In this blog, we’ll cover the latest RV and travel data news. December 2023 RV production numbers are out, and we’ll cover the latest travel data so you can better gauge if it’s time to buy, sell or hold an RV. Later in the news, we’ll examine how the new law governing Florida State Park reservations is impacting snowbirds and Florida residents.

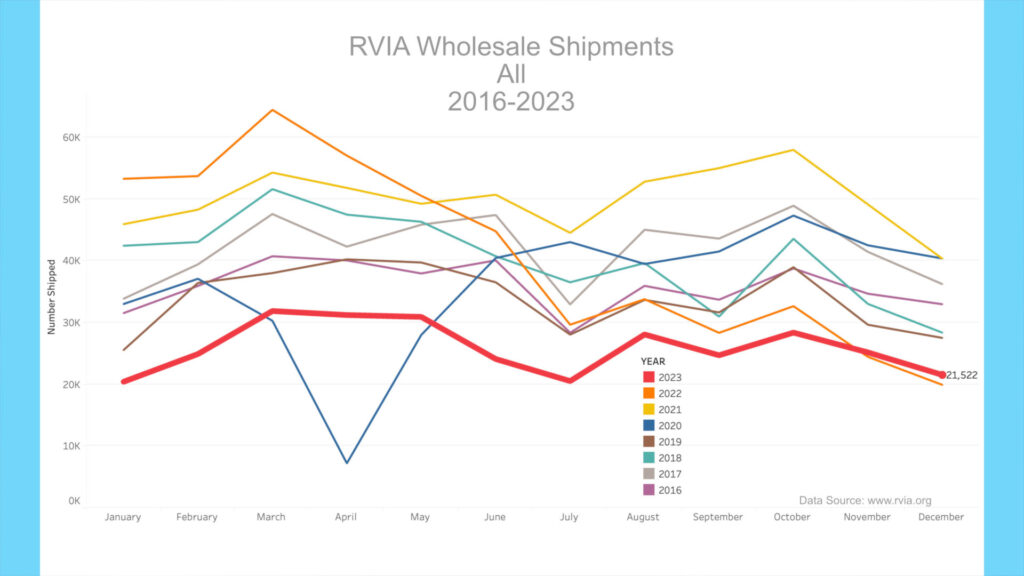

RVIA Numbers

On January 24th, 2024, the RVIA posted the latest RV wholesale shipment data for December 2023. Production stabilized compared to the prior year, with 21,522 total RVs shipped in December, up slightly from 19,907 in December 2022. December 2023 was the second lowest production December since 2016. Travel trailers also stabilized year-over-year, with 14,030 shipped in December vs. 12,958 a year ago. For context, December 2021, just two years ago, saw production of 28,550 travel trailers – about 14,500 more than in December 2023.

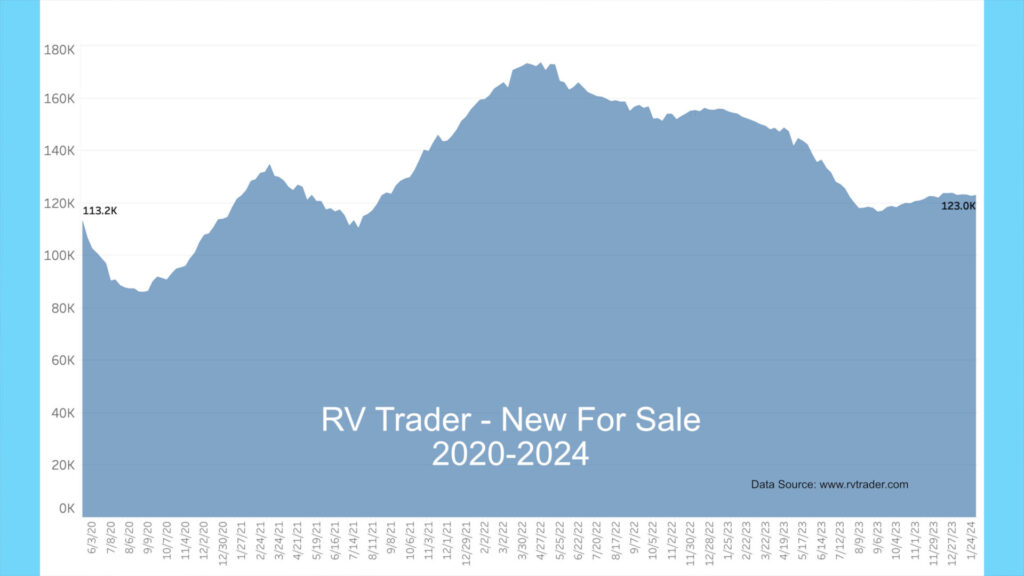

RV Trader Numbers

Meanwhile, RVs for sale on RVTrader.com are holding steady. There were 122,994 new RVs for sale as of January 31st. This is down about 800 units from late December 2023 and down approximately 31,900 new units versus late January 2023’s 154,900 new units. The industry is slowly seeing supply and demand equalize with recent production cuts.

