This blog will cover the latest RV and travel data news. August 2024 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell or hold an RV. Later in the blog, we’ll discuss the deteriorating situation in the RV industry. It’s becoming a huge problem.

RVIA Numbers

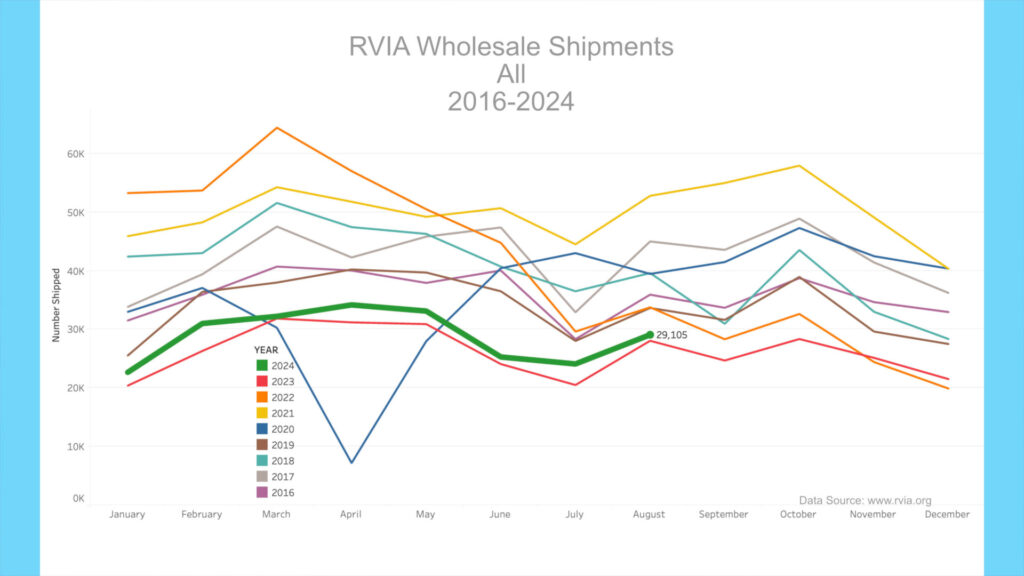

On September 25th, 2024, the RVIA posted the latest RV wholesale shipment data for August 2024. Production increased slightly compared to the prior year, with 29,105 total RVs shipped in August, up 3.7% from August 2023. However, August 2024 was the second lowest production for any August since before 2016, other than last year. Travel trailer production increased year-over-year, with 21,234 shipped in August 2024 vs. 18,703 a year ago (a 13.5% increase). For context, August 2022, two years prior, saw the production of 21,417 travel trailers – 183 more than in August 2024.

