This blog will cover the latest RV and travel data news. July 2023 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell or hold an RV. We’ll also look at how industry leaders see things going forward and a big change for Oliver Travel Trailers.

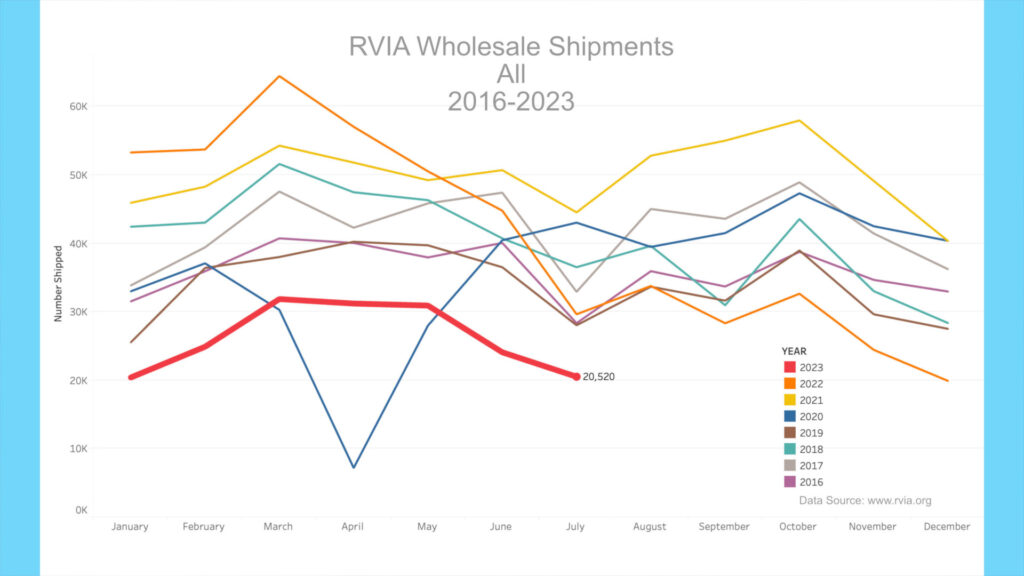

RVIA Numbers

On August 25th, 2023, the RVIA posted the latest RV wholesale shipment data for July 2023. Production continued a downward trend compared to the prior month and is significantly down year-over-year, as expected. Only 20,520 total RVs were shipped in July, compared to 29,647 in July 2022, down about 31% year-over-year. Travel trailers witnessed a significant decline, with only 13,293 shipped in July vs. 19,355 a year ago, also about a 31 percent decline. It was by far the worst July for towable trailer shipments in recent memory, with almost 6,000 fewer travel trailers shipped than in the next lowest July, in 2016. It is important to understand the context, as July of 2022 had already witnessed the beginning of severe production cuts. Both July 2020 and 2021 saw production of over 30,000 travel trailers. In light of those record July numbers, 2023 is only about 42% of these record volumes. For reference, at the height of production, March 2022, there were almost 46,000 travel trailers produced, about 3.4 times the amount produced in July 2023.

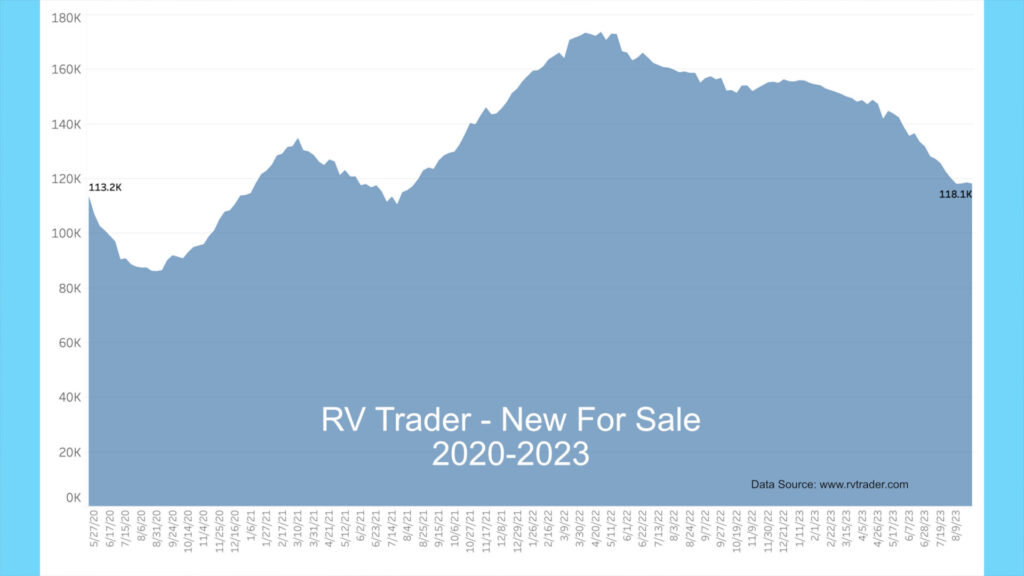

RV Trader Numbers

Meanwhile, RVs for sale on RVTrader.com continue a slow decline, with new units seeing a decrease since last month and used units for sale continuing to increase. This still points to significant discounts on new units that are crowding out the sale of used units. There were 118,110 new RVs for sale as of August 30th. This is down 4,259 units from late July’s 122,369 and down approximately 40,500 new units versus late August 2022.

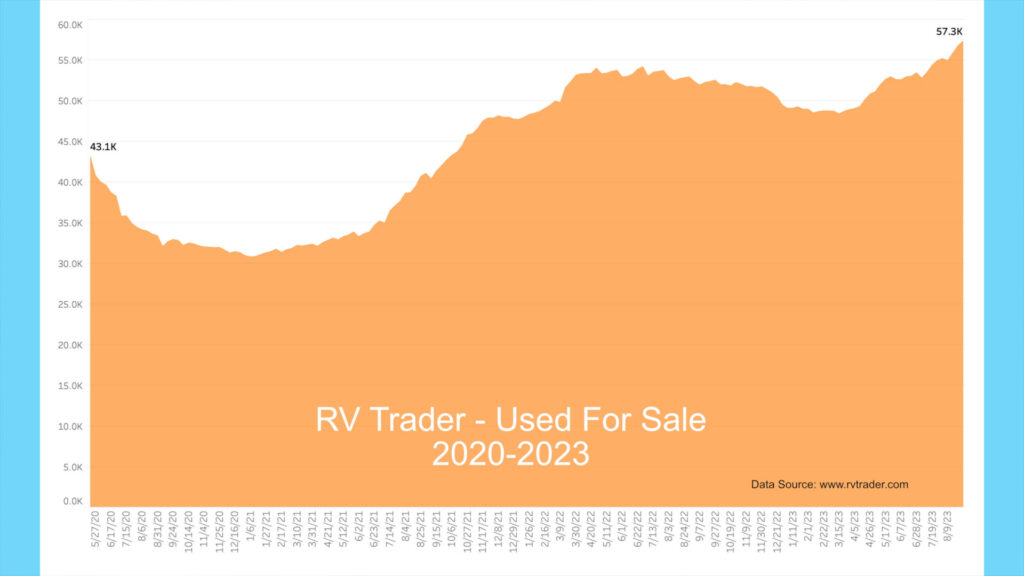

Used units for sale increased to 57,308, up from 54,907 last month, as more people attempt to unload used RVs. This is now the twentieth week in a row with used for-sale units above 50,000. This time last year, the number of used RVs for sale was 52,903, so we have about 4,400 more used units for sale versus late August 2022.

