This blog will cover the latest RV and travel data news. March 2023 RV production numbers are out, several RV suppliers and dealers have reported 1st quarter earnings, and I’ll cover my experience using Starlink satellite internet service on a recently completed longer trip. We’ll get into this and more.

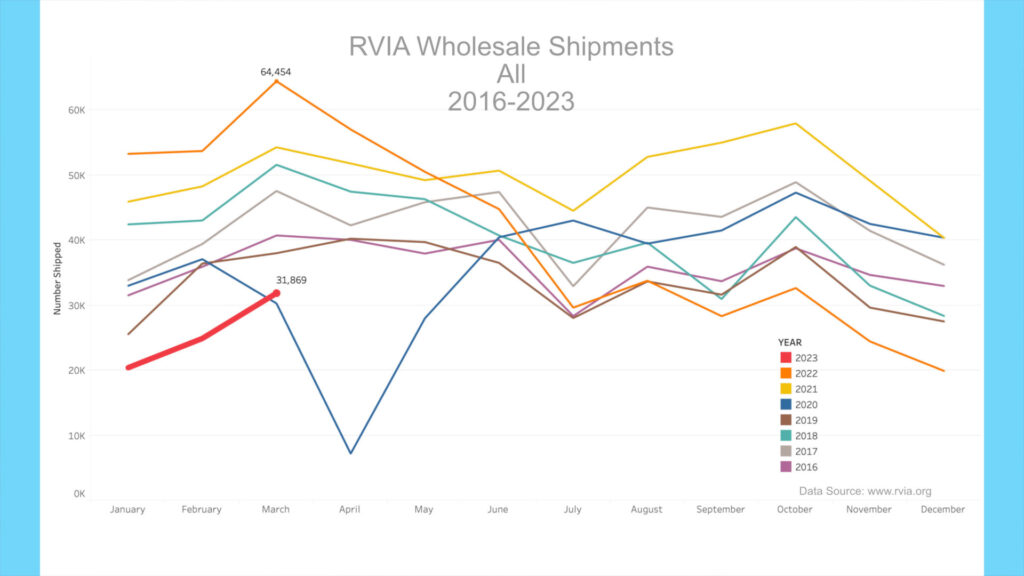

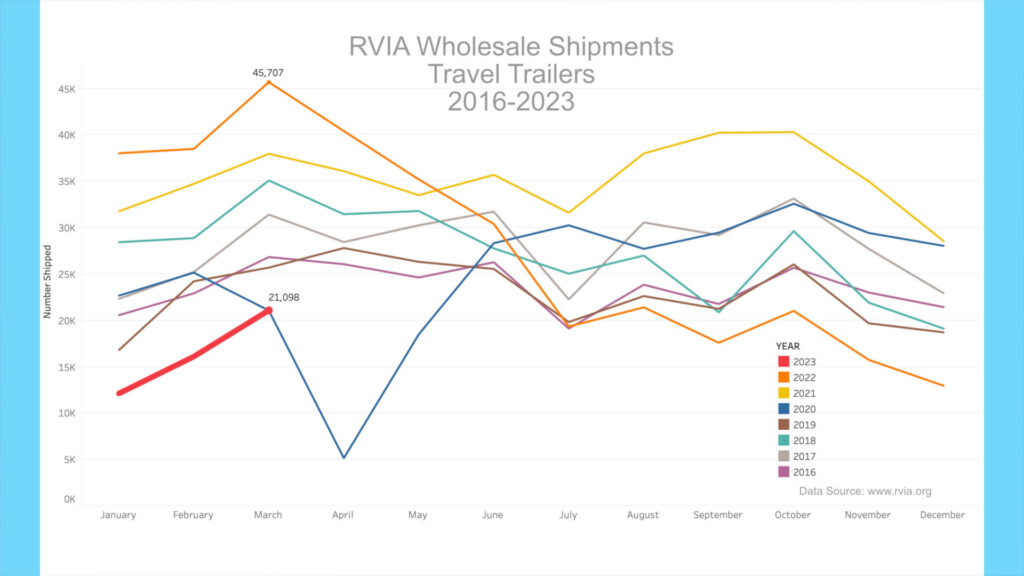

RVIA Numbers

On April 24th, 2023, the RVIA posted the latest RV wholesale shipment data for March 2023. Production numbers are up versus prior months but significantly down year-over-year, as expected. 31,869 total RVs were shipped in March, compared to the record 64,454 in March 2022, down about 51% year-over-year. Travel trailers witnessed a significant decline, with only 21,098 shipped in March vs. a record 45,707 a year ago, about a 54 percent decline. It was by far the worst March for towable trailer shipments other than 2020 in over six years. Almost 6,000 fewer travel trailers were shipped than in March 2016.

