This blog will cover the latest RV and travel data news for January 2026. December 2025 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell, or hold an RV. Later in the news, we’ll look at news from the Tampa RV show and what may be a real innovation for towing.

RVIA Numbers

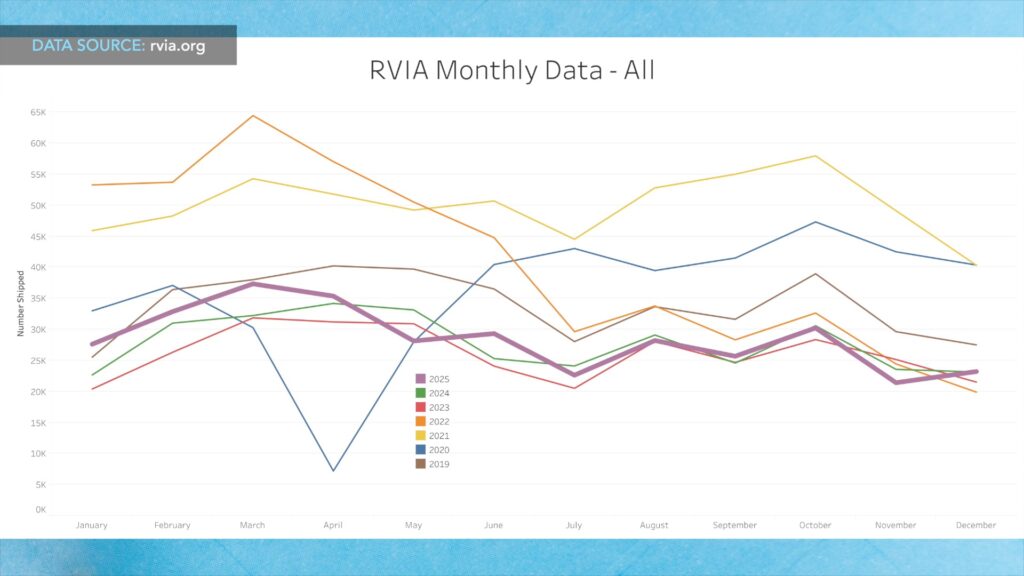

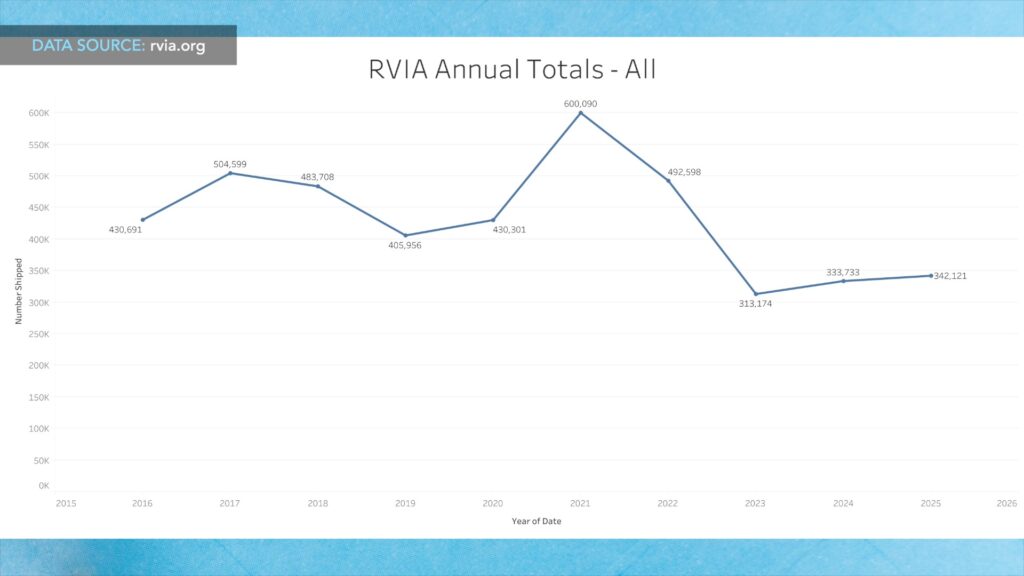

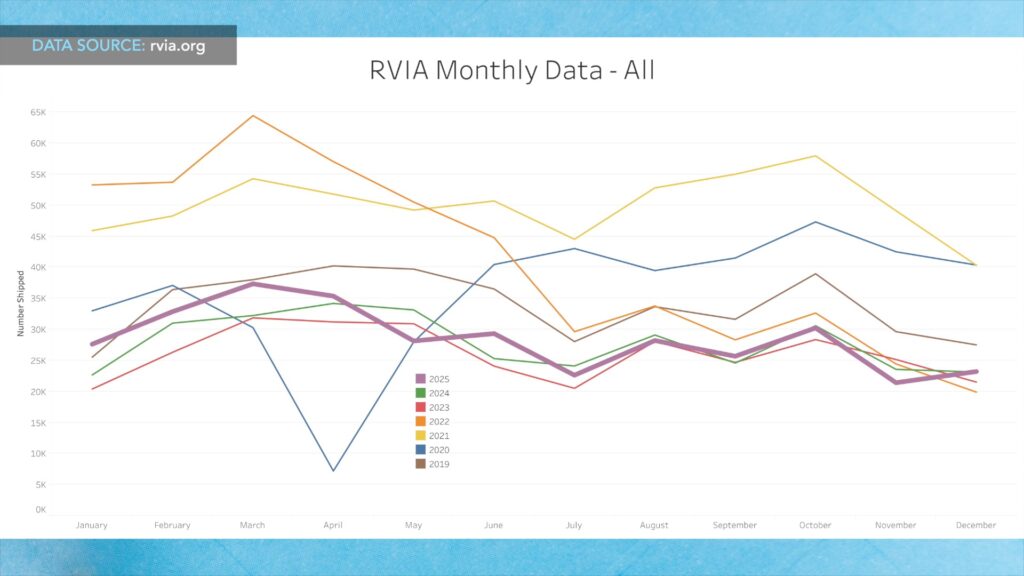

On January 25th, 2026, the RVIA posted the latest RV wholesale shipment data for December 2025. Production was steady compared to the prior year, with 23,220 total RVs shipped in December, up by only 67 units year-over-year. December 2025 barely passed the lows of 2022 & 2023 shipments and was below all other recent years, all the way back to 2016. Compared to full-year 2024 volume of 333,733 units, total 2025 units came in at 342,121, up by 8,388 units, or 2.5%. 2025 is the third lowest full-year production run for RVs since before 2016.

