In this blog, we will cover the latest RV and travel data news. March 2025 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell or hold an RV. Later in the news, we’ll discuss the latest results from the country’s largest dealer and my thoughts on why I am cold on buying a new RV.

RVIA Numbers

On April 24th, 2025, the RVIA posted the latest RV wholesale shipment data for March 2025. Production increased compared to the prior year, with 37,348 total RVs shipped in March, up 5,105 or 15.8% year-over-year. March 2025 beat 2023 and 2024 March shipments but was below all other recent years, including 2016. Travel trailer shipments increased year-over-year, with 26,482 units shipped in March 2025 vs. 22,835 a year ago, up 3,647 or 16%.

Motorhome shipments, which include Class A, B & C motorhomes, beat March 2024, with 3,366 units shipped, up 141 units or 4.4% year-over-year. This is the first time in over a year that Motorhome shipments have beaten a prior year. To add some perspective, past March shipments averaged around 4,900 for previous years (not including 2020), so the segment is still lagging behind the historical average by about 1/3rd.

RV Trader Numbers

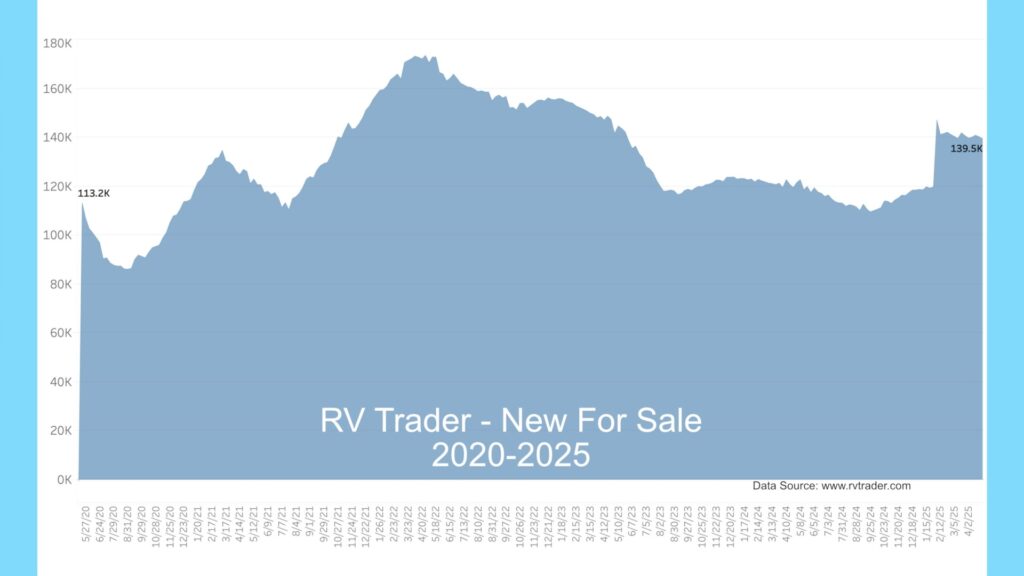

RVs for sale on RVTrader.com have decreased slightly since last month, with 139,525 new RVs for sale as of April 30th, 2025. This is down from 140,735, or 1,210 units or .9% from a month ago, and up 17,974 or 14.8% from a year ago.