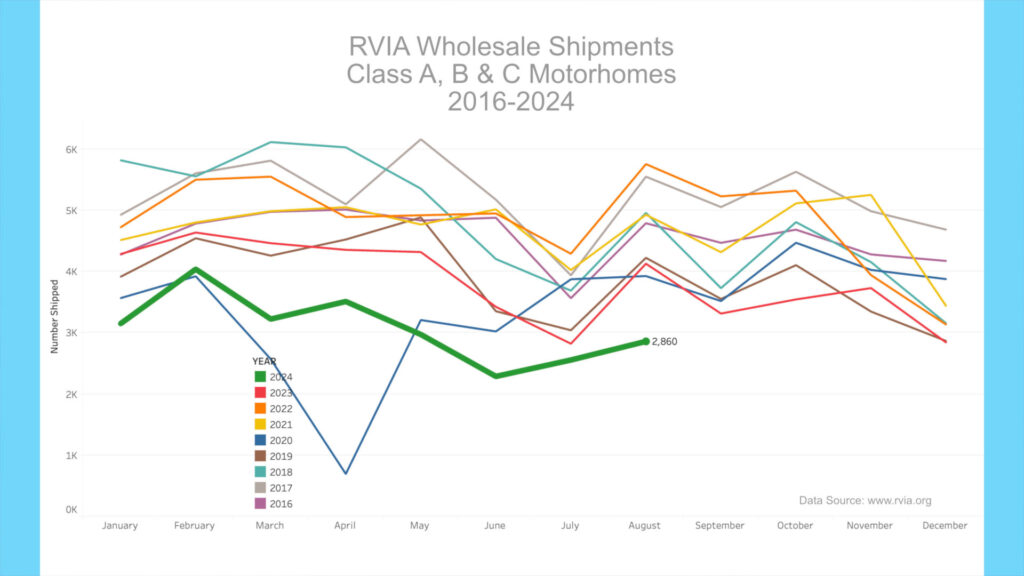

Motorhome production, which includes Class A, B & C motorhomes, witnessed its lowest August since before 2016, with only 2,860 units shipped, up 304 from last month and down 1,270 or 31% from August 2023. As discussed in detail in prior month’s newscasts, motorhome sales are in a free fall, with high-end buyers noticeably absent from the market.

RV Trader Numbers

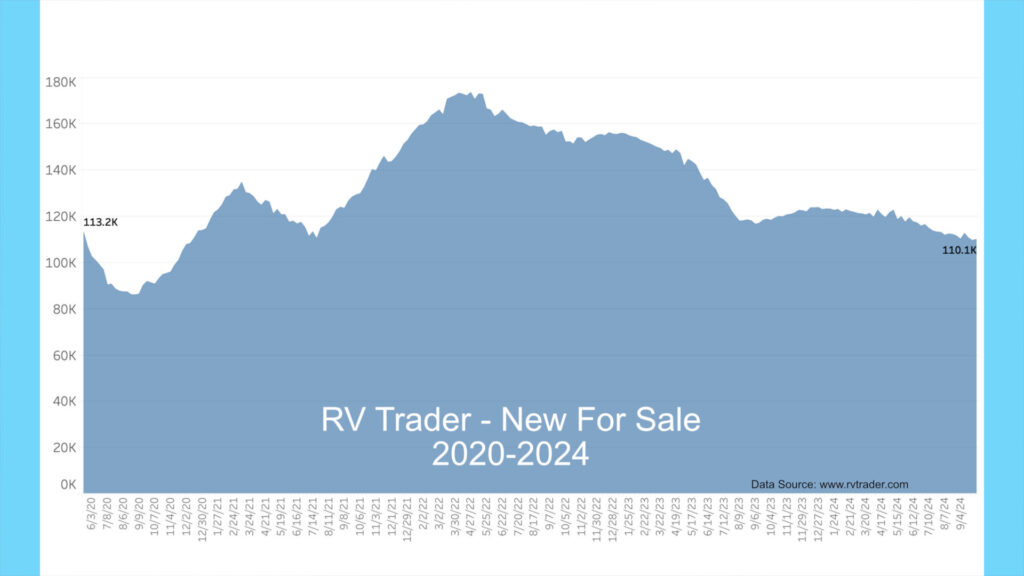

Meanwhile, new RVs for sale on RVTrader.com have dropped since last month, with 110,068 new RVs for sale as of October 2nd. This is down by 1,453 units from the end of August 2024 and down 8,721 or 7.3% compared to a year ago.