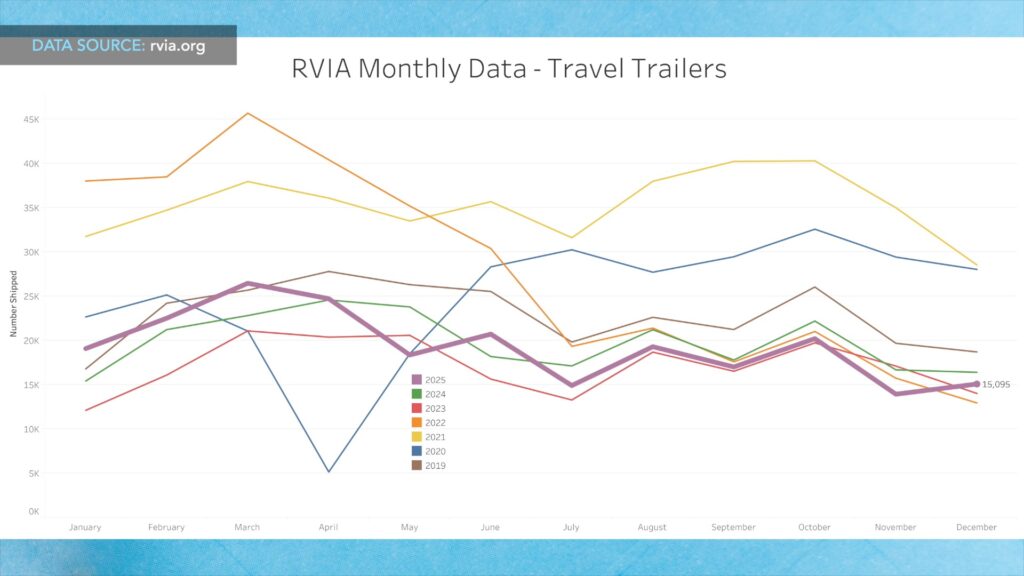

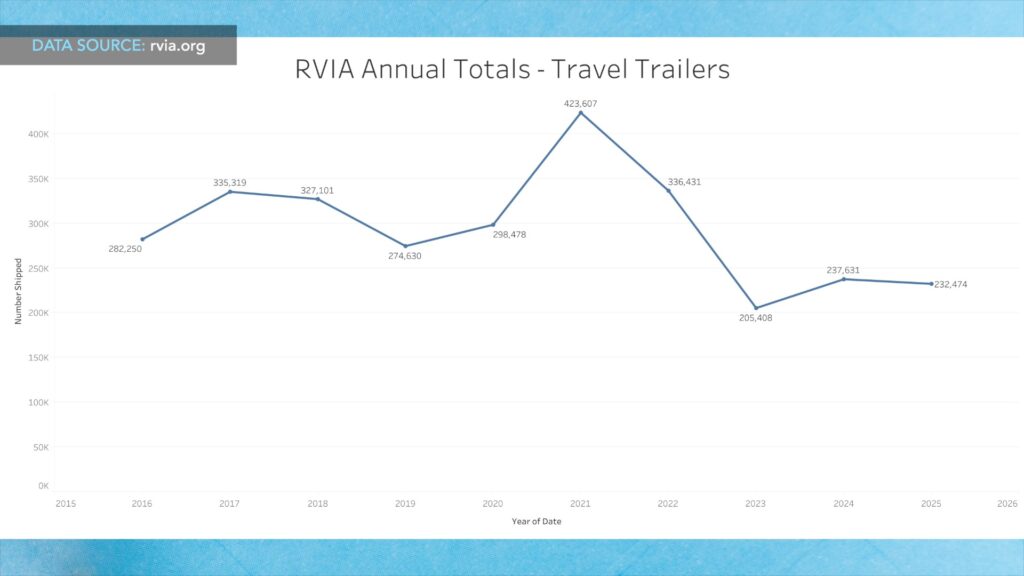

Travel trailer shipments decreased year-over-year, with 15,095 units shipped in December 2025, compared to 16,419 a year ago, representing a decrease of 1,324 units, or 8.1%. Travel trailers had their third lowest production December in recent memory. Compared to full-year 2024 volume of 237,631, 2025 full-year numbers were down by 5,157 units to 232,474, or down by 2.2%. Besides 2023, 2025 is the lowest full-year production run for travel trailers since before 2016.

