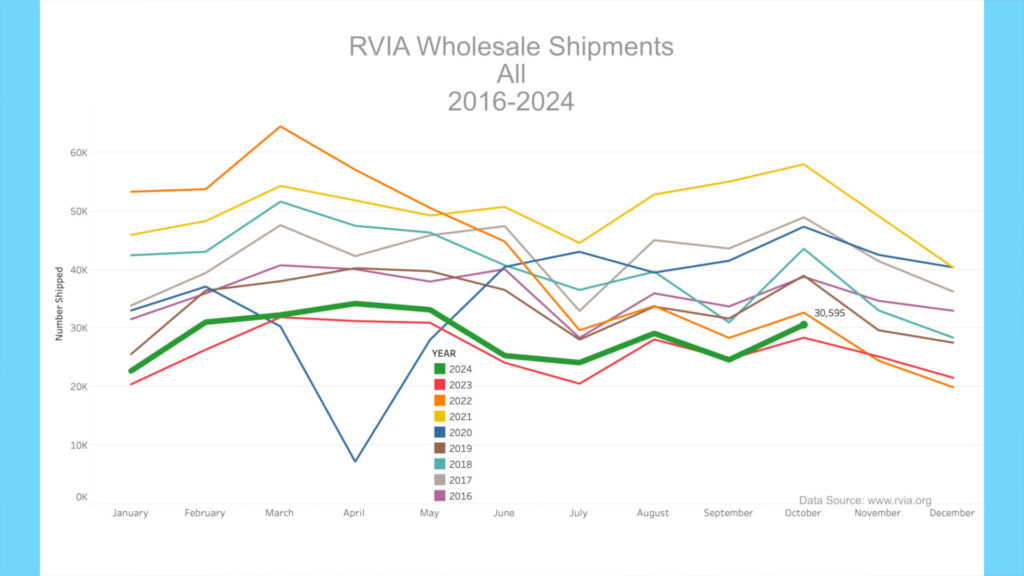

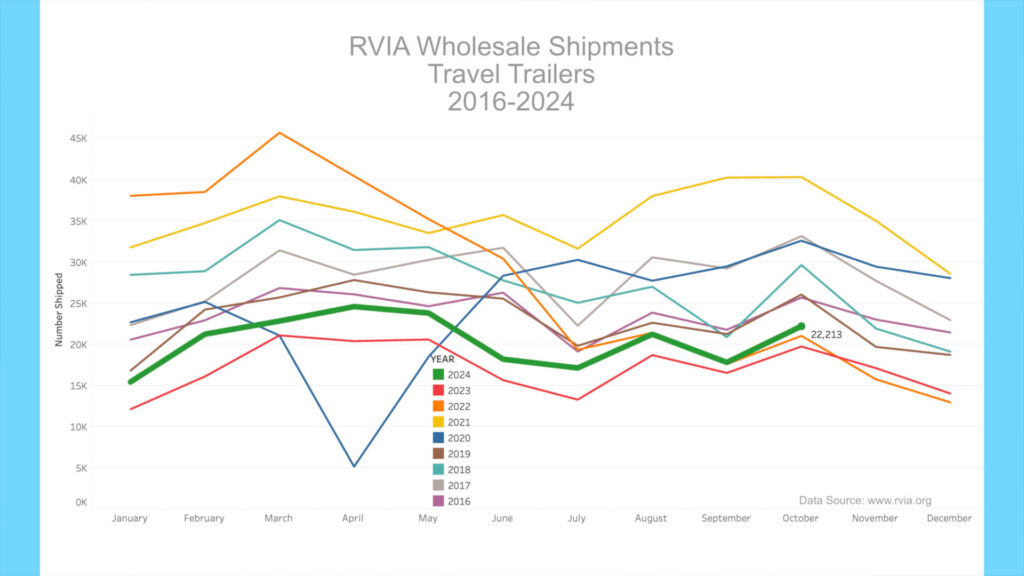

On November 24th, 2024, the RVIA posted the latest RV wholesale shipment data for October 2024. Production increased compared to the prior year, with 30,595 total RVs shipped in October, up 7.84% from October 2023. October 2024 was the lowest production for any October, besides 2023, since before 2016. Travel trailer production increased year-over-year, with 22,213 shipped in October 2024 vs. 19,744 a year ago (a 12.5% increase).

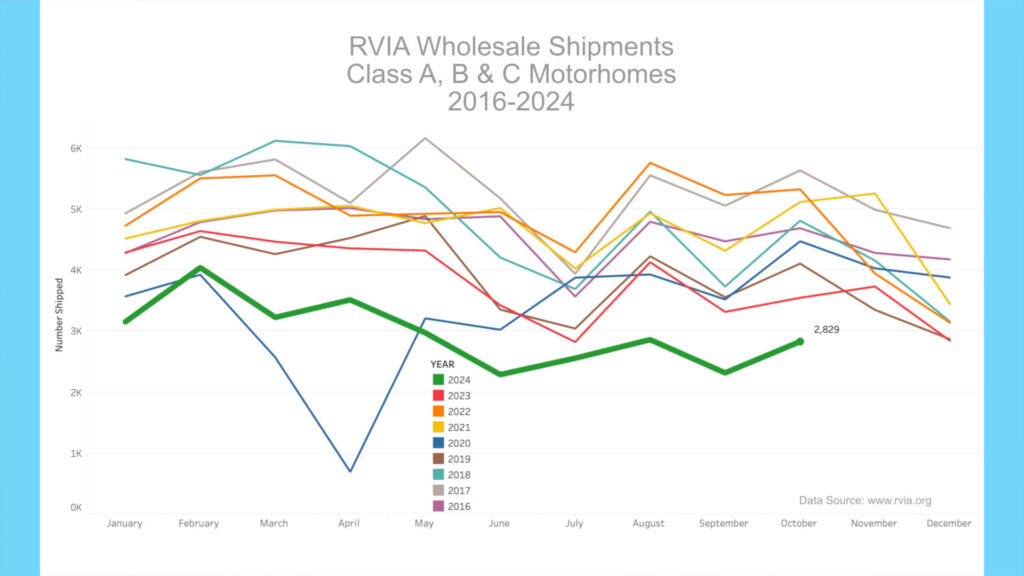

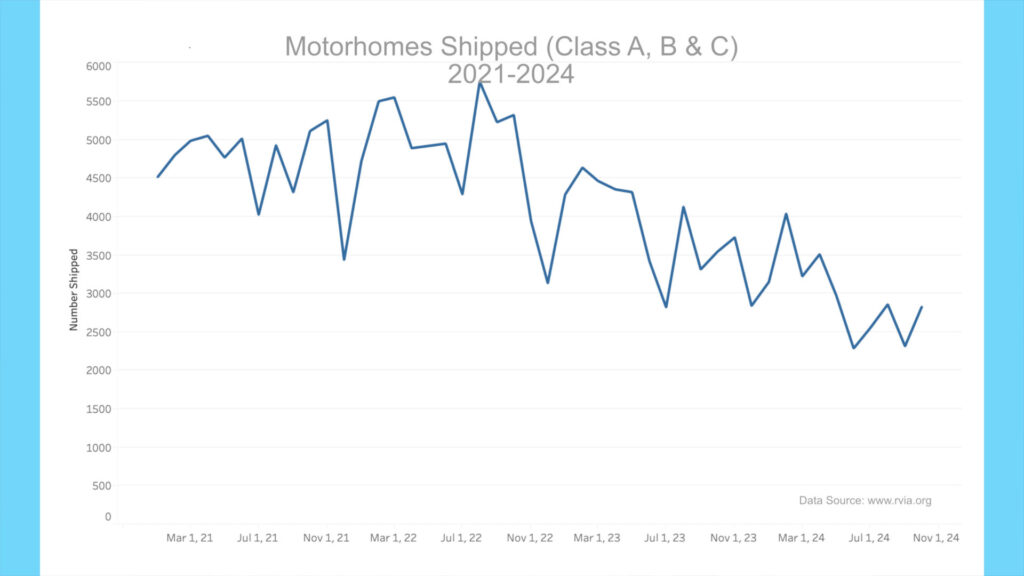

Motorhome production, which includes Class A, B & C motorhomes, witnessed its lowest October since before 2016, with only 2,829 units shipped, down 717 or 20.2% from October 2023. The increase in travel trailer shipments concurrent with the steep drop in motorhome shipments speaks to the shift in the market to lower-cost and lower-margin units. Unfortunately, there is more bad news for motorhomes that we’ll get to in a moment.

