This blog will cover the latest RV and travel data news. 2023 RV production has continued a steady slide, as expected, as wholesale shipment numbers continue to slow going into the spring selling season. There is no question at this point that it is a buyer’s market. I recently watched an RV Business video interviewing four dealers in different parts of the U.S. that shed light on the current situation. We’ll get into this and more.

The Numbers

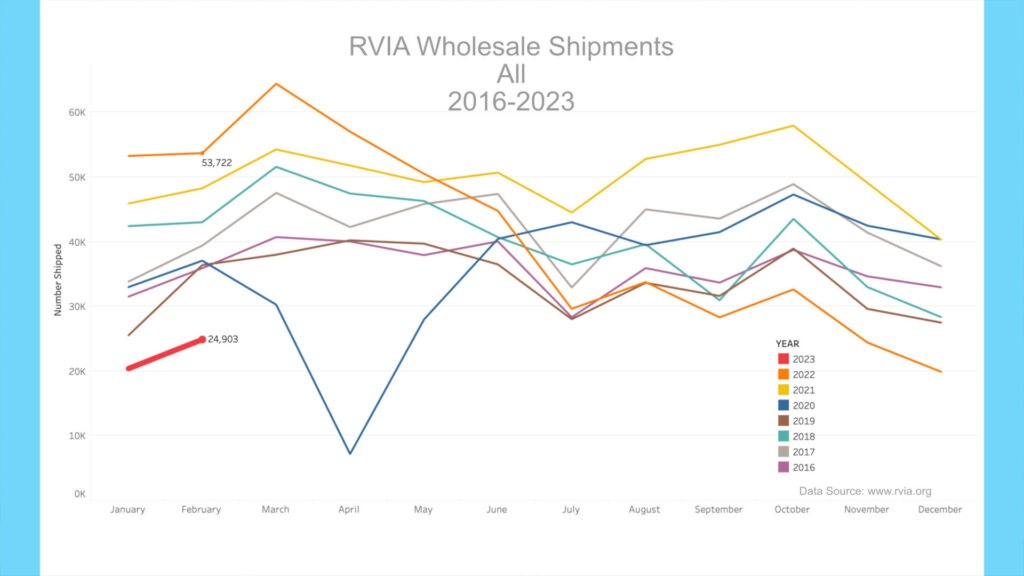

On Monday, March 27th, 2023, the RVIA posted the latest RV wholesale shipment data for February 2023. Production numbers are up versus prior months but significantly down year-over-year, as expected. 24,903 total RVs were shipped in February, compared to the record 53,722 in February 2022, down about 54% year-over-year. Travel trailers witnessed a significant decline, with only 16,109 shipped in February vs. a record 38,508 a year ago, about a 58 percent decline. It was by far the worst February for towable trailer shipments in over six years. Almost 7,000 fewer travel trailers were shipped than in February 2016.