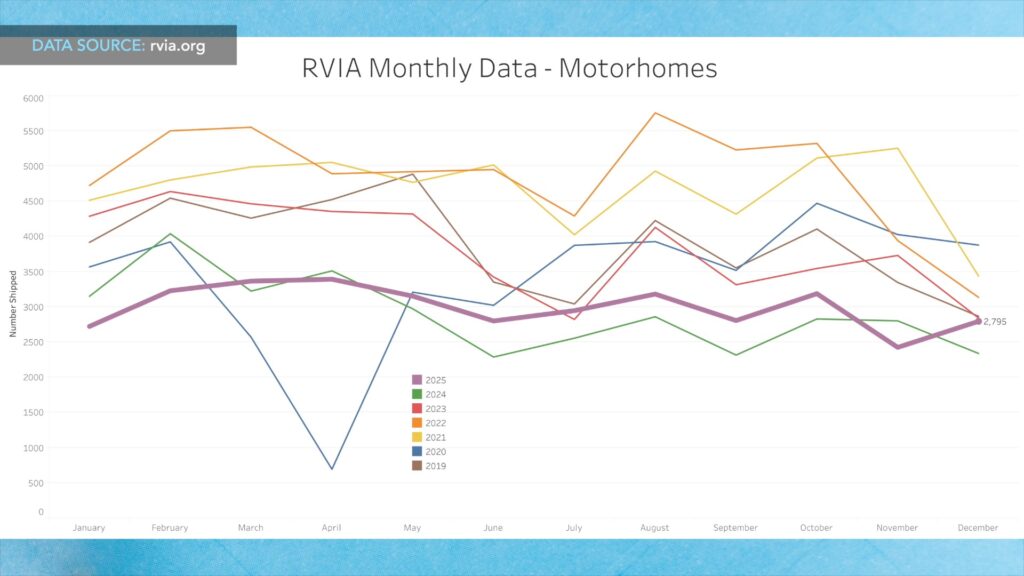

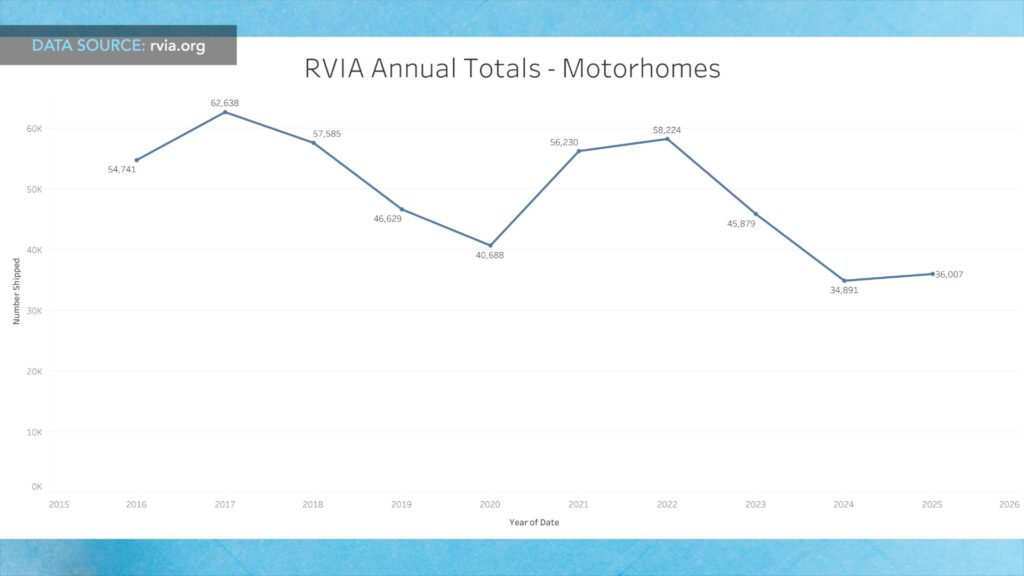

Motorhome shipments, which include Class A, B, and C motorhomes, were higher than in December 2024, with 2,795 units shipped versus 2,339 a year ago, an increase of 456 units or 19.5% year-over-year. While beating December 2024, Motorhome shipments were still the second lowest December on record, going back to 2016. Compared to full-year 2024 volume of 34,891, Motorhomes were up to 36,007 units, up by 1,116 units, or 6.6%. Besides 2024, 2025 is the lowest full-year production run for Motorhomes since before 2016.

RV Trader Numbers

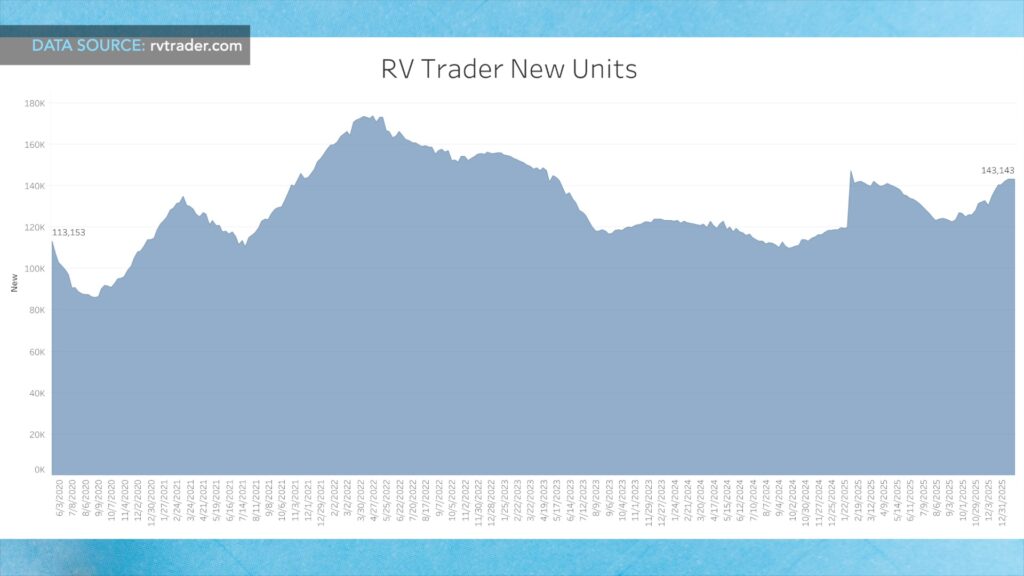

RVs for sale on RVTrader.com have increased since last month, with 143,143 new RVs listed as of January 28th, 2026. This is up from 140,350, or 2,793 units, or 2.0% from a month ago, and up a 23,378, or 19.5% from a year ago.

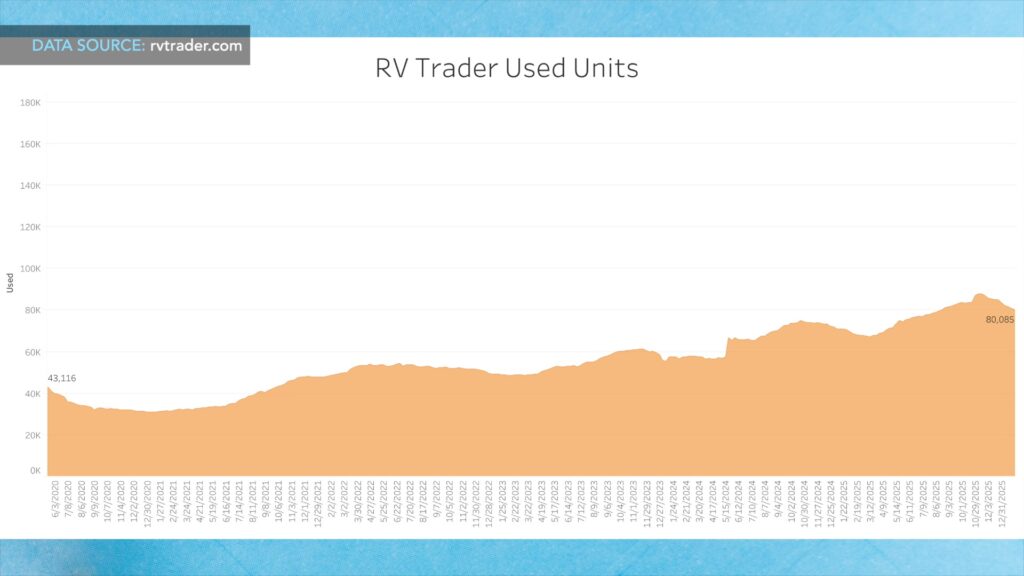

The number of used units for sale has decreased again from Fall highs, with 80,085 used RVs for sale as of January 28th. This is down by 3,616 units, or 4.3%, compared to about a month ago and up by 9,627 units, or 13.7%, compared to a year ago. It seems obvious that the sale of so many used RVs curtailed new RV sales in the latter half of 2025.

Model Year Charts

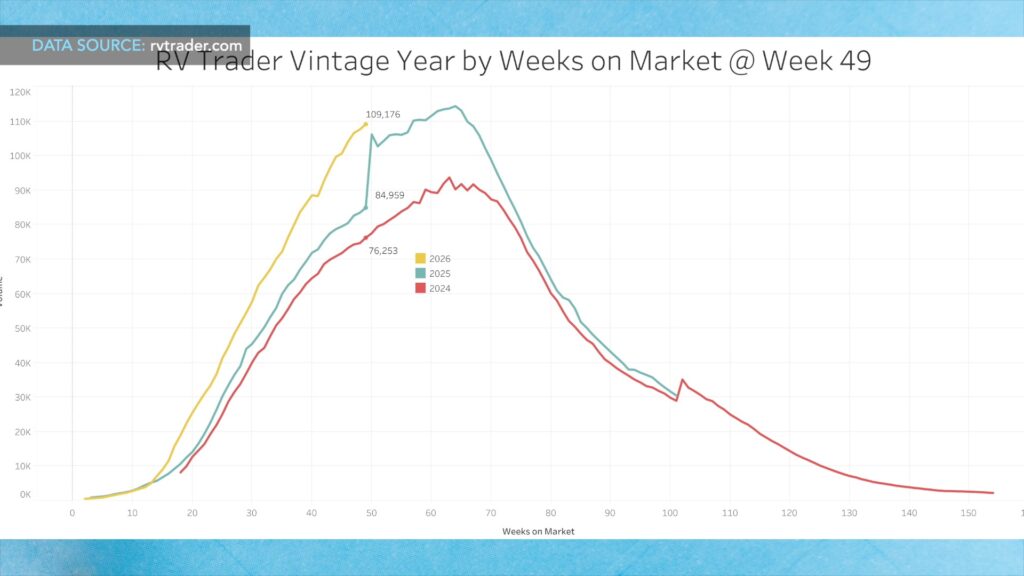

Our model year chart, based on weeks on market, shows that 2026 models are outpacing the number of new units for sale vs. prior years at the same point in time. At the same 49 weeks on market there are many more 2026 models vs. 2025s and 2024s at the same time on market. This would indicate that there is some measure of overproduction of 2026s models, and if demand doesn’t materials, many of these will see significant discounts after the Spring selling season.

As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory. You can follow my account on X at @JohnMarucci to receive weekly updates on this data.