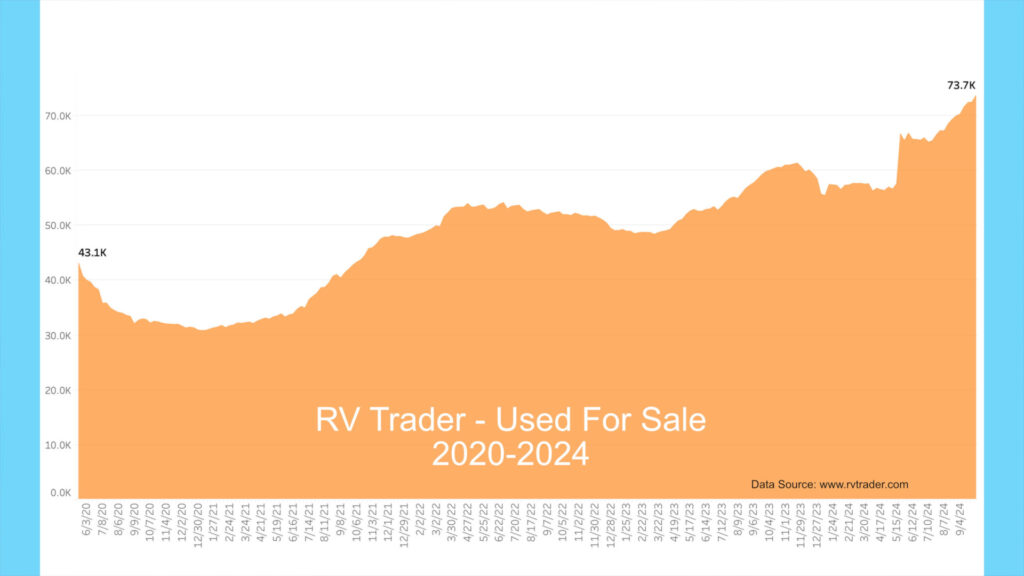

Used units increased to a record 73,670 from 69,962 when last reported at the end of August. This time last year, the number of used RVs for sale was 59,777, so we have 13,893 or 23.2% more used units for sale now than a year ago. Used units for sale have increased rapidly and have stayed historically high for the past several months.

For reference, four years ago, in late September 2020, there were only 32.8k used units for sale during the pandemic. The new norm of over 70k used RVs for sale, more than double four years ago, speaks to a mass inoculation among pandemic buyers who seem to be unloading used RVs in record numbers.

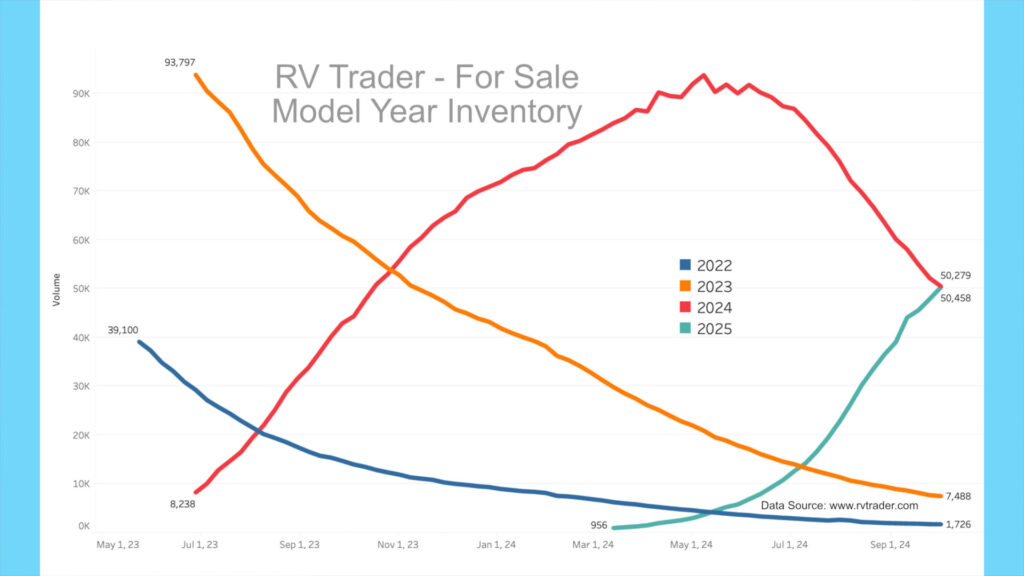

Our model year chart shows new model volumes for 2022 through 2025 since May of last year. As dealers unload the older units, 2022 models, as shown by the blue line, have decreased from 39,100 to 1,726 units. The orange line shows 2023 models going from 93,797 to 7,488 units since late June 2023. Meanwhile, the red line shows 2024 models on RVTrader.com. In late June 2023, there were 8,238 new 2024s, and now there are 50,458, having peaked as 2024 production runs wane. Also, 2025 units, as shown by the teal line, are ramping up. There are currently 50,279 2025 units for sale, increasing by 13,784 since late August.

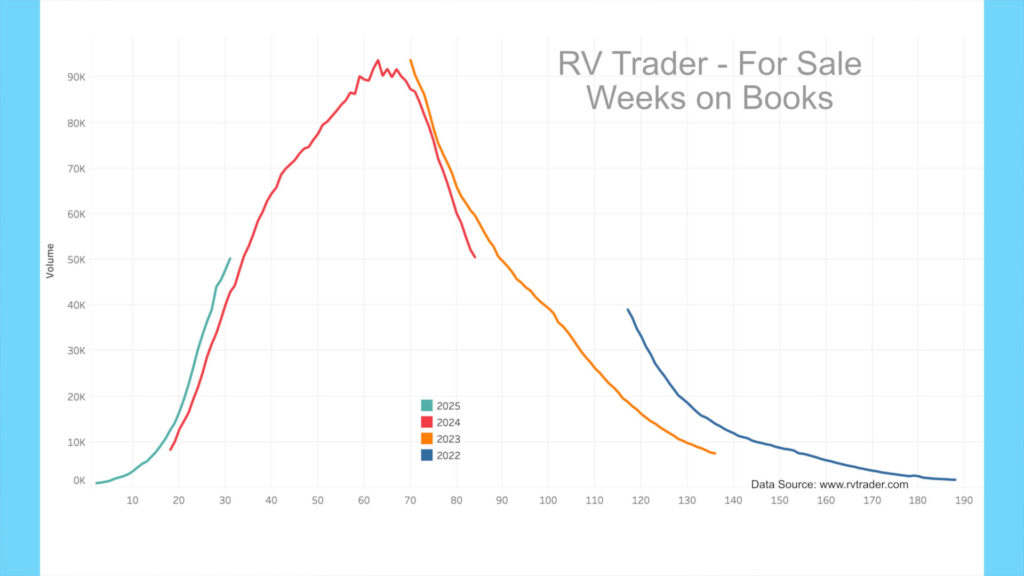

When we look at the model year data by number of weeks on market, surprisingly, we see that 2025’s (teal line) is ramping up quicker than 2024’s (red line) at the same number of weeks on market. Also, the 2024s are falling off faster than the 2023s (orange line). The 2024 model year looks like a historically low production run that ended about four months ago.

As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory. You can follow my account on X at @JohnMarucci to receive weekly updates on this data.

High-End Market – Colonial Airstream

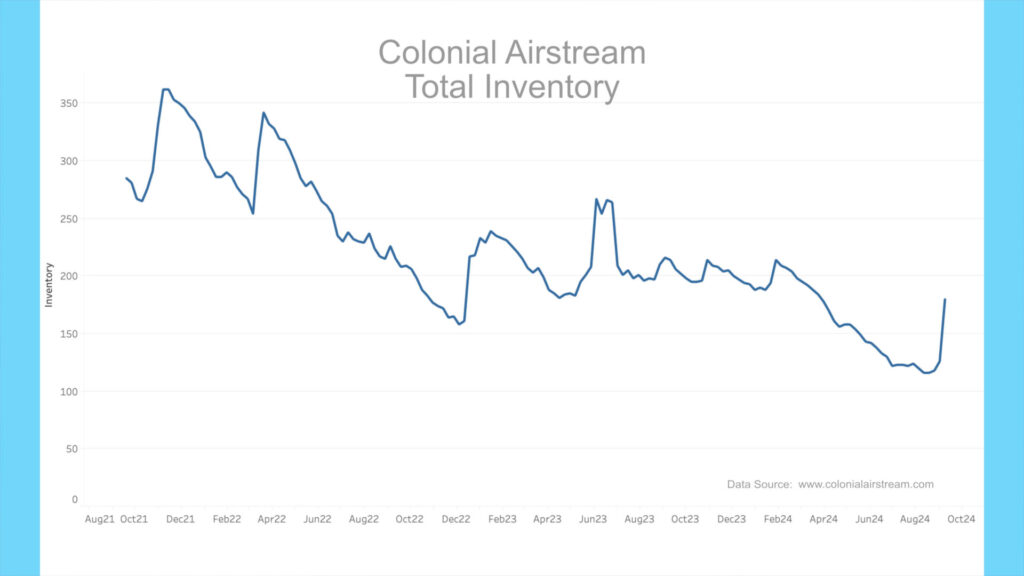

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, the nation’s 2nd largest Airstream dealer, shows a large recent increase in inventory and a glut of in-stock units.

As of October 2nd, Colonial currently has 108 new units on the lot for sale, with 18 spoken for. Their order book has increased sharply to 72 units on order, with seven spoken for. Last month, they only had 23 units in their order book with only one spoken for. It seems that Colonial’s business is recovering and that management has just placed a sizeable order for new Airstreams, an apparent bet that business is about to improve with the recent lowering of interest rates by the Fed. In just one month, Colonial went from having only 11 buyers lined up to having 25.

BLS RV Manufacturing Labor Stats

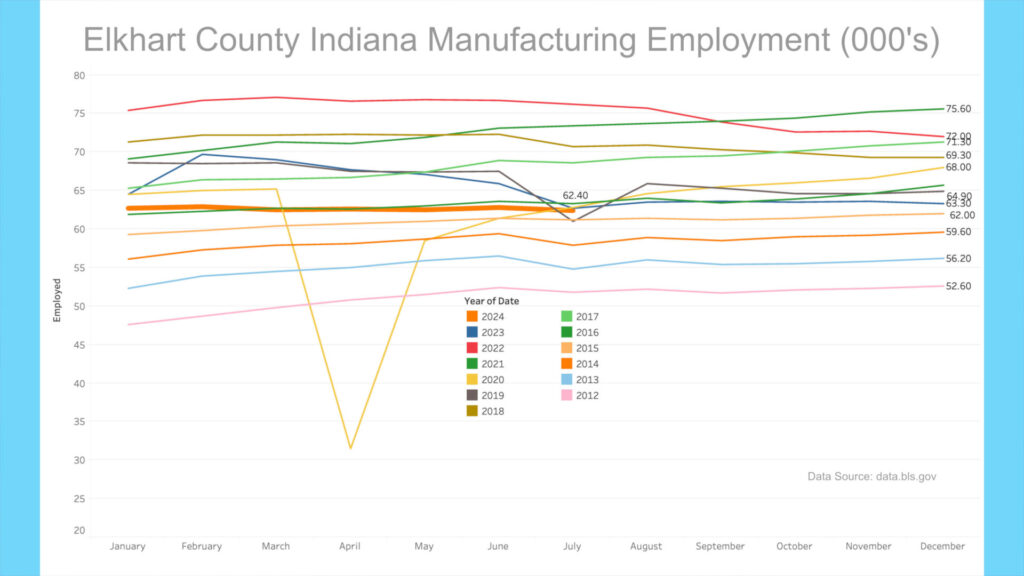

The Bureau of Labor Statistics revised July 2024 manufacturing employment data for Elkhart County, Indiana. The July 2024 manufacturing employment level sits at 62,400, staying reasonably steady since the beginning of the year. The July 2024 number is below June 2016, which was eight years ago. The last eight years of manufacturing employment growth in the Elkhart area have effectively been wiped away and reset to below 2016 levels. The BLS is forecasting manufacturing employment to increase slightly for August of 2024.

AAA

Gas prices have decreased in the past month. According to AAA, the current average nationwide price as of October 2nd was $3.204 per gallon for regular unleaded, down 12.9 cents from a month ago and down 61.1 cents per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $961 now vs. $1,145 a year ago, a 16% decrease. Diesel prices have also decreased in the past month and currently sit at $3.571 per gallon, down 12.8 cents from a month ago and down 98.9 cents from a year ago. A similar 3,000-mile trip getting 12 mpg would cost $893 now vs. $1,140 a year ago, a 21.7% decrease.

My Take on Motorhomes

For the past few monthly newscasts, I’ve discussed at length the problem with the high-end market for RVs and how motorhome sales have dried up. This trend only worsened when looking at the latest shipment numbers. The difficulty with losing sales of higher-priced units is that it takes several lower-priced travel trailers to make as much revenue as one larger motorhome.

Unfortunately, we can trace the current sales collapse for motorhomes to comments we published from RV dealers three years ago, when sales were booming. In our September 2021 RV newscast three years ago, we quoted an article from RVTravel.com where anonymous dealers, on a conference call, spoke their minds about quality issues. Here are a few quotes from that newscast. “Dealers decried significant quality issues with RVs being built out of northern Indiana.”[1] “It’s some of the worst stuff I’ve seen in 30 years,” said one longtime RV dealer. “It’s horrendous inside and out. But we have no recourse but to put it on the lot and try to sell it. You take what you can get, and you move on.” An East Coast dealer said RV manufacturers are “building them as fast as they can, and there just isn’t any quality control. Manufacturers are not doing a good job of taking care of their customers. It’s gone from bad to worse.”

One West Coast dealer echoed those thoughts. “My greatest fear now is watching the motorized RV industry get toppled,” he said. “They just don’t have the expertise to complete a motorhome in Northern Indiana anymore. Their labor force has no eye for quality and they have no way of teaching it. The industry is ripe for someone else to step in and start producing quality products, but it will likely have to be someplace other than Indiana. Right now, if the workers there get upset by something, they just walk off because it’s easy to get a job in Elkhart right now.”

A New England dealer said some manufacturers are only running their plants three to four days a week due to shortages in both parts and labor. “The quality that is coming out is just terrible,” he said. “Their ability to retain employees is bad. You can just tell that the guys on the manufacturing lines have been on the job for just a week. Plants don’t have the proper staffing, and they can’t do the service after the sale.”

Remember, these comments are from three years ago when production was at all-time highs. They have proven incredibly accurate at foretelling what we now see. There was a huge concern with the poor quality being pushed out then, and now there is a great lament about the lack of sales. So, you can see that the current collapse in Motorhome sales has been coming for a long time, as quality issues take some time to impact future sales. Yet, when listening to industry insiders today, one would think that the only problem is with interest rates and affordability. No one in the industry seems to see that with the massive overproduction of 2021 and part of 2022, and the resulting lack of quality, a great inoculation was set in motion for future sales and upgrades.

Dometic & Thor Financial Results

In light of this, it is no surprise that two of the largest players in the industry, Thor and Dometic, recently released statements curtailing expectations about a quick recovery. Thor is the largest RV manufacturer in North America, and Dometic is a huge player in supplying the components that go into RVs.

On September 18th, Dometic’s CEO Juan Vargues reported that given “…the current macroeconomic situation, market conditions, and customer purchasing patterns have a negative impact on the business in all sales channels, which is expected to remain throughout the year.” Dometic said third-quarter organic net sales are expected to be 15% lower than third-quarter 2023 net sales. “Demand visibility has turned shorter than normal and the situation has worsened during the third quarter as customers are cautious building inventories as the low season approaches,” Vargues said.[2]

Meanwhile, Thor is reporting fiscal fourth-quarter and full-year financial results, posting a $265.3 million profit in fiscal 2024, a 29% decrease from fiscal 2023 profits. They mention that dealers continued to lower inventories in the fiscal fourth quarter, and they “…believed dealers’ inventory levels were at or slightly higher than their comfort level in the current market.” Thor’s comments continued, “As we look ahead to fiscal year 2025, we believe dealers will remain hesitant to hold any excess inventory until a sustained positive inflection in retail demand takes hold,” Thor said. “We also expect product mix will continue to favor lower cost and lower margin units.”[3]

The last sentence is especially troubling for higher-end RV sales. In essence, the major manufacturer of RVs in North America is admitting that sales will primarily shift to lower-cost units. Translation: cheaper units will be what sells, so we need to drive costs out of the average RV to make money. I’m unsure how a company does this without lowering materials costs or average labor costs. It seems like a reinforcement of a recipe for poor quality that caused the issue in the first place. It reminds me of General Motors’s mistake in the 1980s, making cheaper and less reliable cars. It opened the door for competitors and inoculated many people from their brand. In this case, we are seeing an inoculation from the RV lifestyle.

As mentioned many times in recent newscasts, my recommendation is that you hold on to what you have, maintain it well, and use it often. If you want to purchase, consider a well-maintained used unit where the prior owner can show the effort they have put into caring for the unit. Have it independently inspected and then enjoy it thoroughly.

That should do it. All the best in your camping adventures!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!