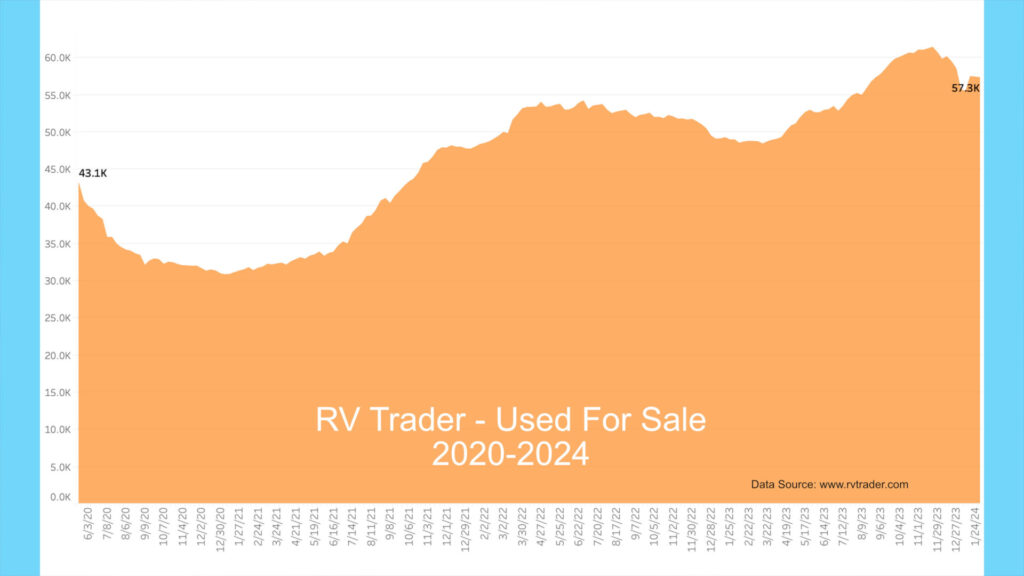

Used units for sale decreased to 57,295 from 58,508 in late December (down by 1,213), as used units are slowly moving off lots. This time last year, the number of used RVs for sale was 48,946, so we still have 8,349 more used units for sale now than a year ago. These past 12 months have witnessed a significant increase in people trying to sell used RVs.

