In this blog, we’ll cover the latest RV and travel data news. We’ve had an interesting month since our last newscast and blog, with a huge outpouring of comments about the topics we covered. It turns out that many people feel frustrated about their RVs and the RV industry. We’ll also cover Jayco’s recent press release and Starlink’s new service. There’s a lot to cover.

This Month’s Big Story

First up, let’s dig into the data as we do in most news blogs. As a reminder, we pull data daily, weekly, and monthly from various sources to bring you the latest picture of where things are in terms of RV production, sales, and quality. We do this so you can know if it is a good time to buy, sell or hold on to your RV.

TSA Volumes

Let’s start with the latest TSA air passenger travel numbers. We haven’t looked at this in several months, as air travel has stabilized since last spring.

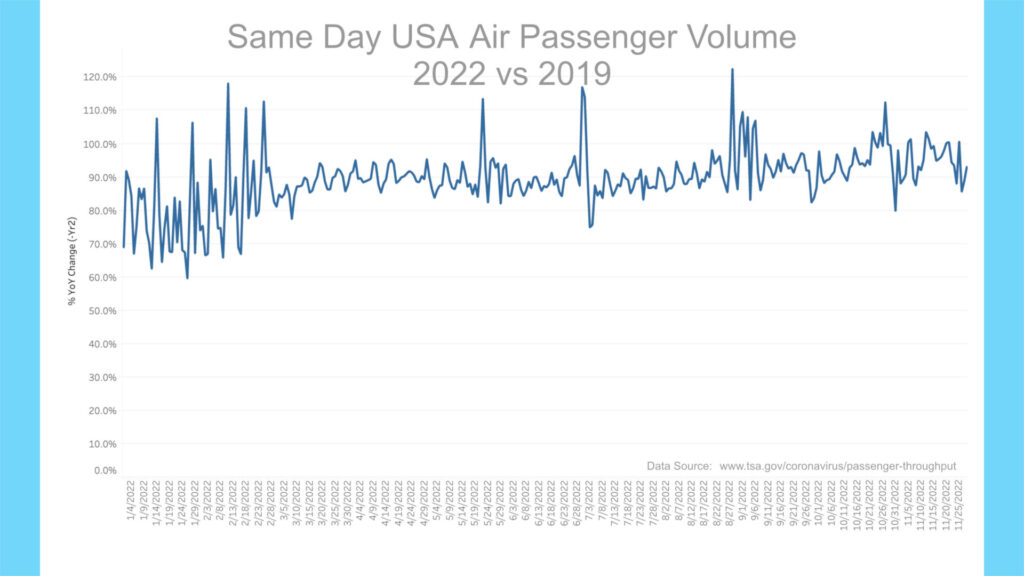

The chart shows 2022 daily passenger volume vs. 2019 same day. Data is directly from the TSA. It is easy to see this chart as a “Pandemic Indicator,” meaning if the ratio is higher, more people are willing to travel in a very small, enclosed space with strangers. 2019 is used as the last normal year as a reference.

Interestingly, the ratio started 2022 at about 80% and by mid-March, hit and stayed at the 90% rate until about the end of August. Since then, the average has been closer to 95%, meaning we’ve regained about 95% of 2019 volumes since the fall. I think it may be safe to say that most air travel volume has recovered, except possibly some business travel that may or may not fully bounce back.

My take is that this may mean fewer people opting into the RV lifestyle going forward. Much of the increased demand for RVs and subsequent space issues at campgrounds was likely a short-term phenomenon. Some tried out RVing during the pandemic as a travel substitute, while others tried out RVing and will continue to do so. Others have been inoculated by the RV experience and ownership and will return to their previous ways of traveling.

Production Numbers

The RVIA posted the latest RV shipment data for October 2022, and the numbers are still falling short of the prior six years for the same month. 32,652 total RVs were shipped in October, compared to the record 57,971 of October 2021, down 44% year-over-year. Travel trailers witnessed the most significant decline, with only 21,036 shipped in October vs. 40,317 a year ago, a 48 percent decline. It was by far the worst October for towable trailer shipments in over six years.

