In this blog, we will cover the latest RV and travel data news. December 2024 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell or hold an RV. Later in the news, we’ll discuss the latest TSA data and an industry leader’s insight.

RVIA Numbers

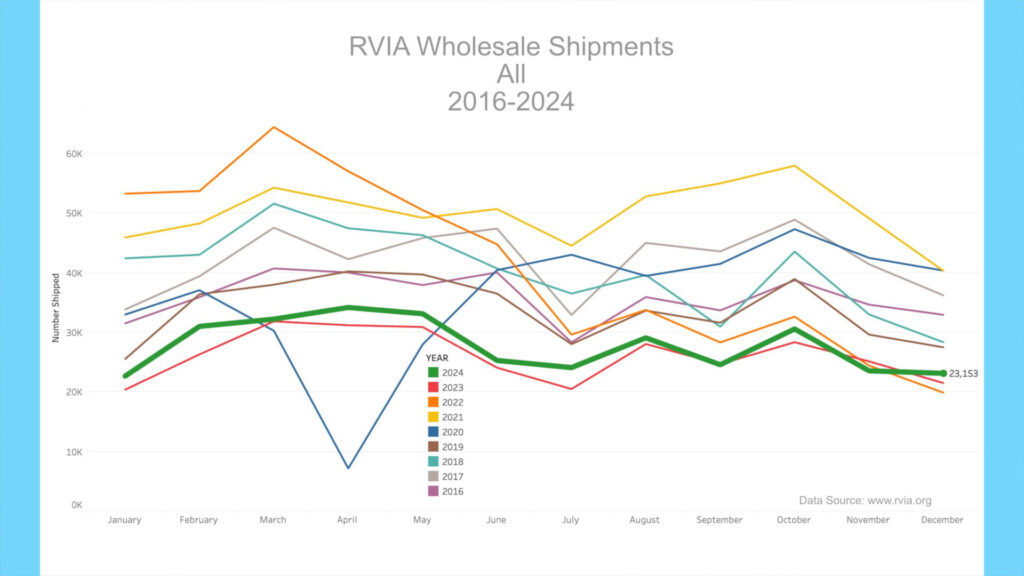

On January 26th, 2025, the RVIA posted the latest RV wholesale shipment data for December 2024. Production increased compared to the prior year, with 23,153 total RVs shipped in December, up 1,631 or 7.58% from December 2023. December 2024 beat both 2022 and 2023 December shipments. Travel trailer production increased year-over-year, with 16,419 shipped in December 2024 vs. 14,030 a year ago (a 17% increase).

Unfortunately, the bad news continued for motorhome shipments. Motorhome shipments, which include Class A, B & C motorhomes, witnessed its lowest December since before 2016, with only 2,339 units shipped, down 503 or 17.7% from December 2023.

