This blog will cover the latest RV and travel data news. September 2024 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell or hold an RV. Later in the news, we’ll discuss the latest reporting from some of the larger players in the RV industry and how it affects RV owners.

RVIA Numbers

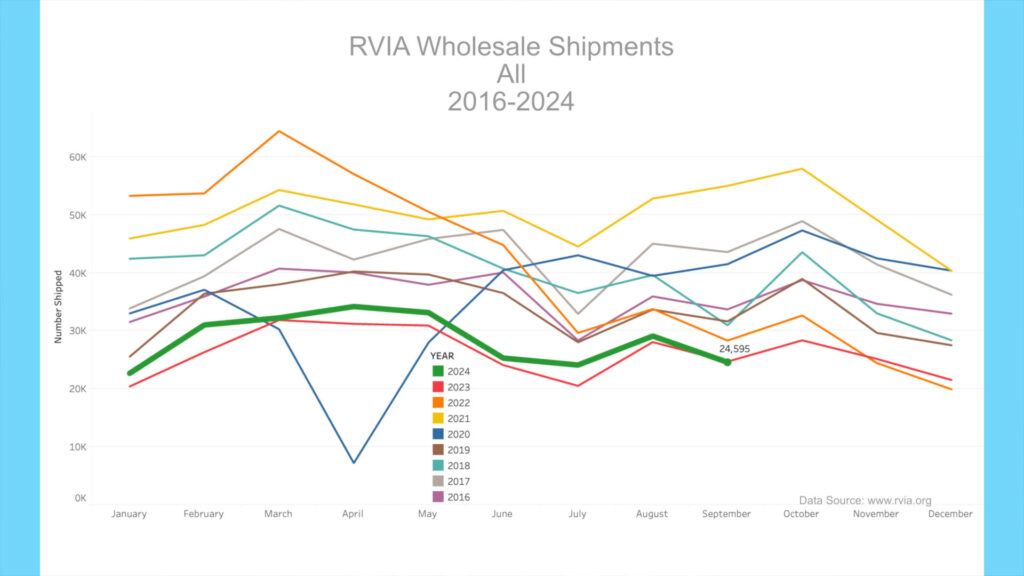

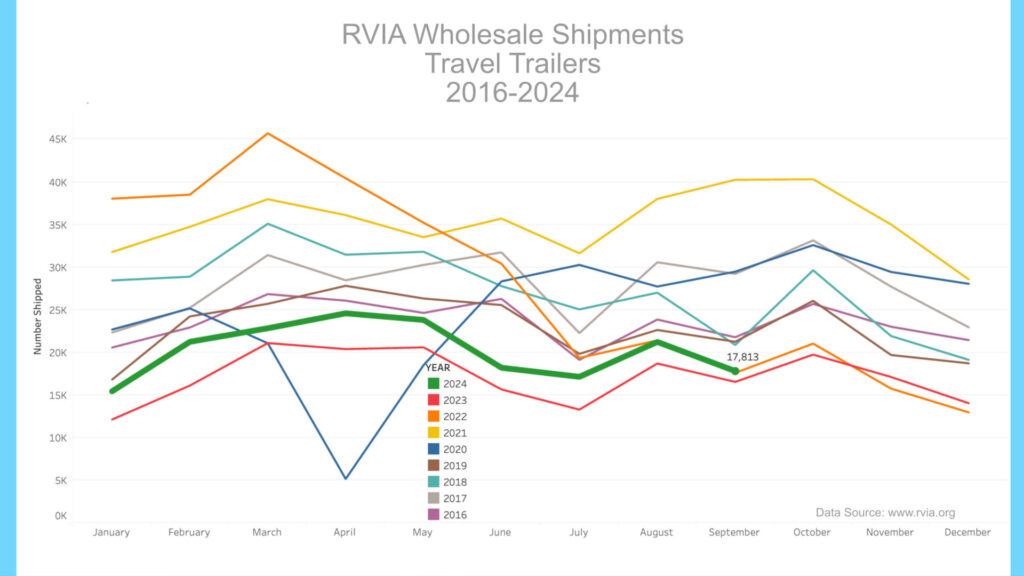

On October 24th, 2024, the RVIA posted the latest RV wholesale shipment data for September 2024. Production decreased slightly compared to the prior year, with 24,595 total RVs shipped in September, down .43% from September 2023. September 2024 was the lowest production for any September since before 2016. Travel trailer production increased year-over-year, with 17,813 shipped in September 2024 vs. 16,542 a year ago (a 7.7% increase).