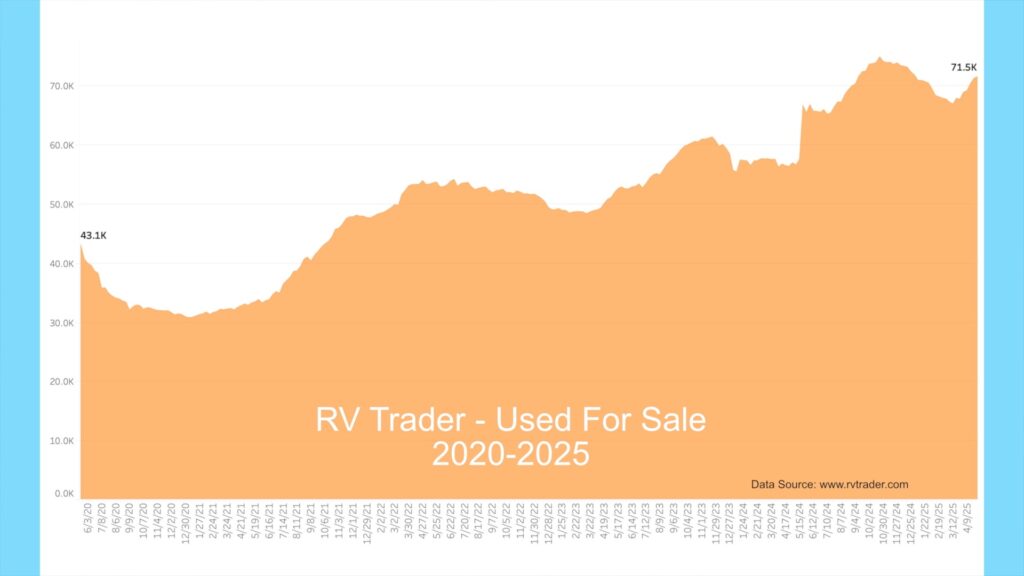

Used units have increased sharply in the past month, with 71,543 used RVs for sale as of April 30th. This is up by 3,813 units or 5.6% vs. about a month ago and up by a whopping 14,542 or up 25.5% compared to a year ago. Interestingly, when we compare the end of March to the end of April, year-over-year, used units for sale were down by 588 in this time period last year versus the 3,813 increase this year. This is a 4,401 swing. It seems evident that there is an increase in the unloading of used units this early Spring season. I believe we are continuing to see the results of mass inoculation of RVing by pandemic buyers.

Model Year Charts

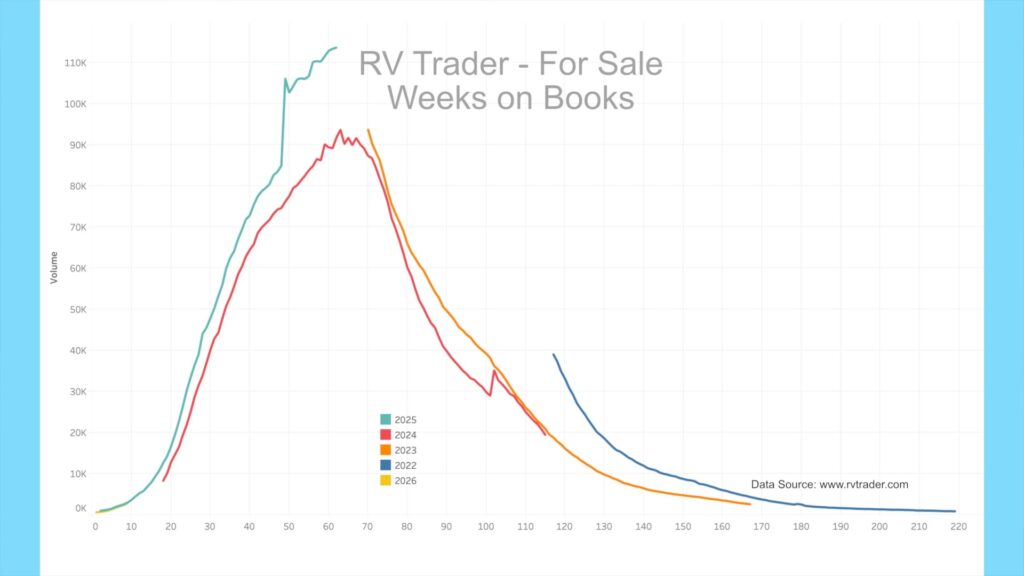

Our model year chart shows new model volumes for 2022 through 2025 since May of 2023. As dealers unload the older units, 2022 models, as indicated by the blue line, have decreased from 39,100 to 846 units, down by 138 since last month. The orange line shows 2023 models going from 93,797 to 2,581 since late June 2023, down by 623 since last month.

Meanwhile, the red line shows 2024 models going from 8,238 in late June 2023, ramping up last spring, and now at 19,409, down about 5,600 units since last month. It seems evident that the huge clearance of 2024 units is still underway, as 2026 models are set to hit dealer lots shortly. 2025 units, as shown by the teal line, have ramped up and are now leveling off. There are currently 113,733 2025 units for sale, increasing by about 3,300 in the past month.

New RVs – Weeks on Market

Looking at the model year data by the number of weeks on market, we see that 2025s (teal line) is ramping up much more quickly than 2024s (red line) at the same number of weeks on market. Also, the 2024s are falling off faster than the 2023s (orange line). The 2024 model year looks like a historically low production run that ended last summer. It sure appears the industry is betting that 2025 models will sell more swiftly than 2024s, yet my commentary below questions this assumption. We have also welcomed 2026 models into the chart data, and at week 9 on market, 2026 models are mirroring 2025s so far.

As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory. You can follow my account on X at @JohnMarucci to receive weekly updates on this data.

High-End Market – Colonial Airstream

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, the nation’s 2nd largest Airstream dealer, still show a glut of in-stock units.

As of April 30th, Colonial had 116 new units on the lot for sale, with 7 spoken for. This is down from 128 and 11 spoken for about a month ago. Interestingly, Colonial continued to decrease its order book over the past month, which now stands at only 11 units (vs. 40 in late January and 47 in late November). A year ago, Colonial had 48 units on order.

This indicates that Colonial has put the brakes on new orders as their lot is full of 2025 models. 2026 models should be arriving shortly, so with nearly 120 high-end 2025 model Airstreams on their lot, they seem to be signaling a problem with unloading these existing units.

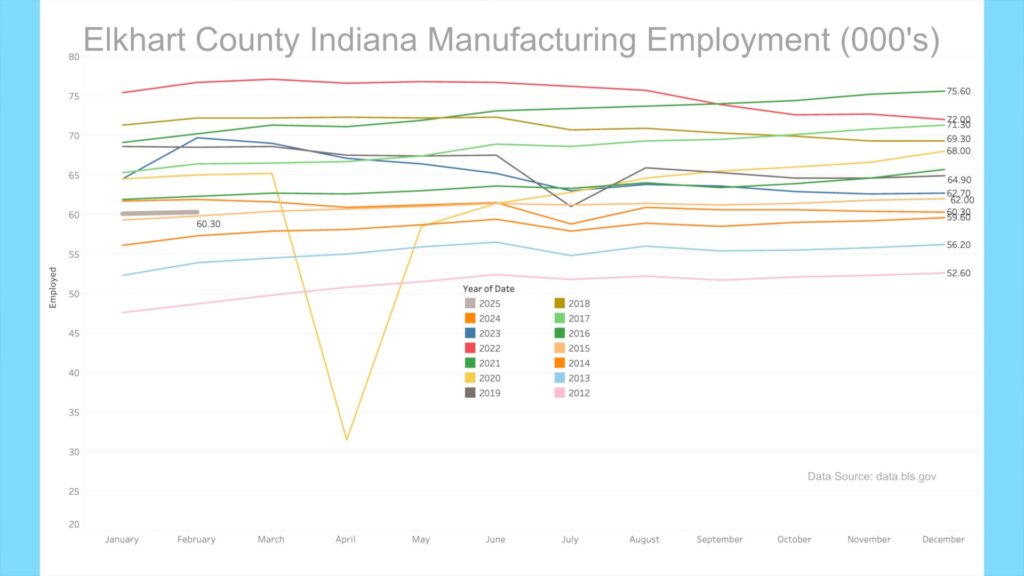

BLS RV Manufacturing Labor Stats

The Bureau of Labor Statistics published February 2025 manufacturing employment numbers for Elkhart County, Indiana. The current manufacturing employment level was 60,300, just above March 2015 but significantly below 2016 and later years. The BLS is forecasting manufacturing employment to increase slightly in March 2025.