BLS RV Manufacturing Labor Stats

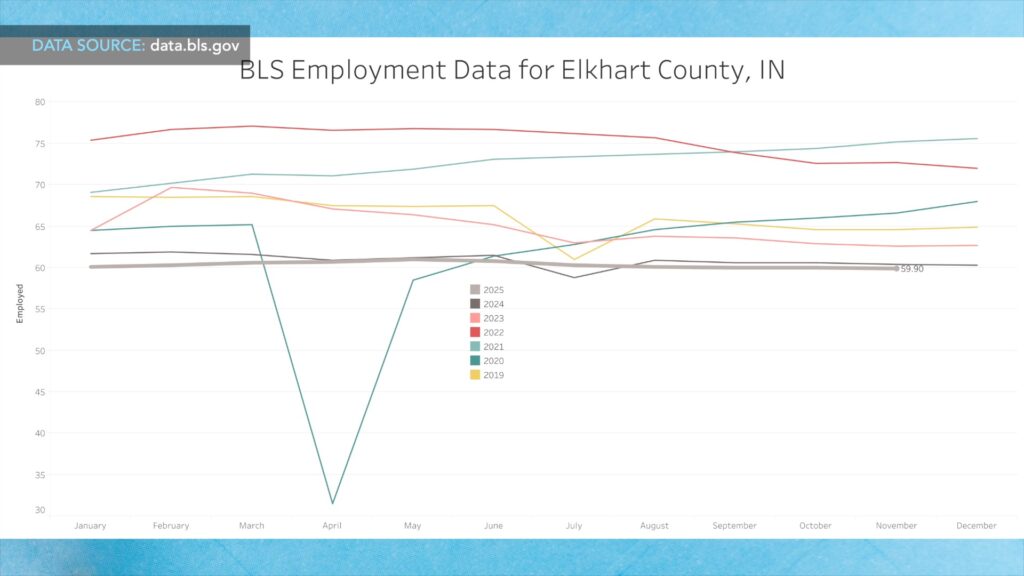

The Bureau of Labor Statistics published revised November 2025 manufacturing employment numbers for Elkhart County, Indiana. This is an indicator of RV manufacturing growth or decline. November 2025 manufacturing employment level declined to 59,900, the lowest level since July 2024, and on par with 2015 employment levels. The BLS is forecasting that manufacturing employment will decline slightly again in December 2025.

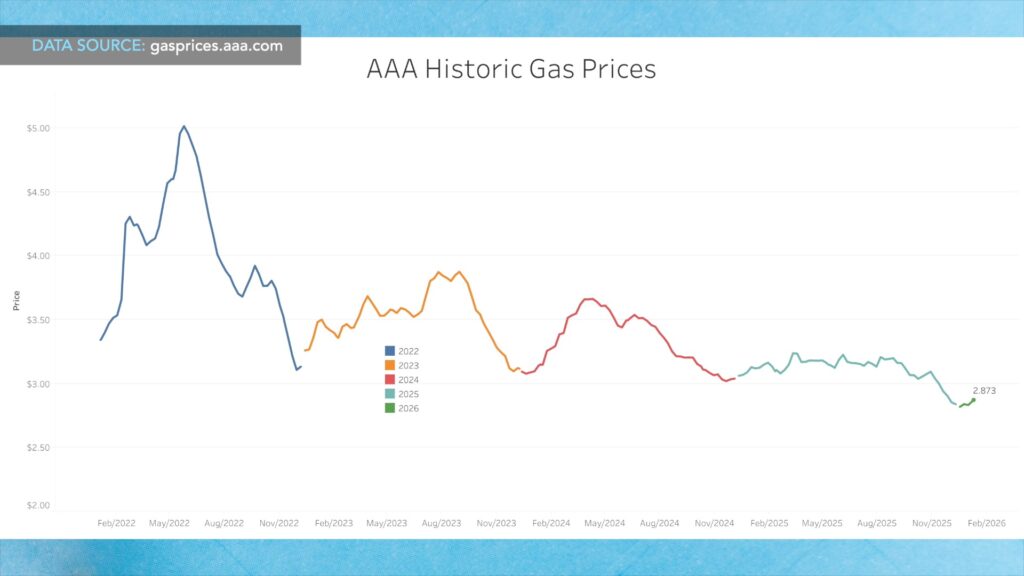

AAA

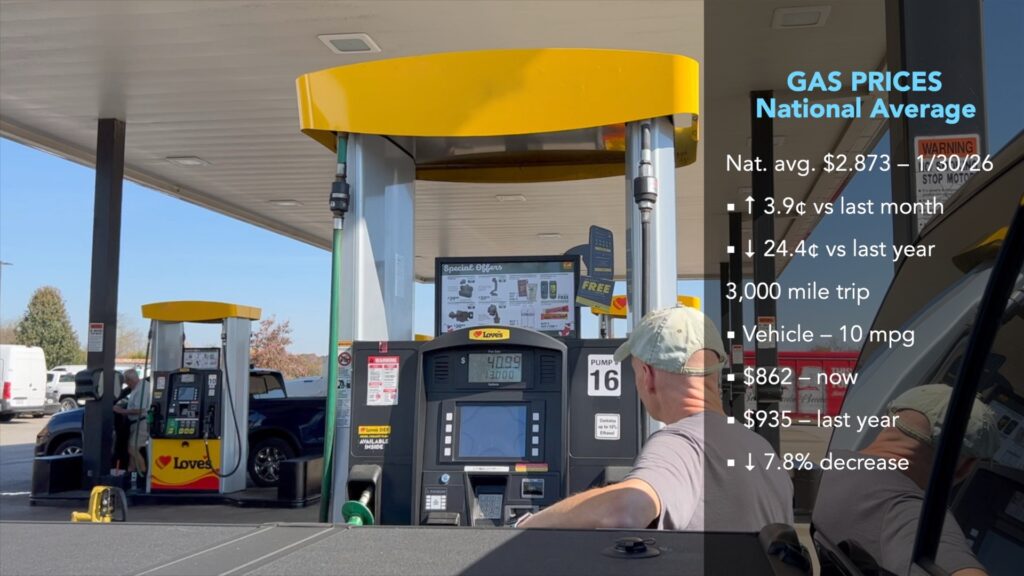

Gas prices have increased slightly in the past month after hitting multi-year lows in early January. According to AAA, the current average nationwide price as of January 30th was $2.873 per gallon for regular unleaded, up 3.9 cents from a month ago and down 24.4 cents from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $862 now vs. $935 a year ago, a 7.8% decrease.

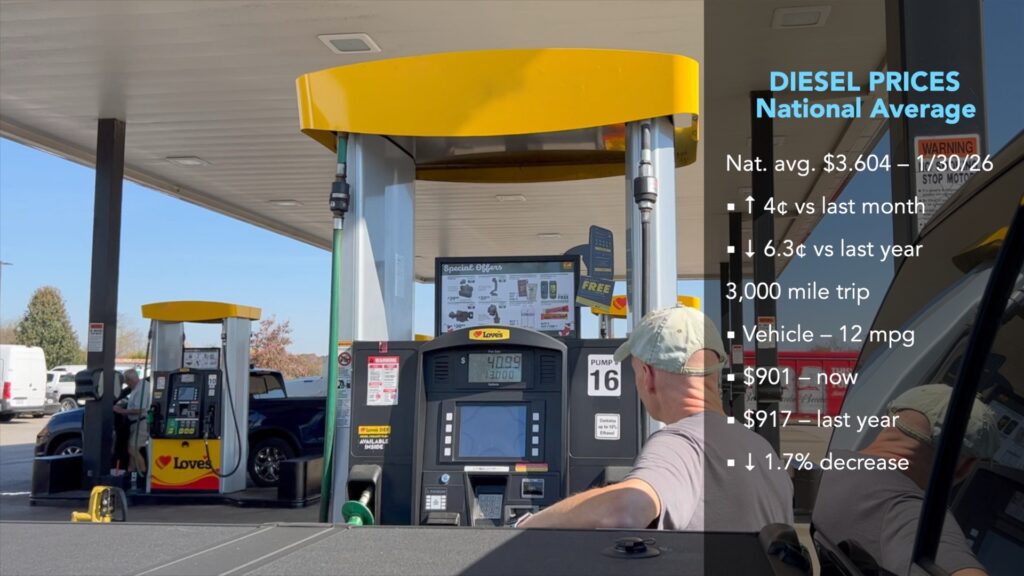

Diesel prices have increased over the past month and currently stand at $3.604 per gallon, up 4.0 cents versus a month ago and down 6.3 cents from a year ago. A similar 3,000-mile trip, getting 12 mpg, would cost $901 now, compared to $917 a year ago, representing a 1.7% decrease.