Motorhome production, which includes Class A, B & C motorhomes, witnessed its lowest September since before 2016, with only 2,316 units shipped, down 999 or 30.1% from September 2023. As discussed in detail in prior month’s newscasts, motorhome sales continue a free fall, with high-end buyers noticeably absent from the market.

RV Trader Numbers

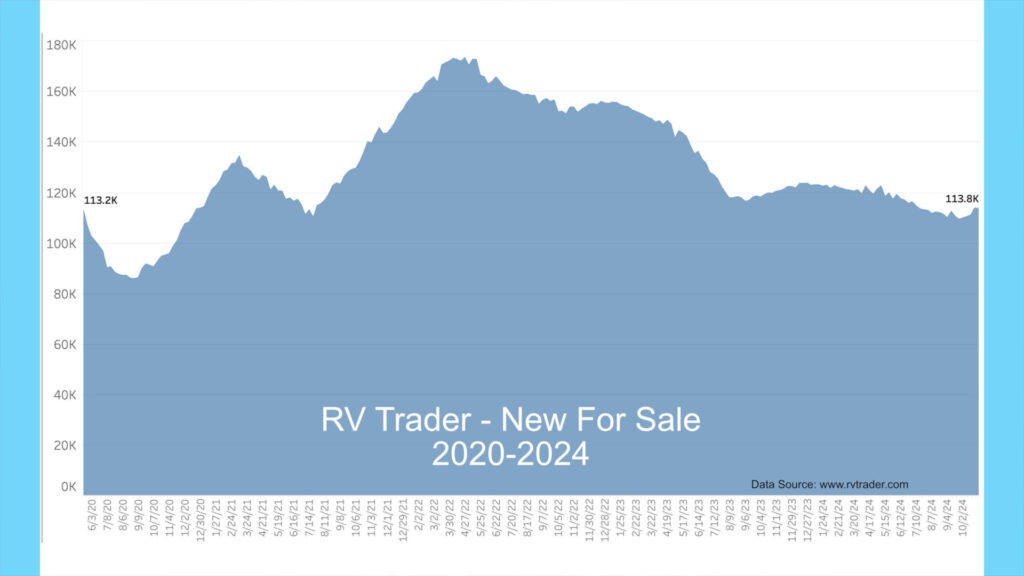

Meanwhile, RVs for sale on RVTrader.com have increased since last month, with 113,818 new RVs for sale as of October 30th. This is up by 3,750 units from early October 2024 and down 6,840 or 5.7% compared to a year ago.

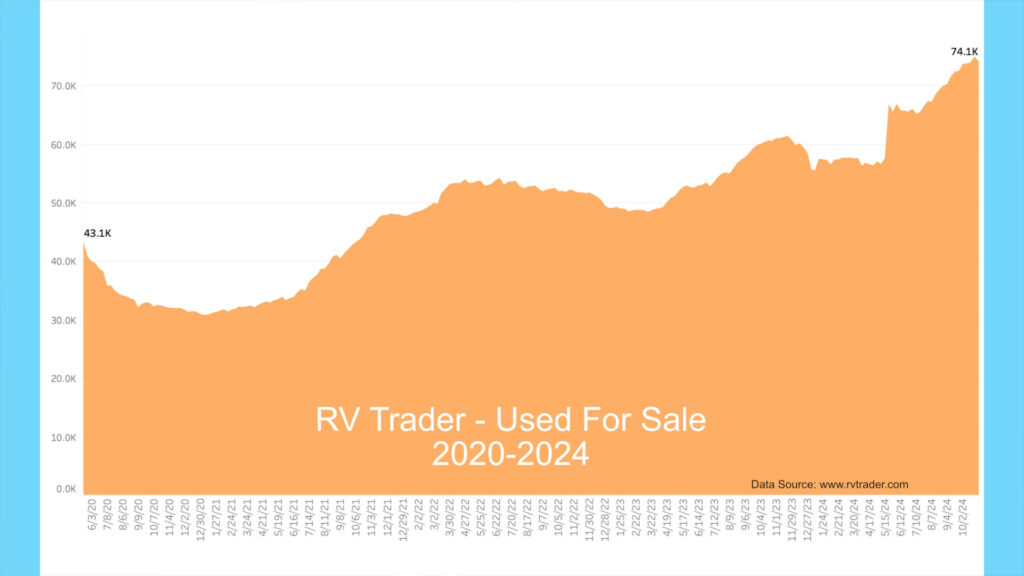

Used units increased again, breaking the 74k level at 74,131, up from 73,670 when last reported in early October. This time last year, the number of used RVs for sale was right at 61k, so we have 13k more used units for sale now than a year ago. One of the biggest stories this year, besides how the high-end market has collapsed, is the significant increase in the number of used RVs for sale.

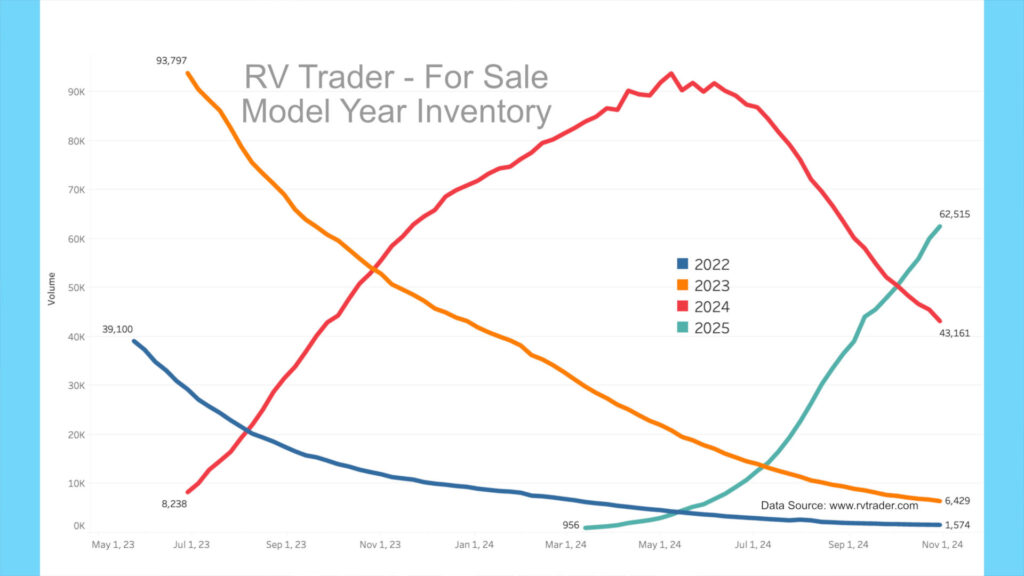

Our model year chart shows new model volumes for 2022 through 2025 since May of last year. As dealers unload the older units, 2022 models, as shown by the blue line, have decreased from 39,100 to 1,574 units. The orange line shows 2023 models going from 93,797 to 6,429 units since late June 2023. Meanwhile, the red line shows 2024 models on RVTrader.com. In late June 2023, there were 8,238 new 2024s, and now there are 43,161, having peaked as 2024 production runs wane. Also, 2025 units, as shown by the teal line, are ramping up. There are currently 62,515 2025 units for sale, increasing by 12,236 since early October.

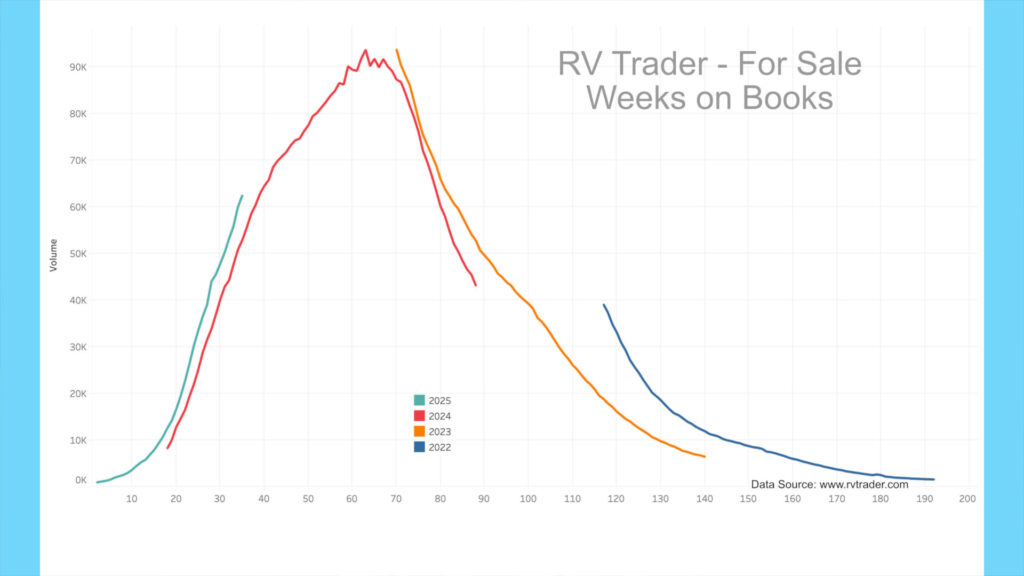

When we look at the model year data by number of weeks on market, surprisingly, we see that 2025’s (teal line) is ramping up quicker than 2024’s (red line) at the same number of weeks on market. Also, the 2024s are falling off faster than the 2023s (orange line). The 2024 model year looks like a historically low production run that ended about four months ago.

As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory. You can follow my account on X at @JohnMarucci to receive weekly updates on this data.

High-End Market – Colonial Airstream

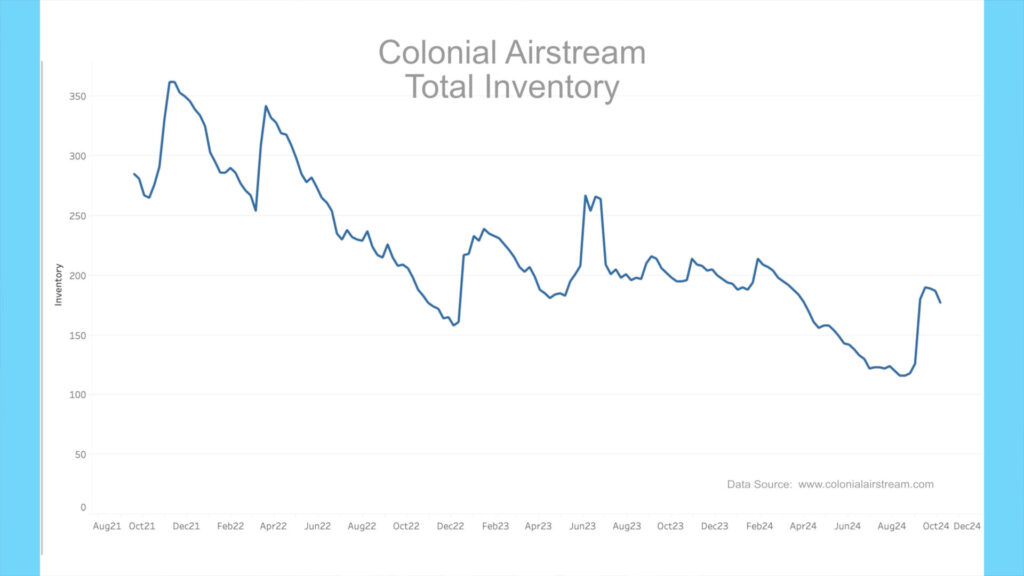

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, the nation’s 2nd largest Airstream dealer, show a large recent increase in inventory and a glut of in-stock units.

As of October 30th, Colonial currently has 108 new units on the lot for sale, with nine spoken for. Their order book has increased sharply recently, with 69 units on order and nine spoken for. In late September, they only had 29 units in their order book with only seven spoken for. It seems that Colonial’s business is slowly recovering. This chart shows Colonial’s inventory over time. This lends insight into the ordering of this large, high-end RV dealer.

BLS RV Manufacturing Labor Stats

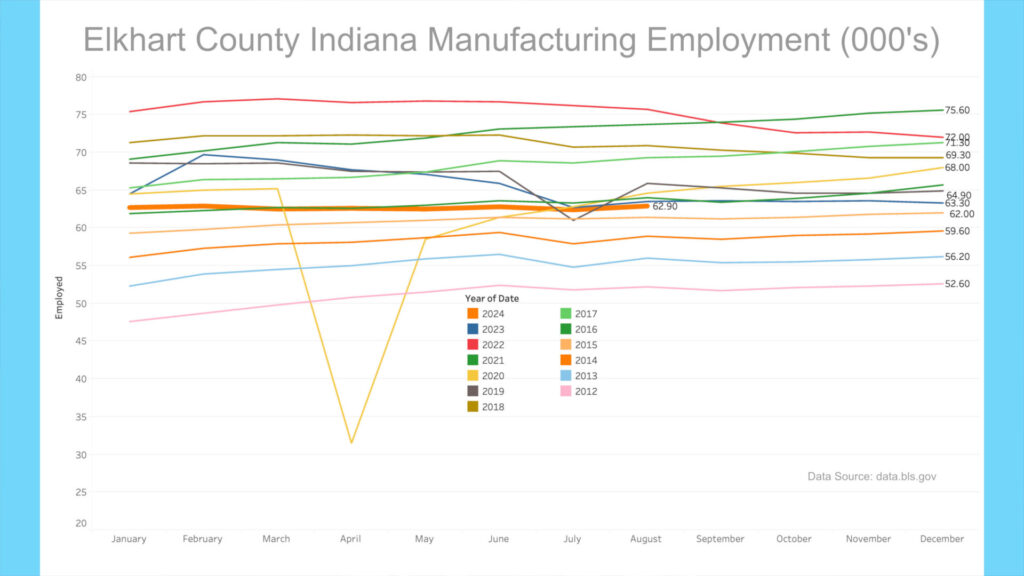

The Bureau of Labor Statistics revised August 2024 manufacturing employment data for Elkhart County, Indiana. The August 2024 manufacturing employment level sat at 62,900, staying reasonably steady since the beginning of the year. The August 2024 number is below June 2016, which was eight years ago. The last eight years of manufacturing employment growth in the Elkhart area have effectively been wiped away. The BLS is forecasting manufacturing employment to decrease sharply for September of 2024.

AAA

Gas prices have decreased in the past month. According to AAA, the current average nationwide price as of November 2nd was $3.11 per gallon for regular unleaded, down 8.6 cents from a month ago and down 33.8 cents per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $933 now vs. $1,034 a year ago, a 9.8% decrease. Diesel prices have also decreased in the past month and currently sit at $3.563 per gallon, down about a penny from a month ago and down about 88 cents from a year ago. A similar 3,000-mile trip getting 12 mpg would cost $891 now vs. $1,110 a year ago, a 19.7% decrease.

The Latest Bad News:

Camping World

Camping World reported 3rd Quarter earnings on October 29th. They are the largest RV dealer, which is why we are taking a quick look.

Revenue increased on the sale of new RVs by $145.7 million or 21.5%. This was counterbalanced by a decrease of $143.0 million on the sale of used RVs. Units sold in aggregate were up slightly, but the average price was down for both new and used RVs. New unit average selling price was down 7.4%, and 7.7% for used RVs.2

Let me elaborate for a moment. What this shows is that while Camping World is selling slightly more units, they have done so by discounting both new and used prices. This is good for the few of us who might be considering a new RV; however, this isn’t good news for most of us who own an RV. Generally, the price of used RVs is a function of the discounted price of new RVs. So, if a large dealer is discounting new and consequently used RV prices, we, who might want to sell our current RVs, are now competing with dealers who have lowered prices.

In reality, it means lower prices for every used RV and a loss of value in what you currently own, and this is not because of anything you have done. This is why I have been so adamant and outspoken about how the industry failed customers by yielding to pressure to overproduce during the pandemic. By doing so, the customer initially lost with poor quality and lost again with lower residual values.

Winnebago

Meanwhile, after recently reporting disappointing results, Winnebago CEO Mike Happe said that retail sales are “sluggish” compared with last year.

Happe said, “The focus on affordability and price points that consumers are open to engaging with our high volume, lower cost competitors innately probably have more of an advantage and an appetite to compete aggressively in those price points.”[1] Hmm, okay, let’s unwind Happe’s word salad.

- Customers are focused on cheaper RVs.

- So, they are engaging more with competing brands who make cheaper RVs.

- These cheaper brands have an advantage over us and are taking lots of sales from us.

Happe also said the market is flooded with elevated discounts and allowances across towable and motorized segments. Also, two towable plants were consolidated into one due to the challenges they are having selling towables (given that cheaper trailers are sold from other brands). Still, according to CFO Bryan Hughes, Winnebago was inefficient while making this change to only one manufacturing plant.

The last part of that sentence seems like coverage for some issue they had downsizing to one towable plant.

Hughes continued, saying that several of their towable RV lines levels of inventory were managed poorly, leading to write-downs, write-offs, and increased sales incentives to move the inventory to consumers. The company also experienced high warranty expenses because of quality issues with the towable RVs.

In summary, if you’ve shopped Winnebago products, you know their travel trailers are a bit nicer and more expensive than the average trailer. This is hurting the company in real ways, as people buying trailers are buying cheaper units from other brands. They are stuck with inventory they have to discount and have, unfortunately, run into quality issues that are causing an increase in warranty expenses.

So, what we are witnessing, is that pretty much all more expensive units, whether motorhomes or more expensive trailers, are seeing a real decline in demand. Only cheaper units seem to be attracting buyers.

My Take

Every month, it seems like more bad news is coming out of the RV industry. We are certainly on the back side of an asset overproduction bubble, and most of us holding RVs are being burnt because of this. To understand more about the financial impacts of RV ownership, we put out a great video this past September that gets into the details of this. In my opinion, it isn’t a good time to sell or buy an RV, so we continue to hold and maintain what we have, even though industry missteps are negatively impacting residual values.

That should do it. All the best in your camping adventures!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!