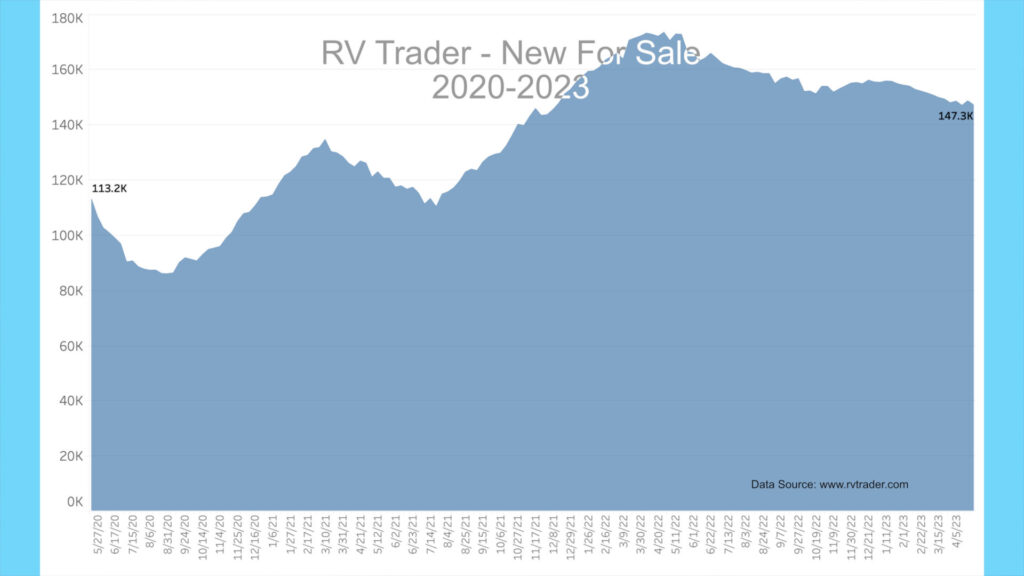

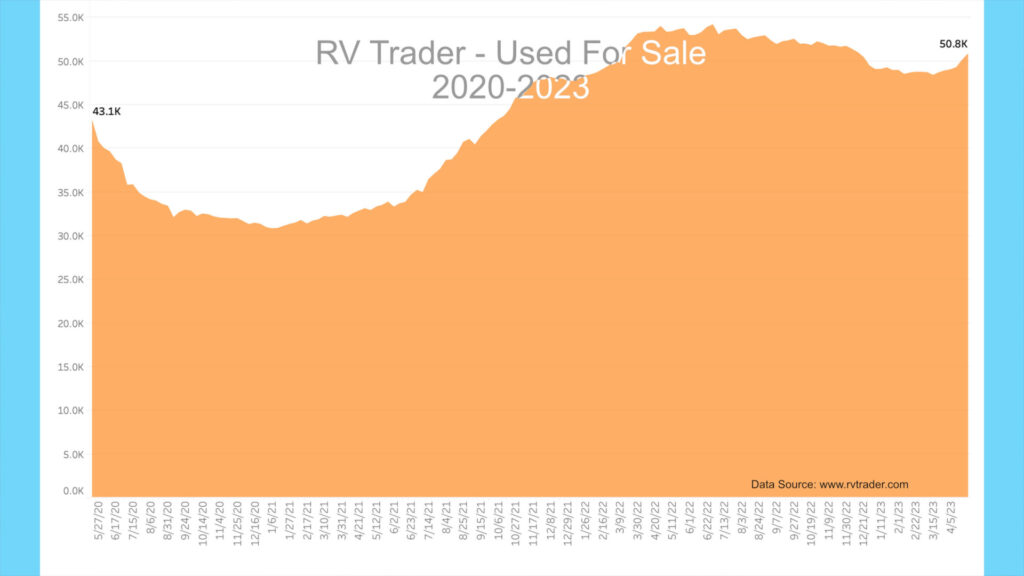

RV Trader Numbers

Meanwhile, RVs for sale on RVTrader.com are slowly declining but continue to remain high. There were 147,282 new units for sale as of April 26th. This is down about 2,000 units from late March’s 149,385 units and down about 26,000 new units versus late April 2022, the highest inventory level in recent history.