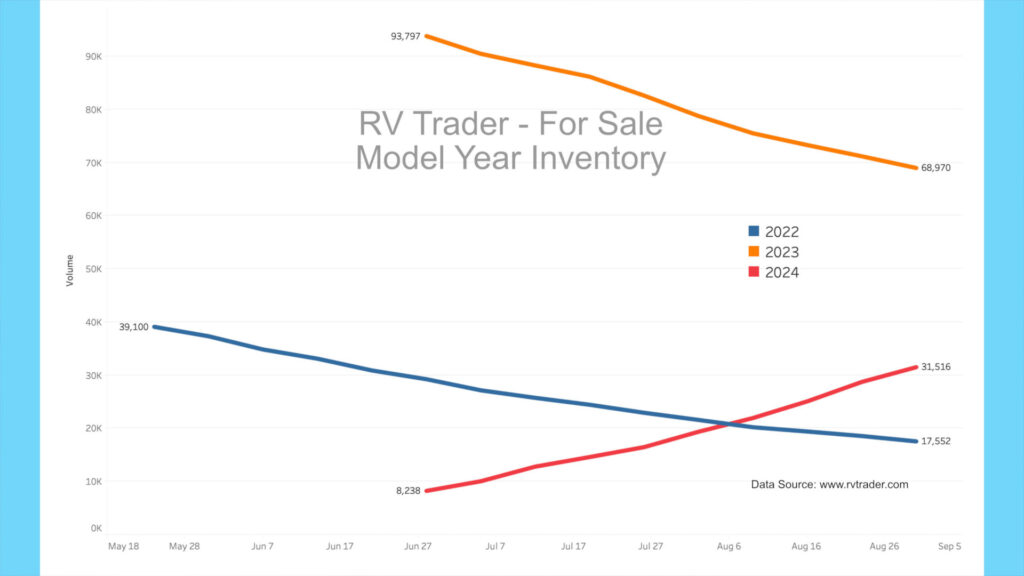

Our new model year chart shows new 2022 model volumes for the past fourteen weeks. As dealers unload these 2022 units, the number of models has decreased from 39,100 to 17,552 units. The orange line shows 2023 models going from 93,797 to 68,970 units over the past nine weeks. Meanwhile, the red line shows 2024 models now showing up on RVTrader.com. Nine weeks ago, there were 8,238 new 2024s, and now there are 31,516. So, there are still over 86,500 new 2022 and 2023 models on dealer lots. As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory.

High-End Market

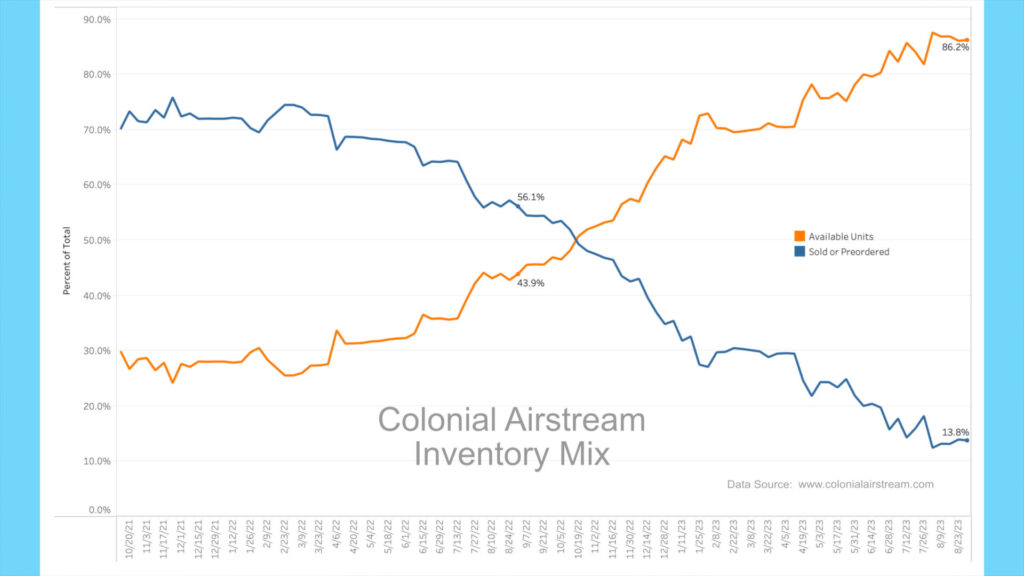

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, one of the nation’s largest Airstream dealers, continue to move towards a buyer’s market with in-stock units remaining high.

About a year ago, roughly 56% of Colonial’s inventory was preordered, meaning only 44% of their Airstream inventory was either on the lot for sale or being delivered and available. As of August 30th, 2023, roughly 86% of inventory is available for sale, with only 14% spoken for. This has meant a continued buildup of on-the-lot inventory. They now have 80 new units on the lot for sale and another 89 inbound that are unspoken for. This glut should mean a potential buyer can bargain significantly. The problem is that MSRPs have risen considerably in the past few years, so even discounted, these units can be costly.

BLS RV Manufacturing Labor Stats

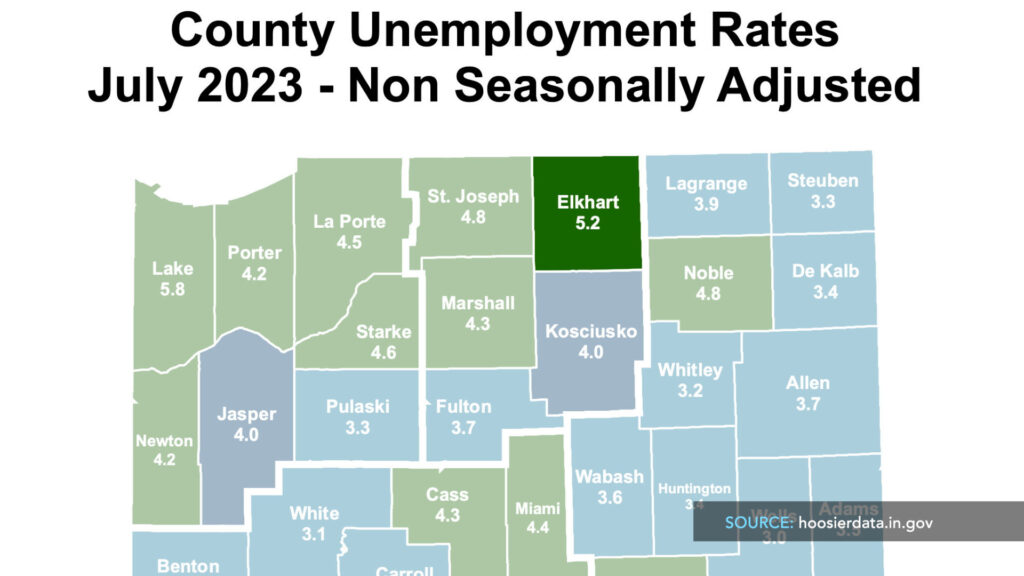

The Bureau of Labor Statistics has revised Elkhart County, Indiana’s latest manufacturing employment data for June 2023. We cover this because a very high percentage of North American RVs are made in this area of the country. The revision shows that at the height of production in the spring and early summer of 2022, there were 77,200 people employed in manufacturing. For June 2023, this number stands at 70,100 people, down 7,100 since the peak. The employment number will likely sink further going into the fall as manufacturers and suppliers lay off employees, given the current demand shortfall. Accordingly, the unemployment rate for Elkhart, based on July preliminary numbers, has risen to 5.2% from 4.4% in June. Elkhart country now has the fourth highest unemployment rate for all of Indiana’s 92 counties.

TSA Numbers

TSA air travel has picked up this summer, and August 2023 is proving to be a solid month for air travel vs. 2019, our pre-pandemic baseline. We have been tracking these data since the pandemic’s beginning and can say that air travel is beginning to surpass pre-pandemic levels. We tracked these data because the working hypothesis was that for many people, RV travel was a substitute for air travel vacations during the pandemic. This then brought about the RV boom of 2020 through early 2022.

We can conclude that the inverse relationship between air travel and the demand for RVs is more than speculation. Now, as many of us venture to new places, we are likely thinking of broadening our horizons beyond the local state park or national park. I’d be interested if any of you are venturing back into air travel for vacationing during the remainder of this year and into 2024.

AAA

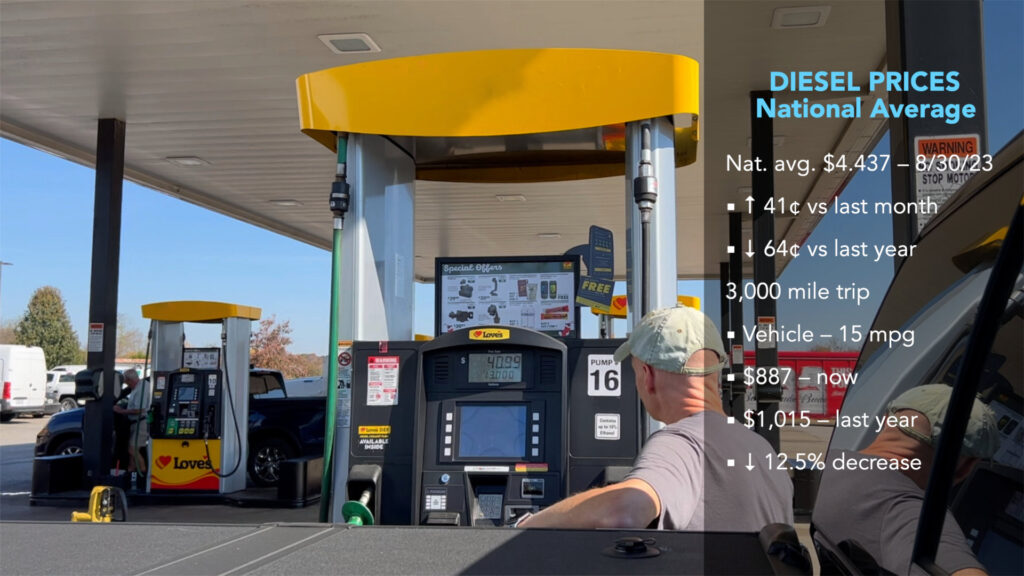

Gas prices have increased in the past month. According to AAA, the current average nationwide price as of August 30th was $3.872 per gallon for regular unleaded, up $.075 from a month ago and down only $.02 per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $1,148 now vs. $1,153 a year ago, less than a 1% decrease YoY. Diesel prices have increased sharply in the past month and moved well above the $4 mark and now sit at $4.437, up $.41 from a month ago and down $.64 from a year ago. A similar 3,000-mile trip getting 15 mpg would cost $887 now vs. $1,015 a year ago, a 12.5% decrease.

Market Outlook

Where do industry insiders see things going with the RV market? It’s an essential question for us as consumers to decide if it’s time to buy, sell, or hold. Three substantial insiders recently spoke about their outlook. First, the CEO of Camping World, the nation’s largest RV retail dealer, spoke out in early August and called a bottom to the market. “We believe we may have seen the bottom, and the path up to a more stable and robust outlook seems to be around the corner” (Marcus Lemonis).[1]

Others disagree. NTP-Stag is North America’s leading distributor and marketer of aftermarket RV parts and accessories. Company President and CEO Nick Zarcone said RV and towing-related products were “off substantially more” than the rest of the Specialty segment. According to Zarcone, the prolonged slump may continue. “We are not predicting that we are at the bottom yet,” he said. “The reality, it has been a rough couple of quarters for our specialty business. We have not seen a catalyst that is going to turn it quickly.”[2]

From the supplier side, Jason Lippert was recently on the RVBusiness podcast. He mentioned that he thought the industry was about 70% through the downturn and would recover during the 1st or 2nd quarter of 2024. Lippert is a massive supplier of many inputs in RVs. He also mentioned that while the RVIA is forecasting 300-320k in production for 2023, they, as a supplier, are slowing down to a 250-260k production rate.[3] Overall, things will likely remain slow well into 2024 from the supplier and aftermarket parts side. I think the slump is much worse than initially thought, and we won’t know if things will bounce back until next spring. The problem is that many economists believe a recession is relatively likely in 2024.

InTech New Small RV

An R-Pod owner recently asked me if there were smaller-sized RVs with better quality. One such company that produces smaller RVs with all aluminum structures is InTech. Recently, InTech launched a new model, the InTech Sol Dusk. Coming in at just under 21 feet long, the new Sol Dusk has twin beds that can convert into an 80” x 80” queen bed. It has a wet bath with a porcelain toilet, a 28-gallon freshwater tank, and a 32-gallon gray & black combo tank. The dry weight is below 4,000 lbs. with a Gross Vehicle Weight Rating of 4,800 lbs.

The new Sol Dusk model has some definite pluses and some drawbacks. On the plus side are the general length and weight of the model. At 21 feet, it should fit in almost any state and national park campsite. With a dry weight of less than 4,000 lbs., it should be towable by most trucks and larger SUVs. The all-aluminum structure is a definite plus, given the lighter and more durable material. I am also a big fan of the lounge/sleeping area, where you can convert the lounge into two twin beds or one queen bed. I also generally like the large U-shaped dinette and the porcelain toilet.

Some drawbacks from a first look are that the kitchen has almost no counter space, the combo gray & black tank capacity of 32 gallons would mean relatively short trips unless one is staying at a full-hookup campsite, and the GVWR of 4,800 lbs. on a just under 4,000 lb. dry-weight trailer means limited storage and carrying capacity depending on options. The fridge is also only 4.5 cu ft and is a 12V compressor unit, so no propane capability for boondocking. It is pricey. The starting price of just under $45,000 for the base model does not include some of the more aggressive desirable options in the Rover package – so we can likely assume that the price with options will be closer to the $50,000+ range.[4]

Oliver Trailers

RVTravel.com is reporting that Oliver Travel Trailer is planning to expand by establishing a dealer network. Based in south-central Tennessee, Oliver is one of the only RV manufacturers not currently working through dealers for sales or service. They have only sold directly to the customer from their Tennessee location. Many people who own Oliver travel trailers are thrilled with the trailer’s quality and the company’s customer service. According to an Oliver owner I recently interacted with, Oliver has used trained mobile technicians for service. It will be interesting to see if Oliver can maintain their stellar reputation after they add a layer between themselves and the customer. I firmly believe a manufacturer is only as good as their worst dealer.[5]

All the best in your camping endeavors!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!

- https://www.rvnews.com/camping-world-ceo-calls-industry-bottom/ ↑

- https://www.rvnews.com/ceo-will-not-call-rv-bottom-yet/ ↑

- https://www.youtube.com/watch?v=VkayRmtoOhs (Lippert comment time stamps: 70% through the downturn (3:00). 1st or 2nd Qtr of 2024 is when we should see improvement to the business (3:28). Suppliers slowed down to a run rate of 250-260k for 2023 (4:00).) ↑

- https://intech.com/rv/models/sol/dusk/ ↑

- https://www.rvtravel.com/oliver-travel-trailers-establish-dealer-network-1119b/ ↑