RV Trader

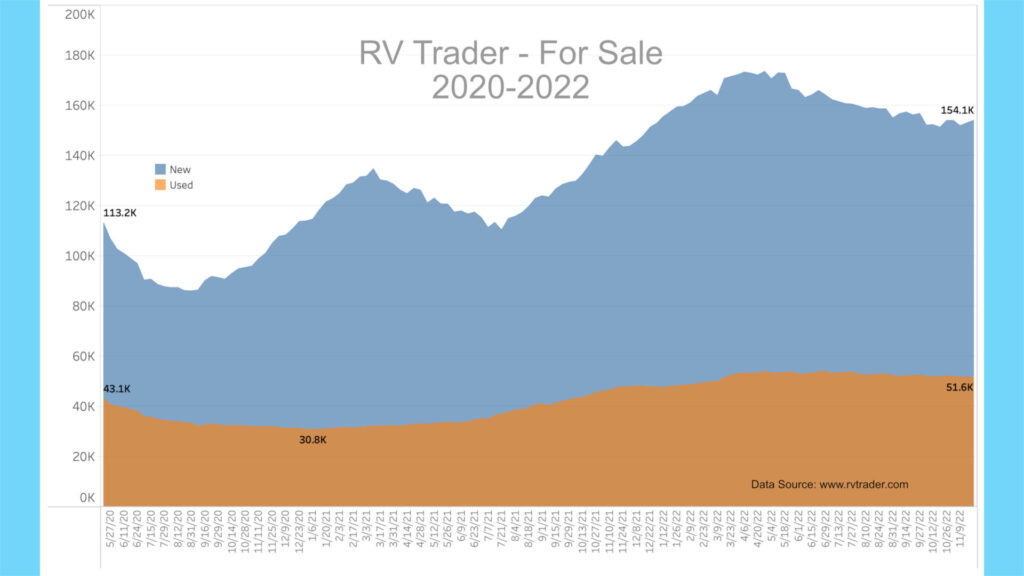

Meanwhile, as expected, new and used RVs for sale on RVTrader.com remain stubbornly high. There were 154,067 new units for sale as of November 23rd. This is up from October’s 153,993 units a month ago, which continues to be very high for this time of year. While new units for sale are staying high, used units are down very slightly from last month, at 51,559. This is now the ninth month with used for-sale units at greater than 50,000. This time last year, the number of used RVs for sale was roughly 48,000.

RV Quality Concerns

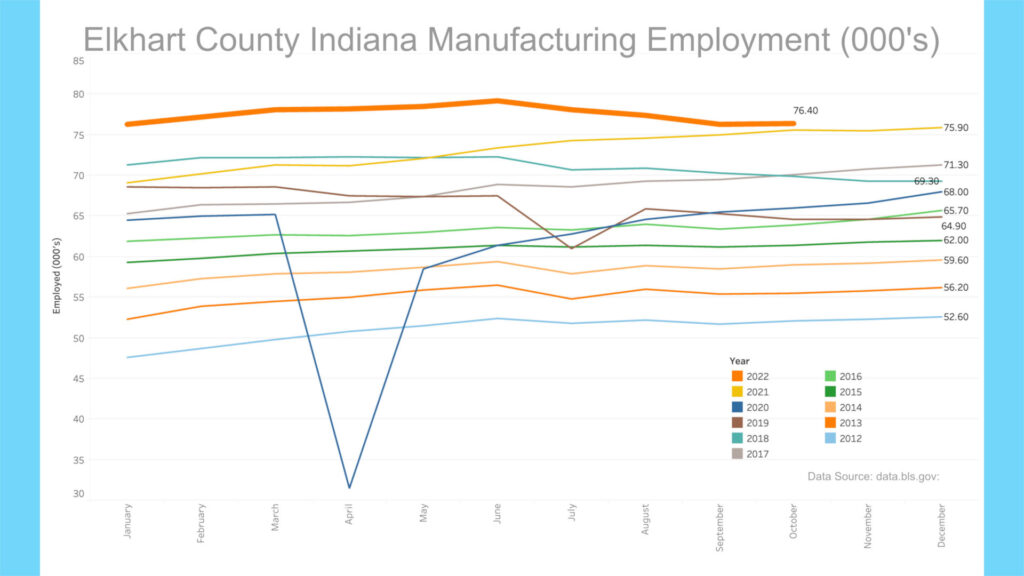

Meanwhile, manufacturing employment levels in Elkhart County, Indiana, have stayed steady even with the pullback in shipment volumes, which seems counterintuitive. There were 76,400 people employed in manufacturing in October, according to the Bureau of Labor Statistics. This is down from 77,400 in August 2022 and a record 79,200 in June 2022, yet staying reasonably steady for the past two months. This gives Elkhart an unemployment rate of 2.6% for October, up from 2.0% in September. I must admit to not fully understanding how the employment levels in manufacturing are staying elevated, given the significant pullback in RV production. Manufacturers may be keeping employees partially or somewhat inactively employed just in case production picks back up.

High-End Market

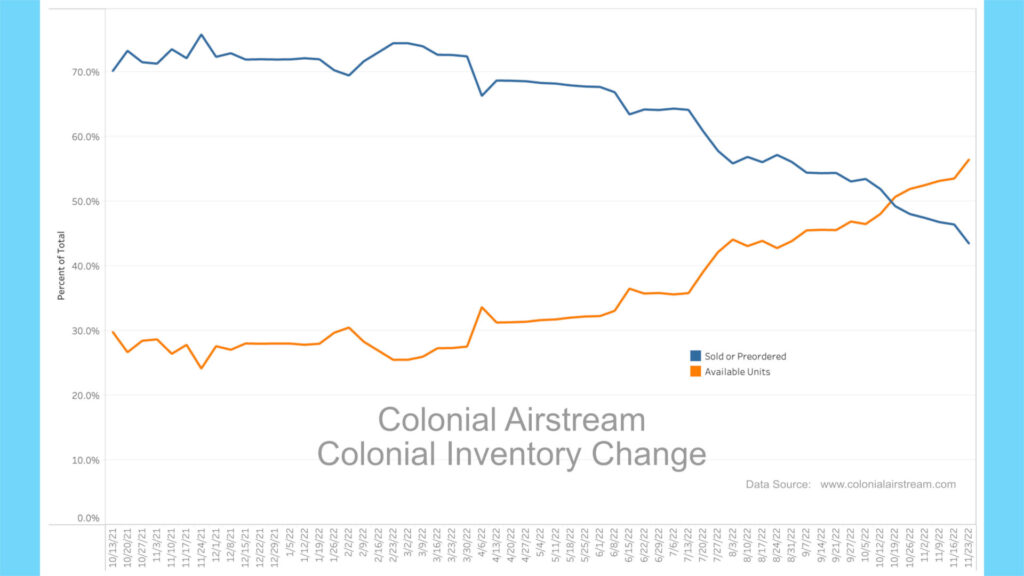

Let’s again peer into the high-end RV market. For over a year, we have taken a weekly snapshot of inventory levels at Colonial Airstream in Millstone Township, New Jersey. They are one of the largest Airstream dealers nationwide.

Until recently, 60%+ of Colonial’s inventory was preorders; this is now near 40%. You’ll notice the significant uptick in the number of units available vs. preordered of late as the dealership is apparently slowing orders. All this is to say that the same factors influencing the low and middle markets are now beginning to affect those with more resources.

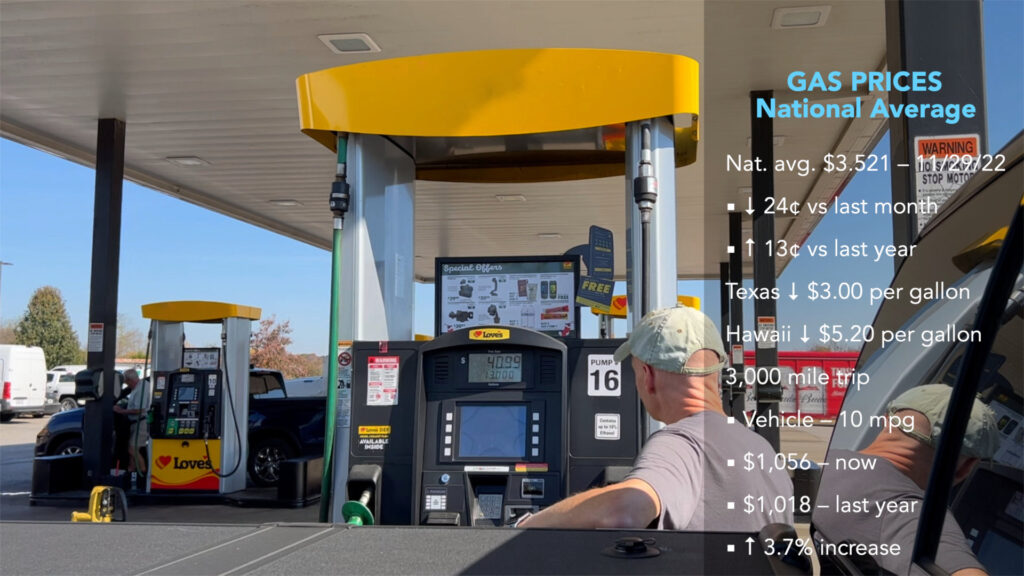

AAA

Some good news on gas prices, according to AAA, prices have begun to fall over the past month, which is a welcomed relief to all those about to or who are now snowbirding with their RVs. The current average nationwide price as of November 29th was $3.521 per gallon for regular unleaded, down about $.24 from a month ago and up only about $.13 per gallon from a year ago. Texas is the only state with an average price below $3 per gallon. In contrast, Hawaii has the highest price at just under $5.20 per gallon. An RV trip of 3,000 miles at 10 mpg would cost $1,056 now vs. $1,018 a year ago, about a 3.7% increase YoY. Diesel sits at $5.199 today, down about $.11 from a month ago yet up about $1.56 from a year ago. A similar 3,000-mile trip getting 15 mpg would cost $1,040 now vs. $728 a year ago, a 43% increase.