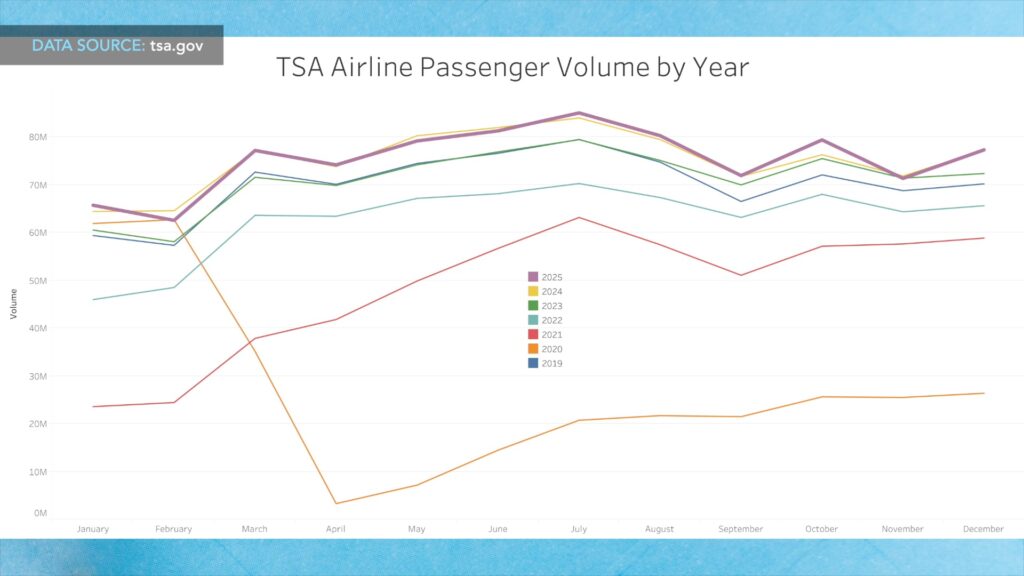

TSA Air Year End Travel Update

Air travel is up for 2025. Full-year 2025 is up slightly compared to 2024, even with a down month in November due to the government shut down. 905.7 million people traveled by air domestically in 2025, beating 2024 by 2.5 million. Verses the pre-pandemic year of 2019, domestic air travel was up by 63 million travelers or 7.5%. It seems obvious that as a leading indicator, people are traveling more than ever. We may even see our first ever 1 trillion passenger year in the next few years.

Towing Assist is the News

I have been watching many videos about the Tampa RV Supershow that happened in mid-January. I didn’t get a chance to be at the show this year but did intake much information on the industry and new innovations that were presented. Overall, my take is that, on the whole, it is business as usual. While some manufacturers are adding new items to RV, for the most part nothing new really stood out. This is especially true when speaking about changing the manually intensive manufacturing process that is prone to produce variances in quality.

This time last year I covered the introduction of the Lightship RV. One innovation that could impact RV towing in a big way is being worked out by this company with their TrekDrive system. Since last year, the company has refined this trailer-based propulsion system and we now have real-world tests. Lightship partnered with the popular TFL Truck YouTube channel to test the trailer-based TrekDrive propulsion assist system. TFL did a real-world test in Colorado where the trailer provided propulsion assist to a diesel truck to see what towing declination, if any, would occur. You can watch it here: https://youtu.be/0o-fQAlg148

As most of you know, when towing a trailer with an internal combustion engine, you lose considerable gas mileage and subsequent range. For example, my 2017 Toyota Tundra gets about 17 MPG on the highway while not towing and just under 10 MPG when towing my 5,000lb. 2020 Keystone Bullet. So, my distance between gas stations is greatly diminished when towing. TFL tested the Lightship with TrekDrive and only lost 1 MPG on a long towing circuit. If this were to hold true for my Tundra, I would get 16 MPH while towing, or a 60% increase in distance between fill-ups. That becomes a substantial gain over time and would be a potential game-changer for those of us with half-ton trucks.

Buyer’s Dilemma

For those of us with older RVs, we are still in a dilemma when looking at a newer RV to own. I am not convinced quality has improved for the average RV being produced, yet prices remain high. The industry for the most part still pays by piece work and “handcrafted” can mean real variances in quality based on the experience level of the line worker and the number of different models they must produce. This isn’t confidence building, especially with prices stubbornly high on models with better perceived quality.

I’m running into the problem of my existing RV hitting a point where the exterior skin and interior elements (floor & dinette) are wearing out from age and use, even though I have spent considerable time and money to keep the trailer up. It seems that my trailer went from a shaky adolescence to old age in about a year. It feels like it is time to upgrade, but the task of getting good value for the money is presenting a considerable headwind. Maybe you are in my shoes, owning an older camper that is looking older than it is, but caught in a dilemma of what to buy next. It is just a tough time to be a buyer, even with the excess amount of inventory available.

That should do it. All the best in your camping adventures!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated!