In this blog, we’ll be going over recent RV news and the very latest travel trends. One of the goals of John Marucci – On The Road is to give you tools to make better RV travel and purchase decisions. There is a lot to cover, so let’s get to it.

First up, traditional forms of travel have recovered significantly in recent months.

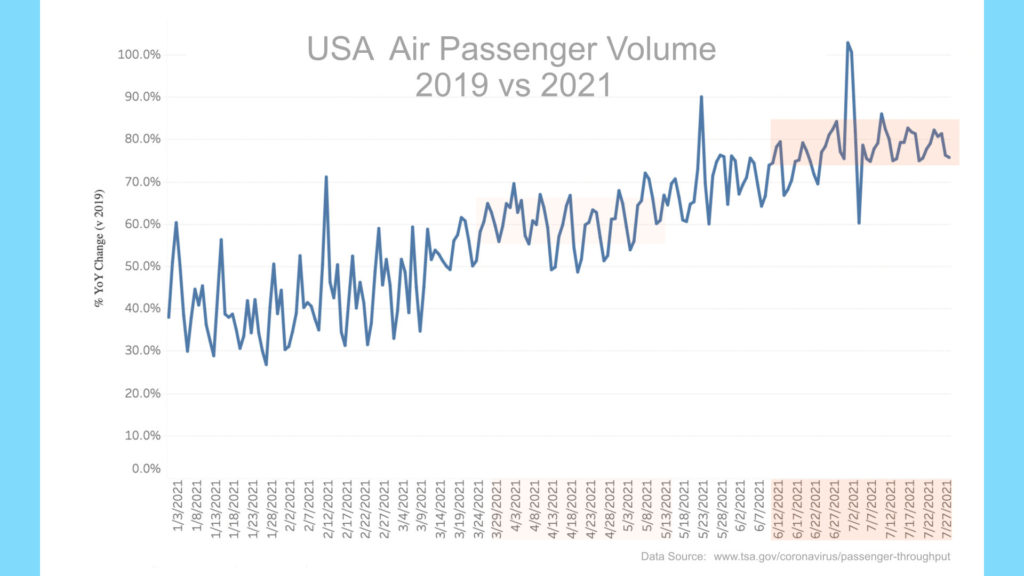

TSA checkpoint numbers are showing air travel has recovered consistently to about 80% of 2019 levels. We’re not looking at 2020 numbers, since 2020 was such an anomaly given the pandemic. Over the four-week period of July 1-28, 2019, vs 2021, 71.5M people traveled by air in 2019 vs 56.9M in 2021. Just a hair shy of 80% of 2019 volume. This is up significantly since mid-spring, where the percentage was sitting at about 60%. Although air travel has recovered to this 80% rate, it hasn’t moved much during July with growth stalling in recent weeks. One area where air travel has not recovered well is international travel, as many countries are still restricting incoming traffic.[1]

Some have speculated, including myself in the past, that the boom in RV sales is in some way linked to people substituting RV travel for air travel. While this could be an input, it is looking more like a minor input given vaccination rates increasing and air travel volumes recovering. At this point, I do not think there is much of a substitutionary effect going on between air travel and RVing. This leaves the question open as to why the continued boom in RV sales if domestic air travel has recovered to these latest levels.

One thing to consider is the risk-aversion aspect to the question. This is worth considering given the difficulty many people encountered in 2020 not being able to travel using traditional means. RVing in 2020 was one of the few ways people could still travel safely and social distance. It is quite possible that many people have decided to keep RVs as an option, at least for a while. If this hypothesis is correct, then the great “dumping of used RVs” on the market this year that some have predicted, will likely not occur.

Another thing to consider is the shortage of parts, supplies and components the RV industry has been experiencing lately. These supply shortages have caused delays in retail RV deliveries and have caused prices to increase for both new and subsequently for used RVs. If you know you may have to wait six months to a year to get a new RV, many people may just hold on to their used late model vs going through the waiting game and potential delays.

My take is that the perception of prices increasing can also cause more shortages to some degree. If for example, you are planning to sell your home and you think the price of your house is going to continue to rise, you may delay trying to sell your house until you believed the high point in the market has been reached. I think some of this is occurring in the used RV market as prices have shot up.

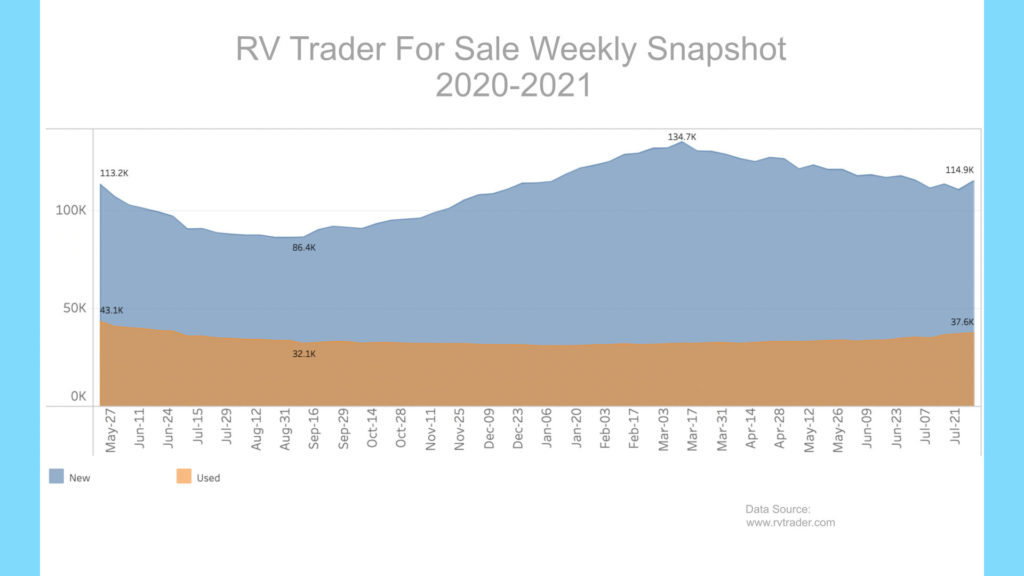

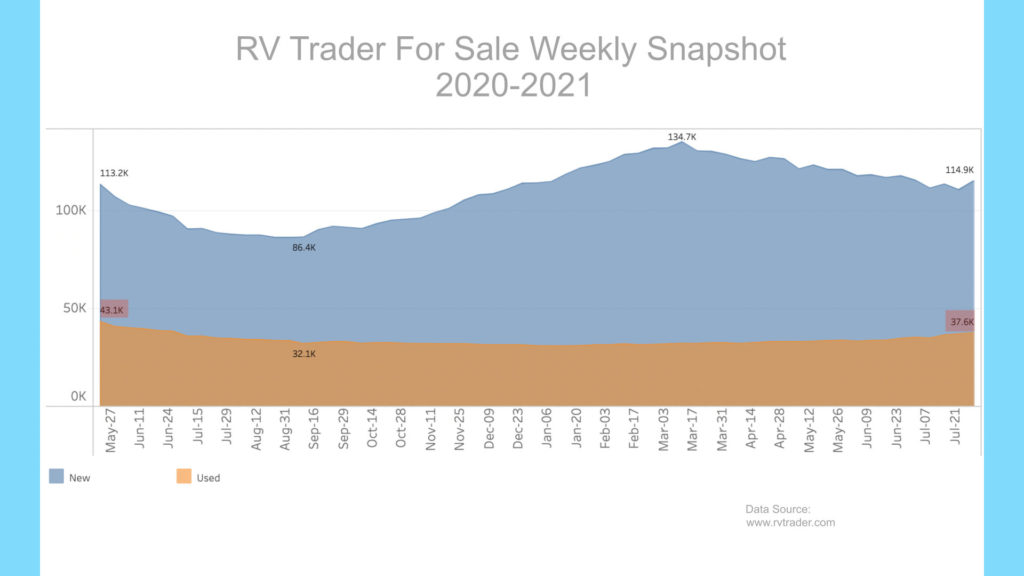

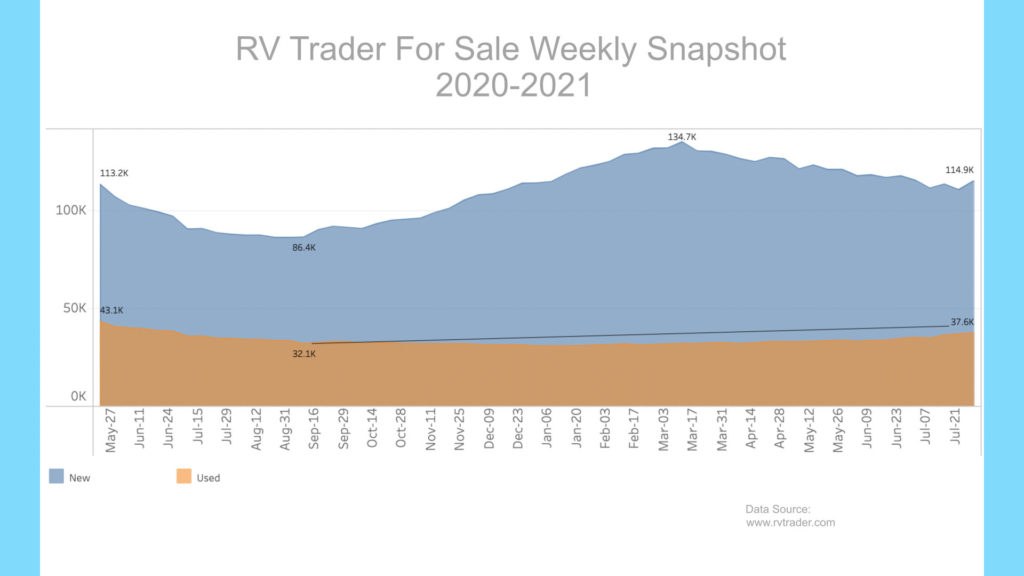

New and used RVs for sale on RV Trader have stayed strong this year with slightly more units for sale than this time last year. RVs for sale are at about the same levels as at the beginning of the pandemic, with used RVs beginning to recover very slowly. However, and this is a big however, new units advertised for sale include dealer inventory that are being built or are in transit. Generally, new inventories are scarce on dealer lots, and many people are having to order new RVs for a future delivery date. This is evident by the lack of dealer stock, delays in deliveries due to component shortages, and the huge backlog of orders at the major manufacturers. Thor Industries, the largest RV manufacturer, mentioned in a recent press release that they have over $14B in back orders that will be produced well into 2022.[2]

If we focus on used RVs, notice that the current number of used RVs for sale is close to 6,000 units or roughly 13% below where it was in May 2020. Used RVs for sale have very slowly trended back up from the low levels of last fall, but it is a slow increase of which the reasons for the rebound are inconclusive. Higher prices may be drawing people to sell used RVs; however, this conclusion can’t be substantiated. It is possible that existing RV owners are finally upgrading and beginning to take delivery of ordered new RVs and selling existing units. There are also likely some sellers who tried RVing and simply didn’t like it. Generally, however, we can’t definitively say that any one cause is bringing slightly more used RV units to market.

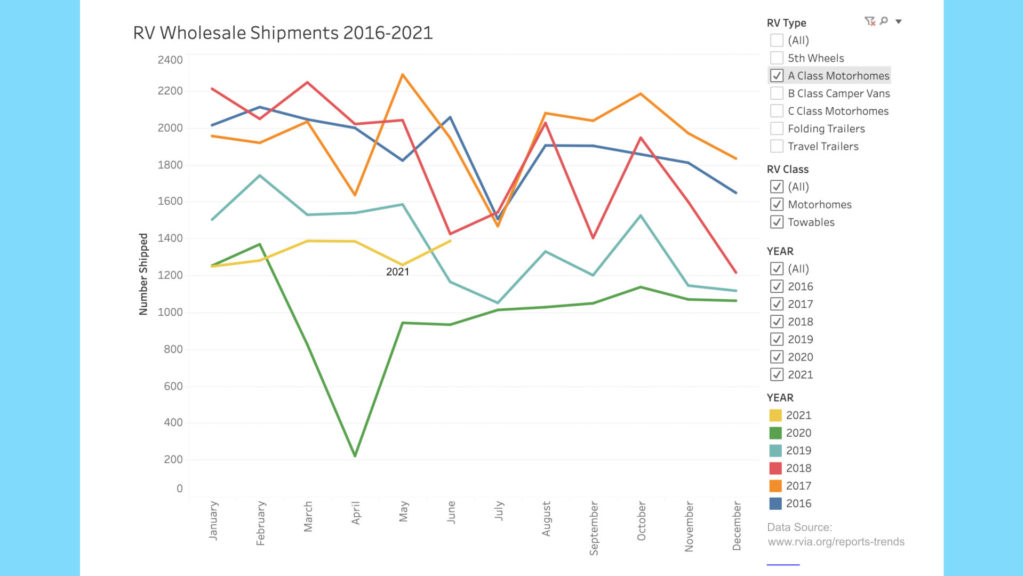

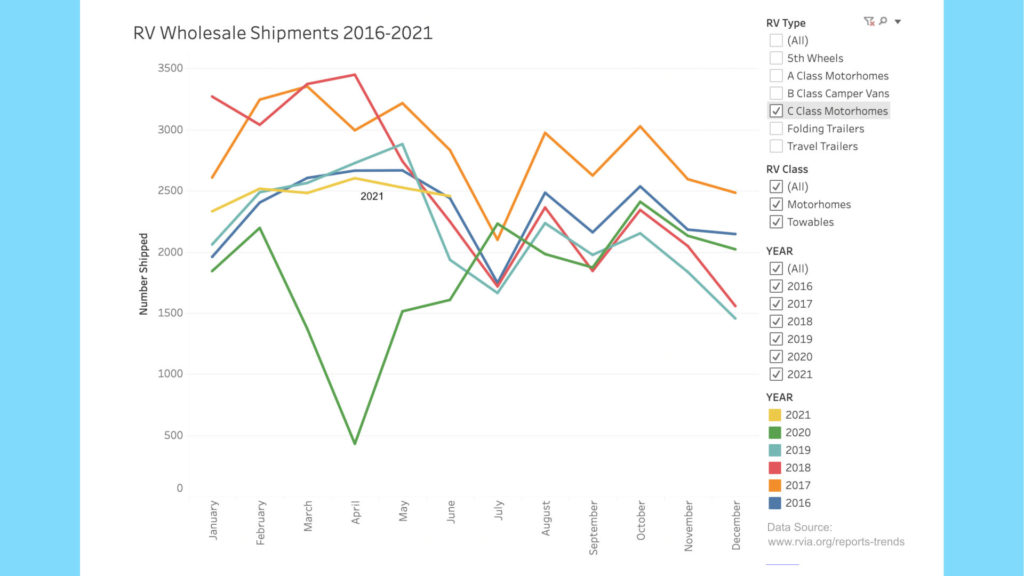

Something new we are introducing on johnmarucci.com for those of you who enjoy digging into the data, is that we have gone back and gleaned the past five years of RV shipment data by RV type from RVIA.org. We’ve created a data visualization that you can manipulate. These visualizations are on the Travel Data Visualization page in the Resources area of the site. Let’s take a closer look at this RV shipment data visualization.

While it is true that RV shipments have increased to the highest level in the past 5 years,

Motorhomes, which Include Class A, B & C RVs, are generally lower vs the record year of 2017. Towable RVs, which include travel trailers, 5th Wheels, and folding trailers account for the lion’s share of the increase in RV shipments.

One exception is Class B camper van sales which have skyrocketed vs prior years. This sheds some light on a portion of the market that has more money to spend, given the average price of a new Class B camper van is significantly higher than the average towable RV. While we can’t draw too sharp a conclusion, it seems apparent that many customers with significant resources have opted for a mobile travel lifestyle by choosing higher-end camper vans since the pandemic started.

It is important to understand, however, that all RV sales are not doing well. Larger Class A motorhomes haven’t excelled at all during the pandemic. Through May 2021, Class A’s were having their worst year of the prior 5 years except for 2020. There has been a slight rebound in June of 2021, but it appears marginal.

Class C motorhomes are also not selling exceptionally well. Like Class A’s, the Class C motorhomes have lagged vs prior years through May with a slight rebound in June. So be aware of the news reports that speak of record-breaking RV sales. The boom is not affecting all types of RVs. Yet, we need to be careful in that some manufactures may be intentionally shifting production away from the Class A & C models as they see the current trends, thus magnifying the lower shipments.

Where we are seeing huge demand, besides for Class B camper vans, is for tradition towable travel trailers and to some extent 5th wheel travel trailers. Since these two types of RVs make up such a large portion of shipments, they are having a larger relative impact on overall shipment numbers. 5th Wheels have trended better than other years except for June, while travel trailers are outpacing prior years every month and are on pace to break even 2017 record numbers.

My take is that there is a large demand for both entry-level, less expensive RVs like towable travel trailers and for very high-end expensive Class B camper vans. Other RV types are simply not doing all that well vs prior years. This would make sense as an indicator of RVs making inroads to large numbers of new buyers on both ends of the financial spectrum. It is important to understand that larger 5th wheel travel trailers and Class A & C motorhomes are often a second or third RV purchase for RVers. These RVs carry significant expense and decisions to buy them are often made after RVers have grown to understand from experience their own travel style and preferences.

So where is all this going? Likely the trend of record RV shipments for both travel trailers and higher end camper vans will continue for a while until the pandemic truly fades from both the news and from impacting people’s lives directly.

I don’t see gas prices affecting RV shipments in the near term, as most RV buyers are fairly gas-price insensitive – at least to a point. Yet even RVers will become price sensitive at some point. If gas goes to $5 per gallon, for example, it may begin to challenge current demand trends. Something more likely to influence RV shipments is if the economy sputters into a stagnant period. These risks may not materialize at all in the near term, and RVs may continue to ship at record levels. We shall see.

Hopefully this short news and analysis has shed some light on what is currently going on in the RV market and with travel trends in general.

All the best in your camping endeavors!

We’d love for you to join the On The Road Team by subscribing to the YouTube channel. If you want to dive deeper, we put more content and photos on Instagram and Twitter @JohnMarucci. You can also follow John on Facebook @JohnMarucciOnTheRoad.

As always, thanks to our teammates who support the channel by watching the YouTube Ads and by starting their shopping from the On The Road Amazon Storefront at: amazon.com/shop/johnmarucci. Your support is greatly appreciated!

Watch the more than 100 videos from John Marucci – On The Road!

- https://thepointsguy.com/news/business-travel-return-airlines/ ↑

- https://ir.thorindustries.com/investor-resources/press-releases/press-release-details/2021/THOR-Industries-Revenues-Up-105.7-Gross-Profit-Margin-Improved-By-240-Basis-Points-And-Earnings-Per-Share-Up-665.1-For-The-Third-Quarter-Of-Fiscal-2021/default.aspx ↑