RV Quality News

In RV quality news, on November 28th, Jayco announced that their new 70,000 square foot Pre-Delivery Inspection facility was up and running as of November 25th, which according to the Jayco press release, “allows for 100% of all Jayco, Entegra Coach, Starcraft RV and Highland Ridge RV products to be PDI-ed before being shipped to a dealer. The Jayco PDI began in January of 2019 and by January 2022, 55% of all units were being PDI-ed, including 100% of all motorized units and units produced in the Idaho and Shipshewana manufacturing facilities. Once the new Southridge facility is fully running all lines on November 24th, 100% of all units for all Jayco brands will be PDI-ed before being shipped to dealers.” [1]

Hopefully, you caught this: as of this past January, close to 45% of units being sent to dealers were not being PDI’d. This points to the potential quality issues we have been talking about lately in the RV industry as a whole. Hopefully, all manufacturers will be challenged by Jayco’s new commitment to Pre-Delivery Inspections.

Starlink in Alaska and Canada

On November 21st, SpaceX announced that Starlink’s high-speed satellite internet service is now available in Alaska, Canada, and other northern latitude nations like Finland, Norway, and Sweden. This should be a game changer for our remote neighbors to the north and those who would like to visit these areas and work remotely but have been prevented from doing so for lack of connectivity.

Feedback

Last month’s newscast video caused a stir in the RV community and broke a record for us in terms of the number of views (>70k) and comments (almost 300) in such a short time. A number of our viewers commented on their experience with the quality of recent RV purchases, and the general tone was one of dissatisfaction. Here are a few examples.

John M. writes, “Having bought travel trailers since 1988, I can say that there is a huge difference in quality since 2008. Before the conglomerates bought up all the RV manufacturers, they cared about quality because there were so many manufacturers they had to compete at the quality level. Now with a few large companies supplying the majority of travel trailers (and parts for that matter), the quality is terrible because there really isn’t competition. I highly recommend an independent inspection on any new or used unit now.”

Toby D. writes, “I’ve been researching as well as shopping for an RV for the last 3 years. My research is exactly what you’re stating here. I retired in May of 2021. I had started shopping online for an RV in 2019 knowing I was going to be retiring in a couple of years. When the pandemic hit in 2020 and you couldn’t get on a cruise ship, couldn’t go to a theme park, and were less likely to get on a plane, people decided they could get a RV and go camping. Obvious with demand, prices began to soar, and quality of RV’s went down due to this high demand. I’ve seen prices on certain models I was looking at in 2019 go up 50% in 2021 and 2022. Therefore, I’ve held off on any purchase and plan to wait until prices and quality change for the better. Gas prices, have to come down. Also, costs to stay in a campground have risen tremendously. Right now, I’m better off staying in hotels and building points for free nights. I appreciate your videos.”

Matt P. writes, “My family has been camping out of RV’s since I was a kid. I lived in a 5th wheel all the way through college to save money. I still own a 1960 Shasta that my grandfather bought brand new. (Looks very similar to the model behind you on the wall.) I have a 1988 Vacationeer 5th wheel, a 1998 Teton homes 5th wheel and a 1997 Lance cabover camper. I can tell you that the level of quality in those older units is, by far, better than anything I have seen in the new markets for at least ten years. My 5th wheels are better built, more durable, and of much higher overall quality than anything, anywhere, I have seen. All of my units are paid for, and I have learned how to repair them. The only unpredictable part for me is the price of fuel. To anybody looking at getting an RV for the first time, I suggest buying a high-quality, older unit for cash.”

I did have a former RV worker confront me about the video content. They said, “Maybe you think it would be better to shut everything down?! You are listening to only one side!! Anyone who is building them and says he would never buy one is obviously not a good quality worker. I worked in RV’s for about 18 years and we took a great satisfaction in building quality units…they are basically a house on wheels and need to be as light yet strong as possible…and yet affordable…so they do the best they can.”

In response, I replied, “I think manufacturers need to allow workers to go slower so things are not missed, and fewer mistakes are made. Changing from piece work to hourly rates would likely slow things down and allow for more time and care to be put in each unit. I have seen people running in factories building RVs which to me says speed is the most important thing to the owners. I do think the industry pushed to build 600,000 units in 2021 and to do so meant hiring many people who may have not been as diligent or skilled as you and your coworkers were at the time you worked. Most RV owners will concur that units built before the pandemic were better quality, and I think it is proving true.”

With that, I think we’ll wrap things up for this RV news blog. For those of you who put off RVing due to high gas prices, things are certainly getting better and are not much different than traveling a year ago. This is good news for our viewers who plan to snowbird shortly.

Okay, that’ll do it!

All the best in your camping endeavors!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and by their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!

- https://www.jayco.com/newsroom/100-percent-pdi/ ↑