Used units for sale increased by over 2,000 to 50,802, up from 48,685 last month, as more people attempt to unload used RVs. This is now the second week in a row with used for-sale units above 50,000 after four months in a row below 50,000. This time last year, the number of used RVs for sale was 53,998, so we have about 3,000 fewer used units for sale versus late April 2022. So, as expected, we are seeing new inventory decline at a snail’s pace and used units for sale increasing going into the Spring selling season.

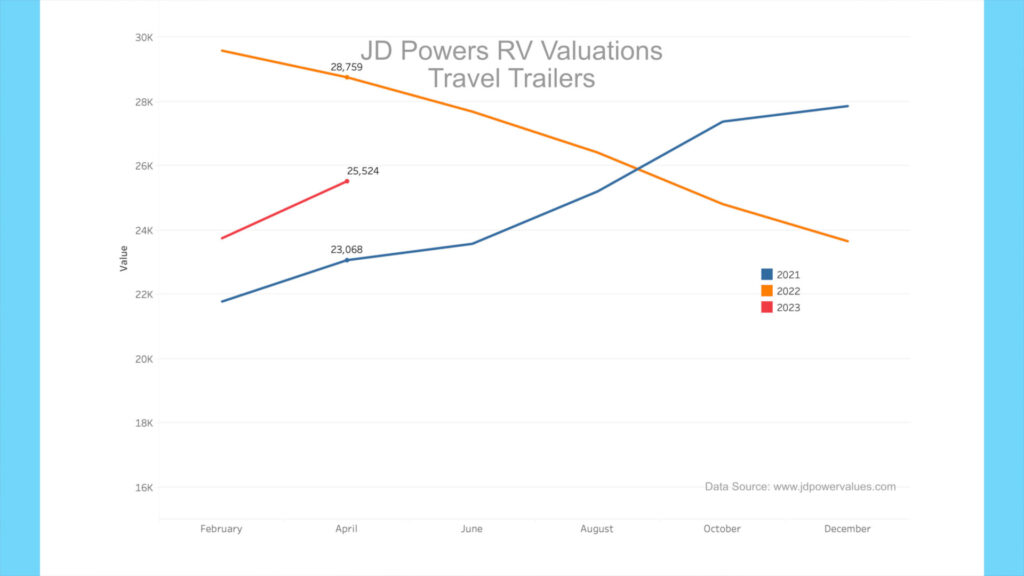

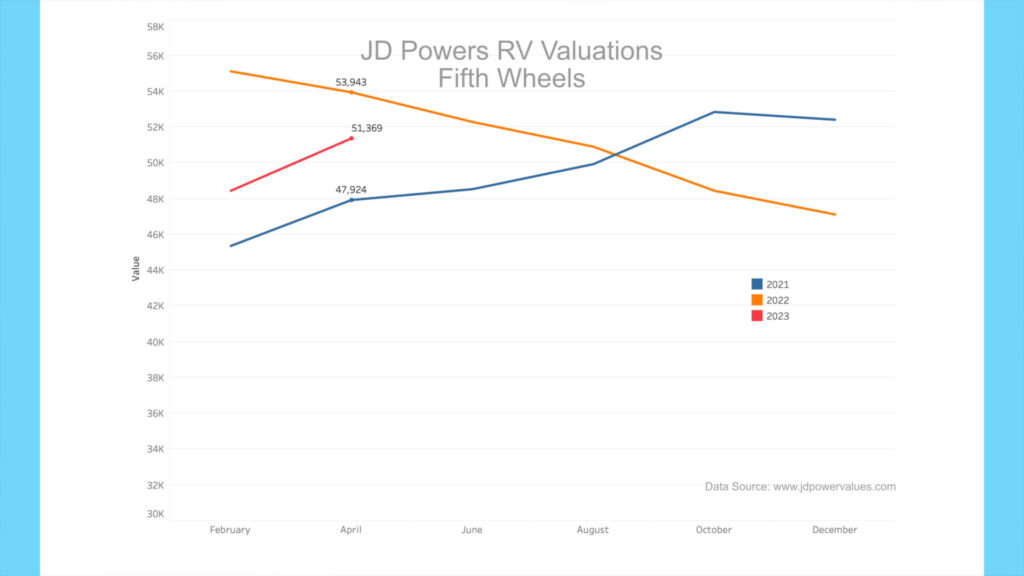

JD Powers RV Valuations

JD Powers is reporting that 1st Quarter 2023 RV valuations have increased versus prior months but are still considerably below this time last year, with “Standard Hitch trailer values averaged 15.6% lower in the first four months of 2023 compared to the same period of 2022” and “Fifth Wheel units averaged 8.5% lower in the first four months of 2022.”[1] It is apparent that RV valuations peaked last year and have fallen consistently in the past 12 months until recently. The upward valuations of late don’t seem to correlate to the current supply, so we’ll see if values continue to rise at this recent pace or fall as the spring selling season rolls on.

Industry Forecast

In early April, several industry executives, including the heads of Thor, Forest River, and Grand Design, met industry leaders to discuss the state of the RV industry. When asked about the recent industry resetting of volumes, Don Clark, President of Grand Design RV, a subsidiary of Winnebago Industries, said, “I think we’re going through a resettling stage where many of you took on products in some cases just because of the volume of people (consumers) who were discovering the RV lifestyle (over the past couple of years)… and even though the economy is slowing, I think we’re getting back to a new norm, whatever that’s going to be.”[2]

Bob Martin, President and CEO of Thor Industries added, “…we really need to help work with the dealers and focus on ’22 model year inventory. We know that’s very important to everybody — and just figure out what that correct leveling state is. But as the economist just pointed out, there’s just a lot of unknowns. So, I think for all of us to remain cautious is a big thing. And just working together, we’ll find the answers. But right now, I don’t think there’s anybody in this room that really knows.” Sherman Goldenberg of RV Business added that “All three OEM execs figure the RV Industry Association’s (RVIA) recent forecast of 324,000 to 344,000 shipments by the end of 2023 — a 32% drop from 2022’s 493,000 wholesale shipments and a rather precipitous decline from 2021’s record 600,000-plus units – as not far off the mark.”

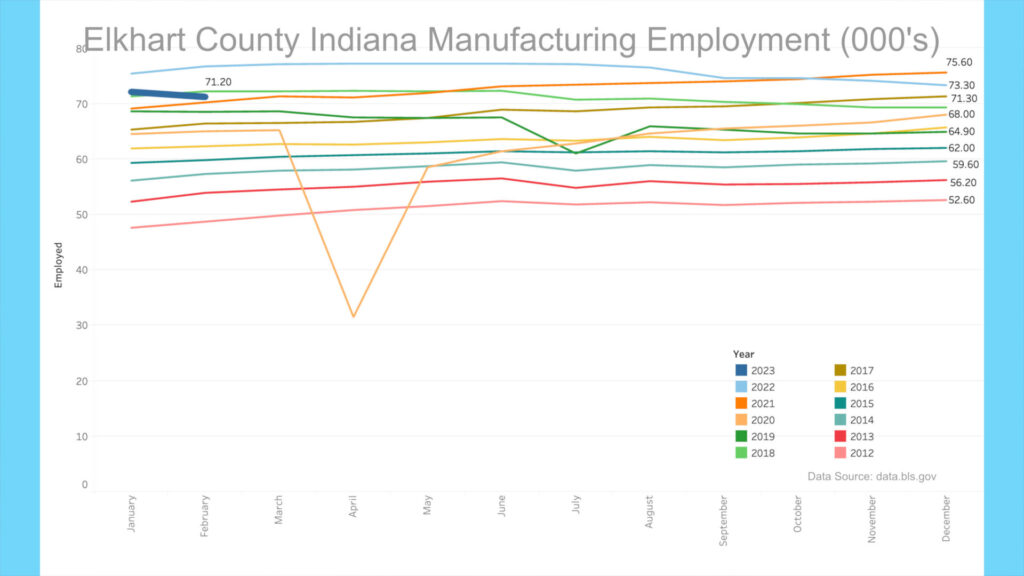

BLS RV Manufacturing Labor Stats

The Bureau of Labor Statistics has revised Elkhart County, Indiana’s latest manufacturing employment data for February 2023. The revision shows that at the height of production last April through June of 2022, there were 77,200 people employed in manufacturing. For February 2023, this number stood at 71,200 people, down 6,100 since the peak. Things can change quickly, and the employment numbers will likely continue down as we move through the year.

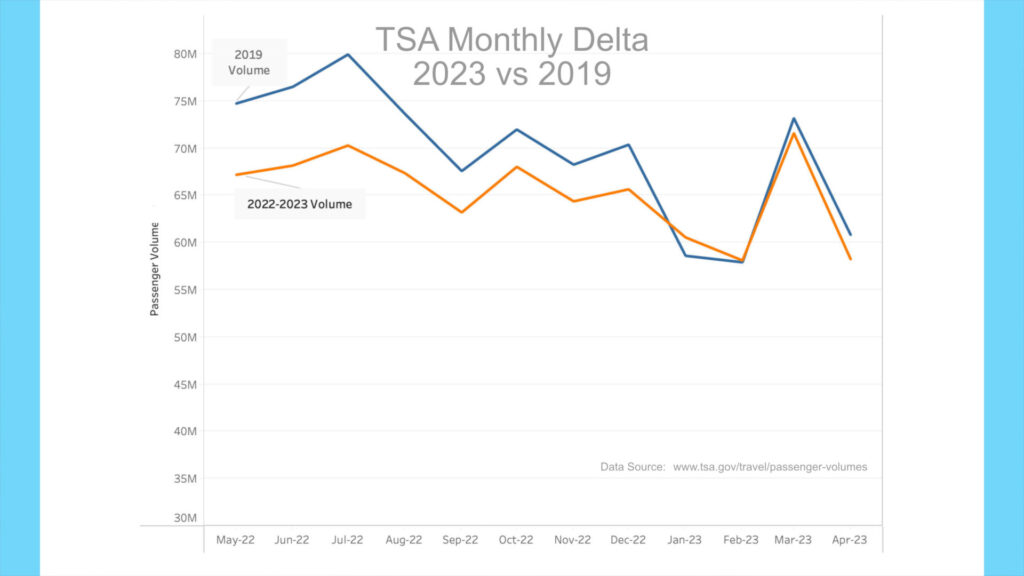

TSA Passenger Volumes

We no longer regularly report on TSA air passenger volumes, yet we continue to track these data regarding general travel trends and how these affect RV travel. Recently, air travel has recovered almost fully to 2019 pre-pandemic levels as more people opt to travel by air again. As you can see from this chart of the past year of monthly air passenger volumes in the U.S., 2022-2023 passenger volumes have caught up with 2019 pre-pandemic levels. January and February 2023 were the first months in years where air passenger volumes exceeded 2019 levels. While March 2023 fell short of 2019, April is falling by more than 4%. This chart is an excellent early recessionary indicator, especially with 2023 data. For now, air travel does not indicate an immediate recession. We’ll see how these data change as the year rolls on.

High-End Market

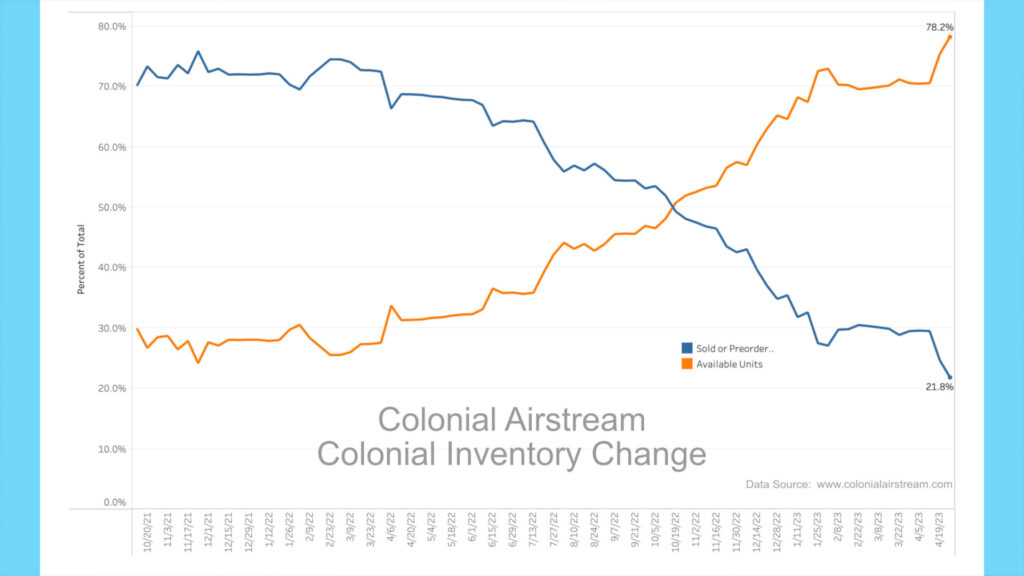

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, one of the nation’s largest Airstream dealers, continue to move towards a buyer’s market with in-stock units remaining high.

About a year ago, roughly 70% of Colonial’s inventory was preordered, meaning only 30 percent of their Airstream inventory was either on the lot for sale or being delivered and available. A year later and the entire mix has inverted. Now, roughly 78% of inventory is available for sale, with only 22% spoken for. Also, total inventory has declined from 328 units to just 188 units, year-over-year. This is a considerable decrease in sellable inventory and a monumental shift in the mix of available units.

Suppliers & Dealers Report Earnings

Several major RV suppliers and dealers who trade publicly reported quarterly earnings in April. Since these companies have to report revenue and earnings publicly, it is easy to see how the industry is doing by looking at these companies.

RVBusiness.com is reporting that Dometic saw its service and aftermarket organic net sales decline by 19% in the first quarter.[3] Patrick Industries, a leading component supplier, saw sales drop by 33% versus the same quarter last year.[4] On the dealer side, LazyDaysRV witnessed a 21% drop in sales compared to the same quarter the previous year.[5] In general, and as expected, suppliers and dealers are feeling the effects of the sales slowdown.

AAA

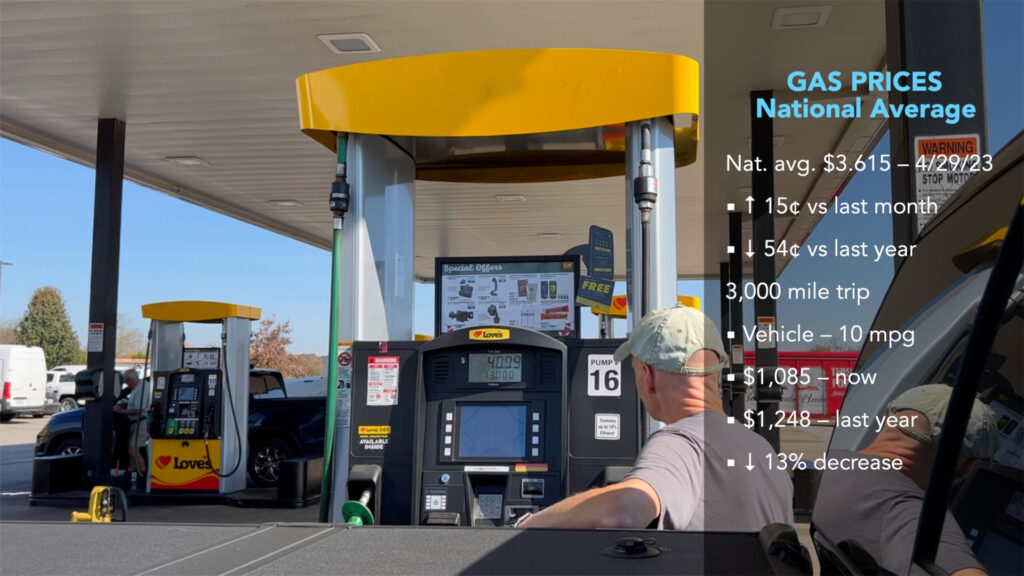

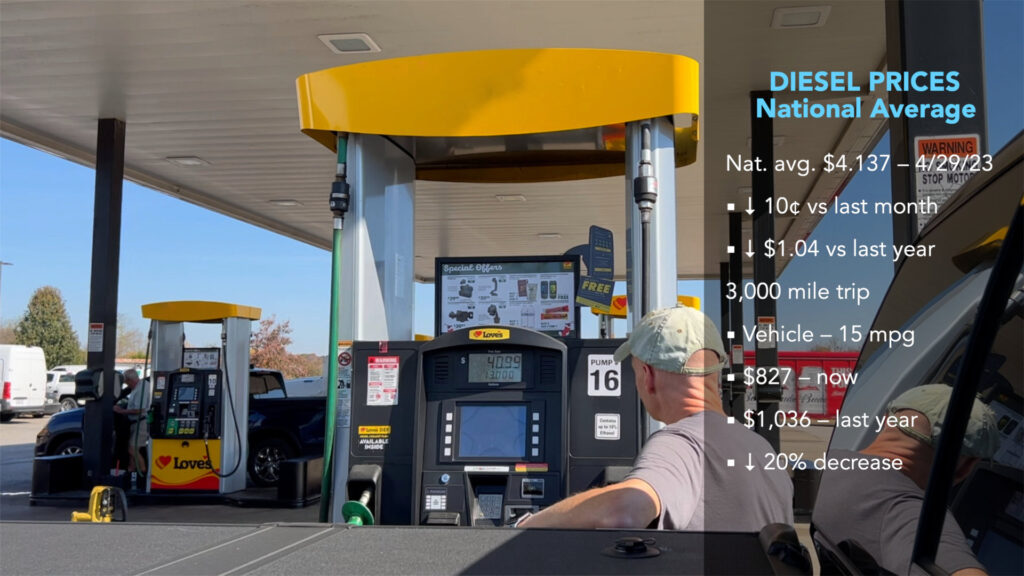

Gas prices have risen considerably in the past month. According to AAA, the current average nationwide price as of April 29th was $3.615 per gallon for regular unleaded, up about $.15 from a month ago and down about $.54 per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $1,085 now vs. $1,248 a year ago, about a 13% decrease YoY. Diesel sits at $4.137 today, down $.10 from a month ago and down about $1.04 from a year ago. A similar 3,000-mile trip getting 15 mpg would cost $827 now vs. $1,036 a year ago, a 20% decrease.

Starlink

I have recently returned from a more extended trip and visited several Florida State Parks where internet bandwidth using cell service is sketchy at best. This is the first longer trip where we had Starlink satellite internet service with us, and overall it was a great success. Let’s take a look at some examples. Colt Creek State Park, 16 miles north of Lakeland, Florida, in the Green Swamp, has almost no cell service. In the past, we’ve had to drive to Zephyrhills, Florida, 15 miles away, just to upload a video. Using Verizon cell service, we had speeds of 2.92 Mbps down and only .10 Mbps up, making it nearly impossible to use. Using Starlink, we had speeds of 48.6 Mbps down and 10.1 Mbps up, making it relatively easy to work and stream video content.

Rainbow Springs State Park, near Dunnellon, Florida, has limited cell service. On Verizon, we had download speeds of 6.12 Mbps and only .05 Mbps up, making it almost useless. Using Starlink, we got 147 Mbps down and 8.48 Mbps up, again making working and streaming easy. It is important to note that while Starlink worked well, it was much faster during working hours versus in the evenings when prime-time usage would be higher.

Overall, I consider Starlink a must-have going forward as it enabled a better overall experience in terms of workability and uploading of videos from the campsites we stayed at. Other remote state parks like Lake Kissimmee in the middle of Central Florida were the same story. Little or no internet bandwidth using cell service, but easy to connect using Starlink. If you need to travel and work remotely, I see this as a game-changer if you have clear access to the sky.

Okay, that should wrap things up.

All the best in your camping endeavors!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and by their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!

-

https://www.jdpowervalues.com/article/2023-q1-rv-market-insight-report ↑

-

https://rvbusiness.com/priority-rv-oem-panelists-agree-with-rvias-2023-forecasts/ ↑

-

https://rvbusiness.com/dometic-q1-2023-report-reveals-improved-cash-flow/ ↑

-

https://rvbusiness.com/patrick-industries-sees-rv-sales-dip-growth-in-marine/ ↑

-

https://rvbusiness.com/lazydays-q1-financials-mirroring-national-sales-trends/ ↑