AAA

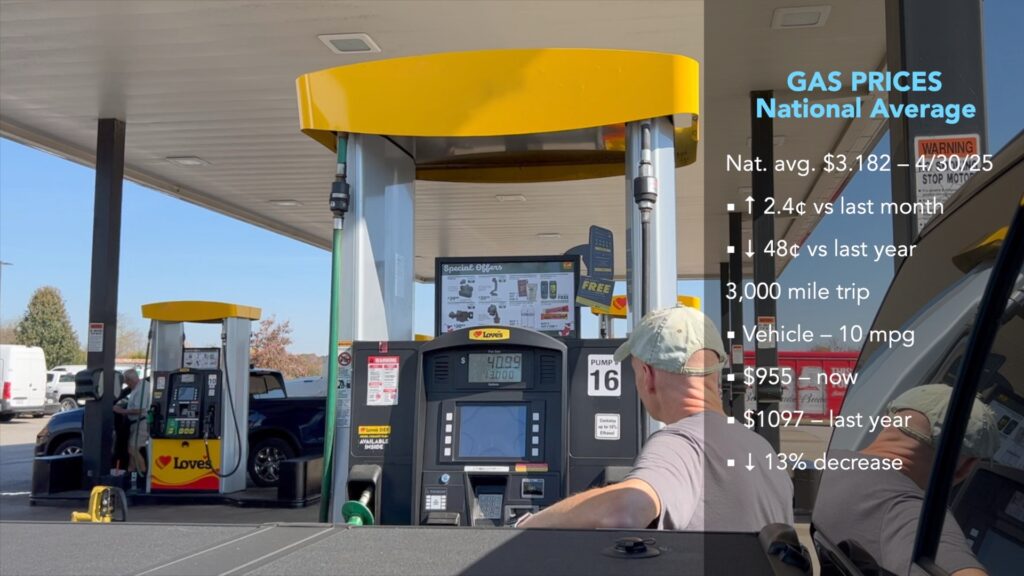

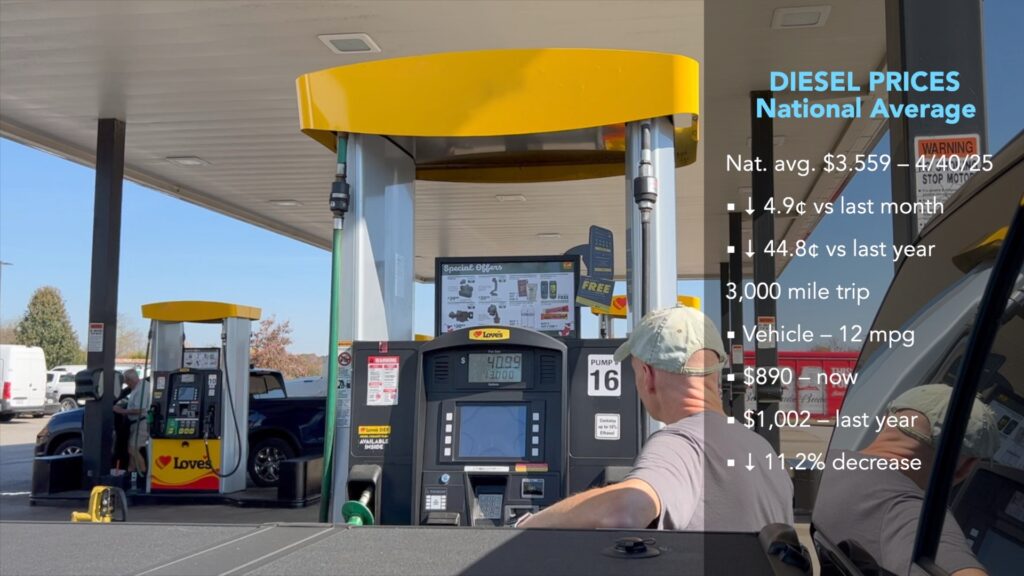

Gas prices have increased slightly in the past month. According to AAA, the current average nationwide price as of April 30th was $3.182 per gallon for regular unleaded, up 2.4 cents from a month ago and down about 48 cents from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $955 now vs. $1097 a year ago, a 13% decrease. Diesel prices have decreased in the past month and currently sit at $3.559 per gallon, down 4.9 cents from a month ago and down 44.8 cents from a year ago. A similar 3,000-mile trip getting 12 mpg would cost $890 now vs. $1,002 a year ago, an 11.2% decrease.

Camping World

On April 30th, Camping World reported 1st quarter results, with a mix of good and bad news. The good news is that overall revenue increased by 3.6% versus last year’s quarter, and used vehicle revenue increased by 25%. The company’s net loss was cut in half compared to the previous year’s quarter. This is where the good news ends.

New vehicle revenue decreased by 5.3%, with the total number of new units sold down by about 1%. Camping World sold 16,726 new units and 13,939 used units from 209 stores. Yet, to accomplish these sales levels, the company increased its selling compensation and marketing expenses by nearly $19 million. So, used sales have become a large part of the business at 45.5% of sales, and new unit sales at 54.5% of sales have had trouble and needed significant increases in sales incentives. Essentially, they have wagered on used units as the hot commodity this season, and that wager has somewhat paid off. High-end dealers, like Colonial Airstream, have 116 (77.4%) new units and only 34 (22.6%) used units in stock, a much more new-unit wager vs. Camping World.

Reality Check

I recently completed a longer trip with my trailer, and over the several days of being on the road, we passed many RV dealers situated next to the highways. I understand my opinion here is impression-based, but almost every RV dealer lot looked full, sometimes very full, with little to no room for new units.

Something goes tilt when I think about this and try to reconcile it to the uptick in RV shipments we spoke about earlier. If you have been tracking with our newscasts lately, you know I’ve been skeptical about the 2025 model run—that the industry was again over-producing. I still believe this, and I wonder why any dealers are ordering more RVs just now. Looking at Colonial Airstream, which we discussed earlier, they appear to have put the brakes on ordering.

There is an issue we haven’t discussed in a while: Nothing significant has changed on the RV manufacturing side since before the pandemic. Buyers still have little or no recourse for bad quality. Warranty claims are at the manufacturer’s mercy, state RV lemon laws are little to non-existent, and workers are still generally paid piece work, so speed is valued over quality. Often, warranty work sidelines your new RV for long periods while you wait for authorization or service appointments. I admit that, to some extent, I have been inoculated from buying new again for these reasons (besides exorbitant prices).

Of course, buying used RVs has its downsides, as sellers can try to hide real issues. Yet, generally, I would recommend a quality used unit from a private party over a new unit if a buyer has the unit inspected by an independent third-party RV inspector. So, buy, sell, or hold? Right now, “hold” is my recommendation. Maintain the unit well with the caveat of buying quality used if you have to replace your unit.

If you are looking for your first RV, there is no reason you can’t try a used RV first. You may be able to snag a unit from someone like me who has gone through the warranty period and has maintained the rig well even though it was used extensively. Even if you want new at some point, a quality used unit may help ease you into the lifestyle with less cost and fewer issues.

That should do it. All the best in your camping adventures!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!