RV Trader Numbers

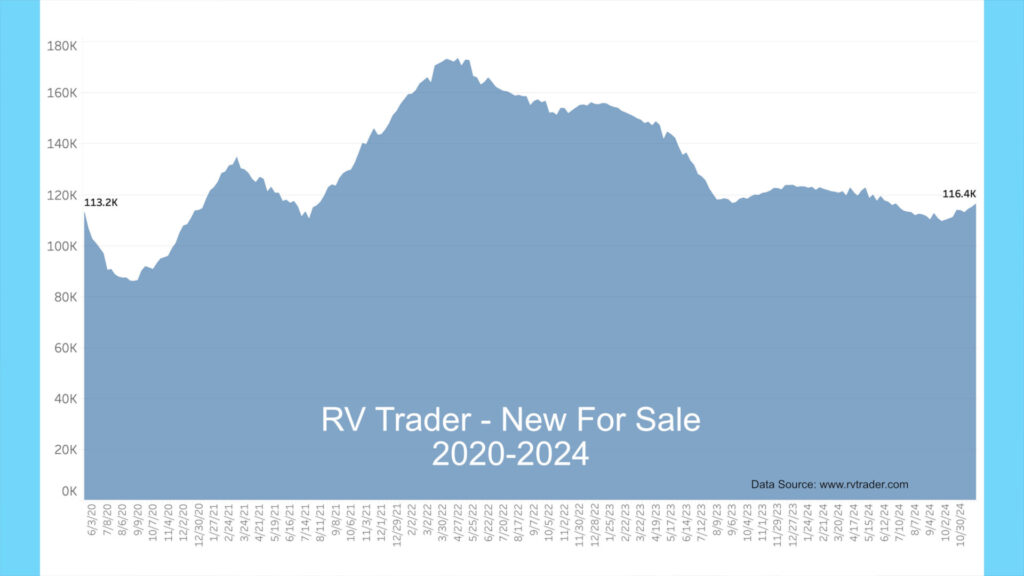

Meanwhile, RVs for sale on RVTrader.com have increased since last month, with 116,397 new RVs for sale as of November 27th. This is up by 2,579 units from late October 2024 and down 6,102 or 5.0% compared to a year ago.

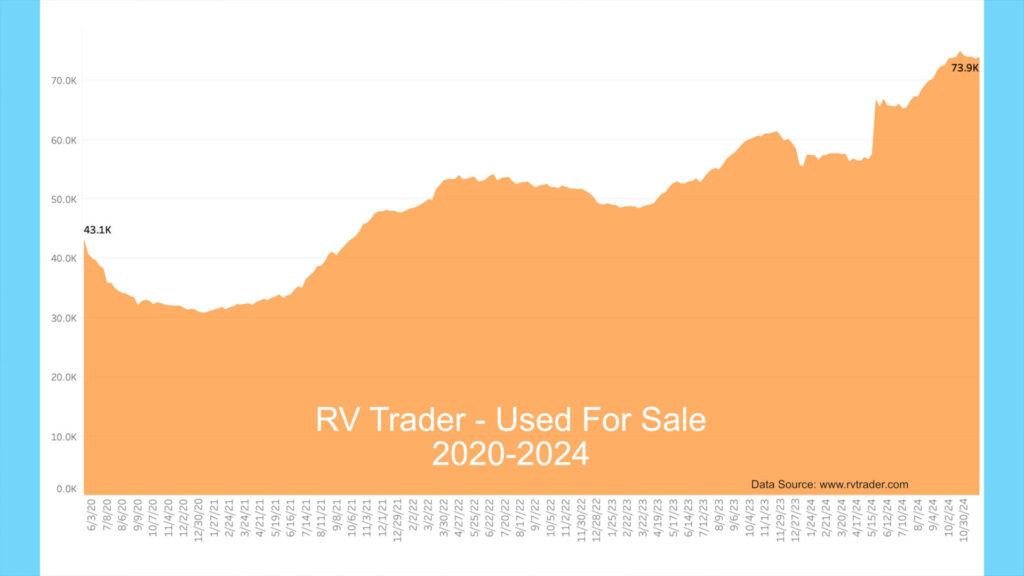

Used units have held steady since last month, with 73,882 used RVs for sale as of November 27th. This is down by 249 units from late October 2024 and up by 13,197 or up by 21.7% compared to a year ago. This continued record level of used RVs for sale is evidence of the massive inoculation among new RV buyers that has taken place since the pandemic boom.

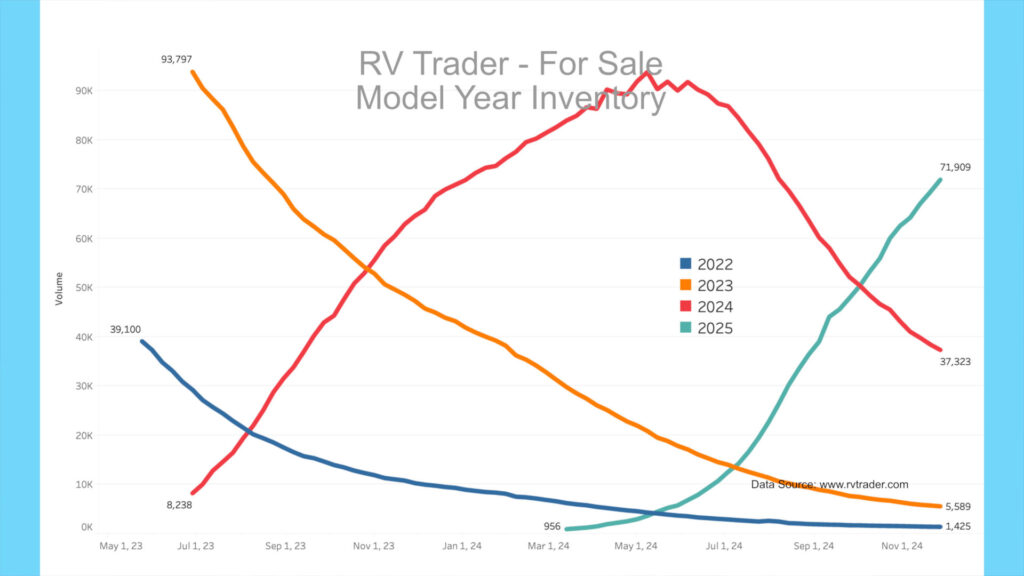

Our model year chart shows new model volumes for 2022 through 2025 since May of last year. As dealers unload the older units, 2022 models, as shown by the blue line, have decreased from 39,100 to 1,425 units. The orange line shows 2023 models going from 93,797 to 5,589 units since late June 2023. Meanwhile, the red line shows 2024 models on RVTrader.com. In late June 2023, there were 8,238 new 2024s, and now there are 37,323, having peaked as 2024 production runs wane. Also, 2025 units, as shown by the teal line, are ramping up. There are currently 71,909 units for sale, increasing by 9,394 since late October. As we’ll see in the following chart, the industry seems to be overproducing 2025 models.

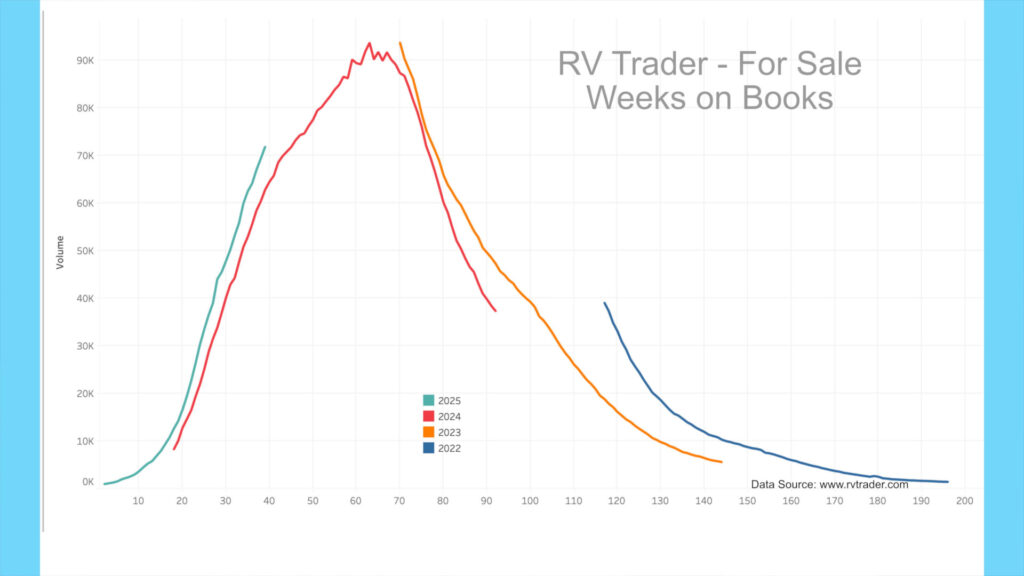

When we look at the model year data by number of weeks on market, surprisingly, we see that 2025’s (teal line) is ramping up quicker than 2024’s (red line) at the same number of weeks on market. Also, the 2024s are falling off faster than the 2023s (orange line). The 2024 model year looks like a historically low production run that ended about four or five months ago.

As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory. You can follow my account on X at @JohnMarucci to receive weekly updates on this data.

High-End Market – Colonial Airstream

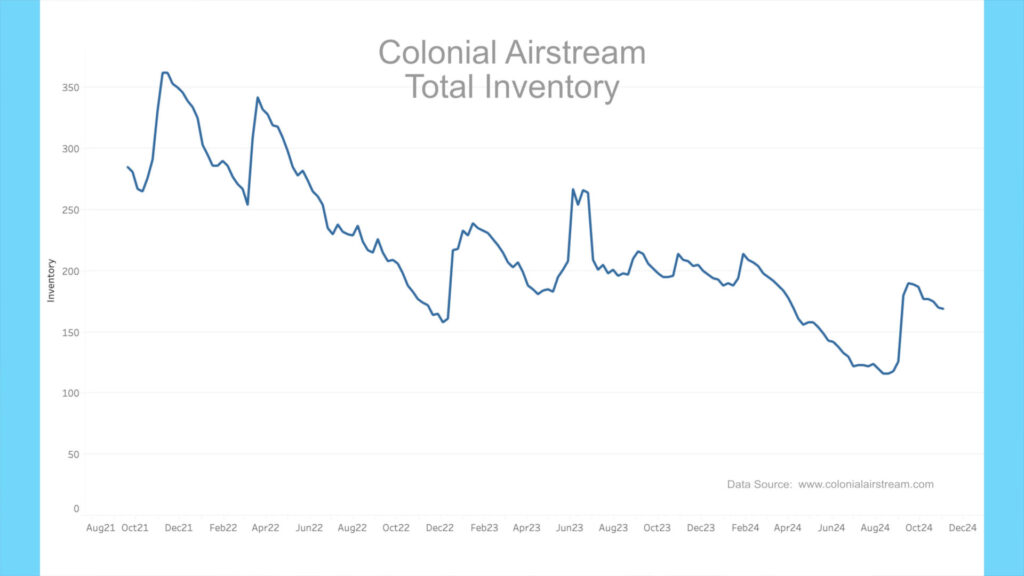

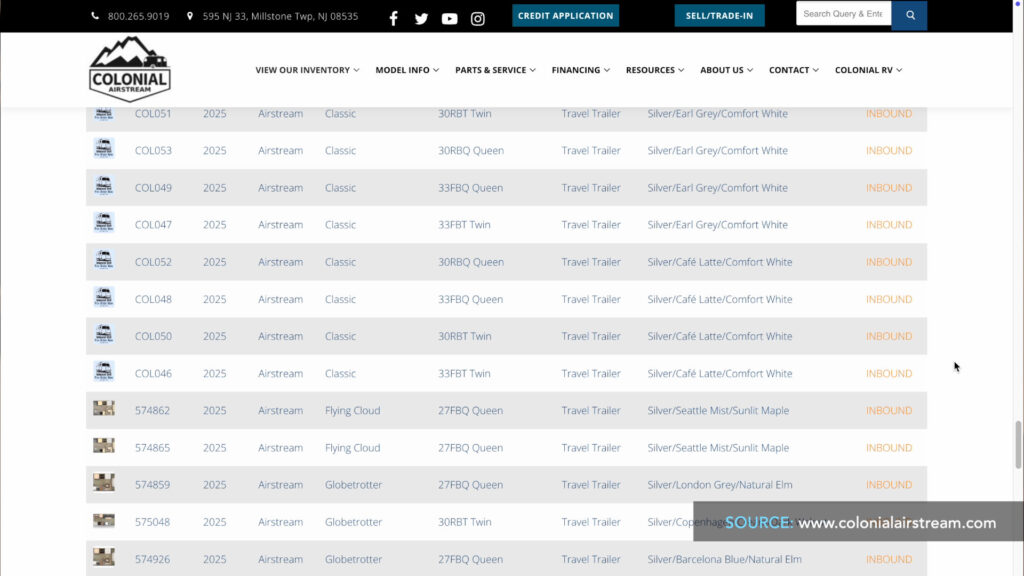

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, the nation’s 2nd largest Airstream dealer, show a glut of in-stock units.

As of November 27th, Colonial currently has 122 new units on the lot for sale, with 17 spoken for. This has lowered their order book, which now stands at 47 (vs. 69 in late October). Their order book has decreased sharply over the past month as they seem to be pausing new orders. I looked at what models they are ordering, and most seem to be higher-priced trims. There are only two Flying Cloud models out of the 47 units on order. I’m unsure of the logic behind this, as the market has headed downstream.

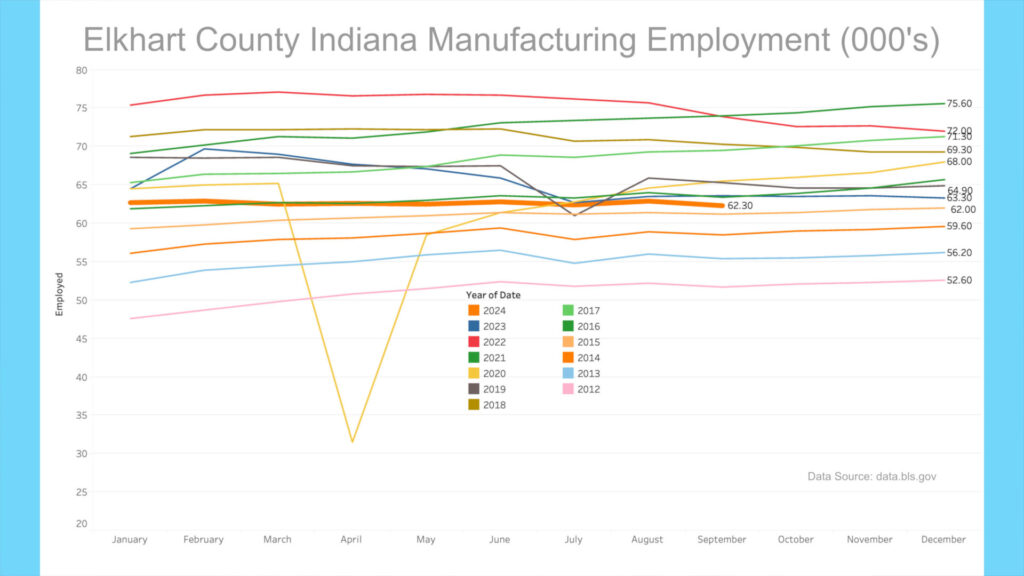

BLS RV Manufacturing Labor Stats

The Bureau of Labor Statistics revised September 2024 manufacturing employment data for Elkhart County, Indiana. The September 2024 manufacturing employment level sat at 62,300, decreasing slightly from the prior month. The September number is below September 2016, which was eight years ago. The BLS is forecasting manufacturing employment to decline again for October of 2024 as production continues to wane.

AAA

Gas prices have decreased in the past month. According to AAA, the current average nationwide price as of November 28th was $3.065 per gallon for regular unleaded, down 6.5 cents from a month ago and down 18.1 cents per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $920 now vs. $974 a year ago, a 5.6% decrease. Diesel prices have also decreased in the past month and currently sit at $3.554 per gallon, down about a penny and a half from a month ago and down about 68 cents from a year ago. A similar 3,000-mile trip getting 12 mpg would cost $889 now vs. $1,058 a year ago, a 16.0% decrease.

Sale of 2025 Motorhomes Possibly Banned in California

In early November, a story broke that detrimentally affects the RV industry and motorhome sales. Motorhomes, which include Class A, B & C models, have had a tough year and have seen a steady decline since the beginning of 2021, especially during 2024. The latest impact is from an environmental regulation, the Advanced Clean Truck (ACT), coming out of California, which several other states are complying with. The gist of the new regulation means that motorhome shipments and sales in these states will stop in 2025 and beyond.

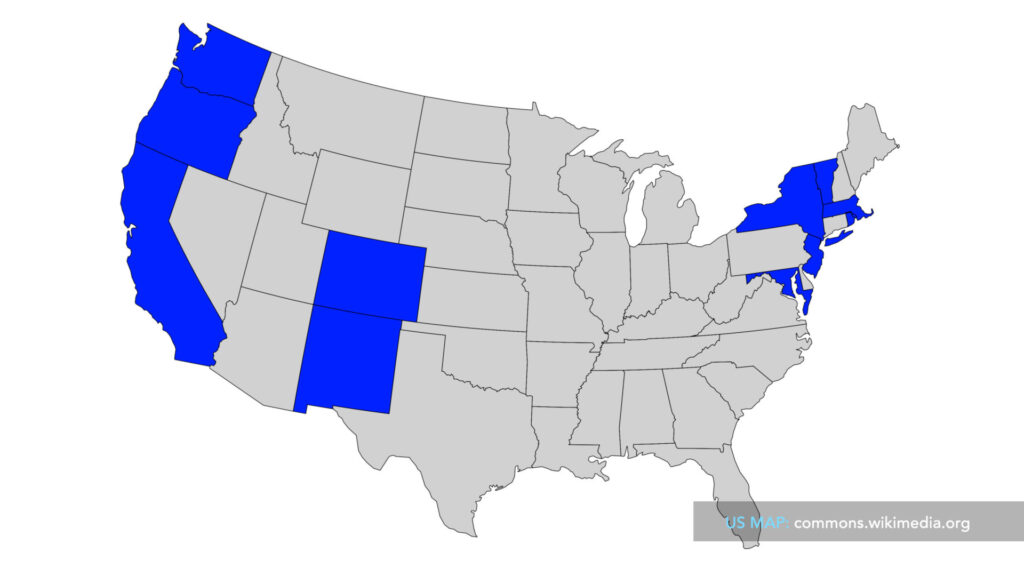

Ten states besides California have adopted the CARB ACT rule. Massachusetts, New Jersey, New York, Oregon, and Washington will take effect with the 2025 model year, while regulations in Vermont will take effect with the 2026 model year, and those in Colorado, Maryland, New Mexico, and Rhode Island with the 2027 model year. This represents over 30% of the entire population of the U.S. While we don’t have RVIA shipment numbers per state, we can assume it will affect about the same percentage of motorized RVs. So, roughly 30% of motorized shipments will likely disappear starting in 2025. This is a massive hit since higher-priced motorhomes are a disproportionally large percentage of revenue for manufacturers.

The regulation applies to motorhome chassis manufacturers and requires that for every three ICE chassis sold, one EV chassis must be sold – a requirement that can’t be met currently by any motorized RV chassis manufacturer. Therefore, no motorized RVs can be sold or registered in California and other complying states unless an exception is made.[1]

History

Here is a quick history of the issue:

- In 2021, the California Air Resources Board (CARB) established zero-emission vehicle standards for medium and heavy-duty vehicles with over 8,500 lbs. gross vehicle weight rating (GVWR). The regulation is known as the Advanced Clean Truck (ACT) regulation.

- Manufacturers of such vehicles have to produce and sell an increasing portion of their sales as zero-emission vehicles (ZEVs) starting in the 2024 model year and ramping up through the end of the 2035 model year.

- Two other regulations passed that complicate matters are the Omnibus Low NOx rule and the Advanced Clean Fleets rule. These three rules work together to gradually transition medium- and heavy-duty vehicles to zero-emission vehicles (ZEVs) by 2036.

- Along this timeframe, the RVIA has been working with CARB to make an exception for motorized RVs to little avail. The main argument has been that “the vast majority of motorhomes are driven very few miles in a given year.”1 Additionally, the “EPA reiterated that motorhomes are not suitable vehicle applications for EV technology due to the projected impact of the weight of EV batteries.”[2]

- Another argument for an exception made by the RVIA to the CARB ACT rule was that based on first-year miles driven by motorhomes sold in California (based on < 6,000 units shipped), vs. other trucks over 8,500 lbs. (> 130k units) that “motorhomes represent only 11.8 million miles versus the 4.8 billion miles for medium- and heavy-duty trucks, making it obvious that an exemption for motorhomes will not have an adverse impact on environmental concerns.”[3]

- CARB did not make any amendments for an exception for motorized RVs to the ACT rule even after the RVIA submitted comments in October 2024. So, “the only way these suppliers feel they can meet the ACT requirement on motorhomes is to not sell into the six ACT states starting in 2025. And as of now, the chassis suppliers have indicated that there is no change in sight for future years as well.”[4]

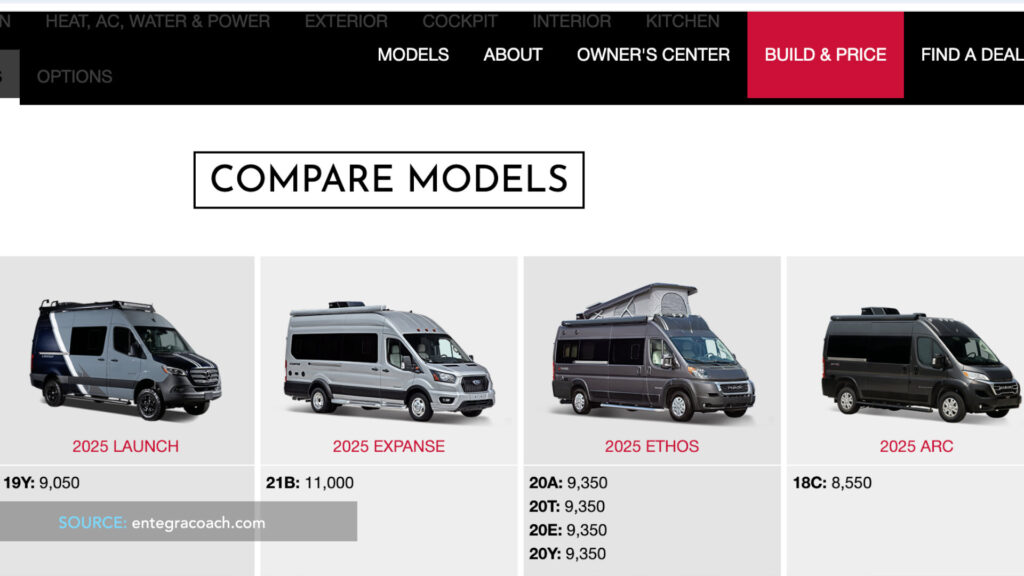

To be clear, this would include many Class B camper vans. For example, Entegra Class B 2025 models have no trims under 8,500 lbs.[5] Here, you see a snapshot from their website and the accompanying GVWRs for their Class B lineup. So, it’s essential to understand that any restriction isn’t limited to large Class As. Pretty much all motorized RVs are impacted.

My Take

Many of you who have been following my channel for a while know that I am no fan of recent RVIA leadership and think their lack of foresight has led to much of the pandemic excess and subsequent bust we are now experiencing. In this case, however, the RVIA is correct in arguing against the Advanced Clean Truck regulation being applied to motorized RVs. The simple physics of a motorhome means that without some substantial technological breakthrough in battery or charging technology, no motorized RV will be fully electric anytime soon. If the ACT rule doesn’t provide an exception for motorized RVs, it will likely mean the end of new Class A & C sales in these states.

I also agree with the argument presented by the RVIA that the actual environmental impact of motorized RVs, based on miles driven, is almost nil compared to the larger impact of heavy-duty trucks. I am reasonably sure that compared to commercial vehicle emissions, it is even more imperceptible.

There are secondary effects if the rule remains as is. “CARB said that a used vehicle, defined as one with more than 7,500 miles on the odometer, could be brought in and registered. Any motorhome with less than 7,500 miles would be considered a new vehicle and would have to be compliant in order to be registered.”[6]

Can you think of ways out-of-state dealers or owners would take advantage of this 7,500-mile rule and the 8,500 lb. limit?

That should do it. All the best in your camping adventures!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!

https://rvbusiness.com/rvia-oems-meet-with-carb-discussions-are-to-continue/

https://www.rvia.org/system/files/media/file/RVIA%20Comment%20letter%20to%20CARB%20re%20ACT%20102124.pdf ↑

Ibid. ↑

Ibid. ↑

https://www.entegracoach.com/compare-class-b/ ↑

https://rvbusiness.com/rvia-oems-meet-with-carb-discussions-are-to-continue/ ↑