This blog covers the latest RV and travel data news. August numbers are in, and it is the worst month for 5th wheels and travel trailer wholesale shipments in six years. Also, why are RV dealers and industry insiders up in arms over a recent FTC rule change? Likely, if the RV industry is frustrated, it is good news for buyers. Let’s get started with the news.

This Month’s Big Story

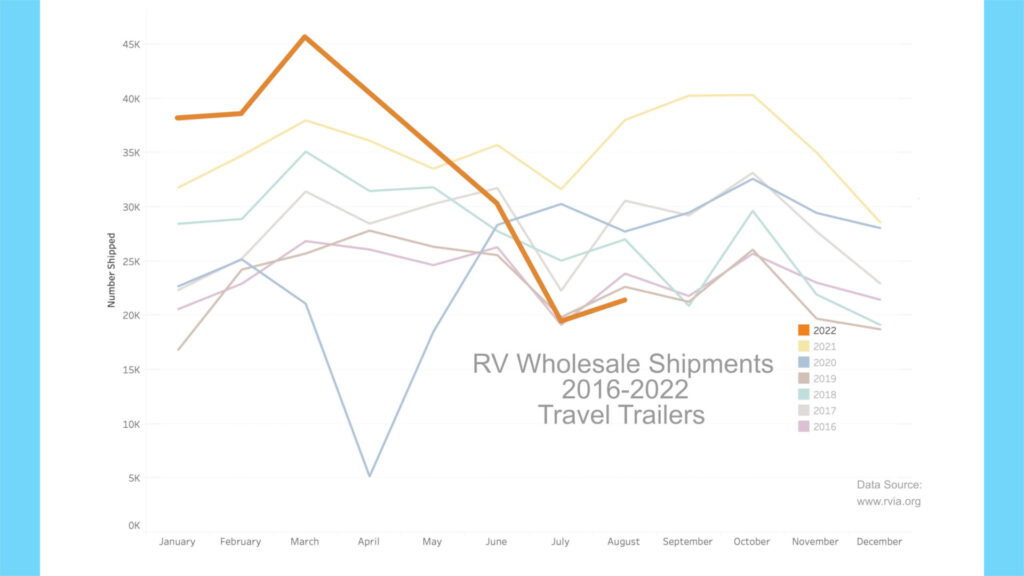

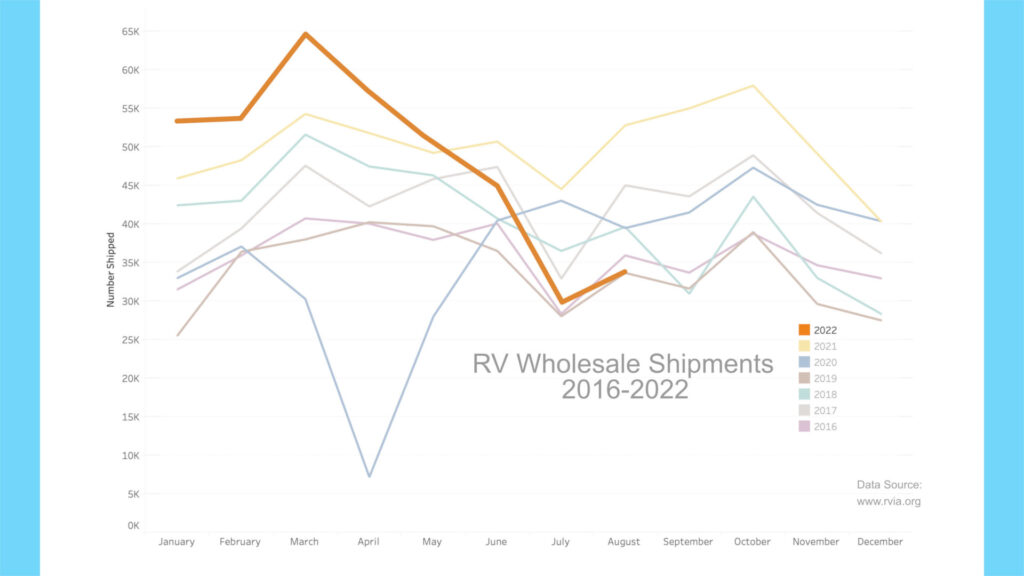

Although we have been pointing to a slowdown in RV production for a while, August 2022 has been the worst in the past six years for low and middle-market travel trailer and 5th wheel shipments. Given that most low and middle market customers purchase a new RV based on what payment they can afford, higher interest rates have thrown cold water on new travel trailer and 5th wheel purchases. Middle market customers are also much more sensitive to general inflationary pressures, and the increase in prices seems to be delaying significant purchases.