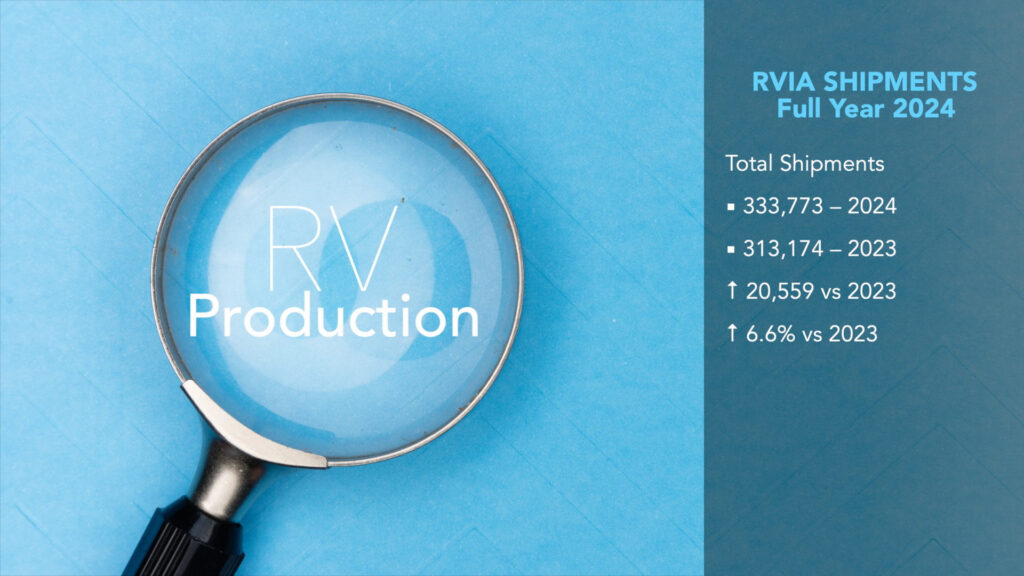

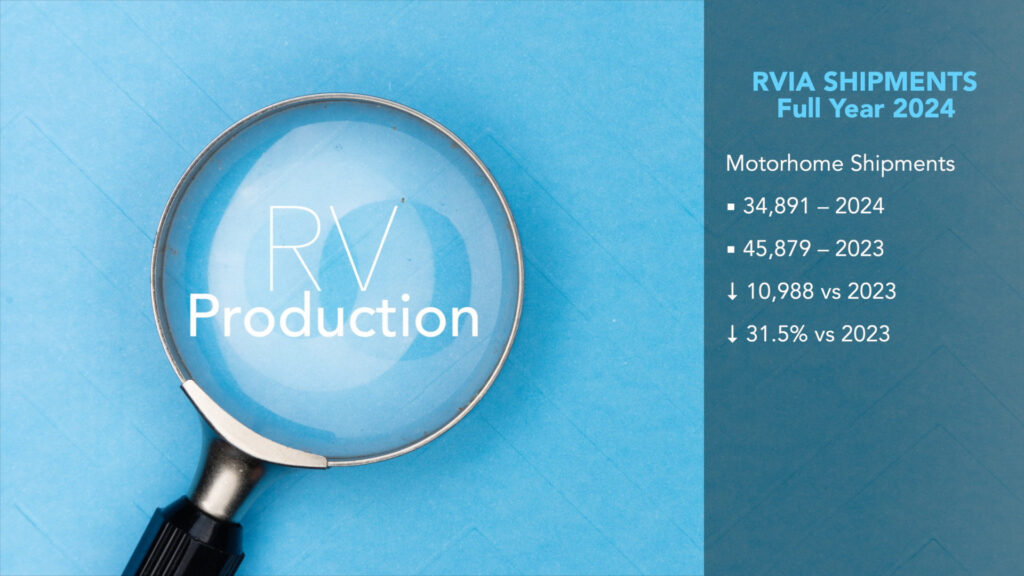

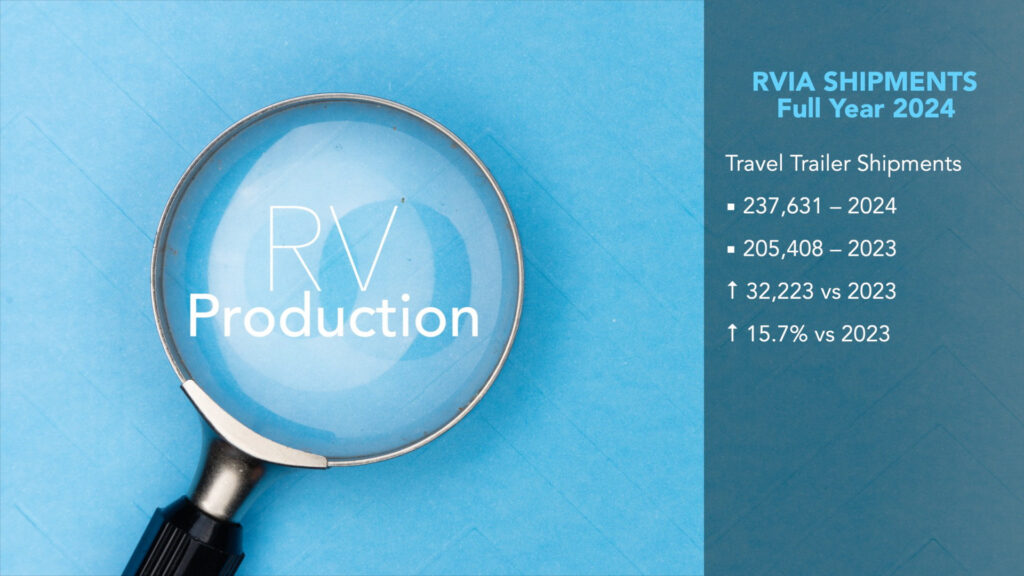

For the full year 2024:

Total shipments were 333,773 compared to 313,174 for 2023, up by 20,559 or 6.6%.

Motorhome shipments for 2024 were 34,891 compared to 45,879 for 2023, down by 10,988 by or 31.5%.

Travel Trailer shipments for 2024 were 237,631 compared to 205,408 for 2023, up by 32,223 or 15.7%.

RV Trader Numbers

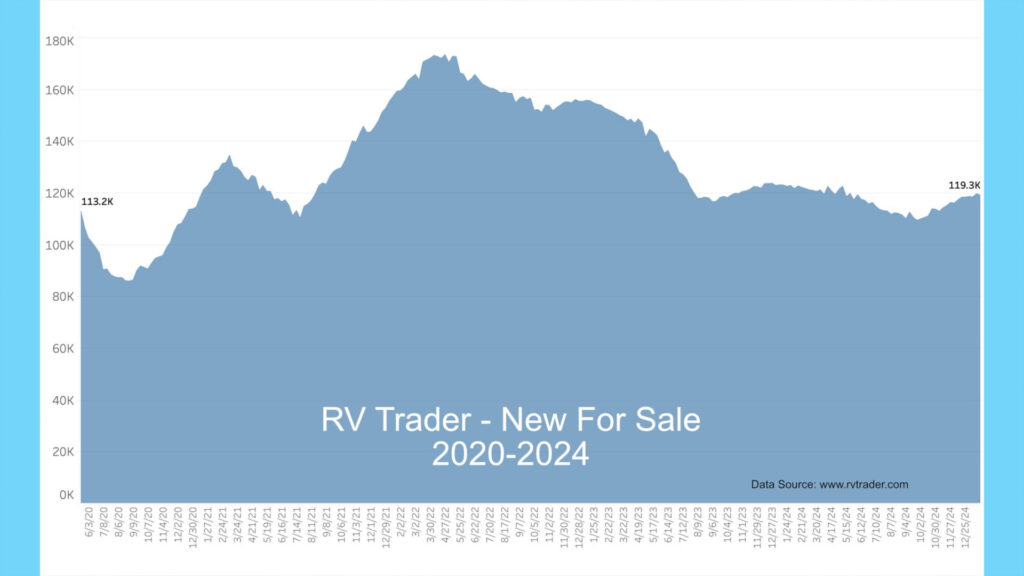

Meanwhile, RVs for sale on RVTrader.com have increased since last month, with 119,266 new RVs for sale as of January 22nd, 2025. This is up by 522 units from about a month ago and down 3,376 or 2.8% compared to a year ago.

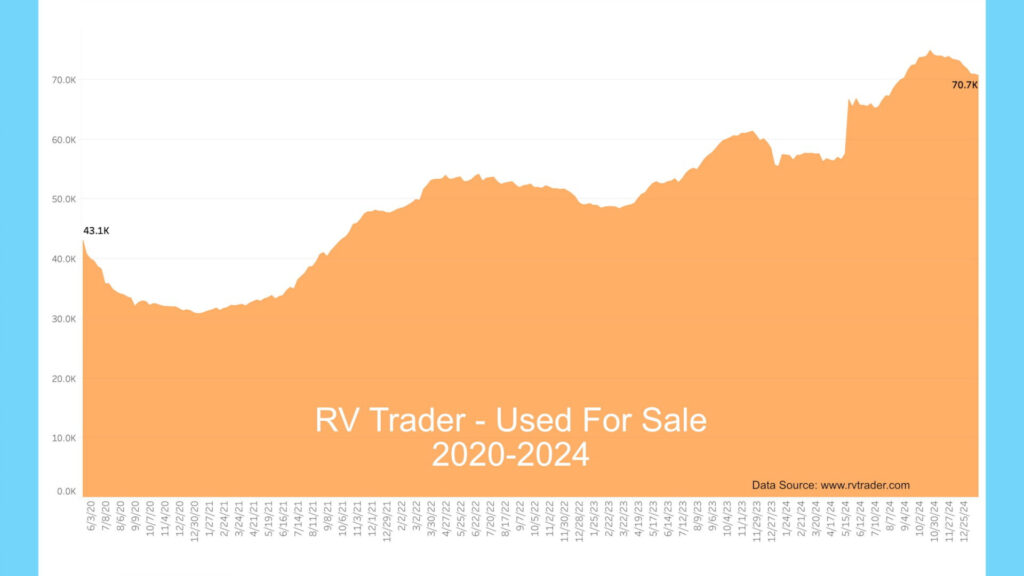

Used units have decreased, with 70,721 used RVs for sale as of January 22nd. This is down by 1,080 units vs. about a month ago and up by 13,341 or up 23.3% compared to a year ago. This continued record level of used RVs for sale is evidence of the shedding of pandemic trailers by recent RV buyers. Of the 70,721 used units for sale, 29,560, or 41.4%, were built pre-2020, and 36,668, or 51.3%, were built for model years 2020 to 2023.

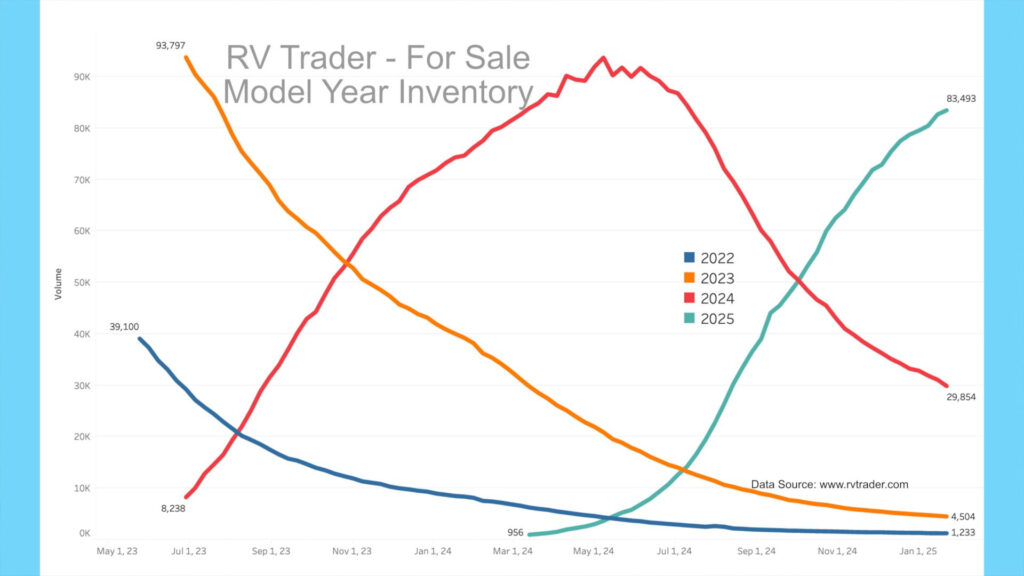

Our model year chart shows new model volumes for 2022 through 2025 since May of 2023. As dealers unload the older units, 2022 models, as indicated by the blue line, have decreased from 39,100 to 1,233 units. The orange line shows 2023 models going from 93,797 to 4,504 units since late June 2023. Meanwhile, the red line shows 2024 models on RVTrader.com. In late June 2023, there were 8,238 new 2024s, and now there are 29,854, having peaked this past summer and running off quickly. Also, 2025 units, as shown by the teal line, are ramping up. There are currently 83,493 units for sale, increasing by 4,743 in the past month.

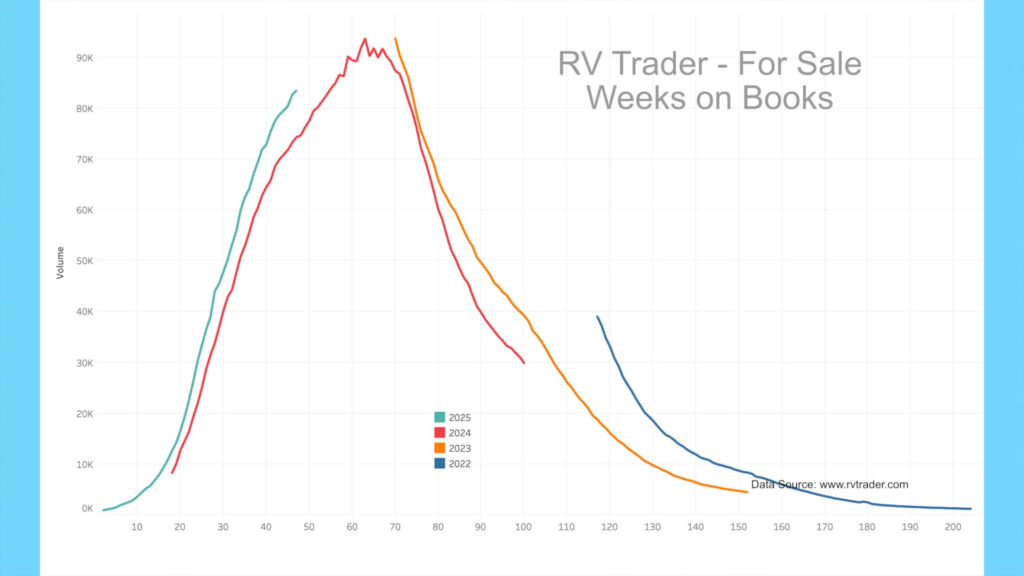

When we look at the model year data by number of weeks on market, surprisingly, we see that 2025’s (teal line) is ramping up quicker than 2024’s (red line) at the same number of weeks on market. Also, the 2024s are falling off faster than the 2023s (orange line). The 2024 model year looks like a historically low production run that ended about four or five months ago. It sure appears the industry is betting that 2025 models will sell more swiftly than 2024’s.

As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory. You can follow my account on X at @JohnMarucci to receive weekly updates on this data.

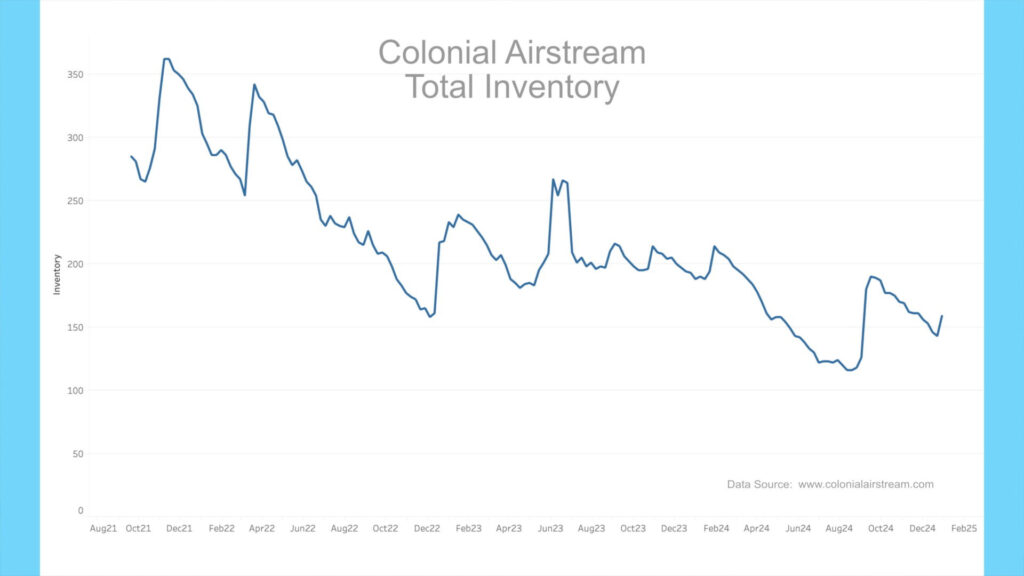

High-End Market – Colonial Airstream

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, the nation’s 2nd largest Airstream dealer, still show a glut of in-stock units.

As of January 22nd, Colonial had 119 new units on the lot for sale, with eight spoken for. This is down from 127 and 17 about a month ago. They have increased their order book in the past few weeks, which now stands at 40 (vs. 27 in late December and 47 in late November). This time last year, they had 49 units in their order book.

AAA

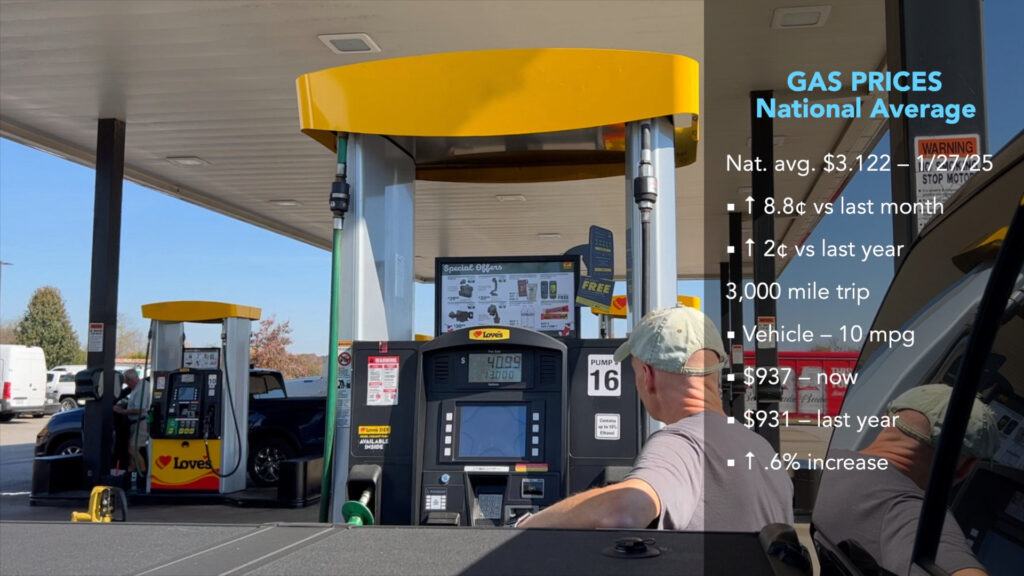

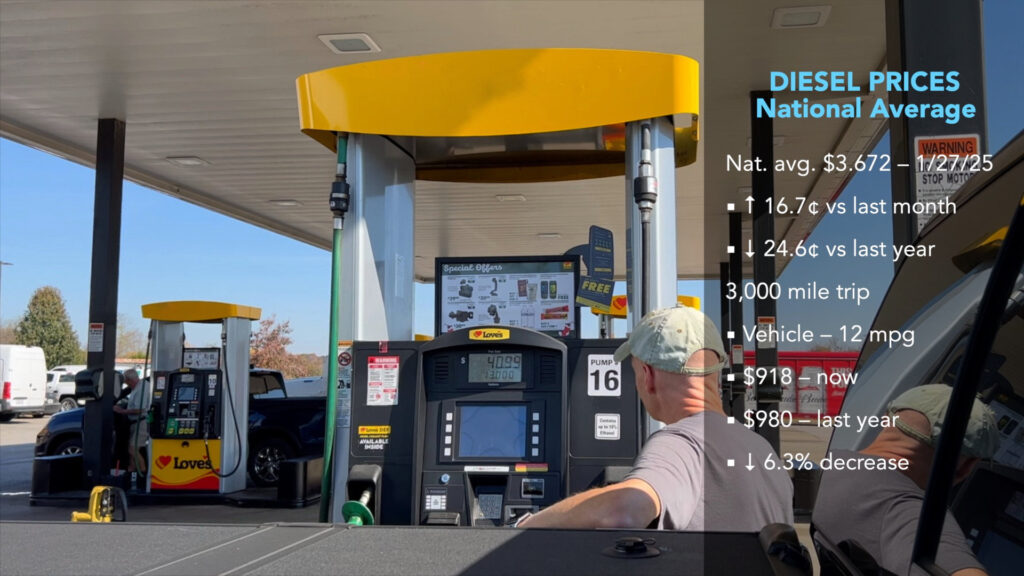

Gas prices have increased in the past month. According to AAA, the current average nationwide price as of January 27th was $3.122 per gallon for regular unleaded, up 8.8 cents from a month ago and up about 2 cents from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $937 now vs. $931 a year ago, a .6% increase. Diesel prices have increased in the past month and currently sit at $3.672 per gallon, up 16.7 cents from a month ago and down 24.6 cents from a year ago. A similar 3,000-mile trip getting 12 mpg would cost $918 now vs. $980 a year ago, an 6.3% decrease.

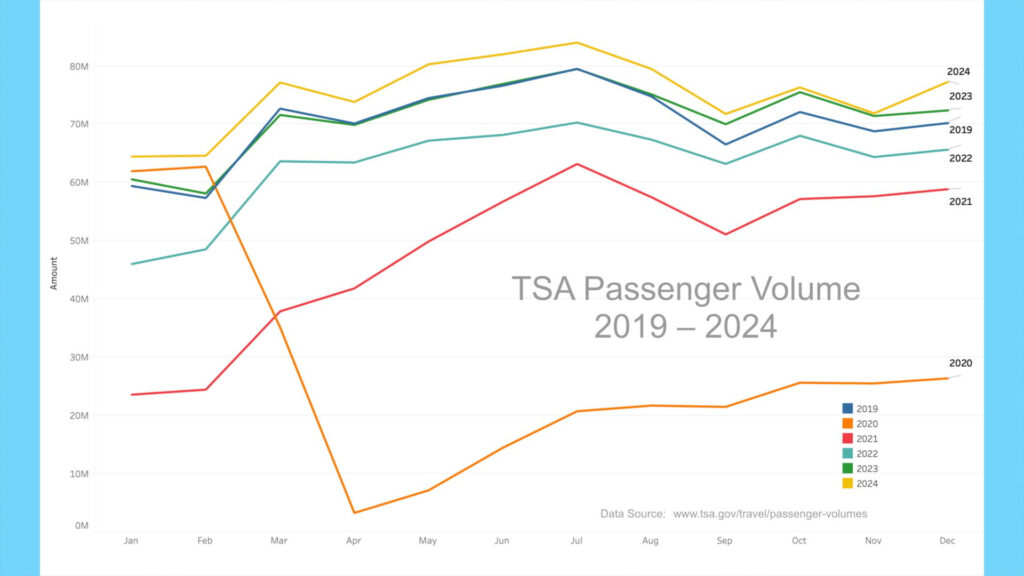

TSA Data Look

We haven’t looked at air travel data lately. For several years now, since the beginning of the pandemic, we have tracked the correlation between TSA air travel data and RV shipment data. During the pandemic, air travel tanked while RV shipments took off. The reverse is now true. Looking at the latest data from 2019 to the end of 2024, it is easy to see what happened to air travel. 2020 saw the lowest rates of air travel in the past several years, yet as air travel began to bounce back, the RV industry over-produced. 2019 is the baseline year I was keeping an eye on for air travel numbers to measure against, and as you can see from this chart, it took until August of 2023 for air travel levels to match that of 2019. Since then, air travel has consistently outpaced 2019 levels. Any air travel slump due to pandemic concerns abated in the past 18 months.

Tampa, Florida Rv Supershow

The big news this month, and every January, comes from the Tampa, Florida RV Supershow. This show is the Superbowl of RV shows and starts the year with most manufacturers showing their best units to the most customers. Besides having been to the show before, I usually follow it to find out what the industry is thinking. This year, attendance was down due to rainy and cold weather, but some sales were up more than in previous post-pandemic years.

According to CEO and President of Blue Compass RV, Jon Ferrando, “We were up 24% from 2024 even though attendance was down this year at the show. It could have been even better if we didn’t have a monsoon on Sunday, but our teams in Blue Compass fashion hung in there and finished strong.”[1]

“We also had customers buying and willing to spend,” noted Ferrando, adding that the 175 products shown at eight displays covered a wide spectrum. “In fact, we sold 12 $1 million luxury Foretravels (Class A’s), which was a bright spot. But the real story was customers looking for great product at good values. So, we had excellent product that was at very good price points, and that equaled the magic formula.”

“I think there’s a lot of pent-up demand,” he maintained. “RV customers have confidence about the future, which is important when stepping into a large RV purchase, so we saw that in Tampa. And we’re also confident about our plan with our product lineup and the level of inventory that we’ll be stocking to drive sales increases in 2025 regardless of whether the industry is flat or up 10%. And I’m on the more optimistic side that the overall industry will be up in 2025.”

My Take

I have been thinking about his statement about pent-up demand and think I agree. Many of us have used our RVs a bunch over the past few years and are also tentative about buying again. We don’t want to go through the typical issues of working out the kinks on a new RV. At some point, we must decide whether to continue using an older RV or buy again. I think this group of owners, of which I am a part, is growing in numbers. I am looking at greater time, energy, and expense in the upkeep of what I currently have. So, Jon Ferrando may be correct that there is pent-up demand. We’ll see what happens as the year progresses.

That should do it. All the best in your camping adventures!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!

1. https://rvbusiness.com/rv-industry-leaves-tampa-feeling-positive-about-2025/