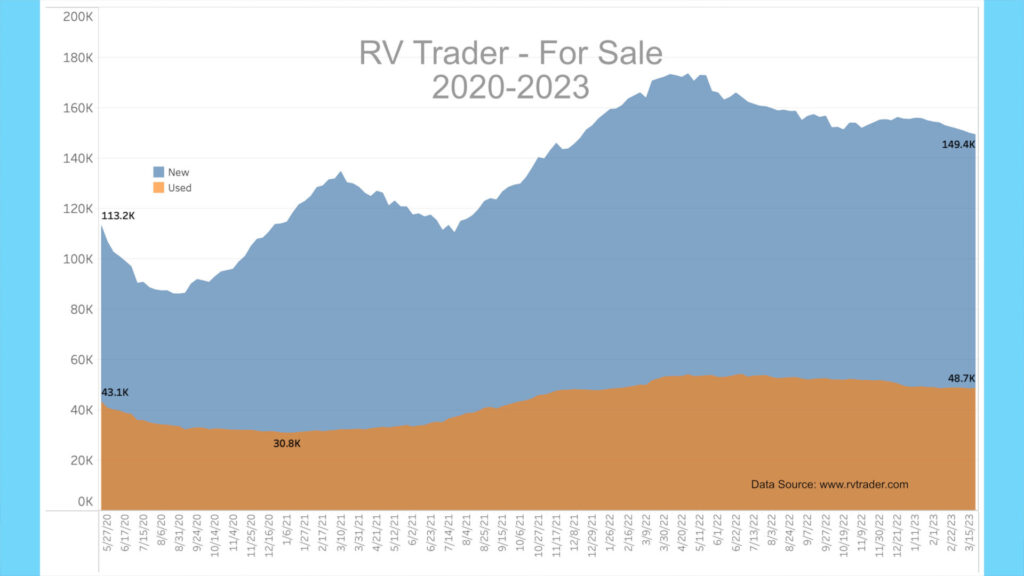

Meanwhile, RVs for sale on RVTrader.com are slowly declining but continue to remain high. There were 149,385 new units for sale as of March 22nd. This is down about 3,000 units from February’s 152,243 units. Used units for sale declined only 1/10th of 1% from last month to 48,685, which is not a great sign. This is now the fourth month in a row with used for-sale units below 50,000 after nine months in a row above 50,000. This time last year, the number of used RVs for sale was 52,296. So, we are seeing inventory decline at a snail’s pace for new and used units. Given yet another interest rate increase just last week, this doesn’t bode well for selling 2022 models lingering on dealer lots.

RV Quality Concerns

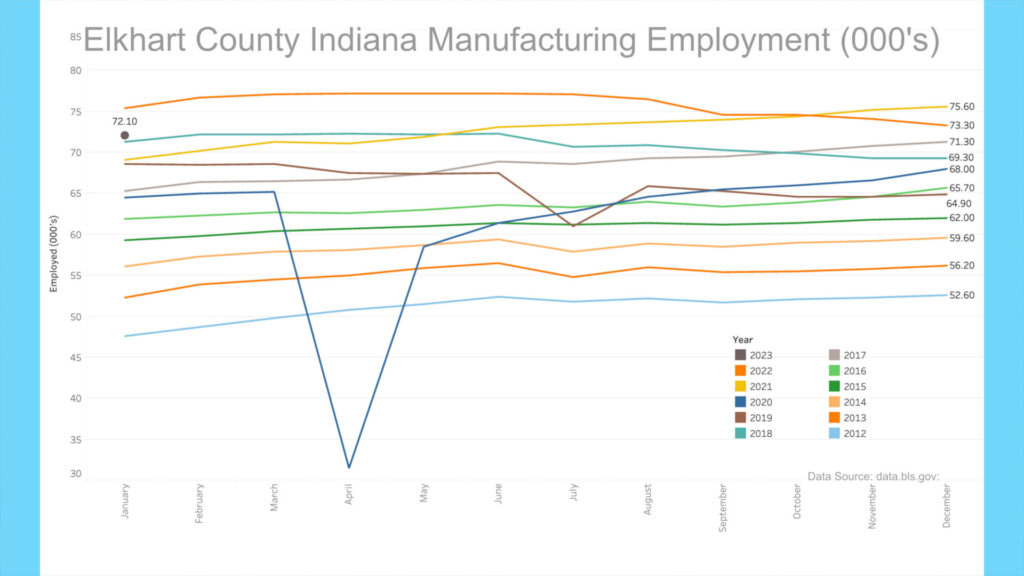

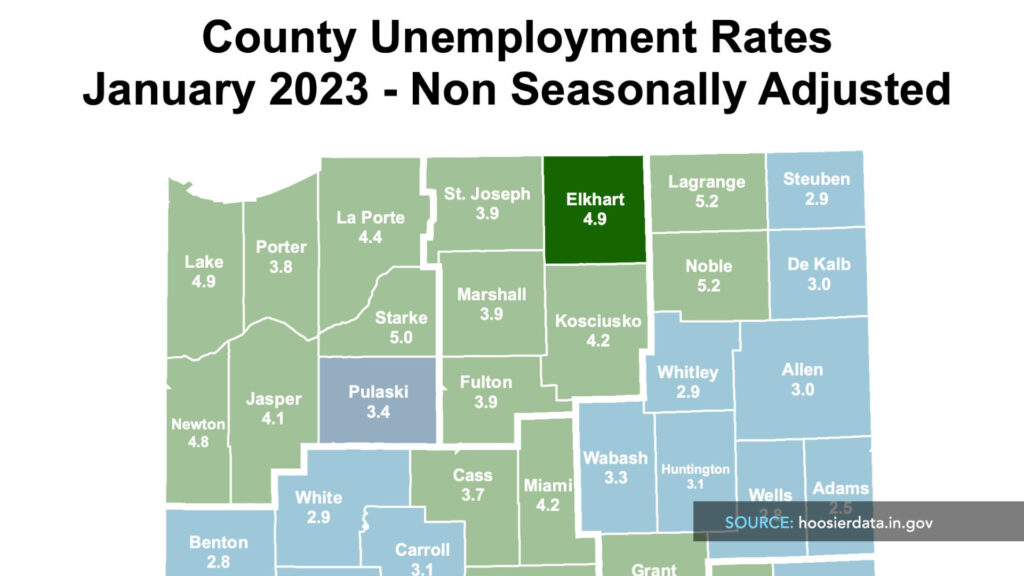

The Bureau of Labor Statistics has revised Elkhart County, Indiana’s latest manufacturing employment data for the past several months, including January 2023. The revision shows that at the height of production last April through June of 2022, there were 77,200 people employed in manufacturing. For January 2023, this number stood at 72,100 people, down 5,100 since the peak. Moreover, Elkhart’s unemployment rate increased to 4.9% in January 2023 versus only 2.5% in December, almost doubling. This is quite a change from when I drove through the town in November 2021, seeing numerous help-wanted signs promising elevated pay. Things can change very quickly.

My Rant

I don’t usually veer from reporting the numbers too much, but this is a troubling occurrence at this point. This now impacts many people’s livelihoods. It is looking clearer that the RV industry made a colossal miscalculation of production planning, thinking the pandemic boom was the new norm. At the very least, RV manufacturers tried to strike while the iron was hot and pushed hard to produce all that the market could bare in 2021 and into 2022.

What we are seeing now is akin to a gold rush town. Everything is great during the boom, but when the gold runs out, everyone except a very few pay for the miscalculation. A recent dealer call confirmed this. Each dealer was talking about trying to unload 2022 models at reduced margins. The bust side of the boom cycle is in full effect right now.

So, what do you do when you need to increase production quickly to meet skyrocketing demand? For a labor-intensive task like building RVs, you hire many new people, have them learn on the job, and push everyone to work extra hard to push units out to meet demand. The problem is that now that things are on the bust side, you still have workers who learned the trade during the boom. You may have just lowered average unit quality ongoingly. The problem is that newer workers usually cost less to keep employed, so there is motivation to cut costs by cutting more expensive labor.

All this is to say that a lack of discipline by executives during the boom time has repercussions on manufacturers, dealers, and consumers regarding lasting quality. Given social media, ongoing quality issues are impossible to hide. The term “pandemic trailer” is being used regularly online as something to avoid. So, dealers now have too much inventory of products consumers are scared to own. Given higher interest rates and higher prices in play, it’s easy to see the slowdown deepening.

This is good news for those who want an RV, have cash, are willing to take a risk, and can fix things themselves. Most consumers have to finance and can’t manage a larger discretionary purchase at elevated costs. I hope I’m wrong, but it could be a long and lonely spring for RV dealers.

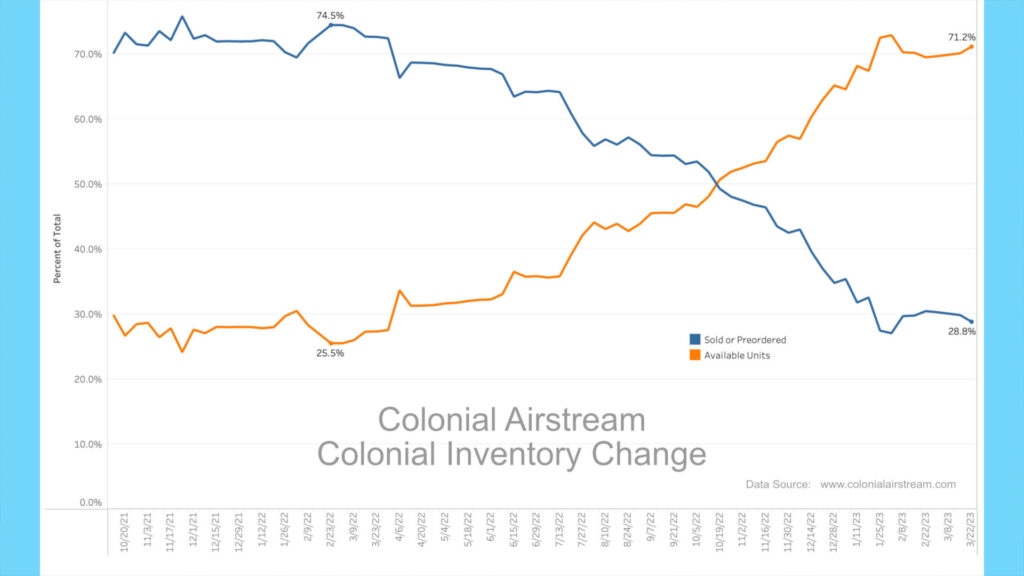

High-End Market – Airstream

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, remain high. About a year ago, 72.7% of Colonial’s inventory was preordered, meaning only 27.3% of their Airstream inventory was either on the lot for sale or being delivered and available. A year later and the entire mix has inverted. Now, about 71.2% of inventory is available for sale, with only 28.8% spoken for. Also, total inventory has declined from 267 units to just 215 units, year-over-year. This points to a move to a buyer’s market, even on higher-priced Airstreams.

AAA

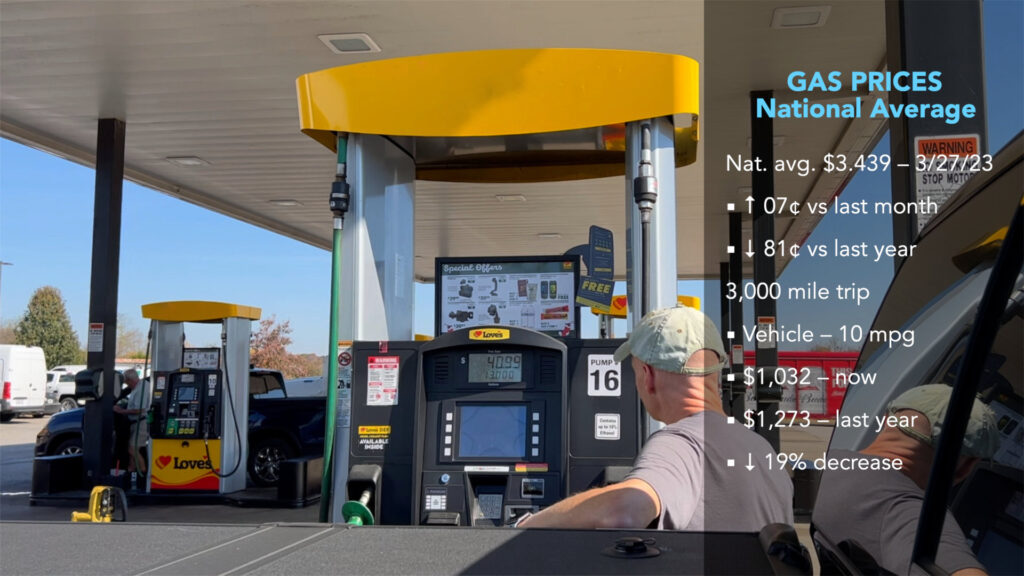

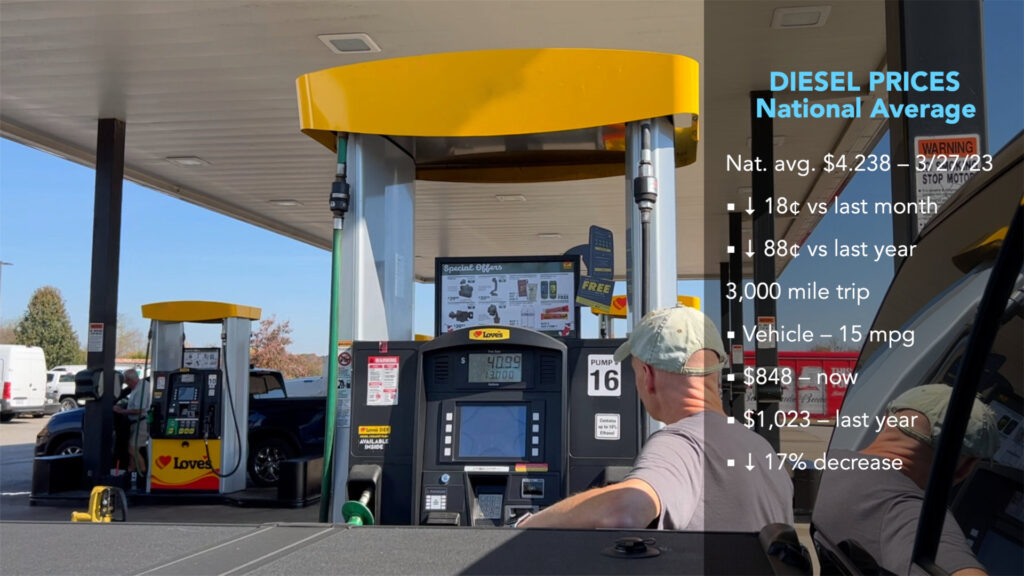

Gas prices have stabilized in the $3.40-$3.50 range of late. According to AAA, prices have increased slightly over the past month. The current average nationwide price as of March 27th was $3.439 per gallon for regular unleaded, up about $.07 from a month ago and down about $.81 per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $1,032 now vs. $1,273 a year ago, about a 19% decrease YoY. There is good news on the diesel side. Diesel sits at $4.238 today, down $.18 from a month ago and down about $.88 from a year ago. A similar 3,000-mile trip getting 15 mpg would cost $848 now vs. $1,023 a year ago, a 17% decrease.

Dealer Interviews Takeaways

I recently watched a podcast from RV Business where they interviewed four regional RV dealers, asking them about the current environment. Here are a few takeaways I gleaned from the interviews. First, while there is a measure of optimism among dealers, sales and margins are lacking in every region of the country. Some dealers mentioned that things are realigning to the slimmer profit margins of 2018 & 2019 and that RVs are not selling themselves anymore. One dealer actually said that it is a buyer’s market. Lower margins mean that real prices have fallen significantly and that you should get a hefty discount as a consumer shopping for a new RV. Don’t be fooled by anyone telling you that RVs are in high demand.

The next takeaway was that each dealer knew they had too many 2022 models on their lot, and you should also know this. This means there are likely great deals to be had on 2022 models if you are willing to take the risk on quality and ongoing repairs. Next, the dealers saw good traffic at recent RV shows, but it didn’t seem that shoppers were turning into buyers. Some dealers were concerned about their businesses if lower margins and sales continued for many months.

My take is that most dealers are in the same boat, stuck with a large inventory of 2022 models and few buyers and that this equation needs to change quickly for their business. There seems to be a faux optimism among dealers and the industry, possibly generated by recent RV show traffic, but April and May will show what the future holds. The FED just raised interest rates again, MSRPs are still way higher than a few years ago, and most astute consumers know about the quality issues of 2022 units. I guess that if things improve at all, it will be minor with all the headwinds. In the meantime, astute consumers with cash are king.

Okay, that should wrap things up.

All the best in your camping endeavors!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and by their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!