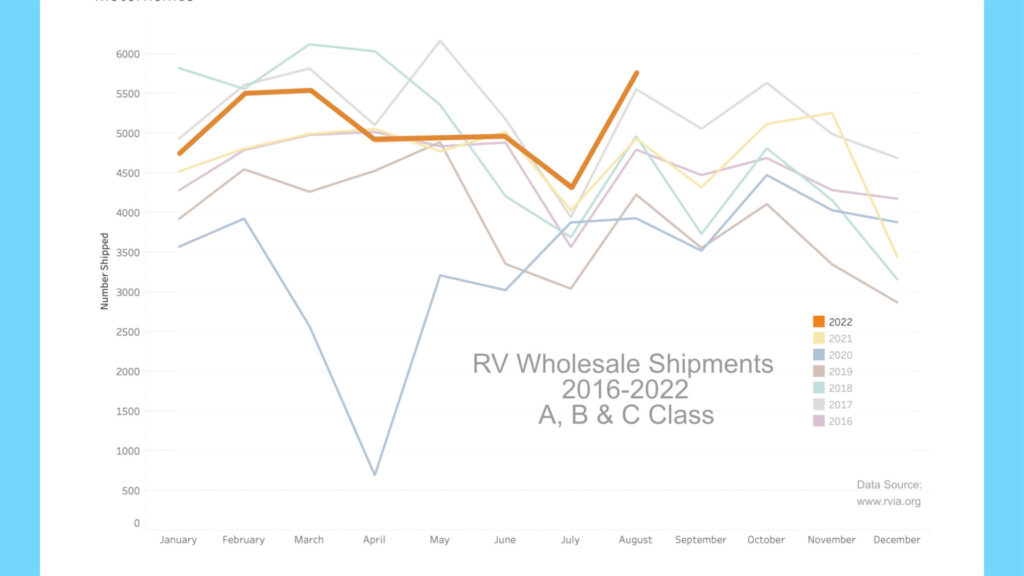

Interestingly, higher-end Class A motorhomes, Class B camper vans, and Class C motorhomes all witnessed an uptick in shipments as shortages in vehicle production are being worked out. It seems apparent that higher-end customers are less price and interest rate sensitive, as expected.

Production Numbers

On September 26th, the RVIA posted the latest RV shipment data for August 2022, and as just mentioned, the numbers are the worst in six years for travel trailers and 5th wheels. Basically, the low and middle market has collapsed, given rising interest rates and inflation. Only 33,783 RVs were shipped in August, compared to the record 52,819 of August 2021 (-36%). Travel trailers witnessed the most significant decline year-over-year, with only 21,417 shipped, vs. 38,011 a year ago (-44%). Given all shipments, August 2022 only beat August 2016 by 109 units shipped!

RV Trader

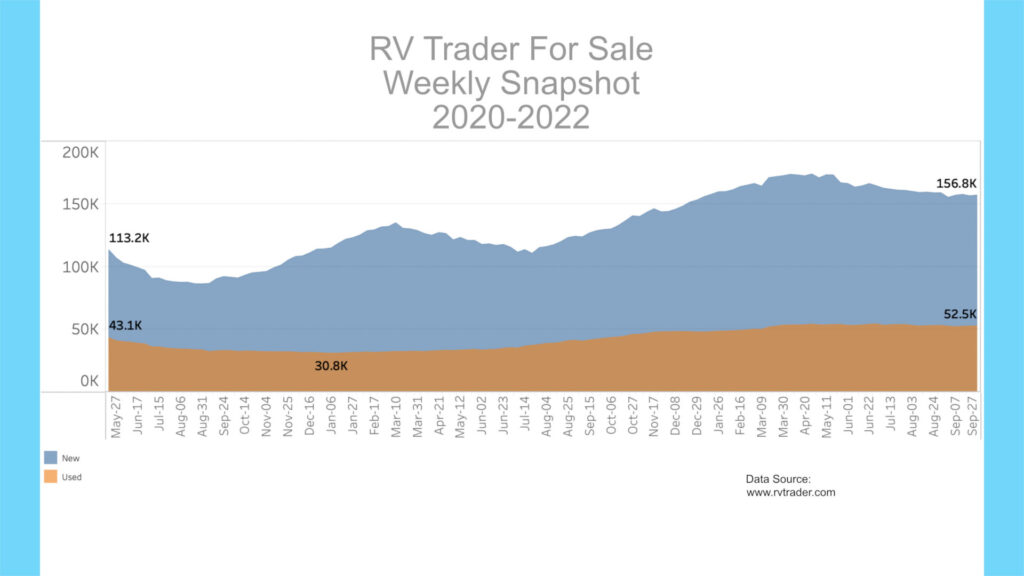

Meanwhile, new and used RVs for sale on RVTrader.com remain stubbornly high, as expected, given that new units are not moving off dealer lots. There were 156,776 new units for sale as of September 27th. This is down slightly from the 158,629 units a month ago, which is very high for this time of year. While new units for sale are staying high, used units for sale are down slightly from last month, at 52,513. This is now the sixth month in a row with used for-sale units at greater than 50,000. This time last year, the number of used RVs for sale was roughly 43,000.