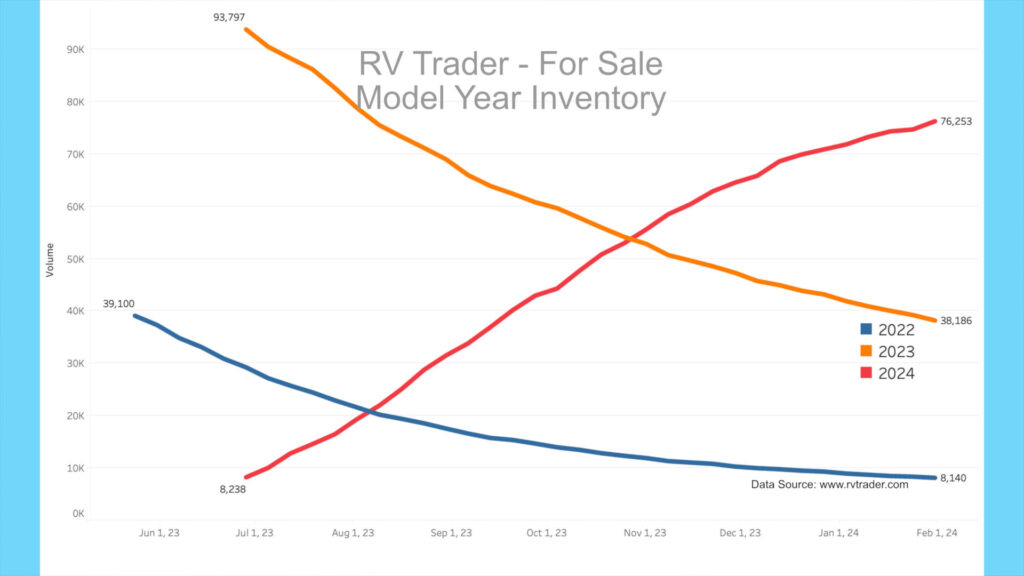

Our model year chart shows new 2022 model volumes since May. As dealers unload these 2022 units, the number of models has decreased from 39,100 to 8,140 units. The orange line shows 2023 models going from 93,797 to 38,186 units since late June. Meanwhile, the red line shows 2024 models on RVTrader.com. In late June, there were 8,238 new 2024s, and now there are 76,253. So, there are still about 46,300 new 2022 and 2023 models on dealer lots. As a reminder, many but not all dealers advertise on RVTrader.com to sell inventory. It remains an excellent proxy for overall dealer inventory. To receive weekly updates on these data, you can follow my account on X (formerly Twitter) at @JohnMarucci.

High-End Market

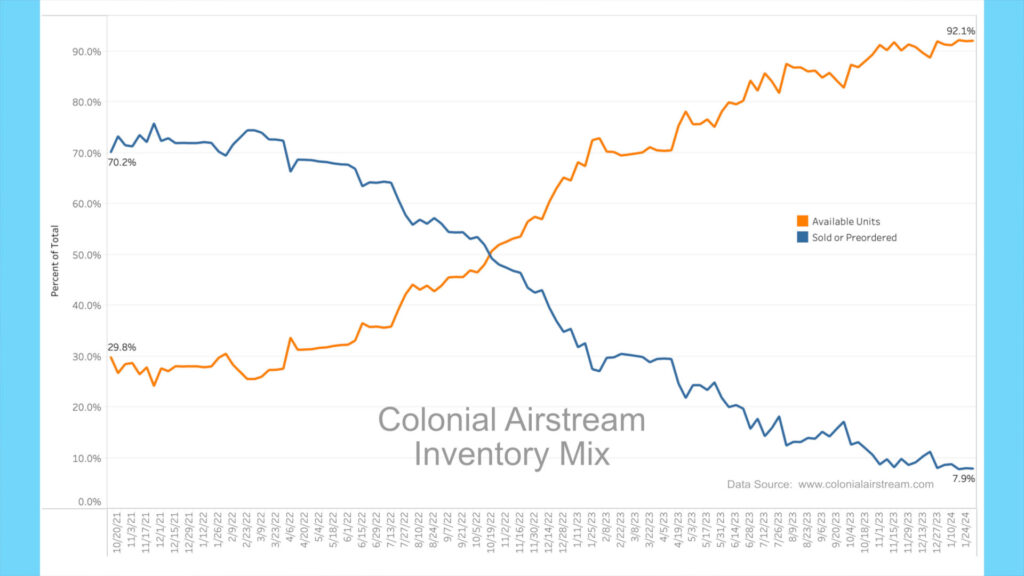

For the high-end market, inventory levels for Colonial Airstream in Millstone Township, New Jersey, one of the nation’s largest Airstream dealers, is still seeing a glut of in-stock units.

About a year ago, roughly 27% of Colonial’s inventory was preordered, meaning 73% of their Airstream inventory was either on the lot for sale or being delivered and available. As of January 31st, 2024, roughly 92% of inventory is available for sale, with only 8% spoken for. This 90+% availability has continued for the past two months. This has meant a continued buildup of on-the-lot inventory. Colonial now has 138 new units on the lot for sale vs. 101 at the end of September 2023. This increasing glut should mean a potential buyer can bargain significantly.

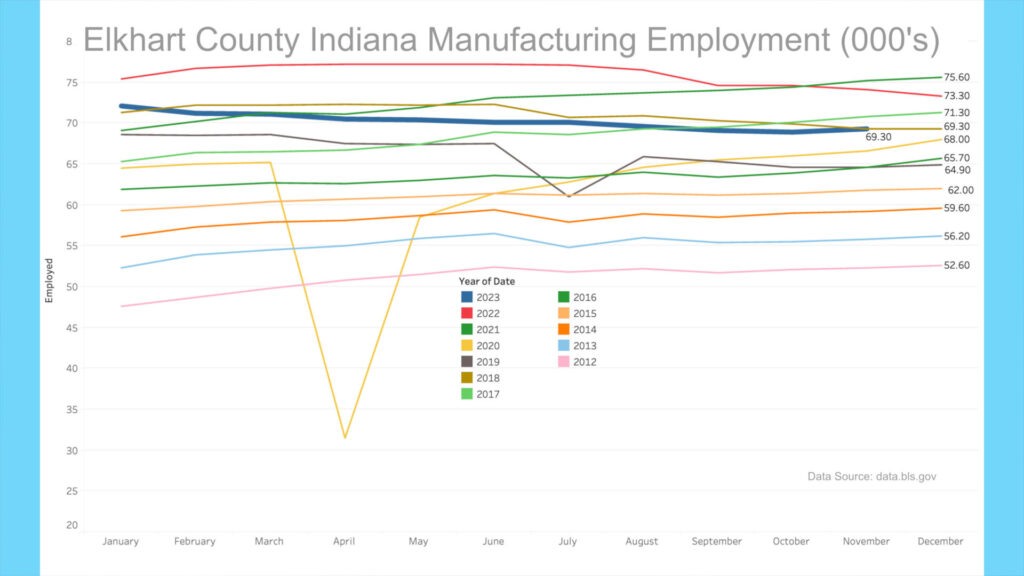

BLS RV Manufacturing Labor Stats

The Bureau of Labor Statistics has revised Elkhart County, Indiana’s latest manufacturing employment data for November 2023. We cover this because a very high percentage of North American RVs are made in this area of the country. The revision shows that at the height of production in the spring and early summer of 2022, there were 77,200 people employed in manufacturing. For November 2023, this number stands at 69,300 people, down 7,900 since the peak. The 69K manufacturing employment level has remained steady over the past few months.

AAA

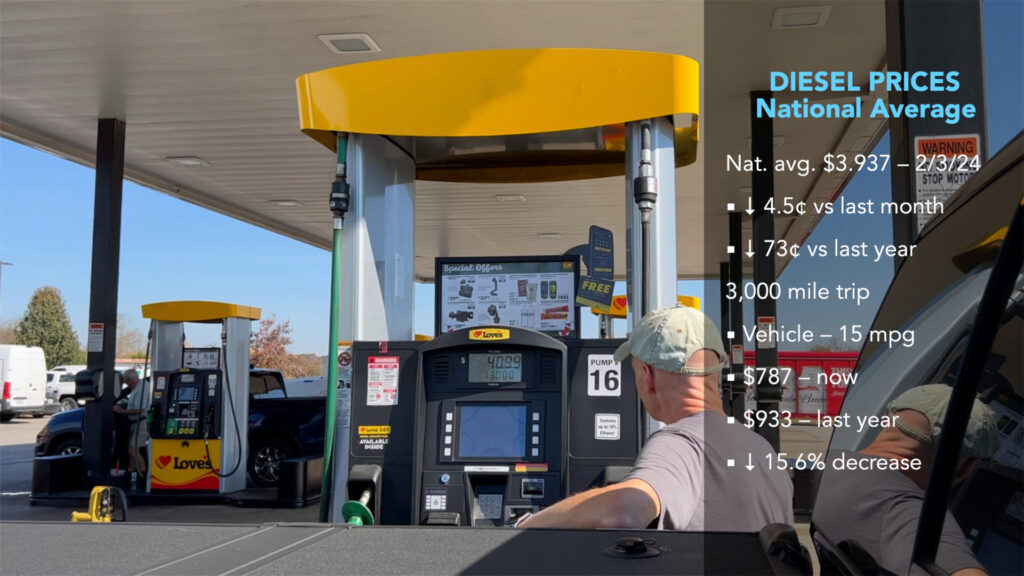

Gas prices have increased in the past month. According to AAA, the current average nationwide price as of February 3rd was $3.15 per gallon for regular unleaded, up $.056 from a month ago and down $.34 per gallon from a year ago. An RV trip of 3,000 miles at 10 mpg would cost $945 now vs. $1,047 a year ago, a 9.8% decrease YoY. Diesel prices have also decreased in the past month and currently sit at $3.937, down $.045 from a month ago and down $.73 from a year ago. A similar 3,000-mile trip getting 15 mpg would cost $787 now vs. $933 a year ago, a 15.6% decrease.

News Story – Tampa RV Show

I couldn’t attend the Tampa RV Supershow in January, but from all reports, indications are that attendance was down by about 5%, possibly due to the rain and cooler temperatures. Besides more control systems and a few new models, there wasn’t much to report about from the show. As reported last fall, many manufacturers have tried to reduce costs by de-contenting units. The fundamental reality shown by the data is that the industry is not doing well, and whether it be because of interest rates, the pandemic effect of fast-forwarding sales, or poor quality, the results are lower sales and fewer repeat customers.

Florida State Park Booking Change

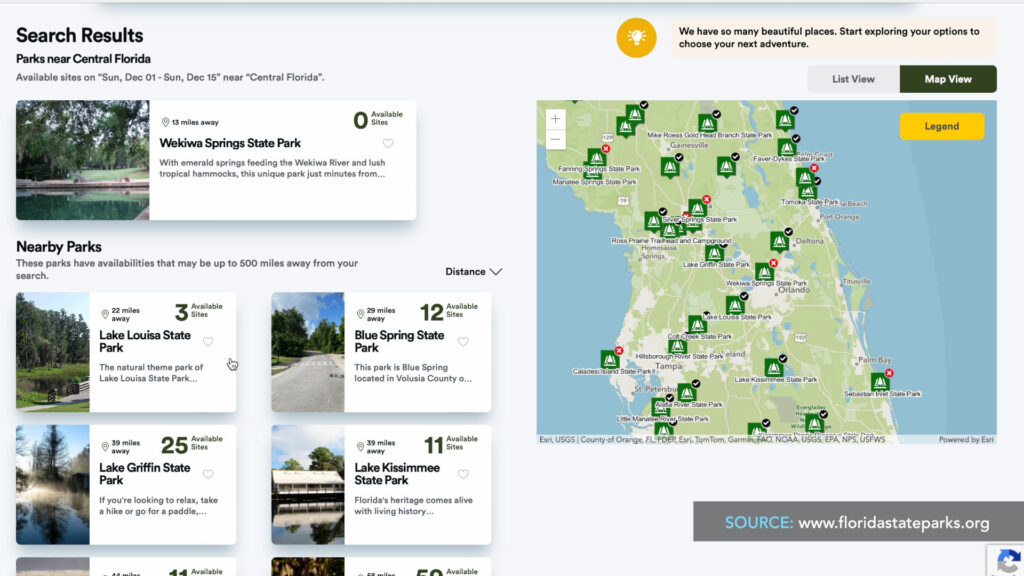

I think the biggest RV news story of the past year that affects RVers the most is the change to the Florida State Parks reservation system. We have two videos on this if you are interested in the details. The bottom line is that Florida residents can (starting this past January 1st) book 11 months in advance, while non-residents can only book ten months in advance. I’ve argued that a better solution would have been to charge non-residents more for the same campsites vs. giving a time advantage to residents, and I fully stand by this solution. We now have an entire month of the new system in place, and as we’ll see in a moment, we are currently seeing a patchwork of reservations with an apparent loss of revenue.

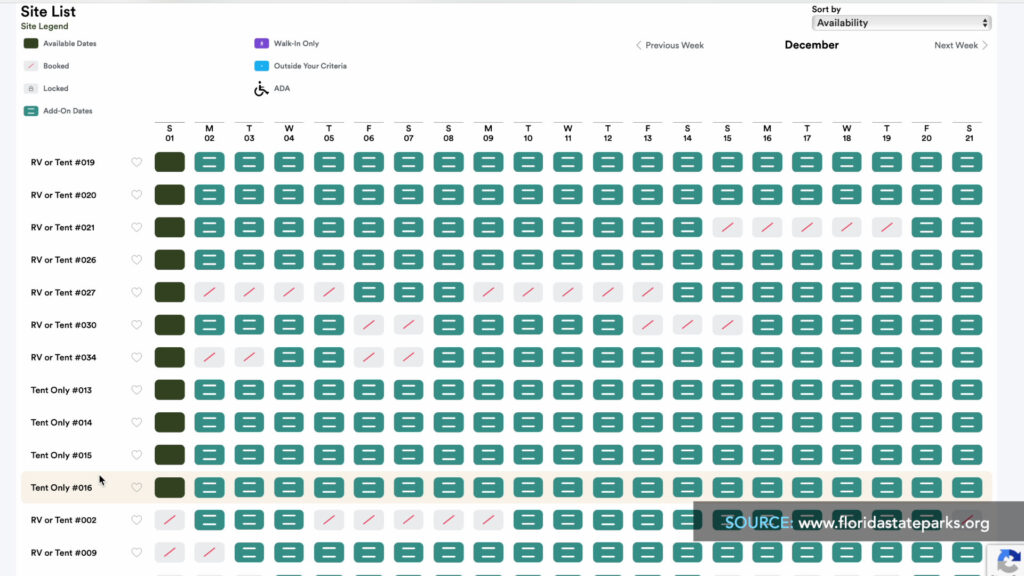

Let’s take a look at trying to reserve a campsite ten months in advance. We’ll search for a campground in Central Florida for the beginning of December 2024. Interestingly, when I get to December, the system correctly restricts me to booking ten months out. I’ll choose a 14-day trip starting on December 1st, select Camping, and look at what is available. You’ll see immediately that nothing is available at Wekiwa Springs north of Orlando in Apopka, Florida. As I scroll down, sites are available at various locations for the entire two-week period. Be aware that December 1st through 15th are by no means heavy vacation times as people are finishing up school and work before the holidays. Nonetheless, there is availability in some places.

Let’s now look at Lake Louisa in Clermont, Florida, as it is fairly close to Disney and a popular spot for snowbirds. Notice that even in early December, only three sites are available for the full 14 days. As we click in and look at the full grid of 21 days ahead, you can see that any sites taken already are from residents and that weekends are usually booked. Many sites are sitting unbooked during the week, which would break up any longer-term reservation from a non-resident. In essence, the law is doing exactly what I thought it would: creating a patchwork of reservations by residents that keeps non-residents from being able to plan anything of length. Site 57, for example, is a lovely private non-full-hook site in Loop C, but because a resident booked a weekend in mid-December, it will likely be unused during the week. This would probably have been fully booked without the new law.

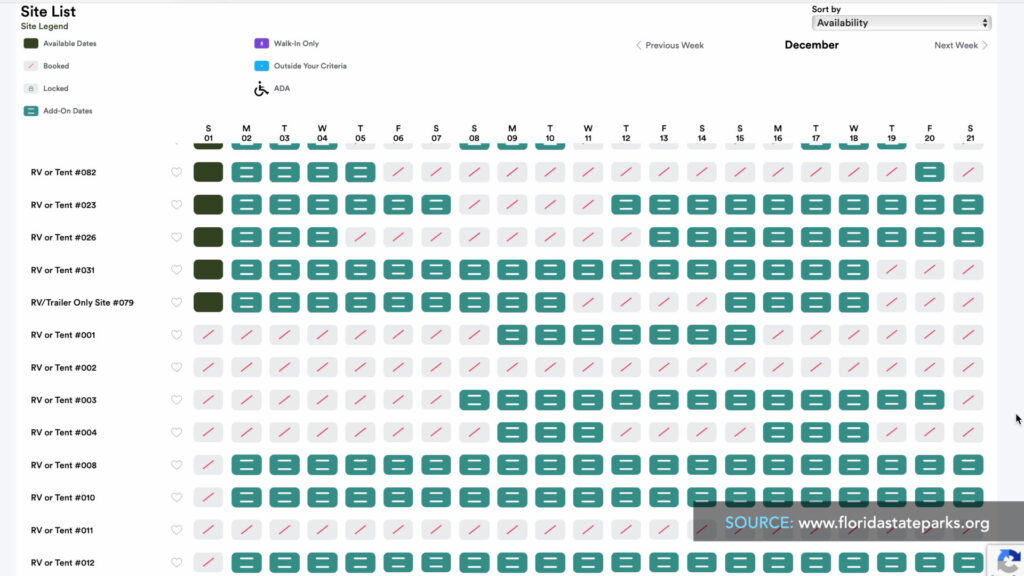

Let’s now look at Colt Creek State Park for the same timeframe. Unlike Lake Louisa, Colt Creek has more open sites for the 14-day window, although four are tent-only sites. This might be a good choice for snowbirds; however, to commit, one must know what would be available after this reservation. Where do you go next? What this does, in essence, is kill the ability to plan out as a non-resident and curtail revenue for the Parks.

Finally, let’s look at Jonathan Dickinson State Park, just north of Jupiter, Florida. Here, the problem is amplified, with only one campsite available for the fourteen days and an even greater patchwork of sites going unused. Weekends, in general, are pre-booked by residents with shorter average stays. I think the picture is clear that the new law is doing what was to be expected: residents with the reservation time advantage are grabbing sites with shorter average stays and effectively blocking out non-residents. This will likely dramatically affect State Park revenue, with an eventual lowering of quality and an increase in pricing to make up for the shortfall.

That should do it. All the best in your camping adventures!

As always, thanks to our fans who support our efforts by starting their shopping from our Amazon Storefront and their generous financial support by using the THANKS feature located under each YouTube video ($ within the Heart icon). Your support is greatly appreciated