RV Quality Concerns

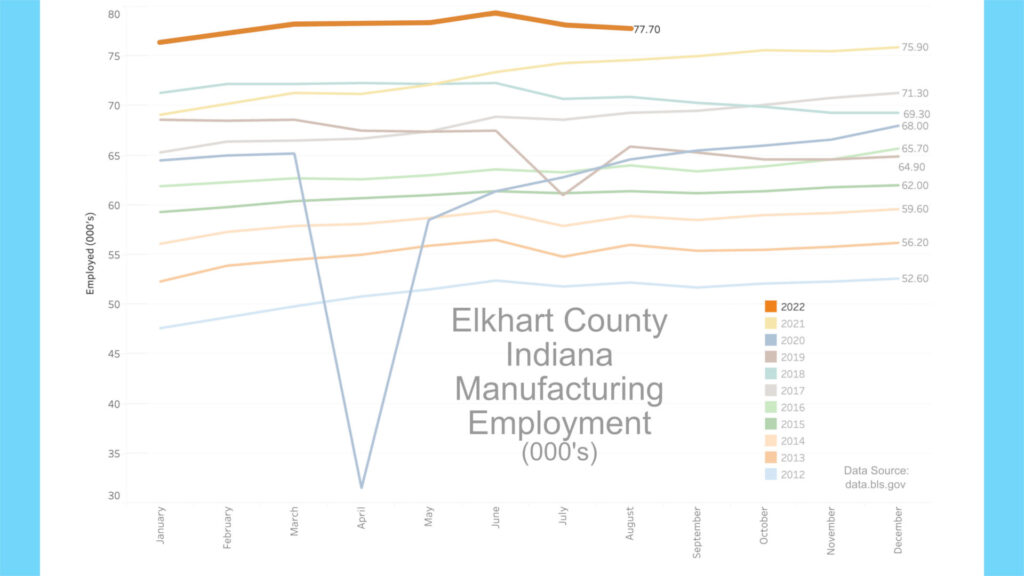

Meanwhile, manufacturing employment levels in Elkhart County, Indiana, have started to pull back with the decreased shipment numbers. There were 77,700 people employed in manufacturing in August, according to the Bureau of Labor Statistics. This is down from 78,100 in July 2022 and a record 79,200 in June 2022. This gives Elkhart an unemployment rate of 2.5% for August 2022, up considerably from the Spring.

So, while more travel trailers and 5th wheels are available on dealer lots and discounts may be had, quality concerns remain, and list prices are much higher than pre-pandemic.

AAA

According to AAA, gas prices have started to rise again. The current nationwide price as of September 27th was $3.747 per gallon for regular unleaded, down from $3.857 a month ago, yet inching back up from the low 3.60s of early to mid-September. Today’s price is .56 cents higher than a year ago. An RV trip of 3,000 miles at 10 mpg would cost $1,124 now vs. $957 a year ago, about an 18% increase.

Diesel sits at $4.899 today vs. $5.038 a month ago and up from $3.315 a year ago. A similar 3,000-mile trip getting 15 mpg would cost $978 now vs. $663 a year ago, a 48% increase.

New FTC Rules for Dealers

Next up, what is the Federal Trade Commission’s Motor Vehicle Dealers Trade Regulation Rule, and why are RV dealers so upset about it? Well, if you have ever been frustrated when buying a car or RV from a dealer, then you may want to focus in for the next few minutes. You can almost always tell something is good for consumers based on the volume of dissent from those who benefit from the status quo, which appears to be the case here.

The RV Dealers Association objects strenuously against the new FTC rules for motor vehicle dealers based on the argument that RV dealers are significantly different from automobile dealers, and therefore the new stringent rules should not apply to them. Once again, the industry is playing the card that RVs are discretionary purchases and not “used daily like cars.” While this may be true to a point, plenty of people live and work in their RVs.

Contrarily, most of us know that a vehicle dealer is a vehicle dealer, no matter the industry. Whether presenting truth in advertising, transparency in pricing, selling insurance, or skimming off financing, there really isn’t a difference in how dealers make money between autos, RVs, boats, etc.

I recall an experience with a new car purchase where there were deceptive practices by the dealer. It’s not uncommon. In fact, there is an incentive to sell not just a vehicle but protection plans (insurance), financing, addons, and ongoing service plans. I have had a new car finance director at a local dealership ask me point blank, “What’s in it for me?” when I told him I would not be using their financing and wasn’t interested in any addons or insurance. It got a bit heated with the finance person, and I went elsewhere to buy the vehicle.

For RV dealers to claim separation of practices from automobile dealers based on being a smaller niche or that RVs aren’t used as much is a pretty weak argument. RV dealers sell the same addons, financing, insurance, and service plans. Of course, they don’t want to have additional rules to live by because it will mean increased compliance costs and reduced revenue. No rational business owner would want this.

However, like in many things, a few bad apples abusing the system mean everyone has to pay, which seems to be the case here. I know an excellent RV dealer who is small and has been in business for a long time, taking care of customers. They will be paying for the ones who have mistreated customers repeatedly. The lesson for the RVDA is that they should have severely disciplined rouge member dealers rather than have so many complaints end up at the FTC so that all dealers now have to pay ongoing increased costs and lower revenue. Of course, businesses don’t usually absorb increased costs; they get passed along to the customer.

So, here is a summary of the new prohibitions in the FTC’s rules in my words. The full text is available at federalregister.gov.

Section 463.3(a) – You can’t fake people out with the terms of financing the vehicle.

463.3(b) – You can’t trick people with add-ons.

463.3(c) – You can’t trick people with loan or lease confusion.

463.3(d) – You can’t trick people with discounts or rebates factored into the price but not available for all buyers.

463.3(e & f) – If you advertise a price, you have to have some sort of availability at that price. Part F means that you can’t guarantee preapproval when advertising.

463.3(g) – You can’t cheat and change a customer’s loan application info, including the down payment amount or income information.

463.3(h & i) – You can’t give the customer a vehicle to drive off before the deal is finalized and keep their trade-in to force the customer back to the dealership to craft a new deal.

According to the FTC, “These provisions are intended to curb yo-yo financing, which occurs when a dealer obtains a consumer’s agreement to a deal that has not been finalized, allows the consumer to drive the vehicle off the lot, and then directs the consumer to return and engages in unlawful tactics, such as failing to give back a consumer’s trade-in vehicle, while refusing to honor the deal or pressuring the consumer into entering a new deal.”

463.3(j) – This keeps dealers from the sleight-of-hand trick of taking a trade-in from a customer that has an underwater loan, promising to pay it off, but instead, fraudulently putting the payoff amount into the new financing package.

463.3(k & l) – Your dealer can’t say they are associated in any way with the government or misrepresent customer reviews being from ordinary customers when they are not.

463.3(m) – You can’t tell someone they have won something unless they have, including sweepstakes.

463.3(n) – You can’t tell a customer you can’t move a vehicle out of state or out of the country when they can.

463.3(o) – You have to be honest about any repossession implications in a deal.

463.3(p) – You must accurately present required disclosures to the customer.

So, after going through these prohibitions, I’m not sure why any honest dealer would object. It can be summed up by saying, treat people well and don’t try to cheat them when they are buying a vehicle.

I suppose an honest dealer would feel like they are being punished unduly with new requirements based on someone else’s bad behavior.

There is a set of required disclosures corresponding to the prohibitions mentioned above that will be part of the new rules. Since there is way too much to cover here, let’s summarize this section with an example:

Section 464.4(d) will require dealers to disclose the total monthly payments and not just the monthly payment amount. So, if a dealer offers a lower monthly payment, they have to disclose total payments when comparing financing deals. A lower payment may mean longer terms and higher overall costs, and the FTC feels this is often used to trick customers into a lower monthly payment that will mean greater costs in the long term.

Most other disclosure requirements follow a similar vein, making sure dealers have to disclose the actual costs of about everything that goes along with a sale. Likely, the most important item is 464.4(a) that dealers would have to disclose the “Offering Price.” “Under the proposed rule, the ‘Offering Price’ of a vehicle means ‘the full cash price for which a dealer will sell or finance the motor vehicle to any consumer,’ excluding only required government charges.”

Overall, I have to lean to the side of the FTC on the new rules, given my personal experience with car dealers. Should it apply to RV dealers? Likely, because RV dealers do much of the same practices when selling an RV, including selling insurance, loans, and add-ons. Unfortunately, it will create a paperwork burden for small dealers who don’t practice shady sales or poor financing. Like most regulations and government rules, they are made to restrict the bad actors and can punish the good actors as a side effect.

Okay, that’ll do it for the news. All the best in your camping endeavors!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and by their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated